Online Support

Product Profile

Product/Service Description

The Yobota Platform is a cloud-based operating platform, offering a leaner, faster and cheaper way for our clients to set up and run their financial businesses. Our clients pick the functional components they want, and with consumption-based pricing they pay for exactly what they use, rather than bearing would otherwise be large fixed IT costs. Our platform provides access to the financial services ecosystem, enabling a full, front-to-back operational capability without the need for countless integrations.

Customer Overview

Features

- Flexible

- Modular

- Easy to Implement

- Supports very high degree of innovation of financial products

- Pricing based on usage

Benefits

- Derisks the provision of banking technology capability

- Enables customers to create game changing products

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

iSHRAQ Advanced Investment & Financing Management Model

Product/Service Description

iSHRAQ provides Islamic based Financial and Investment solutions to clients, specializing in Sharia investments to bring the best of Stock Markets, Mutual Funds, Portfolio Management Services, Real Estate Investment, and Wealth Management Services in a Sharia-compliant way. Consisting of 6 modules: iSHRAQ*Invest, Finance, Sukuk, Fund Management, Treasury and General Ledger covering all aspects of investment, finance and banking available on the market, while providing a user-friendly interface with the ultimate performance and an accurate calculation and speedy data retrieval.

iSHRAQ’s in-depth research, technical analysis and powerful trading tools coupled with highest standards of service are tailored to suit the requirements of financial institutions. iSHRAQ is a reliable, flexible and innovative platform that delivers an unparalleled client experience.

Customer Overview

Features

Enables customers to invest in most asset classes, in multiple markets, using one or more currencies.

Improved operational performance and productivity through its fully centralized database along with full scalability for unlimited growth and large volume processing capabilities.

Offers comprehensive and consolidated reports, market updates, and portfolio yields.

Enables portfolio managers to manage money of one or more portfolios in a specified currency which saves front officers of all back office accounting details.

Stock markets support in single and multi-currencies including setting deals, commission and fees rates in each currency allowed by the dealing market.

Automatic calculation of fees at specified periods or with each transaction, whether it is per-transaction, fixed amount or fixed lump sum at a specific period.

Fully integrated web based application allowing employees and customers real time access to investment information.

Ability to maintain several transactions simultaneously with independency in saving different forms allowing users to create, edit and save several records at once.

Murabaha

Mudaraba

Musharaka

Deminishing Musharaka

Tawarruq

Qard Hassan

Musawma

Ar-Rahnu

Istisnaa

Leasing

No collaterals, guarantors, or bank accounts

No penalties for late payments

Loan full or partial dropping in case of customer death or inability to repay

Grouping concept to mitigate collection risk

Takaful concept: Customer performance tracking for further loan programs.

iSHRAQ*Invest provides real time access to investment information through a user friendly web interface that offers 3 levels of information in a single page as well as a multi tabbing feature that makes the navigating experience through the system more effective while saving all the data coherently. Every transaction applied on the system is calculated and reflected automatically, minimizing the overall time consumed to run the portfolio calculations and enhancing the system performance. This advantage is useful when generating reports in previous dates since these reports take almost the same time to generate as the current report.

Key benefits are:

iSHRAQ*Finance provides financial facilitators with a comprehensive Islamic finance platform rich in tools to maximize investment performance through a wide range of Islamic products that are specially tailored to meet the diverse needs of their corporate and retail customers, while being fully compliant with the Sharia regulations. It is a complete customizable and innovative solution that includes all the finance facility cycles starting from the approval workflow, managing legal entities, setting repayment plans, connecting the business parties with the following Islamic products:

iSHRAQ*Microfinance Loan Programs Business Features:

Benefits

Back date facility that can undo the effect of posting transactions backward until a specific date; to add missed transactions in the past and affect balances in the past and update or delete one or more posted transaction.

Built-in data mart for quick generation of complex and multiple-domain reports without affecting the application performance. The data mart also allows getting reports as of any date in the past with the same performance as of current date.

