Windows XP (Microsoft)

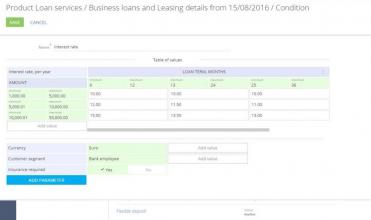

Product Profile

Screenshots

Product/Service Description

Bpm’online is a global provider of award-winning CRM software that streamlines customer-facing processes and improves operational efficiency. Bpm'online financial services is a powerful CRM designed for corporate and retail banks and financial institutions to manage a complete customer journey and enhance customer experience. The users of bpm’online financial services highly value its process-driven CRM functionality, out-of-the box best practice processes and agility to change processes on the fly. Bpm’online financial services offers products that are seamlessly integrated on one platform connecting the dots between banks’ business areas: retail banking and front-office, corporate banking, marketing.

Customer Overview

Features

- 360° customer view

- Customer segmentation

- Opportunity management

- Product management; product-segment matrix

- Customer weight ranking

- Account management

- Customer lifecycle management

- Omnichannel communications

- Product catalog with the possibility to configure product and pricing parameters

- Consulting and transaction contact-center with the workplaces for bank tellers, agents, supervisors

- Case management

- Knowledge management

- Contracts and documents

- Loan origination processes: unsecured loans, mortgage, auto loans, and others

- Lending application processing, managing loan applications from agents or partners

- Fraud prevention

- Verification and underwriting

- Loan maintenance

- Monitoring pledged assets

- Managing loan paperwork

Benefits

- Align marketing, sales and service on a single CRM platform for banks' business processes

- Gain the agility to change processes in the CRM faster than ever

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

FICO®Siron® Anti-Financial Crime Solutions

Product/Service Description

FICO® Siron® Anti-Financial Crime Solutions consists of flexible and highly integrated software modules for:

• Anti-Money Laundering

• Tax Compliance (FATCA, CRS/AEOI)

• Counter-Terrorism Financing

• Know Your Customer

• Business Partner Due Diligence

The building-block design allows variable combination of the products. This paves the way to genuine cost efficiency, transparent total cost of ownership and solutions that can grow along with the challenges of our customers.

Key Features:

• Coverage of all statutory requirements

• Risk-based approach according to FATF

• Full check of customers and transactions

• No IT-knowledge necessary to configure detection scenarios

• Best-practice research scenarios from more than 1,000 of customer installations

• Multi-clients and multi-lingual user interfaces

• Easy integration with existing systems through standardized and flexible interfaces

• 100% audit-proof documentation

FICO® Siron® solutions consistently follow the risk-based approach and support all phases of the compliance process with integrated solution modules: from business risk analysis and customer risk classification to monitoring of transactions and behavioral patterns, and central case management with risk and compliance dashboards.

FICO® Siron® products are highly standardized and parametrizable. They can be combined at will to create custom solutions. Numerous best-practice scenarios from a large number of customer installations have made their way into our standard research products. They guarantee fast roll-out of professional solutions based on the latest compliance knowledge.

FICO® Siron® technology is robust, interoperable, platform-independent and highly scalable. This facilitates integration of our products into existing system environments and provides seamless interaction with third-party applications and databases. The field of application of our products extends from the lean departmental to a cross- and multi-national group solution.

Customer Overview

Features

- Coverage of all statutory requirements

- Risk-based approach according to FATF

- Full check of customers and transactions

- No IT-knowledge necessary to configure detection scenarios

- Best-practice research scenarios from more than 1,000 of customer installations

- Multi-clients and multi-lingual user interfaces

- Easy integration with existing systems through standardized and flexible interfaces

- 100% audit-proof documentation

Benefits

- Largely automated driving the daily surveillance with as little effort as possible

- System-independently integrated into the IT-infrastructure – investments in additional hard- and software not necessarily needed

- Good performance even for high volume of data

- Easily adaptable to regulatory changes and highly flexible support of any individual definition of suspicion criteria according to the specific risk of the bank

- End user-friendly dialog to bring in the compliance officer’s experience and knowledge of what seems to be suspicious

- Audit trail protocols of all operations and definitions including changes - to protect employees from being accused of carelessness

- Reasonable costs for license and implementation

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

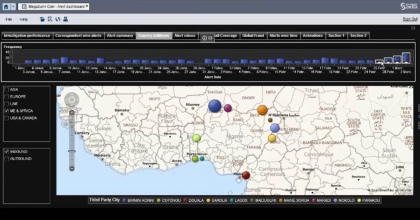

SAS Anti-Money Laundering

Screenshots

Product/Service Description

The SAS solution allows clients to uncover suspicious financial activity efficiently. Get a complete view of threats across your entire institution. And streamline your monitoring, review and investigation processes. SAS provides a common analytics platform and module-based solutions for enterprise fraud, customer due diligence, anti-money laundering and enterprise case management.

