Online Support

Product Profile

Product/Service Description

Informatica Cloud for Salesforce is the integration and data management solution that helps wealth managers get maximum efficiency in leveraging Salesforce. Informatica Cloud provides connectivity to a variety of channels including cloud, on-premises, mobile and social data sources. Its complete integration suite includes Cloud Data Integration, Cloud Application Integration, Cloud Test Data Management, Cloud Data Quality and Cloud Customer 360 for Salesforce.

Customer Overview

Features

- Sales Cloud to Back Office

- Closed-loop Service Cloud®

- Salesforce Analytics

- Custom Salesforce Apps

Benefits

- Increased sales momentum and agility, reduced operating costs

- Exemplary customer service by unifying the customer data

- Integration of customer data with legacy systems

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

MarkitSERV represents a global electronic trade processing service for OTC derivatives. The application provides end-to-end trade processing and workflow solutions that support all participants in the process of trading including post trade notices of execution, trade confirmation and allocations to clearing and reporting. More than 2000 active customers of MarkitSERV include sellside and buyside firms as well as execution venues.

Customer Overview

Features

- Extensive clearing coverage

- Simplified regulatory reporting

- Automated trade workflow

Benefits

- Support for a complete OTC transaction lifecycle

- End-to-end, multi-asset trade processing solutions that support all OTC market participants

- A broad range of asset class

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

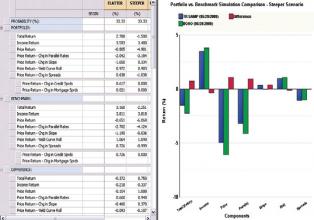

Screenshots

Product/Service Description

BondEdge® Wealth Manager is a packaged solution that provides wealth managers and advisors with institutional level portfolio analytics, investment reporting, charts and compliance reports.

Customer Overview

Features

- Rich capabilities for risk reporting, benchmarks comparisons, total return simulations, and what-if analyses

- Flexible bond modeling tools

Benefits

- Extensive data coverage of taxable and tax-exempt bonds

- A bond database of over 2.8 million securities

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

PhoenixEFE® Core is an enterprise software platform for real-time transaction processing and account servicing. PhoenixEFE Core includes modules for customer management, universal loan and deposit servicing, system administration and general ledger. PhoenixEFE Core database also incorporates functionalities for teller, collections, relationship pricing, sales & service, fraud management as well as card management.

Customer Overview

Features

- PhoenixEFE Universal Loan Servicing

- PhoenixEFE Universal Deposit Servicing

- PhoenixEFE Customer/Member Management

- PhoenixEFE General Ledger

- PhoenixXM Web Services Transaction Gateway

- PhoenixEFE System Administration

- PhoenixEFE Single Sign-On

Benefits

- High performance transaction processing and account servicing

- A universal loan servicing application for commercial, consumer and mortgage loans

- Centralized view of the customer

- Rich enterprise capabilities

- User convenience in password management and policy enforcement

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

ACI Universal Online Banker is a digital banking platform that delivers financial institutions global multilingual and multi-currency cash management solutions. The strength of ACI Universal Online Banker lies in its powerful features built within a user interface designed especially for ease of use and a technology platform with easy integration, flexibility and scalability. The broad-based functionality offers user driven balance and transaction reporting tool, sophisticated entitlements and approval capabilities including panel authorization, and extensive global payment types including NACHA, SEPA, Giro, domestic and international wires, drafts, drawdowns, multi-bank, federal and state tax, and localized payments for the UK, Europe, Middle East and Asia.

Customer Overview

Features

- Tailored service offerings for small businesses to large corporates

- Multi-affiliate banking

- Marketing campaigns

- Extensive treasury portal capabilities

- Comprehensive segmentation approach

- Single sign-on and entitlements

Benefits

- Personalizable dashboard

- User experience differentiation

- Flexible and robust security models

- eLearning tools

- Additional bank administration tool

- Global payments initiation and support

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

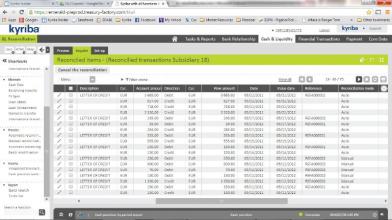

Product Profile

Screenshots

Product/Service Description

More than 1,300 treasury clients use Kyriba to optimize global visibility, improve financial controls, and increase operational productivity across their cash and liquidity, payments, supply chain finance and risk management operations. Kyriba’s transformative financial solutions enable clients to become strategic partners to their organization by making more successful financial decisions and offering more insightful analysis.

Utilizing a fully virtualized cloud solution, Kyriba clients enjoy the benefits of 100% SaaS. Implementing the modular and scalable solution across multiple geographies requires only a fraction of the investment of traditional legacy systems, providing simple and secure access to data—anytime, anywhere. Kyriba delivers a full business continuity solution and is audited to the SOC Type II standard to ensure that our clients align with their own information security policies and external regulatory compliance.