Friendly user interface in terms of facilitating application usage through multi-pages, multi-tabs and customizable favorite list for quick and easy access of day-to-day tasks.

Solid approval workflow engine to guarantee that each transaction has its own approval path, starting from the transaction submission until the final decision is made.

Allows remote approval for application requests.

Task list that shows the current transaction pending for action from the current user. When a transaction is done, it disappears from the list, saving the user from searching, with the option of creating a mass action for bulk transactions.

N-tier architecture with two common presentation and database tiers, in addition to the middle-tier which is composed of control-logic enabling data-access tier directly or through the business tier.

Fully web based structure that grants access to any location (branch) without any installation or maintenance efforts.

SOA (Services-Oriented Architecture) compliant which allows exposing web services to bank clients in order to create application requests, application follow-ups, or any other inquiries.

Fully compliant with Sharia principles.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots & Video

Product/Service Description

Epos Now’s newest hardware innovation, POStoGO, is an exciting step in mobile point of sale technology. A fully mobile POS solution with best in class integrated payment technology, allows you to take payments on the move, with ease, accuracy and speed.

POStoGO provides everything required to trade in one box:

- An intuitive, detachable android tablet complete with our most innovative software to date, Athena™

- Smart base unit, complete with 80mm thermal receipt printer

- Full access to our award-winning AppStore. 120+ integrations with our best in class partners, including Sage, Xero and PsConnect

- A fast, hassle-free start, with the system fully operational in under 15 minutes.

- Full visibility of your business with access to hundreds of detailed reports, allowing you to make informed decisions

Customer Overview

Features

- An intuitive, detachable android tablet complete with our most innovative software to date, Athena™

- Smart base unit, complete with 80mm thermal receipt printer

- Full access to our award-winning AppStore. 120+ integrations with our best in class partners, including Sage, Xero and PsConnect

- A fast, hassle-free start, with the system fully operational in under 15 minutes

- Full visibility of your business with access to hundreds of detailed reports, allowing you to make informed decisions

Benefits

- POStoGO is unrivalled in its ability to cut queues and give customers a seamless experience in both retail and hospitality. Waiting staff can print branded receipts and take payments at the table, while retail staff boost customer satisfaction by taking a chip and pin, contactless and apple pay payments in the queue.

- A versatile and scalable solution, POStoGO utilises cloud technology, allowing you to access your data at any time, from anywhere, on any device. Intelligent and comprehensive reporting functions safeguard the profitability of your business.

- "POStoGo is a dynamic development in the world of mobile POS, empowering retail and hospitality businesses to sell on the move. Many SMEs attend trade shows, craft fairs, and outdoor festivals - environments where traditional EPOS systems just aren’t viable. POStoGO offers the same benefits and insights as it’s fully-sized counterpart, with a fully mobile, ergonomic design." Jacyn Heavens CEO

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Jabatix is a comprehensive, component-based software development and software production environment for batch applications on application servers based on standard technologies. The Jabatix Community Edition is an all-in-one Eclipse-based Interactive Development Environment. It is a comprehensive workbench for developing information management and reporting solutions.

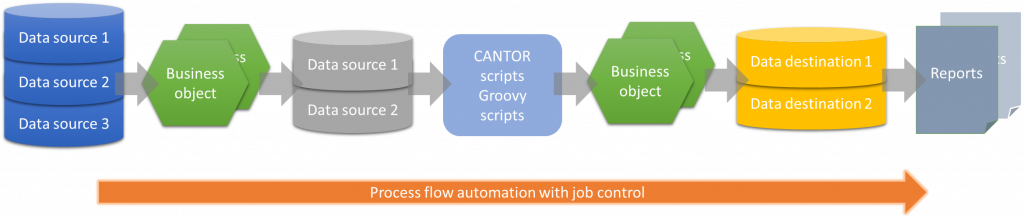

The key enabling tools and features are:

• Encapsulated access to a wide variety of data sources, from flat files (.csv), to Excel spreadsheets, to relational databases; specific queries can even be directly integrated with the logical data source binding

