Windows XP (Microsoft)

Product Profile

Product/Service Description

Esprow is a leading provider of testing and compliance automation solutions for the financial industry. The Esprow Enterprise Testing Platform (Esprow ETP) provides an integrated suite of applications to automate testing of multi-protocol financial systems (ETP Studio), on-boarding and certification of counterparties (ETP C-Box), native exchange and broker simulation (ETP Markets), and management of exchanges APIs and specifications (ETP S-Box).

ETP Studio is sophisticated and versatile FIX-testing and simulation tool for financial markets that you can carry out FIX testing in almost no-time at all. It is also designed to satisfy the requirements of demanding technical users requiring powerful and configurable testing commands. With its modular architecture you only see the tools you need, leaving all other complexities out. Or you can power-up your toolset by adding plug-ins with advanced testing features.

ETP C-Box is the industry's most advanced platform to automate certification and onboarding of all inbound connectivity for exchanges, MTFs and brokers. ETP C-Box reduces certification cycles from months down to days. Multiple exchange members can connect simultaneously to your staging environment and carry out tests round-the-clock, reducing the time it takes to organize and execute the on-boarding process.

ETP S-Box is a centralized repository to store, browse, and edit FIX and non-FIX message specifications across the enterprise, based on the FIX Orchestra technology. ETP S-Box provides a centralized repository that makes it easy to store and share message specifications used across the company. ETP S-Box is a must-have for exchanges wanting to centralize management of FIX and non-FIX (including proprietary) message protocols specifications to avoid duplication and save time.

Customer Overview

Features

- ETP Studio delivers end-to-end automated testing of enterprise trading architectures.

- Test scripts and simulators can be executed headless and integrated within CI/CD pipelines.

- Leverage ETP Studio centralized reporting to fulfill compliance and audit requirements.

- Provide visibility into the testing and release process to all stakeholders

- Achieve complete regression testing of FIX sessions and FIX gateways before every release.

- Test individual services provided by different business modules, with FIX and other protocols.

- Exercise 100% of your business functionality, across the trade lifecycle and trading functions.

- Verify functionality verticals provided through FIX and across business areas.

- Test the integration of FIX-enabled systems within the trading architecture.

- Verify trading limits, fail-over scenarios, authorized transactions, and mission-critical capabilities.

- ETP Studio supports testing of the ION Fidessa platform.

- ETP Studio supports exchange onboarding on the NASDAQ Genium INET OMnet protocol.

Esprow ETP Studio for FIX provides a complete toolset to automate testing of FIX-based systems. Designed around the needs of technical and non-technical users, ETP Studio for FIX enables testing of FIX sessions, building of complex suites of test scenarios or replaying of large production log files. ETP Studio functionality enables creating of test scripts for regression testing, simulation of execution venues in both FIX and binary format, and interactive testing of FIX sessions. ETP Studio rich set of functionality has been designed to meet the sophisticated requirements of brokers, exchanges, vendors, MTFs, and OTFs.

INCREASE AUTOMATION

ENABLE COMPLIANCE

EXTENSIVE CAPABILITIES

Benefits

- Regression and Functional Testing

- Unit and System Testing

- Integration and Security Testing

- Performance and Static-Data Testing

- FIX Order Manager

- FIX Session Manager

- FIX Exchange Simulator

- FIX Market Data Manager

- FIX RFQ Manager

- FIX Performance Package

- FIX On-Boarding Package

- GUI Testing Package and many non-FIX protocol connectors.

- Support for ION Fidessa OpenAccess, NASDAQ Genium INET OMnet, and many binary protocols.

At a time of increasing market regulation and compliance requirements, Esprow ETP Studio delivers a modern toolset to automate testing of FIX connectivity and FIX APIs, guaranteeing system uptime and trading compliance.