Customer Overview

Features

- Cash and Liquidity Management

- Payments

- Risk Management

- Supply Chain Finance

- Connectivity

- Security

Benefits

- Business Continuity

- 100% SaaS

- Simple and secure access to your financial data—anytime, anywhere

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

CA Advanced Authentication is a packaged offer that combines two authentication solutions - CA Strong Authentication (formerly CA AuthMinder) and CA Risk Authentication (formerly CA RiskMinder). The application provides authentication processing for a variety of applications in the organization of any size. The authentication methods include risk-based as well as multi-factor, strong authentication credentials.

Customer Overview

Features

- Comprehensive user behavior modeling for improved risk analysis

- Password files are not stored which eliminates their theft.

- DeviceDNA™ fingerprinting

- Вefault rule sets covering typical fraud patterns

- Support for a variety of credentials – passwords and knowledge-based authentication (KBA) methods, two-factor software and hardware tokens

- Out-of-band (OOB) authentication using one-time passwords (OTPs) delivered via text, voice, or e-mail

Benefits

- Reduces the risk of inappropriate access, data breaches and attacks

- Secures data without burdening legitimate end users

- Blocks high-risk transactions and requires step-up authentication for suspicious activity

- Scales with your organization’s needs

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Blogs

Publications

Product Profile

Product/Service Description

C3 Financial is a web-based cash management software with an integrated framework for cash and ATM branch operations.

Customer Overview

Features

- Accurate cash order and deposit recommendations by denomination

- Complex analysis of historical cash usage

Benefits

- Enhanced communication between branches, finance and operation departments

- Cash management process improvement for de-centralized and centralized operations.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

Founded in 2000, ARQA Technologies is a leading independent financial software provider in Russia and CIS. ARQA’s automated front-to-back solutions are used by over 300 sell- and buy-side institutions from different countries.

The flagship product is QUIK – the multifunctional EMS/OMS platform for trading securities and provision of related services. It is used by both Sell and Buy Side for proprietary operations and brokerage/asset management services to clients.

RISQ solutions form the core of QUIK’s highly developed and flexible risk management functionality which is applied to pre-trade checks, portfolio evaluation and margin trading. QUIK offers a line of low-latency solutions for direct sponsored access (via FIX or exchange API) incorporating online pre-trade control.

QUIK modules are used as building blocks for a number of trading infrastructure solutions. These are developed for optimization of trading infrastructure, aggregation and internalization of liquidity (OMS, ALGO, Matching engine, SOR).

Another product line QORT serves to automate middle-and-back-office operations. MidQORT monitors and controls positions/risks across markets and clients. BackQORT ensures real-time operational accounting and generates reports for regulators and clients. Middle office of asset management company capQORT is used for online position keeping and portfolio control.

Client configurations are formed on modular basis with flexible selection of functionality and transparent pricing. The company also offers its software as managed service from its Moscow and Kiev data centers.

Customer Overview

Features

- Multi-asset and venue-neutral (DMA access to over 30 venues)

- High- and low-touch (incl. algorithmic) trading, latency-sensitive and margin trading

- Sophisticated and extremely flexible risk management (RISQ solutions)

- FIX in / out integrations

- A choice of terminals for end clients and risk/trust managers

Benefits

- Highly functional, adjustable to client's needs and scale of operations, fully transparent flexible pricing

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

essDOCS' flaghsip offering - CargoDocs - provides a holistic paperless trade solution enabling the creation and management of original electronic Bills of Lading & supporting documents, speeding up processes such as presentation to banks under trade finance instruments including eUCP Letters of Credit, Documentary Collections and Bank Payment Obligations. Proven to deliver significant value to the entire supply chain, CargoDocs enables importers, exporters, traders, ship operators and banks to streamline processes, reduce working capital needs and risk, while improving collaboration, compliance and visibility across organisations.

CargoDocs is trusted by a rapidly expanding network of over 3,700+ customers ranging from Fortune Global 500 companies to innovative SMEs spanning across 72 countries.

Customer Overview

Features

- Enables Paperless Trade & Finance

- Secure, web-based solution

- DocPrep allows creation, review and approval of documents

- DocEx allows transfer of eDocs to other users, including banks

- Can be used for Shipments (i.e. electronic Bills of Lading) or Warehouses (i.e. eWarrants)

- eTrade Finance via eUCP Presentation, eDocumentary Collection & BPO+

- Users can integrate at various points to facilitate automation and STP (Straight-Through-Processing)

Benefits

- Automated and streamlined solution

- Less risky, structured lending

- Save time spent distributing, signing, couriering, storing and retrieving documents

- Amendments within hours

- Reduced DSO (Days Sales Outstanding), faster payment

- Eliminate risk of lost or fraudulent documents

- STP / automation (SWIFT-compatible)

- Improved transparency and compliance