• Business Objects (BOs): object-based containers that serve to integrate data sources, apply the required functionality (format consistency, data cleansing, aggregation, calculations), to produce and visualize results quickly

• With the Jabatix Cantor scripting language, a Groovy DSL (Domain-Specific Language), with an easy-to-use, pointerless, Microsoft Visual Basic-like syntax, customization scripts can be quickly and efficiently programmed and deployed, even by junior programmers and savvy web developers

• Jabatix workbench also supports Groovy scripts and integrating Java classes: this flexibility makes the Jabatix “layer” between data sources and destinations highly efficient and capable of even the most sophisticated processing

• The Jabatix process flow feature provides workflow automation capabilities in real-time, it can also be activated event- or time-section-controlled

• Jabatix supports report generation with the Jabatix's own Datapoint Report Generator or with Eclipse BIRT; other forms of visualization can be generated programmatically

Customer Overview

Features

- Cantor Script

- Process Flow

- Data Mart Designer

- Business Objects

- Business Object Mapping

Benefits

- All-in-one Eclipse-based Interactive Development Environment

- Cantor scripting language (a Groovy DSL) is similar to Visual Basic. Alternatively Groovy and Java classes can be used

- Free download, no strings attached for independent program development

- Updates and upgrades available free of charge

- Faster development of high-quality software

- Reduction of training costs for software development

- Easy development of software solutions by staff with little IT knowledge

Platform & Workflow

Jabatix supports report generation with the Jabatix's own Datapoint Report Generator or with Eclipse BIRT; other forms of visualization can be generated programmatically

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

PAYMILL is one of the top payment processing companies in Europe. As your payment service provider, PAYMILL will allow you to accept PayPal and credit/debit card payments directly in your online shop. You will be able to accept mobile payments, recurring payments and online payments globally, enabling you to scale internationally from the get-go. PAYMILL online payment gateway is heavily focused on security measures – you can rest easy knowing your data is being processed by a secure payment service. Start by registering, opening your merchant account and find out how easy it is to get your online payment system up and running. PAYMILL was founded in 2012 and is part of the CYBERservices SA Group since 2016. Following the merge with CYBERservices PAYMILL benefits of 16 years experience in the banking industry.

Customer Overview

Features

- Extensive payment methods: Credit/Debit Card Payments, PayPal Payments, SEPA EU wide Payments

- Recurring payments

- Subscription, mobile and web availability

- Built-in fraud prevention

- PCI compliance solution

- Integrated payment analytics

Benefits

- Worldwide availability

- Easy integration options

- 16 years banking experience

- Owner of banking license

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

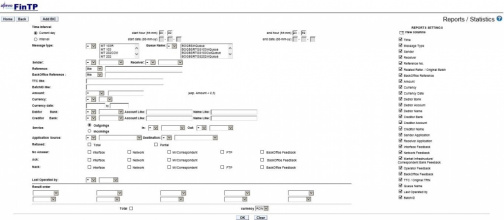

FinTP is a versatile open source solution for flow automation and seamless integration between various internal systems/applications and external market infrastructures or networks, providing operators with relevant information in a one-window approach (acting like a financial middleware), which allows banks to focus less on their internal processes, and more on designing attractive client-oriented services and products.

On top of its core function, FinTP provides support for the most used funds transfer instruments (credit transfer, direct debit, debit instruments) and includes features for operational risk containment (transaction filtering, duplicate detection, accounting reconciliation), liquidity reporting, treasury operations management, end-to-end management of remittances, competitive reporting and SEPA & TARGET2 compliance.

FinTP use cases are in solutions for transaction broker, payment factories, corporation financial consolidation, management of microfinance operations, optimization of payment flows for public administrations, public debt management etc.

