Online Support

Product Profile

Screenshots

Product/Service Description

An integrated risk management solution with predictive analytics, multi – asset class coverage and multiple delivery options. As a truly complete solution Risk Master’s functionalities encompasses all steps of risk control and enterprise-wide decision making. Another value of the product is in its multi-asset class data to analyze risk exposure across markets, trades, counterparties, and portfolios.

Customer Overview

Features

- Scalable risk management and reporting

- Rapid calculations for complex instruments

- Secure, cloud-based delivery model

- Flexible deployment and connectivity with quick time-to-market.

- Valuation options include Scenario & Sensitivity Analysis

- Potential Future Exposure (PFE)

- Back-Testing

Benefits

- Multi-asset class data coverage

- Risk control across markets, trades, counterparties, and portfolios

- Powerful analytics to price and model any instrument

- A consistent valuation framework for pricing and hedging complex portfolios

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

CollateralPro delivers a comprehensive, enterprise-wide collateral management system that enables global investment banks, asset managers and service providers to transform regional and global operations. This Broadridge solution empowers firms to mitigate counterparty risk, comply with changing regulations, and embrace growth. Its end-to-end collateral management capabilities support bi-lateral and cleared derivatives, as well as securities financing transactions.

In addition to providing excellent core collateral management functionality, CollateralPro offers an advanced optimization module which will improve liquidity and enhance revenue.

Agreement management database

CollateralPro supports all international collateral agreement types, including ISDA CSA, GMRA and GMSLA.

Automated exposure calculation and data feeds

Collateral requirements are automatically calculated based on data feeds in a wide variety of formats from both internal and external systems.

Exposure and margin management

Intelligent automation supports margin call workflow through configurable business rules, automatically providing counterparty notifications. Users can drill down from the realtime displays and see exposure at agreement, product and trade levels, as well as view outstanding collateral balances.

Asset and inventory management

Provides an overview of collateral inventory, showing assets available for rehypothecation and confirmed and predicted asset positions. The inventory can be accepted from firmwide positions to make a wider pool of available assets.

Collateral interest calculation and statement

User-definable rules—including periods, rates spreads and internal firm financing rates—drive interest calculations on cash assets. Statements are sent automatically to clients for confirmation, and interest claim status is displayed on the dashboard.

Customer Overview

Features

- Agreement management database

Benefits

- Exposure and margin management

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

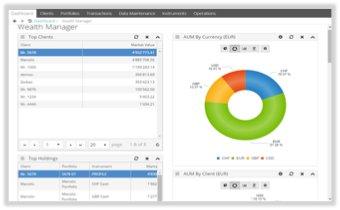

Screenshots

Product/Service Description

The IMSplus Investment Management platform (available on desktop, web and mobile) serves the BFSI industry with specialised solutions for each sector. IMSplus is built to offer flexibility and ease-of-use, fulfilling complex and evolving business requirements in the global Investment Management domain.IMSplus is an integrated, yet modular investment management platform that effectively supports the respective operations of any type of financial entity. Its range of advanced solutions serves: Wealth Management, Asset and Fund Management, Personal Banking and Brokerage, Custody, Insurance Investment Management and Family Offices. These solutions can be deployed as standalone installations or complement the institution’s existing infrastructure as there are ready-to-use interfaces to many 3rd party platforms and a flexible configuration is available to meet specific organizational needs.

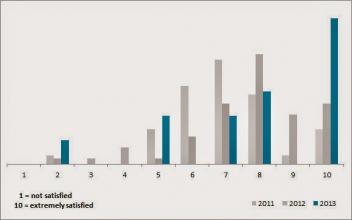

Customer Overview

Features

- Multi-entity design, accommodating international operational models with full support for local business processes

- Full support for a wide set of instruments such as equities, bonds, funds, ETFs, term deposits, FX, derivatives, swaps, precious metals ,real estate and private equities

- Powerful, multi-currency management and reporting

- Multi-dimensional monitoring of performance, profitability and risk

- Dynamic transaction toolkit, providing easy customisation and adaptability

- Customer-centric philosophy with complete KYC and CRM tools compliant with local regulations

- Automated workflow environment, contributing significantly to paperless operations, rapid information exchange and a 360° view of all system entities

- Provision to serve clients over branches, call centers, the web and mobile devices

Benefits

- Cost reduction and profitability margins optimisation

- Close monitoring of all Investment Management operations and improved risk control

- Empowerment of sales and fast new product launches across multiple domains and borders

- Tailored services per client segment ensuring improved customer experience

- Gradual deployment options for fast, low cost and risk-free projects

- Rich functionality and state-of-the-art architecture securing scalability to meet any business change

- Technology- and vendor-independent integration capability

- Fast Return on Investment

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

FlexFinance FRC (Finance, Risk & Compliance) is a ready-to-use, a complete out-of-the-box Enterprise Information Management (EIM) solution which includes historical data storage and is a perfect complement for core banking.

Customer Overview

Features

- Support of diverse national, regulatory reporting standards

- End-to-end solution

Benefits

- Handles the complete chain, covering valuation, accounting, risk calculations and reporting in a 100% automated way

- Ensures rapid implementation in compliance with best practices.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Blogs

Publications

Product Profile

Product/Service Description

Bravura’s Babel STP messaging technology, is an automated end-to-end solution which connects message providers with any distributor platform and transfer agency back office system, providing seamless communication and functionality.

Customer Overview

Features

- Connecting fund message providers with platform and transfer agency back office systems providing seamless communication.

- Flexibility in evolving message standards and future industry initiatives.

- Minimising burden of manual processing requests to back office systems for fulfillment, reducing the chance of errors and mitigating risks

- Accommodation of large volumes of business transactions

Benefits

- Back-office integration

- Data transformation

- System interoperability