Banking

Product Profile

Product/Service Description

FICO Falcon Fraud Manager provides core analytic processing power to handle an organization’s transactional fraud detection needs such as debt, credit, deposit, ePayments and mobile. It can be used to process events, develop strategies to detect fraud and create cases, and execute associated decisioning across an institution’s products, channels and customers.

FICO® Falcon® Fraud Manager provides deep insight into fraud trends and activity. Powered by FICO’s market-leading predictive analytics, it detects up to 50% more fraud than rules-based systems.

Customer Overview

Features

- Robust neural network models with patented service, account, and customer profiling and monitoring of global entities

- Real-time rule creation, rule simulation, and rule implementation

- Efficient investigations with sophisticated case management system

- Seamless integration with your authorization and payment systems for up to 100% real-time scoring

- Region and portfolio-specific fraud models leverage industry-wide consortium data

- Adaptive models generate fraud scores based on analyst feedback

Benefits

- Detects more fraud with lower false positives to provide minimal impact on good customers

- Delivers earliest possible warning of fraud activity

- Boosts analyst productivity and improves effectiveness of fraud operations

- Identifies fraud sooner to give you more opportunity to reduce losses

- Leverages known fraud patterns to achieve highest fraud detection levels

- Adjusts to your findings about fraud dispositions

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

FlexFinance IFRS

Product/Service Description

FlexFinance IFRS. FERNBACH offers a modular solution system. It consists of several blueprints, which in their entirety cover the finance & risk process chain including valuation, financial accounting, reporting and analyses. Each of these blueprints consists of components (“calculation kernels”) which can easily be integrated. One can install selected individual components or the entire range of blueprints. The blueprints for IFRS include the latest rule sets such as IFRS 9 and IFRS 13.

Customer Overview

Features

- FlexFinance IFRS provides, for risk provisioning in particular, a comprehensive catalogue of instruments that includes calculation, simulation, accounting, analysis and reporting. Since different organisational units in a financial institution are usually

Benefits

- Comprehensive IFRS solution which includes valuation of financial instruments, calculation of impairment and hedge management; consolidation with multi-currency capability. • The IFRS solution supports FinRep in accordance with the European Banking Author

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Qbonds is valantic's high-performance solution for electronic bond trading. Market making, bond pricing, as well as the connection to electronic markets, exchanges and data platforms (e.g. Reuters, Bloomberg, Eurex and MTS) are integrated into one application.

Customer Overview

Features

- Complete solution for pricing, quoting and trading of bonds like cds, etf, rates and more

Benefits

- The “visual separation” of quotes and instruments on different screens enables the trader to manage quotes individually

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

Q2platform helps community banks to power up virtual banking operations for both retail and commercial customers. The platform provides virtual banking experience under the concept of the single-platform architecture of LEGO.®

Customer Overview

Features

- Integrated bill pay functionality

- Review balance options

- Wire preparation

Benefits

- Personalization of virtual branch experience

- Multiple language support

- Elegant design and intuitive workflow

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

PC/E Retail Banking Solution Suite enables banks and their customers to plunge into worldwide trend of mobile banking. The Suite provides IT architecture for the optimization of sales and service processing in the front office. As a server – based solution it powers up interaction between mobile devices and self-service systems. With the help of PC/E Retail Banking Solution Suite banks’ customers can execute the transactions through a variety of delivery channels. Additionally the solution allows remote money transfers around the world.

Customer Overview

Features

- Mobile transaction management

- Generation of transaction codes & dispatch via messaging services

- Interface to front and back end system

Benefits

- Text messages and interaction at ATMs

- Cardless withdrawals in any delivery channel

- Increased contacts with potential new customers

- Open architecture and end – to – end security concept

- Enhanced customer loyalty and acquisition

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Finacle is the industry-leading universal banking solution from EdgeVerve Systems. The solution helps financial institutions develop deeper connections with stakeholders, power continuous innovation and accelerate growth in the digital world.Over the past 25 years, the solution has been helping financial institutions develop deeper connections with stakeholders, power continuous innovation and accelerate growth in the digital world. Today, Finacle is the choice of banks across 94 countries and serves over 848 million customers – estimated to be nearly 16.5 percent of the world’s adult banked population.Finacle solutions address the core banking, e-banking, mobile banking, CRM, payments, treasury, origination, liquidity management, Islamic banking, wealth management, and analytics needs of financial institutions worldwide. Assessment of the top 1000 world banks reveals that banks powered by Finacle enjoy 50 percent higher returns on assets, 30 percent higher returns on capital, and 8.1 percent points lesser costs to income than others.

Customer Overview

Features

- A comprehensive, integrated yet modular agile business solution

- Addresses all the core needs of the bank, in easy-to-configure modules

- Multi entity capabilities to support multiple legal entities, across various geographies, currencies and time zones on a single instance of application

- Easy to configure modules and components

Benefits

- Comprehensive coverage so that you can enter into new business segments confidently

- Proven technology, which is consistently rated as best-in-class by leading industry analysts

- Enterprise-class components to create operational hubs across business units to enhance the agility and efficiency of the operations as well as improve customer experience across channels

- Built-in global best practices repository and rich repository of processes

- Product factory and product bundling infrastructure for business users to accelerate new product creation

- 360-degree view of customers across global relationships

- Powerful customer analytics driving right-sell opportunities and personalized offerings

- Cloud-ready platform to enhance infrastructure costs

- Reduced time to compliance with real-time view across enterprise data

- Ready-made integration adaptors and compliance to industry standards reduce your integration costs and enable enhanced STP (straight-through processing)

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

MoonSol is the modern, state-of-the-art, modular bank account management system of Online Business Technologies, a graphical, three-tiered software application that is flexibly extensible, boosts 7x24 operations and several innovative technological solutions. It has full scale embedded workflow and document management both for the front-office and back-office modules, which include the following: Sales Front, Electronic Channels, CRM, Daily Financing, Deposits, Loans, Collateral, Collection, IFRS, Accounting, Risk, Regulatory Reporting, Parameterization.

