Windows XP (Microsoft)

Product Profile

Screenshots

Product/Service Description

Fintellix Asset Quality Manager is an integrated yet modular solution to measure, monitor and manage Asset quality of various portfolios. Besides eliminating the regulatory burden through Asset Classification, Asset Quality Tracking, EWS and NPA modules; it also enables risk-sensitive, proactive decision making through advanced analytical MIS and stress testing.

Customer Overview

Features

- Early Warning Signals for SMA and NPA identification.

- Powerful drill-down and slice & dice features for interactive MIS.

- Dynamic asset Classification based on rules framework.

Benefits

- Enables real time risk based decision making.

- Accelerated Provisioning to minimize regulatory capital drainage.

- Pre-calculated matrices can be directly fed to the internal modeling systems to evaluate PD and LGD estimates.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Rapid change is the norm in Regulatory compliance world-wide. Form, content, format and calculation are constantly being changed by the Regulatory bodies to drive a stable financial ecosystem. Fintellix Regulatory Reporting helps a Financial Institution comprehensively manage reporting to the Central Bank and/or other regulatory bodies via automated data submission of mandated reports. Fintellix enables a ‘straight-through’ processing of information for quality and timeliness of data and with zero manual intervention for data accuracy and integrity. Fintellix Regulatory Reporting is available for India (RBI ADF Compliance), Mauritius (BOM), US (FFIEC, SEC, FRB) as well as multiple other countries [Saudi Arabia (SAMA), Singapore (MAS), Philippines (BSP), HongKong (HKMA) and Australia (APRA)].

Translating the data from the Banking systems into the Regulatory reporting lines and managing submissions in an automated fashion takes a heavy toll on the resources in the Bank’s Finance, Risk and compliance teams. Fintellix Regulatory reporting is a flexible, configurable white-box system that helps convert raw data from the banking systems into Regulatory submissions with full data lineage and easy audit of the data flow.

Customer Overview

Features

- Robust platform offering.

- Configurable business rules.

- In-built Reference Code Management for all recommended reporting codes by regulatory body.

- Configurable maker-checker process based submission with audit trail.

Benefits

- Extensibility and Scalability.

- Platform Agnostic.

- Improved Business Performance.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

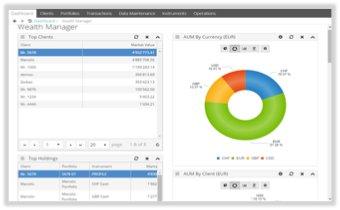

Screenshots

Product/Service Description

The IMSplus Investment Management platform (available on desktop, web and mobile) serves the BFSI industry with specialised solutions for each sector. IMSplus is built to offer flexibility and ease-of-use, fulfilling complex and evolving business requirements in the global Investment Management domain.IMSplus is an integrated, yet modular investment management platform that effectively supports the respective operations of any type of financial entity. Its range of advanced solutions serves: Wealth Management, Asset and Fund Management, Personal Banking and Brokerage, Custody, Insurance Investment Management and Family Offices. These solutions can be deployed as standalone installations or complement the institution’s existing infrastructure as there are ready-to-use interfaces to many 3rd party platforms and a flexible configuration is available to meet specific organizational needs.

Customer Overview

Features

- Multi-entity design, accommodating international operational models with full support for local business processes

- Full support for a wide set of instruments such as equities, bonds, funds, ETFs, term deposits, FX, derivatives, swaps, precious metals ,real estate and private equities

- Powerful, multi-currency management and reporting

- Multi-dimensional monitoring of performance, profitability and risk

- Dynamic transaction toolkit, providing easy customisation and adaptability

- Customer-centric philosophy with complete KYC and CRM tools compliant with local regulations

- Automated workflow environment, contributing significantly to paperless operations, rapid information exchange and a 360° view of all system entities

- Provision to serve clients over branches, call centers, the web and mobile devices

Benefits

- Cost reduction and profitability margins optimisation

- Close monitoring of all Investment Management operations and improved risk control

- Empowerment of sales and fast new product launches across multiple domains and borders

- Tailored services per client segment ensuring improved customer experience

- Gradual deployment options for fast, low cost and risk-free projects

- Rich functionality and state-of-the-art architecture securing scalability to meet any business change

- Technology- and vendor-independent integration capability

- Fast Return on Investment

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

FlexFinance FRC (Finance, Risk & Compliance) is a ready-to-use, a complete out-of-the-box Enterprise Information Management (EIM) solution which includes historical data storage and is a perfect complement for core banking.

Customer Overview

Features

- Support of diverse national, regulatory reporting standards

- End-to-end solution

Benefits

- Handles the complete chain, covering valuation, accounting, risk calculations and reporting in a 100% automated way

- Ensures rapid implementation in compliance with best practices.