The high-level list of Esprow ETP Studio capabilities includes:

ETP Studio is easily extensible with many functionality plugins, including:

Esprow ETP's technology roadmap is mostly driven by our clients, through their feedback and requirements. Whether through training, installation service or custom application enhancements, our professional services team is ready to support you, whichever testing project you are embarking on.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Finlogix is designed to bring together a community of like-minded traders, all helping each other be the best trader they can be through clear analysis, transparency, and the power of social engagement.

Finlogix has everything a new or experienced trader could ask for, starting with their intuitive charting platform with real-time streaming data across 65+ trading instruments. The real power behind Finlogix is access to a community of traders, where you can create, share, and openly discuss trading ideas and build a profile as a trader. Never in history have traders had such powerful tools to showcase their trading talent, build a community and learn from the best trading minds around the world, all from your browser.

Finlogix is a new, technologically inspired solution that media companies and brokers have been asking for, allowing you to compete with the best sites in your space.

Their live streaming HTML 5 charting and responsive widget solutions provide a suite of website tools to take the look and appeal of your site to the next level.

Now you can enhance your website, engage your visitors, and provide live streaming market data to your website visitors through our easy to install intuitive widgets - 100% free of charge. No matter if you have a blog, financial news site, forum or you are building an affiliate website to earn commissions, Finlogix’ s suite of financial widgets will provide the look and presence you want and add value to your end user. They have created their widgets with simplicity in mind. Each one is as easy as embedding a YouTube video on your site. Get started today

Customer Overview

Features

Access to live financial data for Stocks, ETFs, Forex, Cryptocurrencies, Indices and Commodities: Finlogix’s widgets and Economic Calendar gives insight into the markets, major economic events & breaking news. These are completely customisable allowing you to apply filters to see data from your preferred markets and instruments. Perfect for your site visitors and customers.

Intuitive charting combined with powerful trading tools: Finlogix’s HTML 5 charts combined with real-time data, allows you to make informed trading decisions. Choose from 30 indicators, 65+ trading instruments, ten timeframes and gain access from any web browser.

Ability to publish trading ideas & build your team of traders: You can publish your best trading ideas, complete with clear entry, exit and take-profit levels. Or you may choose to follow your favourite traders & use their trading ideas. The choice is yours.

Platform to become a top-ranked analyst: The Finlogix algorithm helps identify the best traders, taking into consideration pure trading performance in % and pips as well as metrics from within the trading community.

More advantages of Finlogix include:

Being able to replay published analysis from start to finish

Live tracking of your open positions in the Strategy window

Email notifications as soon as your shortlisted analyst posts an update

The handy sidebar shows all key market information when you need it

Benefits

For Finance Websites: Access to Financial Widgets and live market data to enhance their websites.

For Analysts: Engage with traders, build a positive community around your style of trading, and provide insights & trade ideas to build your profile.

For New Traders: Access to an active social trading community, Trade Ideas and Analysts

For Experienced Traders: A platform to build your profile, boost your credibility and establish a clear track record for traders to follow.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots & Video

Product/Service Description

axe Collateral Management allows the management of general and specific collaterals including commercial and residential real-estate, shares, equipment, or any other tangible or intangible assets with dedicated fields and documents, business rules specific to each of these types.

It helps handle the entire Collateral Lifecycle is starting from the credit initiation at the proposal stage all the way through valuation, documentation, perfection, deferrals, LTV monitoring, release, and disposal in the event of default.

Customer Overview

Features

- Complex & Flexible Limit Structures

- Pre-deal Limit Checking

- Limit Monitoring

- Excess Management

- Limits Lifecycle Management

- Portfolio Concentration Analysis

- Collateral Perfection

- Revaluation & Documentation renewal

- LTV Monitoring

- Release & Realization

- Deferrals

- Tickler Tracking

axe Collateral Management enables lending institutions to monitor their collateral portfolio in a pro-active manner, thanks to early alerts and ticklers on coverage shortfall, deferral expiration, documentation renewals, margin calls (shares), assignments of proceeds, etc.

axe Collateral Lending Main Features:

Benefits

- Gain Competitive Advantage through Enhanced Customer Service & Response Time

- Optimize Performance by raising transparency, flexibility, and consistency

- Enhance Risk Assessment by providing credit risk managers with a single consolidated view

- Reduce Operational Risk by introducing single capture, thereby reducing manual processing and bringing tighter integrity to documents & data

- Adhere to regulatory requirements in terms of processes, risk assessments, and portfolio management

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots & Video

Product/Service Description

axe Limit Management is a fully integrated solution with the Corporate Lending platform. It allows banks to handle credit limits at both client and portfolio levels from their activation through their entire lifecycle and allows financial institutions to manage and proactively monitor their limits across business segments.

axe Limit Management covers internal risk limits such as Country, Sector, Rating class, Product limits or any combination of risk dimensions as well as regulatory concentration limits.

Customer Overview

Features

- Complex & Flexible Limit Structures

- Pre-deal Limit Checking

- Limit Monitoring • Excess Management

- Limits Lifecycle Management

- Portfolio Concentration Analysis

- Collateral Perfection

- Revaluation & Documentation renewal

- LTV Monitoring

- Release & Realization

- Deferrals

- Tickler Tracking

axe Limit Management Main Features:

Benefits

- Monitor facility limits automatically

- Handle complex multi-level limit structures

- Handle all types of limits including Settlement and Pre-Settlement limits

- Aggregate utilization at any level of the limit structure

- Automate and speed up the credit risk consolidation process across the Bank portfolio

- Benefit from enterprise-wide risk reporting of credit-related activities

- Set Portfolio Limits across a combination of dimensions and monitor/address Breaches/Excesses in a pre-deal manner

- Simultaneously monitor all types of exposures (Gross, Net, Shadow, EAD, Outstanding, MTM, etc.)

- Ensure regulatory compliance with regards to concentration limits

- Automate and speed up the credit risk consolidation process across the Bank portfolio

- Benefit from enterprise-wide risk reporting of credit related activities from executive overview down to branch/RM/transaction levels

- Set Portfolio Limits across a combination of dimensions and monitor/address Breaches/Excesses in a pre-deal manner

- Ensure regulatory compliance with regards to concentration limits such as Single Obligor exposure against the bank own funds

Monitor your client limits

Aggregate credit risk exposures at Portfolio level and monitor against limits

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots & Video

Product/Service Description

axe Retail Lending brings powerful functionality to lenders and is designed to more effectively automate and manage credit approval and follow up processes whatever the distribution channel or customer type. It provides benefits to all credit stakeholders: Relationship managers, credit risk analysts, risk managers…

axe Retail Management enhances customer satisfaction, reduces time to market fully automating the loan processing from walk-in all the way through disbursement thanks to workflow and rule engine features.

Customer Overview

Features

- KYC & Client Onboarding Origination

- Eligibility Engine

- Financial Scoring

- Behavioral Scoring

- Product Based Scoring

- Risk Based Pricing

- Credit Analysis & Write-up

- Credit Admin and Documentation

- Disbursement

axe Retail Lending Main Features:

Benefits

axe Retail Lending helps boost your retail lending business performance and automate the end-to-end credit application life-cycle from the KYC stage through disbursement.

It helps lending Institutions monitor and manage risk to identify bottlenecks, to speed up and to optimize processes.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots & Video

Product/Service Description

axe Corporate Lending brings powerful functionality to financial institutions and is designed to more effectively automate and manage the credit risk management chain and follow up processes.

axe Corporate Lending boost lending business performance through handling unlimited volumes of funded and unfunded products with improved speed and lower risk.

A variety of internal rating models could be hosted including Probability of default (PD) and Loss Given Default (LGD) for Basel approaches.

Customer Overview

Features

- KYC & Client Onboarding

- Origination

- Credit & Risk Analysis and Write-up

- Approval Processes & Delegation of Authority

- Risk-Based Pricing

- Facility Risk Rating

- Obligor Risk Rating

- PD & LGD

- Credit Admin and Documentation

- Facility Sanctioning

- Covenant Management & Monitoring

- Limit Activation

axe Corporate Lending solution streamlines the whole credit lifecycle from client onboarding to facility sanctioning, all the way through origination, appraisal, rating, approval, credit administration, and covenant monitoring.