Customer Overview

Features

- Á LA CARTE’ MODULES MoonSol modules can be collected arbitrarily, even individual modules can be introduced

- FULL SCALE WORKFLOW MANAGEMENT both for the front-office and back-office modules

- SCALABILITY MoonSol can be a good choice for the smallest credit institute as well as for the largest commercial banks serving over tens of millions of customers, no limits in extension both as regards operational size and functionality

- FLEXIBLE CONNECTIVITY MoonSol is an extremely open system, modules can be implemented into any existing environment and can communicate with several interfaces with other systems (e.g. SOA / Web service, ROA / REST)

- ENHANCED PARAMETERIZABILITY MoonSol modules have a refined parameterization layer, with which new products can cost-effectively be created from the user interface with short time-to-market and the operational parameters of individual modules can be set

Benefits

- Á LA CARTE’ MODULES MoonSol modules can be collected arbitrarily, even individual modules can be introduced

- FULL SCALE WORKFLOW MANAGEMENT both for the front-office and back-office modules

- SCALABILITY MoonSol can be a good choice for the smallest credit institute as well as for the largest commercial banks serving over tens of millions of customers, no limits in extension both as regards operational size and functionality

- FLEXIBLE CONNECTIVITY MoonSol is an extremely open system, modules can be implemented into any existing environment and can communicate with several interfaces with other systems (e.g. SOA / Web service, ROA / REST)

- ENHANCED PARAMETERIZABILITY MoonSol modules have a refined parameterization layer, with which new products can cost-effectively be created from the user interface with short time-to-market and the operational parameters of individual modules can be set

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

PhoenixEFE® Core is an enterprise software platform for real-time transaction processing and account servicing. PhoenixEFE Core includes modules for customer management, universal loan and deposit servicing, system administration and general ledger. PhoenixEFE Core database also incorporates functionalities for teller, collections, relationship pricing, sales & service, fraud management as well as card management.

Customer Overview

Features

- PhoenixEFE Universal Loan Servicing

- PhoenixEFE Universal Deposit Servicing

- PhoenixEFE Customer/Member Management

- PhoenixEFE General Ledger

- PhoenixXM Web Services Transaction Gateway

- PhoenixEFE System Administration

- PhoenixEFE Single Sign-On

Benefits

- High performance transaction processing and account servicing

- A universal loan servicing application for commercial, consumer and mortgage loans

- Centralized view of the customer

- Rich enterprise capabilities

- User convenience in password management and policy enforcement

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

ACI Universal Online Banker is a digital banking platform that delivers financial institutions global multilingual and multi-currency cash management solutions. The strength of ACI Universal Online Banker lies in its powerful features built within a user interface designed especially for ease of use and a technology platform with easy integration, flexibility and scalability. The broad-based functionality offers user driven balance and transaction reporting tool, sophisticated entitlements and approval capabilities including panel authorization, and extensive global payment types including NACHA, SEPA, Giro, domestic and international wires, drafts, drawdowns, multi-bank, federal and state tax, and localized payments for the UK, Europe, Middle East and Asia.

Customer Overview

Features

- Tailored service offerings for small businesses to large corporates

- Multi-affiliate banking

- Marketing campaigns

- Extensive treasury portal capabilities

- Comprehensive segmentation approach

- Single sign-on and entitlements

Benefits

- Personalizable dashboard

- User experience differentiation

- Flexible and robust security models

- eLearning tools

- Additional bank administration tool

- Global payments initiation and support

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

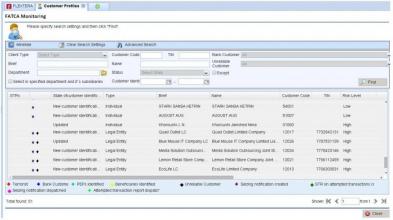

Screenshots

Product/Service Description

FLEXTERA is an innovative financial solution for front-to-back office automation of retail, corporate and universal banking, treasury and capital market operations, and insurance business. The solution is built on Java technologies in full compliance with SOA principles and was developed in tight collaboration with IBM.

Customer Overview

Features

- FLEXTERA Front Office is responsible for Multi-channel Front Office operations and customer relations management for ubiquitous client servicing

- FLEXTERA Middle Office offers a set of components for Middle Office risk management and decision making functions

- FLEXTERA Back Office provides tools for traditional Back Office and Core Banking operations including daily banking transactions processing

- FLEXTERA Accounting offers modern tools for Tax accounting and General Ledger support

Benefits

- SOA-based Modular Architecture and Workflows.

- In-built Business process-engine and Business Rules-engine.

- In-built OCR engine (ABBY FineReader)

- In-built ECM-engine allows easily convert paper document flow into electronic archive.

- Standardized configuration and security policy for better controllability of the solution.

- The only vendor in the world that automates business of all major Autobanks.