Online Support

Product Profile

The Pendo Data Platform (PDP)

Screenshots & Video

Product/Service Description

The Pendo Data Platform (PDP) is a data management and intelligence solution that provides exploration and discovery capabilities across multiple disparate data sources. It is used by large financial institutions to quickly complete incremental projects focused on “dark data” -- data held in legacy systems across the organization where there is little to no transparency. Our Platform and self-service model focus on extraction of metadata from systems, indexing source systems, and quickly gaining insight into how these systems align in a taxonomy. Once in place, we determine if existing relationships endure or if they need reconstructing. Based on decades of experience in approximate matching of data, our algorithms create match sets that align all data sources. Our Platform is shining the light on “dark data”. Finding insight and valuable information enabling financial institutions to provide required transparency. A component to assist in the “Living Will” - our solution can provide the intelligence in the data to free up capital that has a positive impact on Shareholder value. The most critical component of the PDP is the open API’s that enable not only data extraction, but the overhaul of business models and elimination of massive investments in core functional system replacements. PDP will pave the way for disintermediation of legacy systems, processes and workflows. It delivers data that can provide not only the regulatory insight for executives and customers but the ability to understand capital requirements and mitigate fines. Ultimately, our data platform can provide the insight to create more shareholder value.

Customer Overview

Features

- Viewing of structured and unstructured data

- Structure multiple data types into table form

- Universal Search through all data

- Automatically create profile of data set: dimensions, attributes, hierarchy

- Visually identify and associate common relationships across multiple datasets.

- Identify & associate attributes and index

- Create a logical data mode

- Extract tables and/or targeted data from unstructured sources and create tables and fields.

- User-generated data cleansing

- Machine Learning capabilities

- Data quality detection

- Provide banking / financial service domain expertise, particularly familiarity with industry issues, data and processes

- Provide expertise with banking / FS industry data models and integration to address industry issues I opportunities

- Machine learning techniques for anomaly, identification, classification and mapping

Benefits

- We believe we can have a social impact on global financial services.

- Our business has the ability to grow trust in banks, governments and larger establishments as a whole.

- We focus on matters requiring attention and speed and agility in data exploration, discovery and matching.

- The PDP will expose suspect data that is not visible through manual, human intervention.

- We shine the light on the dark data held hostage in legacy systems and processes throughout the financial industry.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

FICO Falcon Fraud Manager provides core analytic processing power to handle an organization’s transactional fraud detection needs such as debt, credit, deposit, ePayments and mobile. It can be used to process events, develop strategies to detect fraud and create cases, and execute associated decisioning across an institution’s products, channels and customers.

FICO® Falcon® Fraud Manager provides deep insight into fraud trends and activity. Powered by FICO’s market-leading predictive analytics, it detects up to 50% more fraud than rules-based systems.

Customer Overview

Features

- Robust neural network models with patented service, account, and customer profiling and monitoring of global entities

- Real-time rule creation, rule simulation, and rule implementation

- Efficient investigations with sophisticated case management system

- Seamless integration with your authorization and payment systems for up to 100% real-time scoring

- Region and portfolio-specific fraud models leverage industry-wide consortium data

- Adaptive models generate fraud scores based on analyst feedback

Benefits

- Detects more fraud with lower false positives to provide minimal impact on good customers

- Delivers earliest possible warning of fraud activity

- Boosts analyst productivity and improves effectiveness of fraud operations

- Identifies fraud sooner to give you more opportunity to reduce losses

- Leverages known fraud patterns to achieve highest fraud detection levels

- Adjusts to your findings about fraud dispositions

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

FICO®Siron® Anti-Financial Crime Solutions

Product/Service Description

FICO® Siron® Anti-Financial Crime Solutions consists of flexible and highly integrated software modules for:

• Anti-Money Laundering

• Tax Compliance (FATCA, CRS/AEOI)

• Counter-Terrorism Financing

• Know Your Customer

• Business Partner Due Diligence

The building-block design allows variable combination of the products. This paves the way to genuine cost efficiency, transparent total cost of ownership and solutions that can grow along with the challenges of our customers.

Key Features:

• Coverage of all statutory requirements

• Risk-based approach according to FATF

• Full check of customers and transactions

• No IT-knowledge necessary to configure detection scenarios

• Best-practice research scenarios from more than 1,000 of customer installations

• Multi-clients and multi-lingual user interfaces

• Easy integration with existing systems through standardized and flexible interfaces

• 100% audit-proof documentation

FICO® Siron® solutions consistently follow the risk-based approach and support all phases of the compliance process with integrated solution modules: from business risk analysis and customer risk classification to monitoring of transactions and behavioral patterns, and central case management with risk and compliance dashboards.