Main Features:

Benefits

- Gain a competitive advantage through enhanced customer service & response time

- Attracting new customers and retaining existing ones

- Decrease time to market of new products and rapidly implement changes to loan application and approval procedures

- Benefit from a highly competitive total cost of ownership

- Benefit from enterprise-wide risk reporting of credit related activity from an executive level to branches for wiser strategic decisions on the bank portfolio

- Business Intelligence module to enhance overall control on all credit related statistics & processes

- Accurately assess credits risk ratings and check regulatory compliance

Boost your Lending Business Performance :

Monitor and Manage risk to identify bottlenecks :

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots & Video

Product/Service Description

axe Commercial Lending solution helps banks through SME’s loans automation. It offers powerful tools for deal execution, activity monitoring, data analytics and BI capabilities.

axe Commercial Lending streamlines the entire credit lifecycle covering initiation, analysis, decision and post-approval events like rescheduling, early repayment, etc.

Customer Overview

Features

- KYC & Client

- Onboarding Origination

- Eligibility Engine

- Financial Scoring

- Risk Based Pricing

- Credit Analysis & Write-up

- Approval Processes & Delegation of Authority

- Risk Based Pricing

- Facility Risk Rating

- Credit Admin and Documentation

- Limit Activation

- Disbursement

Benefits

- http://www.axefinance.com/brochure-axefinance-ACP-solution-lending-automation-2019.pdf

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

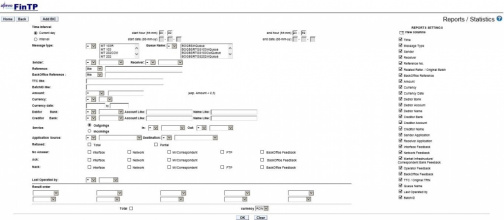

Screenshots

Product/Service Description

FinTP is a versatile open source solution for flow automation and seamless integration between various internal systems/applications and external market infrastructures or networks, providing operators with relevant information in a one-window approach (acting like a financial middleware), which allows banks to focus less on their internal processes, and more on designing attractive client-oriented services and products.

On top of its core function, FinTP provides support for the most used funds transfer instruments (credit transfer, direct debit, debit instruments) and includes features for operational risk containment (transaction filtering, duplicate detection, accounting reconciliation), liquidity reporting, treasury operations management, end-to-end management of remittances, competitive reporting and SEPA & TARGET2 compliance.

FinTP use cases are in solutions for transaction broker, payment factories, corporation financial consolidation, management of microfinance operations, optimization of payment flows for public administrations, public debt management etc.

Customer Overview

Features

- Financial instruments:

- Funds transfer (MT, MX message types)

- Direct debit

- Debit instruments

- Remittances

- Treasury operations

- SEPA (credit transfer – SCT ; direct debit – SDD) compliance

- SEPA for corporates

- Statements (MT940/MT950, MT900/MT910)

- Corporate to bank connectivity

- Operational features:

- Duplicate detection

- Accounts reconciliation

- Transactions filtering

- Competitive reports & alerts

- Liquidity reporting and forecasting

- Business continuity

- Loan disbursements and repayment matching

Benefits

FinTP lowers the total cost of ownership (ensuring nil capital expenses and optimized operational expenses – via shared development and maintenance), while eliminating the common vendor lock-in dependence and aiming to achieve a better level of interoperability - by encouraging a wide adoption, due to financial attractively and short time-to market.

The innovation factor consists in its open source distribution model, allowing banks/corporations/public institutions who use it to contribute updates and improvements to benefit all users. This enables an unprecedented level of transparency and collaboration between clients, being possible because middleware is not a competitive differentiator for them. It is in the best interest of all involved parties that this collaboration happens, so that everyone can focus on primary client oriented attractive services.

