How to Set the Tone to the Relationship between Banks and Clients?

- Product Reviews

- 11.10.2016 08:22 am

As the age old saying goes, you never get a second chance to make a first impression, and the banking world is no different. Specifically, the impression that a bank makes during the First Mile of engagement is crucial to winning over new customers and paving the way for long-term success. The digital onboarding process helps to create an opportunity for banks to not only demonstrate their business capabilities, but at the same time helps to ensure that they are complying with the latest regulations. For years, the onboarding solutions developed by Kofax, a Lexmark company, have provided financial institutions with a mix of functions crucial for onboarding new customers – workflow automation, mobility, omnichannel document capture and extraction, e-signature integration features together with real time analytics. Kofax solutions are used by a whole host of financial institutions around the world including CaruanaFinanceira, ING DiBa, Barclays, Union Bank and Zions Bancorporation.

The eruption of digital media and consumerisation of the workplace has forever changed the global business landscape. Today’s customers have much greater expectations when it comes to engaging with organisations, as they have been conditioned to expect the same level of customer experience in their business lives as they would in their personal lives. To successfully compete in the marketplace, businesses need to ensure they provide the customer services provided on par with brands such as Amazon, eBay and Apple. Organisations wanting to attract and retain this new breed of consumer must take this into account when evaluating their latest technology solutions available in the market today.

Kofax Onboarding Agility addresses the demanding nature of customer behaviour by delivering functions such as mobile enabled digital processing, as well as real time insights into customer data. A set of configurable and extensible software components built on top of the Kofax TotalAgility platform, Onboarding Agility spans front, middle and back office operations enabling banks to improve the end-to-end cycle of the customer onboarding process. In particular, the developers of Onboarding Agility point out to the following as key benefits of the solution – flexibility of integration with existing applications and external sources, complete removal of manual intervention and interaction within the processes (including automation of requests for certain documents), enhanced data capture for drivers’ licence, passport, proof of residency or utility bill as well as verification and validation capabilities.

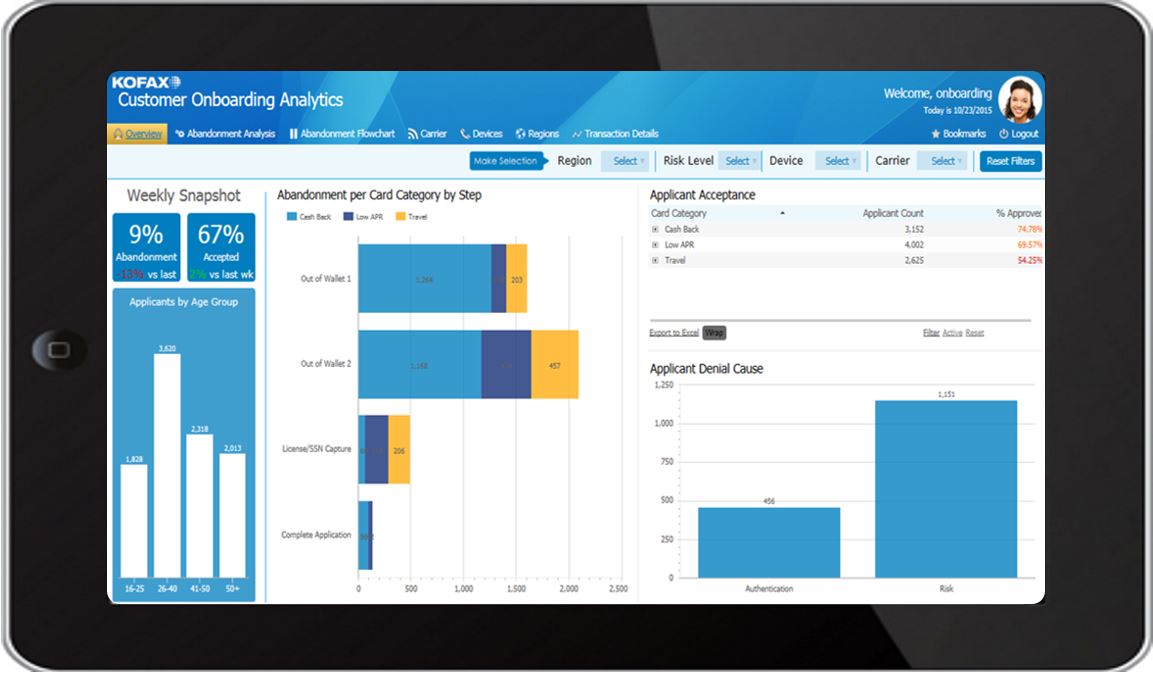

In addition to recognising different forms of information, the Kofax platform allows users to measure and monitor the entire previous onboarding cycles alongside current periods, fuelled with analytics on how to refine the cycle moving forward. Analytics dashboards in Onboarding Agility are easily customisable and provide key performance indicators and metrics. Thanks to real-time reporting and Kofax’s analytics modules, banks can easily solve business bottlenecks in their processes, people, systems and data. Specifically, they can work to enrich communication channels, expedite the routing of digital, process-ready information through multiple departments, as well as discover errors, regulatory risks and sales opportunities within minutes of submitting client information.

Whilst the Kofax Onboarding solution can provide complete automation of an organisation’s onboarding process, it is also modular by design. This provides banks with the freedom to incorporate any component of the solution and to address any in efficiencies within the existing onboarding process. An illustration of this flexible approach could be the partnership with one of the largest banks in UAE, the first to launch a mobile capture application in the region. Following two months of development and installation, the bank’s customers were able to capture an image and receive cheques from their smartphones and tablets, ultimately allowing funds to be deposited directly into their account.

All good things take time and in the same vein, Kofax has gradually grown through various mergers and acquisitions. Over the years, the Kofax business has gained new products, whilst strengthening its existing suite with new business management capabilities, analytics, data integration and communication. Today over 6, 000 banks and insurers use Lexmark/Kofax solutions in more than 70 countries around the world to set the tone for long-lasting client relationships.