Customer Overview

Features

- Money Laundering and Terror Financing Transaction Monitoring, Watchlist and Sanctions Batch Monitoring, Alert and Case Management with Workflow Governance, Regulatory Report Creation, Management, and E-Filing

Benefits

- High Performance scalability to cover very large transaction volume across many lines of business, Transparent system with open data model and no black box monitoring processes or models, Robust and mature data model provided with the solution, Extensive

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

FlexFinance IFRS

Product/Service Description

FlexFinance IFRS. FERNBACH offers a modular solution system. It consists of several blueprints, which in their entirety cover the finance & risk process chain including valuation, financial accounting, reporting and analyses. Each of these blueprints consists of components (“calculation kernels”) which can easily be integrated. One can install selected individual components or the entire range of blueprints. The blueprints for IFRS include the latest rule sets such as IFRS 9 and IFRS 13.

Customer Overview

Features

- FlexFinance IFRS provides, for risk provisioning in particular, a comprehensive catalogue of instruments that includes calculation, simulation, accounting, analysis and reporting. Since different organisational units in a financial institution are usually

Benefits

- Comprehensive IFRS solution which includes valuation of financial instruments, calculation of impairment and hedge management; consolidation with multi-currency capability. • The IFRS solution supports FinRep in accordance with the European Banking Author

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

DeNovo is the next generation platform for strategy consulting that helps to understand the transformative ecosystem and technological potential of blockchain. The platform provides real-time content and insights to build proper strategy, business model and implementation. The solution delivers customized consulting and analysis based on such preferences as emerging technologies, business models, processes, and trends.

Customer Overview

Features

- Dedicated expertise

- Providing context and advice

- Dynamic and customized solution

Benefits

- Five financial services modules, covering innovation in FinTech: Banking services, Capital markets, Investment services, Insurance, Transaction and payment services

- Experienced subject matter experts in FinTech

- Analysis provided on a real-time basis

- Experienced subject matter experts in FinTech

- Global network of 200,000 professionals

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

Founded in 2000, ARQA Technologies is a leading independent financial software provider in Russia and CIS. ARQA’s automated front-to-back solutions are used by over 300 sell- and buy-side institutions from different countries.

The flagship product is QUIK – the multifunctional EMS/OMS platform for trading securities and provision of related services. It is used by both Sell and Buy Side for proprietary operations and brokerage/asset management services to clients.

RISQ solutions form the core of QUIK’s highly developed and flexible risk management functionality which is applied to pre-trade checks, portfolio evaluation and margin trading. QUIK offers a line of low-latency solutions for direct sponsored access (via FIX or exchange API) incorporating online pre-trade control.

QUIK modules are used as building blocks for a number of trading infrastructure solutions. These are developed for optimization of trading infrastructure, aggregation and internalization of liquidity (OMS, ALGO, Matching engine, SOR).

Another product line QORT serves to automate middle-and-back-office operations. MidQORT monitors and controls positions/risks across markets and clients. BackQORT ensures real-time operational accounting and generates reports for regulators and clients. Middle office of asset management company capQORT is used for online position keeping and portfolio control.

Client configurations are formed on modular basis with flexible selection of functionality and transparent pricing. The company also offers its software as managed service from its Moscow and Kiev data centers.

Customer Overview

Features

- Multi-asset and venue-neutral (DMA access to over 30 venues)

- High- and low-touch (incl. algorithmic) trading, latency-sensitive and margin trading

- Sophisticated and extremely flexible risk management (RISQ solutions)

- FIX in / out integrations

- A choice of terminals for end clients and risk/trust managers

Benefits

- Highly functional, adjustable to client's needs and scale of operations, fully transparent flexible pricing

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

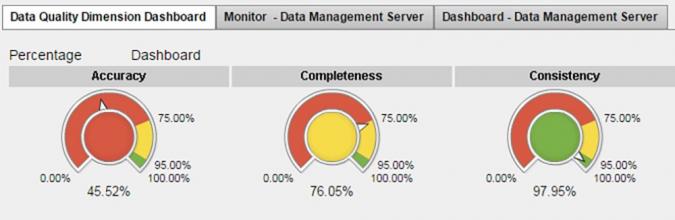

Product Profile

Screenshots

Product/Service Description

SAS delivers a single solution that combines powerful analytics and visualization with robust data management capabilities, providing a solid foundation for all facets of risk data aggregation, governance and reporting – and enhancing your ability to identify and manage risk. SAS Risk Data Aggregation and Reporting connects data silos across your bank for a single, consolidated look at all your data.