FICO® Siron® products are highly standardized and parametrizable. They can be combined at will to create custom solutions. Numerous best-practice scenarios from a large number of customer installations have made their way into our standard research products. They guarantee fast roll-out of professional solutions based on the latest compliance knowledge.

FICO® Siron® technology is robust, interoperable, platform-independent and highly scalable. This facilitates integration of our products into existing system environments and provides seamless interaction with third-party applications and databases. The field of application of our products extends from the lean departmental to a cross- and multi-national group solution.

Customer Overview

Features

- Coverage of all statutory requirements

- Risk-based approach according to FATF

- Full check of customers and transactions

- No IT-knowledge necessary to configure detection scenarios

- Best-practice research scenarios from more than 1,000 of customer installations

- Multi-clients and multi-lingual user interfaces

- Easy integration with existing systems through standardized and flexible interfaces

- 100% audit-proof documentation

Benefits

- Largely automated driving the daily surveillance with as little effort as possible

- System-independently integrated into the IT-infrastructure – investments in additional hard- and software not necessarily needed

- Good performance even for high volume of data

- Easily adaptable to regulatory changes and highly flexible support of any individual definition of suspicion criteria according to the specific risk of the bank

- End user-friendly dialog to bring in the compliance officer’s experience and knowledge of what seems to be suspicious

- Audit trail protocols of all operations and definitions including changes - to protect employees from being accused of carelessness

- Reasonable costs for license and implementation

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

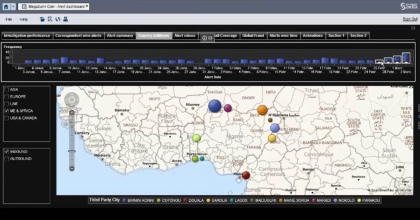

SAS Anti-Money Laundering

Screenshots

Product/Service Description

The SAS solution allows clients to uncover suspicious financial activity efficiently. Get a complete view of threats across your entire institution. And streamline your monitoring, review and investigation processes. SAS provides a common analytics platform and module-based solutions for enterprise fraud, customer due diligence, anti-money laundering and enterprise case management.

Customer Overview

Features

- Money Laundering and Terror Financing Transaction Monitoring, Watchlist and Sanctions Batch Monitoring, Alert and Case Management with Workflow Governance, Regulatory Report Creation, Management, and E-Filing

Benefits

- High Performance scalability to cover very large transaction volume across many lines of business, Transparent system with open data model and no black box monitoring processes or models, Robust and mature data model provided with the solution, Extensive

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

FlexFinance IFRS

Product/Service Description

FlexFinance IFRS. FERNBACH offers a modular solution system. It consists of several blueprints, which in their entirety cover the finance & risk process chain including valuation, financial accounting, reporting and analyses. Each of these blueprints consists of components (“calculation kernels”) which can easily be integrated. One can install selected individual components or the entire range of blueprints. The blueprints for IFRS include the latest rule sets such as IFRS 9 and IFRS 13.

Customer Overview

Features

- FlexFinance IFRS provides, for risk provisioning in particular, a comprehensive catalogue of instruments that includes calculation, simulation, accounting, analysis and reporting. Since different organisational units in a financial institution are usually

Benefits

- Comprehensive IFRS solution which includes valuation of financial instruments, calculation of impairment and hedge management; consolidation with multi-currency capability. • The IFRS solution supports FinRep in accordance with the European Banking Author

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

Dovetail Universal Payments Solution provides centalised processing of payments for a financial institution eliminating multiple legacy systems. Dovetail can process both high and low value transactions on a single platform, cope with multiple incoming and outgoing standards as well as centralise multiple country clearing systems onto one platform. The users of Dovetail Universal Payments Solution might be the organizations of any size starting from small domestic firms to Global Teir 1 companies.

Customer Overview

Features

- Immediate and deferred settlement

- Real-time payment types

- Global clearings

- Cross-border transactions

Benefits

- Easy integration with a bank’s existing systems

- Strong performance and reliability in a highly configurable and rapidly deployable package

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

LexisNexis® Bridger Insight® XG is a fully integrated compliance platform that helps organizations to consolidate compliance procedures, alleviate risk of fraud and strengthen the KYC processes such as account validation, screening and overall due diligence. The solution serves an integral part of the organizations’ compliance programs within such rules as OFAC, Bank Secrecy Act and USA PATRIOT Act. Bridger Insight® XG combines a set of compliance data and sanctions expertise delivered by WorldComplianceTM Data in addition to the filtering software. Among the users of Bridger Insight™ XG is Advancial Federal Credit Union.