Last, but not least, FinTP is highly flexible and configurable and can be adjusted to fit the exact needs of the customer.

Platform & Workflow

Custom reporting capabilities: users can tailor their own reports. A set of standard reports already is available in the application, as most frequently asked by bank or treasury operators

Competitive reports: offers several analyses and reports of the market trends, along with early alerts

Liquidity reporting: ensures real-time cash reports and forecasts using several reporting criteria, in a consolidated view

Auditing: detailed logs of user activity, payment status updates with full information on timestamps, originating application, end application, device information, etc.

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

iMAL Enterprise Islamic Banking & Investment System

Product/Service Description

iMAL Enterprise Islamic Banking & Investment System is a powerful core banking platform specifically built from the ground up to support Sharia banking operations. It is truly geared to address country and region-specific Islamic banking requirements. It is offered to high-end Islamic banking, investment and financing institutions, based on an advanced open architecture with a robust integration platform.

iMAL is the only 100% Islamic banking solution as certified by AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) in 2008.

All iMAL modules adhere to the Islamic law and are in full compliance with IAS (International Accounting Standards). The system is based on the Sharia guidelines for the purpose of financing related to Murabaha, Mudaraba, Ijara, Istisnaa, Salam, project financing, real estate and others.

Customer Overview

Pricing model is based on the modular capability available in iMAL core banking system, whereby each module is priced separately providing a flexible costing structure to fulfill the following goals:

1- iMAL provides a full suite of modules that address different business requirements for the banking industry. These modules have been packaged to focus on the different business areas in a bank.

2- Provide a product-based configuration of the different core modules, whereby a base license is provided for the main module feature, and subsequently the client can select additional products to be added to the base license. This aims to optimize the product offering to the client and provide a cost effective offering.

3- Regarding the deployment in branches, Path Solutions adopts a flexible branch deployment strategy, whereby the option is availed to the Sales team to configure the deployment offering by choosing one of the following scenarios:

a. Combination of number of branches and number of users

b. Adopting the pricing based on the number of branches only

c. Adopting the pricing based on the number of users only

d. Adopting the pricing based on the projected number of customer accounts.

The above options provide the flexibility to select the most suited selling approach depending on the target market and client expectations, and accordingly provide a cost effective offering to the potential clients.

4- In addition to the above approach, an embedded quantity discount brackets is adopted to apply a reduced unit cost for the different selection criteria, which again provides a reasonable pricing for the banks operating a big branch network, or projecting a huge number of customers.

Features

- Supports all known Islamic banking instruments

- Web interface, N-Tier Java based, SOA architecture

- With high parameterization capabilities; greater process efficiency, better risk mitigation

- Multi-currency, multi-branch, multi-company enabled accounting backbone

- With strong product definition features

- Fully integrated yet modularized, with Model Bank

- Highly automated and flexible system

- Ensures quick time to market products.

The iMAL core strengths:

iMAL employs multi-tier architecture using the latest JAVA technology with either Oracle or SAP Sybase as core database servers. These powerful and at the same time affordable Relational Database Management Systems (RDBMS) provide sophisticated data protection and high-speed access to information.

The system runs on all the main platforms and operating systems requiring only an up-to-date internet browser at the client side.

iMAL is rich in opportunities for increasing revenue through cross-selling and upselling. It also enables a 360° view which enhances customer service.

It is also cloud ready and deployable on a fully scalable, multi-server n-tier architecture. It includes out-of-the-box, industry best practice processes that further support rapid implementation, team knowledge transfer and sustainable business processes.

The fully integrated front, middle and back office Islamic core banking platform, running 24/7 in real-time -iMAL- combines comprehensive business functionality with an advanced, secure, scalable and modular architecture proven to meet the market toughest challenges of today and tomorrow.

