Online Support

Product Profile

Screenshots

Product/Service Description

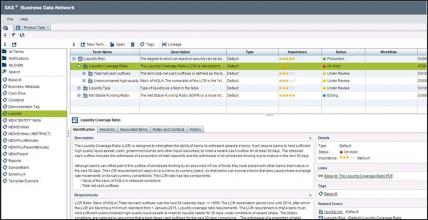

SAS delivers a single solution that combines powerful analytics and visualization with robust data management capabilities, providing a solid foundation for all facets of risk data aggregation, governance and reporting – and enhancing your ability to identify and manage risk. SAS Risk Data Aggregation and Reporting connects data silos across your bank for a single, consolidated look at all your data.

Customer Overview

Features

- A comprehensive data store for all regulatory requirements.

- The ability to aggregate risk data using nonlinear methodologies

- Data quality rules for multiple dimensions

- Self-service visual analytics to convert data into meaningful metrics and information for a holistic view of your bank’s risk.

- Centralized capability for business analysts to develop and refine business rules that govern their data.

- Risk aggregations for banking and trading book

- Updateing business rule logic within a single rule-management environment

- Ability to categorize and assign responsibility for data quality errors

- Top-down correlated aggregation

- Bottom-up approaches

Benefits

- A single foundation for a complete data governance platform of risk data governance, data quality information accuracy, integrity and completeness

- Integration with many major platforms with a flexible and adaptable architecture that doesn’t require replacing existing technology investments.

- Processing of risk data calculations with high-performance, in-memory aggregation of positions (banking and trading book), exposures and data to the highest level of detail

- A high-performance risk engine to aggregate risk measures on demand (VaR, ES, etc.)

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

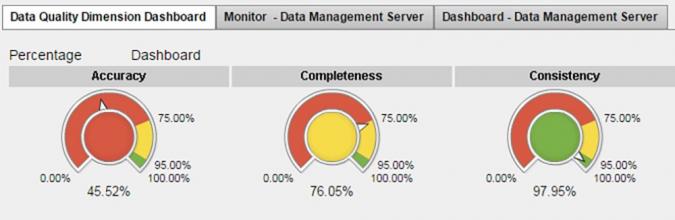

Screenshots

Product/Service Description

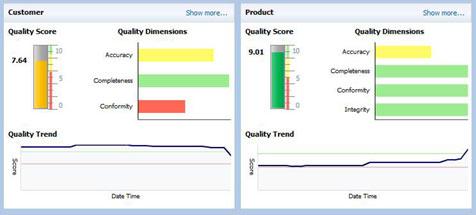

SAP data quality management for the enterprises consists of SAP® Data Services and SAP Information Steward software. Enhanced data profiling, quality metrics together with data matching and consolidation options enable financial institutions to make more informed decisions and speed up business processes. The solution is complemented with concise analytic tools for advanced data quality support.

Customer Overview

Features

- Data quality management functionality to support trusted data

- Data cleansing tools to parse, standardize, and cleanse data from any source, domain, or type

- Data profiling to enhance understanding of data

- Customized management of data policies, data quality

Benefits

- Easy and user friendly solution of data problems

- Deep view of data quality metrics with intuitive dashboards and scorecards

- Option to improve data by parsing, standardizing and cleansing data from any source, domain or type

- Numerous data enhancements with internal or external sources to maximize the value of your data

- Data consolidation to uncover hidden relationships and provide a single version of the truth

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Hyperion Financial Data Quality Management

Screenshots

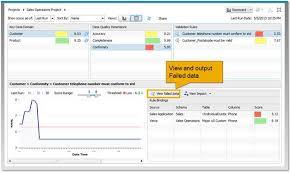

Product/Service Description

Oracle Hyperion Financial Data Quality Management represents a packaged solution for finance users that helps develop standardized financial data management processes with its Web-based guided workflow user interface and powerful integration engine. Financial Data Quality Management's data preparation server can ease integrating and validating financial data from any source system. And to further reduce data integration costs and data mapping complexities, Hyperion Financial Data Quality Management includes prepackaged Enterprise Performance Management (EPM) adapters for Hyperion Financial Management, Hyperion Planning, Hyperion Enterprise, Hyperion Strategic Finance and Oracle Essbase.

Customer Overview

Features

- Guided workflow interface

- Complete data validations and error checking

- Automated data mapping and loading

- Prepackaged system adapters

- Detailed audit reviews and reconciliations.

- Support for standard file formats as well as direct connections to transaction systems.

Benefits

- Increase your confidence in the numbers.

- Lower the cost of compliance.

- Simplify financial data collection and transformation.

- Standardize with repeatable financial processes.

- Deliver process transparency through audit trails.

- Achieve timeliness of data with a Web-guided workflow process.

- Improve the productivity of finance

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

TCS BaNCS, from Tata Consultancy Services, is a globally acclaimed software brand that enables transformation in financial services through a superior and holistic suite of solutions for banks, capital market firms, insurance companies, and other diversified financial institutions.