Customer Overview

Features

- Financial instruments:

- Funds transfer (MT, MX message types)

- Direct debit

- Debit instruments

- Remittances

- Treasury operations

- SEPA (credit transfer – SCT ; direct debit – SDD) compliance

- SEPA for corporates

- Statements (MT940/MT950, MT900/MT910)

- Corporate to bank connectivity

- Operational features:

- Duplicate detection

- Accounts reconciliation

- Transactions filtering

- Competitive reports & alerts

- Liquidity reporting and forecasting

- Business continuity

- Loan disbursements and repayment matching

Benefits

FinTP lowers the total cost of ownership (ensuring nil capital expenses and optimized operational expenses – via shared development and maintenance), while eliminating the common vendor lock-in dependence and aiming to achieve a better level of interoperability - by encouraging a wide adoption, due to financial attractively and short time-to market.

The innovation factor consists in its open source distribution model, allowing banks/corporations/public institutions who use it to contribute updates and improvements to benefit all users. This enables an unprecedented level of transparency and collaboration between clients, being possible because middleware is not a competitive differentiator for them. It is in the best interest of all involved parties that this collaboration happens, so that everyone can focus on primary client oriented attractive services.

Last, but not least, FinTP is highly flexible and configurable and can be adjusted to fit the exact needs of the customer.

Platform & Workflow

Custom reporting capabilities: users can tailor their own reports. A set of standard reports already is available in the application, as most frequently asked by bank or treasury operators

Competitive reports: offers several analyses and reports of the market trends, along with early alerts

Liquidity reporting: ensures real-time cash reports and forecasts using several reporting criteria, in a consolidated view

Auditing: detailed logs of user activity, payment status updates with full information on timestamps, originating application, end application, device information, etc.

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Clari5 Enterprise Fraud Management

Screenshots & Video

Product/Service Description

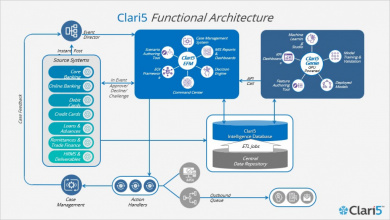

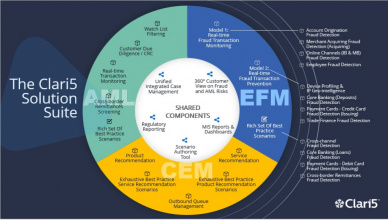

Clari5 is a next gen enterprise platform for real-time intelligence, using the best of technology for the most cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks. Clari5 Enterprise Financial Crime Management Solution suite provides real-time anti-fraud and anti-money laundering capabilities on a unified real-time intelligence platform.

Clari5 Enterprise Fraud Management (EFM) is a real-time Enterprise Wide Fraud Detection, Monitoring and prevention solution that monitors suspicious patterns across transactions, events, users, accounts, systems in real-time and responds with the right action to pass or block transaction, or generate real-time alerts for manual investigation.

Customer Overview

Features

- Proactively combats cross channel, cross product fraud across the enterprise real-time

- Customer aware solution that monitors 360 degrees digesting all transactions and actions

- Silo Breaker solution that combats sophisticated fraud with real-time, actionable insights

- Employs intelligent models based on neural network, time series and complex analytics to deliver insight

Benefits

- Perform fraud prevention in real-time as banking transactions occur

- Prepackaged Scenarios and built-in interfaces across Products/Channels to achieve quick ROI

- Dynamically profiling suspicious devices, cards, merchantsor payees for preventing fraudulent transactions

- Expedited fraud investigation based on Investigation Workbench and Integrated case management

- Integrated reports and dashboard giving insights on the efficiency and effectiveness of the fraud prevention

Platform & Workflow

Cash Transaction Reports, Suspicious Transaction Reporting / Suspicious Activity Reporting, Non-Profit Transaction Reporting, Counterfeit Currency Reporting, Cross-border Transaction Reporting. Management Reporting - Role based Management Reporting and Dashboarding using embedded Enterpsise BI platform

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Clari5 Customer Experience Management

Screenshots & Video

Product/Service Description

Clari5 is a next gen enterprise platform for real-time intelligence using the best of technology for cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks.

