M-Banking/Smart watch

Product Profile

Safenetpay multicurrency business accounts and payment processing services

Product/Service Description

Safenetpay offers multi-currency IBANs for the businessess of all types. It also offers payment processing and FX services.

Customer Overview

Features

Dedicated GBP and EURO IBANs

Payments in 150+ currencies

Accepting all major debit/credit card payments as well as the alternative payment methods

Benefits

Quick onboarding

Competitive FX rates

Industry-leading security

Reporting and analytics

API and SDK integration

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

iMAL Enterprise Islamic Banking & Investment System

Product/Service Description

iMAL Enterprise Islamic Banking & Investment System is a powerful core banking platform specifically built from the ground up to support Sharia banking operations. It is truly geared to address country and region-specific Islamic banking requirements. It is offered to high-end Islamic banking, investment and financing institutions, based on an advanced open architecture with a robust integration platform.

iMAL is the only 100% Islamic banking solution as certified by AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) in 2008.

All iMAL modules adhere to the Islamic law and are in full compliance with IAS (International Accounting Standards). The system is based on the Sharia guidelines for the purpose of financing related to Murabaha, Mudaraba, Ijara, Istisnaa, Salam, project financing, real estate and others.

Customer Overview

Pricing model is based on the modular capability available in iMAL core banking system, whereby each module is priced separately providing a flexible costing structure to fulfill the following goals:

1- iMAL provides a full suite of modules that address different business requirements for the banking industry. These modules have been packaged to focus on the different business areas in a bank.

2- Provide a product-based configuration of the different core modules, whereby a base license is provided for the main module feature, and subsequently the client can select additional products to be added to the base license. This aims to optimize the product offering to the client and provide a cost effective offering.

3- Regarding the deployment in branches, Path Solutions adopts a flexible branch deployment strategy, whereby the option is availed to the Sales team to configure the deployment offering by choosing one of the following scenarios:

a. Combination of number of branches and number of users

b. Adopting the pricing based on the number of branches only

c. Adopting the pricing based on the number of users only

d. Adopting the pricing based on the projected number of customer accounts.

The above options provide the flexibility to select the most suited selling approach depending on the target market and client expectations, and accordingly provide a cost effective offering to the potential clients.

4- In addition to the above approach, an embedded quantity discount brackets is adopted to apply a reduced unit cost for the different selection criteria, which again provides a reasonable pricing for the banks operating a big branch network, or projecting a huge number of customers.

Features

- Supports all known Islamic banking instruments

- Web interface, N-Tier Java based, SOA architecture

- With high parameterization capabilities; greater process efficiency, better risk mitigation

- Multi-currency, multi-branch, multi-company enabled accounting backbone

- With strong product definition features

- Fully integrated yet modularized, with Model Bank

- Highly automated and flexible system

- Ensures quick time to market products.

The iMAL core strengths:

iMAL employs multi-tier architecture using the latest JAVA technology with either Oracle or SAP Sybase as core database servers. These powerful and at the same time affordable Relational Database Management Systems (RDBMS) provide sophisticated data protection and high-speed access to information.

The system runs on all the main platforms and operating systems requiring only an up-to-date internet browser at the client side.

iMAL is rich in opportunities for increasing revenue through cross-selling and upselling. It also enables a 360° view which enhances customer service.

It is also cloud ready and deployable on a fully scalable, multi-server n-tier architecture. It includes out-of-the-box, industry best practice processes that further support rapid implementation, team knowledge transfer and sustainable business processes.

The fully integrated front, middle and back office Islamic core banking platform, running 24/7 in real-time -iMAL- combines comprehensive business functionality with an advanced, secure, scalable and modular architecture proven to meet the market toughest challenges of today and tomorrow.

Benefits

- Built-in Islamic operations standard compliant workflows and system controls

- Various delivery channels

- Faster time to market

- Exact fit to business requirements

- Phased migration and implementation approach

- Running businesses in real-time mode

- Higher operational efficiency:

- Single integrated platform for all banking activities

- Flexibility to meet change and growth requirements

- Cost reduction by implementing STP

- Optimized business performance

- Superior customer service

- Efficient speed of service

- Precision of documentary cycle

- Electronic reconciliation (quick notices)

- Prompt dispute resolution: Legal, collection, valuation, procedures, etc.

iMAL enables Islamic financial institutions to carry out essential tasks across retail, corporate and investment banking including core banking, transaction banking, online and mobile, payments & financial messaging, trade services and cash management. These applications help Islamic financial institutions to meet business needs in areas like streamlining operations, introducing new products, improving efficiencies and customer service, and ultimately increasing revenues while reducing risk.

iMAL provides platform independence, real-time interfaces, extreme usability, full scalability, high-performance, excellent productivity for configuration and deployment, and modular components.