Benefits

- Built-in Islamic operations standard compliant workflows and system controls

- Various delivery channels

- Faster time to market

- Exact fit to business requirements

- Phased migration and implementation approach

- Running businesses in real-time mode

- Higher operational efficiency:

- Single integrated platform for all banking activities

- Flexibility to meet change and growth requirements

- Cost reduction by implementing STP

- Optimized business performance

- Superior customer service

- Efficient speed of service

- Precision of documentary cycle

- Electronic reconciliation (quick notices)

- Prompt dispute resolution: Legal, collection, valuation, procedures, etc.

iMAL enables Islamic financial institutions to carry out essential tasks across retail, corporate and investment banking including core banking, transaction banking, online and mobile, payments & financial messaging, trade services and cash management. These applications help Islamic financial institutions to meet business needs in areas like streamlining operations, introducing new products, improving efficiencies and customer service, and ultimately increasing revenues while reducing risk.

iMAL provides platform independence, real-time interfaces, extreme usability, full scalability, high-performance, excellent productivity for configuration and deployment, and modular components.

With iMAL, Islamic financial institutions are empowered to achieve:

iMAL is based upon customers’ serviceability. One of these backbones is the production of multilingual statements to customers of the Islamic financial institutions. This is done with minimal data entry at the outset of the system’s parameterization, whilst the production of the various statements, advices, is done automatically by the system without manual intervention by the end-user.

iMAL, which is in compliance with Basel II/III & AML, enables Islamic financial institutions to contain the risk element before they get exposed to a higher degree of risk through effective risk management built into every single transaction that is undertaken in the system.

In addition, iMAL helps Islamic financial institutions implement a flexible, cost-efficient infrastructure with instant access to accurate, up-to-the minute financial updating in order to make informed operational and strategic decisions at a moment’s notice. This comprehensive approach produces a higher Return On Investment to our clients.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

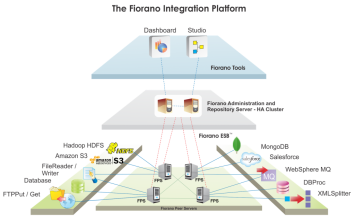

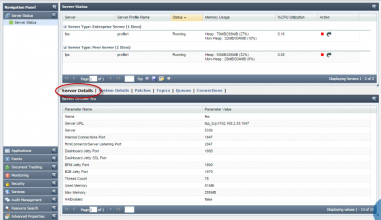

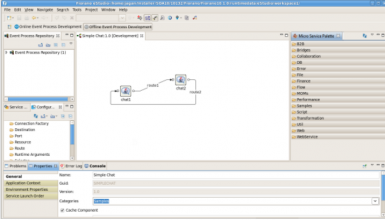

Fiorano ESB

Screenshots

Product/Service Description

An ESB acts as a high speed expressway for data flow in an enterprise, enabling seamless communication among mutually interacting software applications. Fiorano ESB obviates point-to-point integration efforts and integrates heterogeneous applications, databases, cloud and other systems streamlining the complex architecture of an enterprise.

Customer Overview

Features

- Fiorano ESB provides codeless integration between the bank's core banking system with all the channel applications. The configuration based tools enable citizen integrators to use the drag and drop interface to create integration flows without and coding

- Detailed technical product features can be found on this link: http://www.fiorano.com/products/esb-enterprise-service-bus/key-features.php

Benefits

- Secured and reliable communications Fiorano ESB is backed by an underlying standards-based messaging backbone providing scalable, enterprise class messaging with assured message delivery.

- Future proof solution Fiorano ESB's unique architecture allows parallel message flows between nodes, enabling natural and seamless integration of new applications/systems across the enterprise. This unbounded scalability makes your IT infrastructure a las

- Enhanced enterprise-wide visibility and administration Easily monitor all your information flows, manage all security authorizations and event-handling through a centralized ESB Administration Console.

- Reduced development costs Apart from obviating point-to-point integration, Fiorano pre-built adapters and Microservices allows over 80% of all integrations to be implemented out-of-the-box, with no additional programming, saving enterprises significant ti