Converging Payments and Identity

- Product Reviews

- 16.03.2017 09:24 am

What does the product do?

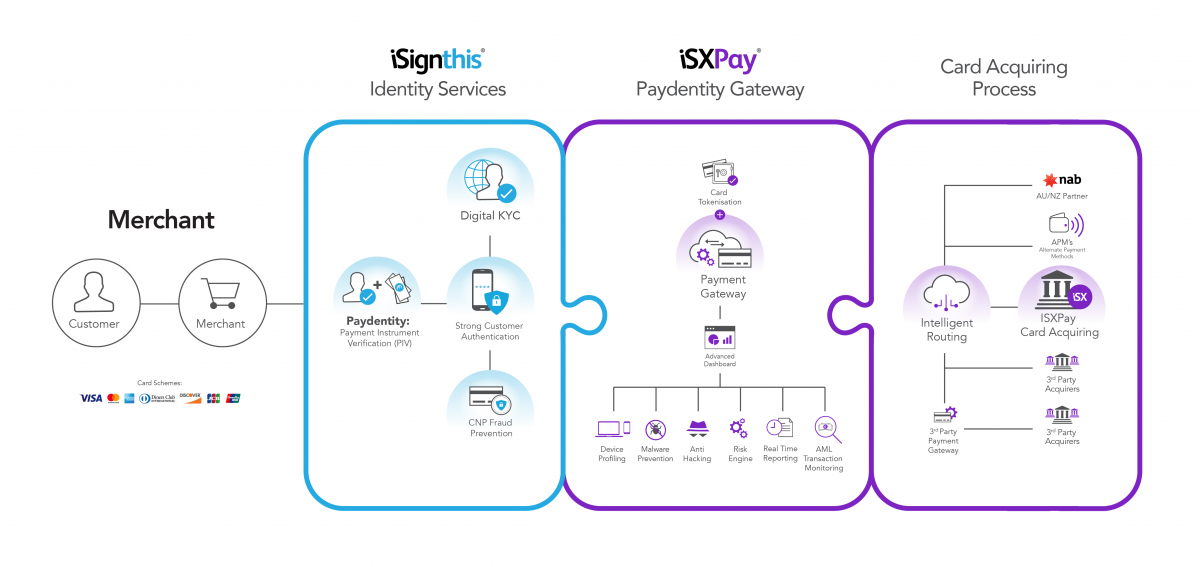

The iSignthis Paydentity solution incorporates real time electronic verification which converges authenticated remote payments with Know Your Customer (KYC) verification. By converging payments and identity, our Paydentity solution can deliver regulatory compliance with automated customer on-boarding. The service offers a global reach of any of the world’s 3.5Bn financially included or “banked” persons.

Paydentity helps regulated merchants meet strict Anti-Money Laundering (AML) requirements including the EU’s 3rd & 4th AML Directives, the Payment Service Directive 2, and the US BSA & Patriot Act.

The full Paydentity solution includes Digital KYC, Strong Customer Authentication, Fraud Prevention and Payment Gateway services. Additional features also include transaction monitoring, threshold management and advanced reporting.

Who needs the product?

The iSignthis solution serves all sectors of the digital economy involved in online transactions and purchases, with specific focus on the regulated sectors such as gaming, gambling, remittance, trading, forex, CFD, wagering, card issue and e-wallet markets, where identity proofing is a regulatory requirement.

What are the main features of the product?

Remote Enhanced Due Diligence

Strong Customer Authentication

Compliance to the EU’s 4th AML Directive and PSD2

AML Transaction Monitoring

Payment Threshold Management

Two Factor Authentication

Advanced AML and transactional Reporting

Card Tokenisation

Secure Card Vault

Intelligent Routing to available acquirers

What is special about product?

Until now, the only feasible online method to perform a KYC check has been via lookup of historic electronic database searches. Although, this method heavily limits merchants reach to certain jurisdictions such as the UK and Australia, the nature of the sources of the historic data is causes decreasing match rates. For example, core data sources such as telephone directories are no longer prevalent, and fewer millennials have home loans, thus impacting the breadth of credit reference agency data.

Further, it is becoming increasingly more difficult to fight off fraudsters who have access to what was once considered as personal and sensitive data, through various sources including social media, the dark web or phishing.

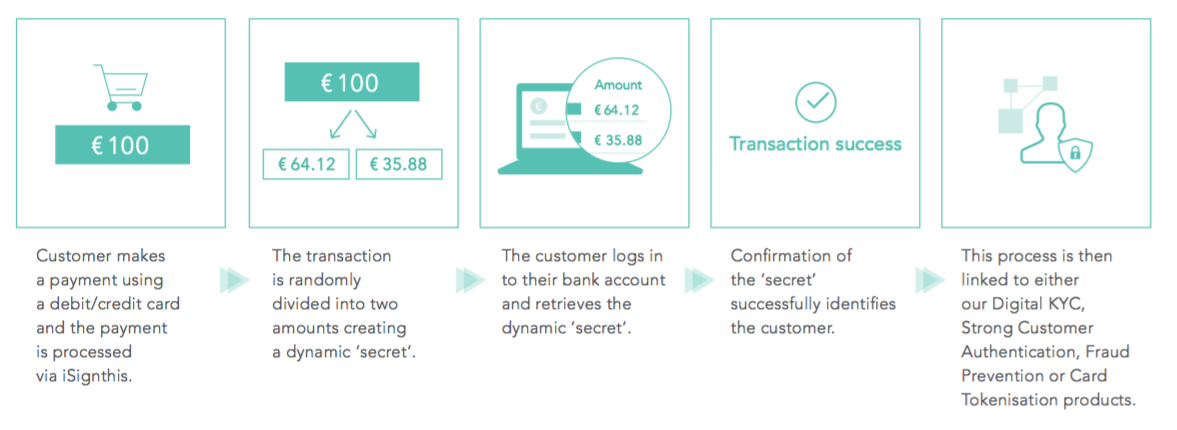

Paydentity™ converges payments with identity verification, and we are thus able to unlock the identity in a payment transaction to verify the end user. The advantage of this includes:

A global reach of any of the world’s 3.5Bn financially included persons.

Live, dynamic KYC data providing an up-to-date KYC profile, consistent with the ‘up to date’ and ‘present’ criteria requirements of recent regulations.

High conversion rates. KYC identity verification check occurs simultaneously with the customer payment.

Automated, self-service customer on-boarding on average within 3 to 5 minutes.

Card Not Present fraud prevention assistance by providing compelling evidence to defend against chargebacks.

Enhanced customer due diligence process which satisfies the 4th AML Directive and PSD2 in the EU, as well as patriot, BSA and AML regulations in most FATF legislative model jurisdictions.

What other background features are relevant?

- Sanction and optional PEP screening.

- Comparative analytics compare attributes across payment data, cellular and internet metadata, device information, geo-data, language, together with TOR, proxy and IP screening.

- Unified payment capture page.

- Seamless iSignthis product integration

How user friendly and accessible is the product?

The Paydentity service is very user friendly, offering merchants the option to have the systems embedded into their on-boarding process, so that users don’t have to leave the site. The service only takes 3 to 5 minutes for users to completely compared to manual process which can take 3-21 days to be approved.

What are the reporting capabilities?

The iSignthis platform can report against any attribute, including those related to either or both of identity or payment transactions, via its relational database.

Typically, reporting structure is based on a Group Company umbrella, with regional or AML operating entities, web domains, merchant identifiers (MID) and terminal identifiers (TID). This allows reports to be generated quickly for the CFO operating at group level, the AMLCO and financial controller at operating level, and back office / reconciliation staff at MID & TID level.