Clari5 Customer Experience Management solution delivers instant contextual intelligence across 3 dimensions: Tacit, Actionable and Conversational. Insights offering contextual, real-time recommendations across all channels helps grow cross-sell/ up-sell revenue exponentially.

Customer Overview

Features

- Cross-sell/ Upsell in Real-time

- Next Best Product Recommendation

- Lead Generation

- Intelligent Prompts

- Real-time Customer Detect at Branch

- Automated Service Messages

- Enhanced User Effectiveness

- User-friendly Analytics

Benefits

- Unified and holistic customer experience at every touch point

- Helps customer facing staff make intelligent and relevant conversations

- Enables banks to proactively improve customer experiences across all communication channels

- Solution leans from transactions, interactions, responses and factors them using mathematical models and fuzzy logic to arrive at right conversation pointers, right messages and right sales opportunity

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Clari5 Anti-Money Laundering Solution

Screenshots & Video

Product/Service Description

Clari5 is a next gen enterprise platform for real-time intelligence using the best of technology for cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks.

Clari5 Anti-Money Laundering (AML) solution helps banks and financial institutions automate, streamline and comply with existing and emerging regulatory AML/CFT compliance programs. Clari5 AML suite consists of following solutions, available individually or as an integrated whole namely: Suspicious Activity Monitoring, Customer Risk Categorization, Entity Identity Resolution/Watch List Filtering, Regulatory Reporting (CTR/STR/SAR and any other reports to be submitted to central bank), Scenario Authoring Tool for creating new scenarios, Integrated Case Management, Investigation Tools, Entity Link Analysis and Comprehensive Management Reporting.

Customer Overview

Features

- Automation of entire AML compliance program, from customer on-boarding to steady relationship monitoring

- Comply to risk-based AML approach with on-going customer risk rating and risk-based Transaction Monitoring

- Comprehensive investigation capability based on the risk level of the suspicious transactions through integrated case management with the power of Investigation Tools

- Entity Link Analysis with graphical analysis to discover money laundering rings and funds structuring

- Automated STR/SAR/CTR generation as part of the regulatory reporting

Benefits

- Real-time approach to monitor and detect suspicious money laundering transactions

- Improved regulatory compliance and customer confidence

- Quicker implementation because of pre-packaged AML scenarios and built-in interfaces for integration

- Low cost commodity hardware infrastructure leading to reduced TCO

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Clari5 Loan Early Warning Signals Detection

Screenshots & Video

Product/Service Description

Clari5 is a next gen enterprise platform for real-time intelligence. We have used the best of technology to bring in the most cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks and this is manifestation of our innovation in technology.

Clari5 Loan Fraud Monitoring automates the entire Early Warning Signal Detection. Each of the Early Warning Signals, if represented through a comprehensive set of rules, identifies the pattern of the Loan Account. In addition, it interacts with your Core Banking System and Loan Origination System to identify all early warning signals of interest for the Loan Account Monitoring system. A fully integrated Case Management System and Regulatory Reporting Framework enables the bank to control the end-to-end activities.

Customer Overview

Features

- Comprehensive Early Warning Signal (EWS) Pattern Detection Engine with an ability to dynamically add new EWS and launch them

- Integration with multiple Core Systems to factor in the entire Customer behavior to identify any suspicious behavior

- Fully Integrated Case Management System to monitor all early warning signals generated by the system and performing additional investiga-tion to authorize an account as a Red Flagged Account

- Regulatory Reporting Workbench to electronically generate and file any report required either by the RBI or Law Enforcement Agencies

- Management Reporting Workbench to keep the management abreast of Fraudulent Behavior Accounts and general daily activities

- Flexibility to Implement either On-Premise or Cloud Based.

Benefits

- Comprehensive Investigation workbench –integrated case management, link analysis

- Flexible modes of deployments-Real-time monitoring & Real time Transaction Stopping

- Business friendly interface for decision and case workflow policies

- Cross Channel and Cross Product Coverage

- Proven Architecture for Scalability and Performance –Easier Integration

- 100% scanning of transactions rather than using transaction sample based fraud detection