Helping Banks in Dynamic Budgeting and Forecasting

- Product Reviews

- 21.06.2016 08:11 am

Tagetik Planning For Banks is a packaged solution designed by Tagetik to help Offices of Finance with balance sheet planning, portfolio forecasting, scenario management and analysis. Compared to other vendors the key benefits of Tagetik include common data model, collaborative workflow, interesting data visualisation and fast speed of web–based execution. The solution runs on any browser, tablet or portable device. Its user friendly interface was developed in HTML5. Thanks to a huge set of banking specific built-in engines Tagetik is able to become a go-to solution for Finance. A full budgeting, planning and forecasting application requires profitability and consolidation capability that are embedded in the common data model that Tagetik provides.

On the image above you can see the landing page of Tagetik. Its screen layout looks pretty simple and it’s easy to navigate. The whole wealth of functionalities can be found within a set of dashboards all integrated into one database of a single solution.The feature of handling multiple processes for budgeting and forecasting within a unified solution can be really helpful to Financial Officers who don’t like jumping from one task to another across numerous windows and applications. This common data model connects a variety of hierarchies, accounts, scenarios, instruments, customers and products in a single view. Tagetik comes also with a good variety of data modeling capability that gives the bank the ability to simulate new acquisitions, new initiatives and new products. That is the reason why Tagetik is a perfect fit for dynamic financial institutions.

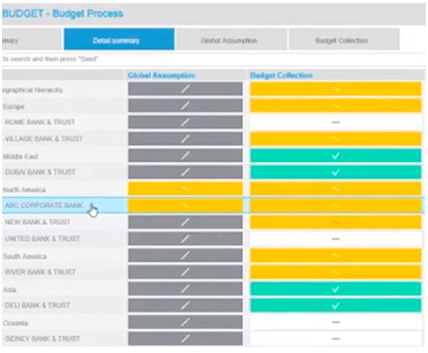

Another advantage of Tagetik is its collaborative workflow that enables reporting and collaboration across numerous operations, divisions and branches. Users can easily create as well as monitor various task lists, track progress and approvals depending on the authorisation and hierarchy level. Below you can see the detailed summary of the budget process that can be categorised and analysed by bank name or user type.

Data visualisation capabilities of Tagetikare really impressive. The solution allows users a big room for playing with data, browsing and categorizing it, comparing financial data through numerous geography and time hierarchies, drilling up and down the database. Another key point to mention is the possibility to export/import the data in Excel for faster data analysis and management.

The overall decision making process becomes more transparent with the use of Tagetik. Finance Officers can monitor performance of their products based on such categories as product yield, average balance, interest income. The graphical layout of the financial data helps to easily pinpoint the strengths and weaknesses in product performance within a certain time span.

Generally speaking, Tagetik might be a good choice for those banks that need a unified solution to manage the budgeting streams of their existing instruments together with detailed forecasting for new products. Tagetik’s packaged solution gives a holistic picture of balance sheet together with reflection of the instruments already generating revenue and cash flows, at various rates and maturity date.

Overall, this solution is a good fit for every bank. Tagetik comes with the flexibility to work with small organisations (few users) and very large ones (thousands of users). The functionalities are scalable and they have been designed to work in both scenarios. Tagetik also has a global presence so implementations have been in place in multiple countries/continents such as Europe, North America, the Middle East, Asia-Pacific and South America.

More information on all Tagetik’s solutions for the banking industry are available here.