Customer Overview

Features

- Comply with global compliance regulations like OFAC, USA PATRIOT Act or the EU's 3rd Money Laundering Directive

- Identify suspected fraudsters using custom hotlist capabilities, even when they try to disguise their identity by using an alias or a new address.

- Screen against robust screening data to help deter crimes such as terrorism, money laundering, illicit financial activity or other criminal acts.

- Comply with Identity Theft Red Flags Rule.

Benefits

- Acceleration of compliance workflow

- In-depth profile data including PEP lists and Enhanced Due Diligence reports

- Access to Accuity's Global Watch List data

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

Calastone Settlements automates the reconciliation and settlement process of investment funds through a single account. All the parties involved in the transaction including fund managers, distributors and transfer agents can gain efficiency using Calastone Settlements. The financial institutions that have leveraged the solution include Schroders and Hargreaves Lansdown.

Customer Overview

Features

- Payment automation with counterparties

- Real-time visibility of trades and account balances

- Automated reconciliation and back office operations

Benefits

- Automated matching of trades

- Liquidity improvements

- Reduction in settlement payments

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Clari5 Enterprise Financial Crime Management and AML Solution Suite

Screenshots & Video

Product/Service Description

Clari5 is a next gen enterprise platform for real-time intelligence. We have used the best of technology to bring in the most cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the Fortune500 global banks - is a validation of our innovation.Clari5 Enterprise Financial Crime Management Solution suite provides real-time anti-fraud and anti-money laundering capabilities on a unified real-time intelligence platform.

Clari5 Enterprise Fraud Management (EFM) is a real-time Enterprise Wide Fraud Detection, Monitoring and prevention solution that monitors suspicious patterns across transactions, events, users, accounts, systems in real-time and responds with the right action to pass or block transaction, or generate real-time alerts for manual investigation.

Clari5 AML solution helps banks and financial institutions automate, streamline and comply with existing and emerging regulatory AML/CFT compliance programs. Clari5 AML suite consists of following solutions, available individually or as an integrated whole, namely: Suspicious Activity Monitoring, Customer Risk Categorization, Entity Identity Resolution/Watch List Filtering, Regulatory Reporting (CTR/STR/SAR and any other reports to be submitted to the Central Bank), Scenario Authoring Tool for creating new scenarios, Integrated Case Management, Investigation Tools, Entity Link Analysis and Comprehensive Management Reporting. Moreover, Clari5 suite has been found very effective crime combatting solution in India, the country where fraud levels are too high.

Customer Overview

Features

- Proactively combats cross channel, cross product fraud in real-time across the banking enterprise

- Customer-aware solution that monitors 360 degrees digesting all transactions and actions

- Silo Breaker solution that combats sophisticated fraud with real-time, actionable insights

- Employs intelligent models based on neural network, time series and complex analytics to deliver insights

- Automation of entire AML compliance program starting from customer on-boarding to steady relationship monitoring

- Comply to risk-based AML approach with on-going customer risk rating and risk-based Transaction Monitoring

- Comprehensive investigation capability based on the risk level of the suspicious transactions through integrated case management with the power of Investigation Tools

- Entity Link Analysis with graphical analysis to discover money laundering rings and funds structuring

- Automated STR/SAR/CTR generation as part of regulatory reporting

Benefits

- Perform fraud prevention in real-time as banking transactions occur

- Pre-packaged scenarios and built-in interfaces across Products/Channels to achieve quick ROI

- Dynamic profiling of suspicious devices, cards, merchants or payees for preventing fraudulent transactions

- Expedited fraud investigation based on Investigation Workbench and Integrated Case Management

- Integrated reports and dashboard providing insights on the efficiency and effectiveness of the fraud prevention

- Real-time approach to monitoring and detecting suspicious money laundering transactions

- Improved regulatory compliance and customer confidence

- Quicker implementation by virtue of pre-packaged AML scenarios and built-in interfaces for integration

- Low cost commodity hardware infrastructure leading to reduced TCO

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

RSA SecurID is the authentication mechanism invented by RSA (currently part of EMC) based on the two – factor authentication with the use of software or hardware tokens. The solution helps organizations to solve complex and sensitive security challenges. The hardware tokens authenticate users by leveraging “something they know” (user name and passcode) and “something they have” (the PIN code on the token). On the top of that RSA SecurID operating model generates and displays new codes every 60 seconds for its hardware tokens.

Customer Overview

Features

- Cryptographic Token Key Initialization Protocol (CT-KIP)

- Basic token code functionality, or a USB form factor for additional smart card capabilities in hardware tokens

- Software tokens are secured on the user’s PC, smart phone or USB device

Benefits

- Support of the most widely deployed mobile and web platforms

- Reduction in the number of devices to manage for secure access

- Over 400 technology integrations