With iMAL, Islamic financial institutions are empowered to achieve:

iMAL is based upon customers’ serviceability. One of these backbones is the production of multilingual statements to customers of the Islamic financial institutions. This is done with minimal data entry at the outset of the system’s parameterization, whilst the production of the various statements, advices, is done automatically by the system without manual intervention by the end-user.

iMAL, which is in compliance with Basel II/III & AML, enables Islamic financial institutions to contain the risk element before they get exposed to a higher degree of risk through effective risk management built into every single transaction that is undertaken in the system.

In addition, iMAL helps Islamic financial institutions implement a flexible, cost-efficient infrastructure with instant access to accurate, up-to-the minute financial updating in order to make informed operational and strategic decisions at a moment’s notice. This comprehensive approach produces a higher Return On Investment to our clients.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

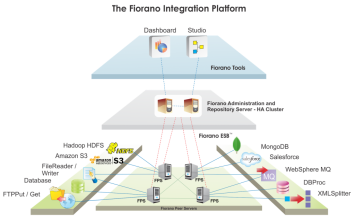

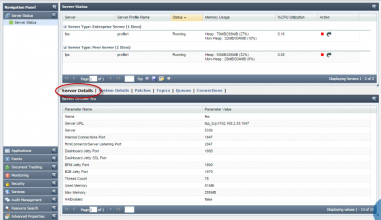

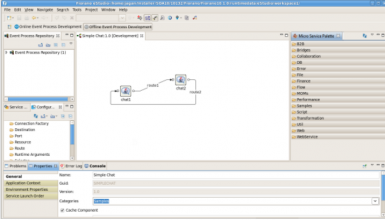

Fiorano ESB

Screenshots

Product/Service Description

An ESB acts as a high speed expressway for data flow in an enterprise, enabling seamless communication among mutually interacting software applications. Fiorano ESB obviates point-to-point integration efforts and integrates heterogeneous applications, databases, cloud and other systems streamlining the complex architecture of an enterprise.

Customer Overview

Features

- Fiorano ESB provides codeless integration between the bank's core banking system with all the channel applications. The configuration based tools enable citizen integrators to use the drag and drop interface to create integration flows without and coding

- Detailed technical product features can be found on this link: http://www.fiorano.com/products/esb-enterprise-service-bus/key-features.php

Benefits

- Secured and reliable communications Fiorano ESB is backed by an underlying standards-based messaging backbone providing scalable, enterprise class messaging with assured message delivery.

- Future proof solution Fiorano ESB's unique architecture allows parallel message flows between nodes, enabling natural and seamless integration of new applications/systems across the enterprise. This unbounded scalability makes your IT infrastructure a las

- Enhanced enterprise-wide visibility and administration Easily monitor all your information flows, manage all security authorizations and event-handling through a centralized ESB Administration Console.

- Reduced development costs Apart from obviating point-to-point integration, Fiorano pre-built adapters and Microservices allows over 80% of all integrations to be implemented out-of-the-box, with no additional programming, saving enterprises significant ti

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

FICO Falcon Fraud Manager provides core analytic processing power to handle an organization’s transactional fraud detection needs such as debt, credit, deposit, ePayments and mobile. It can be used to process events, develop strategies to detect fraud and create cases, and execute associated decisioning across an institution’s products, channels and customers.

FICO® Falcon® Fraud Manager provides deep insight into fraud trends and activity. Powered by FICO’s market-leading predictive analytics, it detects up to 50% more fraud than rules-based systems.