Each solution in the TCS BaNCS family has been designed to fully integrate with existing business models, enterprise infrastructures and technology architectures. Adopted as a platform of choice by financial institutions around the world of all sizes, TCS BaNCS addresses critical industry needs and enables business transformation by providing customers with scalable, customizable, market-ready solutions.

Built on open architecture, this component-based product suite leverages service-oriented and event-driven architectures. Based on TCS’ in-depth market understanding through numerous interactions with more than 280 customers across 80 countries, this product suite offers one of the broadest end-to-end functionalities for financial services

Customer Overview

Features

- The TCS BaNCS platform for Banking encompasses an array of pre-configured, customizable banking products such as Universal Banking, Core Banking, Payments, Risk Management & Compliance, Financial Inclusion, Islamic Banking, Treasury, Wealth Management, Pr

Benefits

- Flexible configuration features.

- SOA-enabled infrastructure.

- Centralized Customer Information Facility and Risk Management.

- Cross channel communication within Branch,

- ATM/Kiosk

- IVRS/Contact Centre

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Linedata Longview is a complete front and middle office solution for institutional, wealth and alternative investment managers. The solution offers multi-currency, multi – asset and multi-geography coverage. Longview provides great flexibility and scalability to firms of any size and business needs.

Customer Overview

Features

- OMS together with trading tools and high speed of EMS in a single platform

- 7 – Level hierarchy portfolio modeling

- Highly configurable interface

- Advanced rebalancing

- Rule – based order routing

- Integrated broker Fix Connectivity with Linedata LyNX

Benefits

- Advanced portfolio and cash Management

- Liquidity Alliance Program with access to 400+ global brokers and 50 partners (ATS, dark pools, broker algo’s, etc.)

- Centralized modules for trading, solution activity monitoring, portfolio management and compliance monitoring

- Add-on service StatPro Revolution, a cloud-based portfolio analysis system

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

SunGard’s Front Arena is the solution for electronic trading and position management for all multi-asset workflows through a single platform. Front Arena allows automation and integration of multiple business lines including trading and risk management, sales and distribution, settlement and accounting.

Customer Overview

Features

- Integration of many instruments through single trading platform

- Rich front-to-back-office capabilities Real time trading and risk monitoring across multiple channels

- Can be installed in deployed and hosted modes

Benefits

- Enhanced order routing and internalization.

- Extensive workflows with customizable data parameters.

- Integrated rules engine.

- Option to build customized automated strategies together with the existing algorithms.

- Connectivity to a large number of trading venues

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

Misys FusionCapital brings together cloud-based components with trading system in one business-wide, cross-silo solution. FusionCapital allows seamless front-to-back customized workflow and easy integration. The componentised trading solution consists of Core Workflow, Curves, Pricing, eTrading, Securities Inventory and can be combines with other components as well.

Customer Overview

Features

- Front-to-back trade processing. Computational elasticity and real-time risk with full valuation. Cross-asset coverage includes processing of OTC derivatives (interest rate, credit, FX, equity), exchange traded derivatives, inflation, fixed income, FX/MM,

Benefits

- Enterprise-wide consistency due to component-based, open architecture. In the front office, FusionCapital enables to manage trading, positions and exposure, what-if scenarios and hedging with screens designed precisely for traders. A rich set of developme

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

midQORT is an automated broker’s middle office enabling monitoring and control of positions and risks with due respect to all markets and groups of participants and providing the representation of financial results.

Customer Overview

Features

- Estimation and control of positions

- Risk management relative to counterparties, clients and own position

- Entry and settlement of OTC transactions

- Financial performance estimates

- Analytics (turnover, commissions, etc.)

Benefits

- Enhanced workflow capabilities.

- Business inteligence.

- Customization.

- Variety of APIs

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

Fidessa’s Minerva consists of several components that altogether cover the entire trading cycle. Minerva OMS, EMS and Connectivity offer comprehensive, end-to-end workflow covering all asset classes with integrated compliance and connectivity to a global community of brokers and venues.

Customer Overview

Features

- Minerva OMS, EMS and Connectivity offer comprehensive, end-to-end workflow covering all asset classes with integrated compliance and connectivity to a global community of brokers and venues. Minerva Connectivity provides managed, maintenance-free access t

Benefits

- Complete asset class coverage. Custom workflows. Integrated restriction checking. Broker/ECN integration. Commission management. Allocation algorithms.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

Verizon’s Infrastructure, Managed Hosting and Application Management Services deliver great connectivity across global networks and data centers allowing customers to effectively provide enterprise applications around the world. Verizon removes the burden of handling complex infrastructures with numerous staff at high cost by providing fast and cost effective resources with proper control and support options.

Customer Overview

Features

- Robust computing performance with storage options

- Equipment inspection, handling, and cabling services

- A thorough verification process

- Robust identity/access management

Benefits

- Strong service level agreements (SLAs)

- Layered security features