Customer Overview

Features

- A comprehensive data store for all regulatory requirements.

- The ability to aggregate risk data using nonlinear methodologies

- Data quality rules for multiple dimensions

- Self-service visual analytics to convert data into meaningful metrics and information for a holistic view of your bank’s risk.

- Centralized capability for business analysts to develop and refine business rules that govern their data.

- Risk aggregations for banking and trading book

- Updateing business rule logic within a single rule-management environment

- Ability to categorize and assign responsibility for data quality errors

- Top-down correlated aggregation

- Bottom-up approaches

Benefits

- A single foundation for a complete data governance platform of risk data governance, data quality information accuracy, integrity and completeness

- Integration with many major platforms with a flexible and adaptable architecture that doesn’t require replacing existing technology investments.

- Processing of risk data calculations with high-performance, in-memory aggregation of positions (banking and trading book), exposures and data to the highest level of detail

- A high-performance risk engine to aggregate risk measures on demand (VaR, ES, etc.)

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Hyperion Financial Data Quality Management

Screenshots

Product/Service Description

Oracle Hyperion Financial Data Quality Management represents a packaged solution for finance users that helps develop standardized financial data management processes with its Web-based guided workflow user interface and powerful integration engine. Financial Data Quality Management's data preparation server can ease integrating and validating financial data from any source system. And to further reduce data integration costs and data mapping complexities, Hyperion Financial Data Quality Management includes prepackaged Enterprise Performance Management (EPM) adapters for Hyperion Financial Management, Hyperion Planning, Hyperion Enterprise, Hyperion Strategic Finance and Oracle Essbase.

Customer Overview

Features

- Guided workflow interface

- Complete data validations and error checking

- Automated data mapping and loading

- Prepackaged system adapters

- Detailed audit reviews and reconciliations.

- Support for standard file formats as well as direct connections to transaction systems.

Benefits

- Increase your confidence in the numbers.

- Lower the cost of compliance.

- Simplify financial data collection and transformation.

- Standardize with repeatable financial processes.

- Deliver process transparency through audit trails.

- Achieve timeliness of data with a Web-guided workflow process.

- Improve the productivity of finance

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Linedata Longview is a complete front and middle office solution for institutional, wealth and alternative investment managers. The solution offers multi-currency, multi – asset and multi-geography coverage. Longview provides great flexibility and scalability to firms of any size and business needs.

Customer Overview

Features

- OMS together with trading tools and high speed of EMS in a single platform

- 7 – Level hierarchy portfolio modeling

- Highly configurable interface

- Advanced rebalancing

- Rule – based order routing

- Integrated broker Fix Connectivity with Linedata LyNX

Benefits

- Advanced portfolio and cash Management

- Liquidity Alliance Program with access to 400+ global brokers and 50 partners (ATS, dark pools, broker algo’s, etc.)

- Centralized modules for trading, solution activity monitoring, portfolio management and compliance monitoring

- Add-on service StatPro Revolution, a cloud-based portfolio analysis system

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

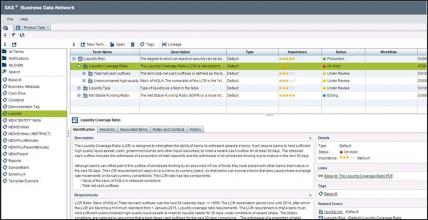

Product Profile

Screenshots

Product/Service Description

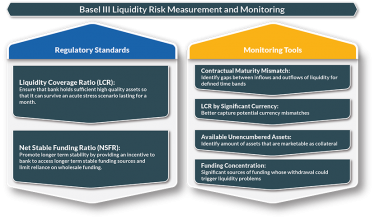

LCR aims to ensure that a bank maintains an adequate level of unencumbered, high-quality liquid assets that can be converted into cash to meet its liquidity needs for a 30 calendar day time horizon under a significantly severe liquidity stress scenario. Fintellix LCR covers all three aspects related to LCR, HQLA, Cash Inflows and Cash outflows, with an exhaustive coverage of banking products and securities with respect to LCR requirements.

The NSFR is designed to ensure that long term assets are funded with at least a minimum amount of stable liabilities in relation to their liquidity risk profiles. Equipped with tools for stable funding classification, Fintellix makes the bank’s ability to track, report and complete all NSFR related requirements seamlessly.

Customer Overview

Features

- Robust platform offering.

- Derived Dimension Engine for multiple classification requirements.

- Flexible Object element framework for assigning multiple types of weights based on Business Rules.

- Configurable business rules for all reporting logic.

- In-built Reporting

Benefits

- Flexible on-demand reporting.

- Extensibility and Scalability.

- Platform Agnostic.

- Improved Business Performance.