Customer Overview

Features

- Robust neural network models with patented service, account, and customer profiling and monitoring of global entities

- Real-time rule creation, rule simulation, and rule implementation

- Efficient investigations with sophisticated case management system

- Seamless integration with your authorization and payment systems for up to 100% real-time scoring

- Region and portfolio-specific fraud models leverage industry-wide consortium data

- Adaptive models generate fraud scores based on analyst feedback

Benefits

- Detects more fraud with lower false positives to provide minimal impact on good customers

- Delivers earliest possible warning of fraud activity

- Boosts analyst productivity and improves effectiveness of fraud operations

- Identifies fraud sooner to give you more opportunity to reduce losses

- Leverages known fraud patterns to achieve highest fraud detection levels

- Adjusts to your findings about fraud dispositions

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

Q2platform helps community banks to power up virtual banking operations for both retail and commercial customers. The platform provides virtual banking experience under the concept of the single-platform architecture of LEGO.®

Customer Overview

Features

- Integrated bill pay functionality

- Review balance options

- Wire preparation

Benefits

- Personalization of virtual branch experience

- Multiple language support

- Elegant design and intuitive workflow

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

PC/E Retail Banking Solution Suite enables banks and their customers to plunge into worldwide trend of mobile banking. The Suite provides IT architecture for the optimization of sales and service processing in the front office. As a server – based solution it powers up interaction between mobile devices and self-service systems. With the help of PC/E Retail Banking Solution Suite banks’ customers can execute the transactions through a variety of delivery channels. Additionally the solution allows remote money transfers around the world.

Customer Overview

Features

- Mobile transaction management

- Generation of transaction codes & dispatch via messaging services

- Interface to front and back end system

Benefits

- Text messages and interaction at ATMs

- Cardless withdrawals in any delivery channel

- Increased contacts with potential new customers

- Open architecture and end – to – end security concept

- Enhanced customer loyalty and acquisition

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Finacle is the industry-leading universal banking solution from EdgeVerve Systems. The solution helps financial institutions develop deeper connections with stakeholders, power continuous innovation and accelerate growth in the digital world.Over the past 25 years, the solution has been helping financial institutions develop deeper connections with stakeholders, power continuous innovation and accelerate growth in the digital world. Today, Finacle is the choice of banks across 94 countries and serves over 848 million customers – estimated to be nearly 16.5 percent of the world’s adult banked population.Finacle solutions address the core banking, e-banking, mobile banking, CRM, payments, treasury, origination, liquidity management, Islamic banking, wealth management, and analytics needs of financial institutions worldwide. Assessment of the top 1000 world banks reveals that banks powered by Finacle enjoy 50 percent higher returns on assets, 30 percent higher returns on capital, and 8.1 percent points lesser costs to income than others.

Customer Overview

Features

- A comprehensive, integrated yet modular agile business solution

- Addresses all the core needs of the bank, in easy-to-configure modules

- Multi entity capabilities to support multiple legal entities, across various geographies, currencies and time zones on a single instance of application

- Easy to configure modules and components

Benefits

- Comprehensive coverage so that you can enter into new business segments confidently

- Proven technology, which is consistently rated as best-in-class by leading industry analysts

- Enterprise-class components to create operational hubs across business units to enhance the agility and efficiency of the operations as well as improve customer experience across channels

- Built-in global best practices repository and rich repository of processes

- Product factory and product bundling infrastructure for business users to accelerate new product creation

- 360-degree view of customers across global relationships

- Powerful customer analytics driving right-sell opportunities and personalized offerings

- Cloud-ready platform to enhance infrastructure costs

- Reduced time to compliance with real-time view across enterprise data

- Ready-made integration adaptors and compliance to industry standards reduce your integration costs and enable enhanced STP (straight-through processing)

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

TCS BaNCS, from Tata Consultancy Services, is a globally acclaimed software brand that enables transformation in financial services through a superior and holistic suite of solutions for banks, capital market firms, insurance companies, and other diversified financial institutions.

Each solution in the TCS BaNCS family has been designed to fully integrate with existing business models, enterprise infrastructures and technology architectures. Adopted as a platform of choice by financial institutions around the world of all sizes, TCS BaNCS addresses critical industry needs and enables business transformation by providing customers with scalable, customizable, market-ready solutions.

Built on open architecture, this component-based product suite leverages service-oriented and event-driven architectures. Based on TCS’ in-depth market understanding through numerous interactions with more than 280 customers across 80 countries, this product suite offers one of the broadest end-to-end functionalities for financial services

Customer Overview

Features

- The TCS BaNCS platform for Banking encompasses an array of pre-configured, customizable banking products such as Universal Banking, Core Banking, Payments, Risk Management & Compliance, Financial Inclusion, Islamic Banking, Treasury, Wealth Management, Pr

Benefits

- Flexible configuration features.

- SOA-enabled infrastructure.

- Centralized Customer Information Facility and Risk Management.

- Cross channel communication within Branch,

- ATM/Kiosk

- IVRS/Contact Centre