Driving Profitability Analytics Deep into Decision Making Process

- Product Reviews

- 03.10.2016 07:29 am

Business intelligence and data analytics have become the potent drivers of growth for banks nowadays. According to IDC those financial institutions who turn to BI and DA observe 82% of quantifiable benefits within 12 months or 45% in 6 months. This includes significant boost in performance, efficiency and speed, according to an April 2015 IDC report entitled Implementing an Analytics Strategy to Accelerate Insight. ProfitGen™, the BI solution invented by Baker Hill®, provides a number of triggers for mid – tier banks and credit unions to open up new ways of profitable interaction and engagement with new audiences.

Any successful business strategy, financial and marketing planning is built on the basis of trusted data, numbers and verified transparent reporting. ProfitGen serves like a brain of the organization saturating its head with the information regarding performance and profitability of products, branches, staff, and accountholders at every level of the organization. ProfitGen’s customized data intelligence helps to formulate the dynamic business strategy and product marketing with the understanding of clients’ needs and demands. As a cloud – based solution ProfitGen gathers the data externally and internally within the organization and consolidates it in real time to reflect the changes in the budget profits and make sure the enterprise can react to the market transformations on the fly. All the data is structured in a consolidated SQL relational database with queries by an abstracted MDX MultiDimensional eXpressions language (no special query skills required).

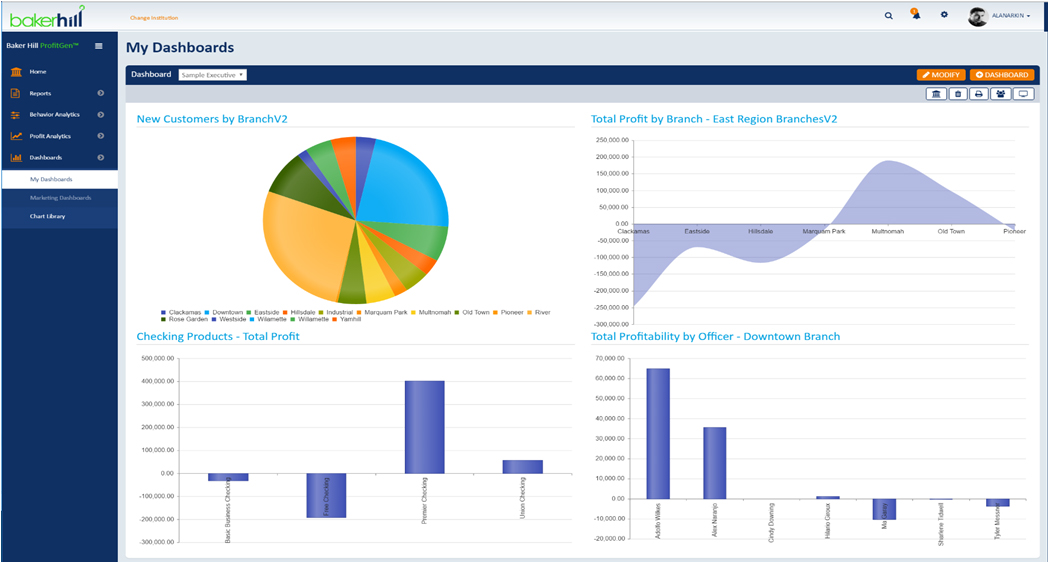

Among the other notable features of ProfitGen is highly detailed targeting in campaign management for the purpose of product development and marketing. ProfitGen’s actionable insights help the banks to build up a meaningful politics in bank’s product offerings and customer loyalty grounded on the analysis of client’s behaviour. The user friendly layout of the solution consolidates data from the System of Record, General Ledger and External Data visualized in the system as charts, graphs and dashboards. The additional layer of artificial intelligence together with logic enables banks to perform profitability measurement with income statement on each client, account, product, officer, branch, delivery channel, retail and business relationship. With a view to enhanced security the access to data and functionalities is based on the employee’s role and job. Equally important to mention the integration capabilities, ProfitGen can be easily deployed to the front end customer facing systems, ATMs or current banking back end systems such as CRM applications running at the bank. In terms of deployment period it varies from a few weeks to months depending on complexity of the project and bank’s preferences.

As more and more financial institutions move towards the new ways of interacting and engaging with their potential clients, and from purely descriptive to predictive and prescriptive analytics, ProfitGen addresses these needs by providing performance analysis and communication strategy for all paper based as well as electronic channels including web, mobile, rich text email and SMS through a single access point of the program’s dashboard. Navigation through the pie charts, graphs and other visualizations makes it easy to explore how each product performs in a certain geographical area, within a certain client profile and period of time. Predictive analytics for different scenarios like “what – if” pricing together with data analysis of clicks, leads and views, sales and conversion rates in product realization can bring significant value in the decision making for future production and marketing. Moreover, the data consolidated by the solution provide a dynamic picture of employees’ ability to react to the needs of clients and market turbulences.

As a cloud – based solution ProfitGen’s pricing works on an enterprise license with flexible “pay – per – use” policy or a consumption plan chosen by the bank. Speaking about clientele of ProfitGen it mostly includes banks and credit unions; Hiway Federal Credit Unionare is one of them. Baker Hill shares the market with such vendors as Intuit, SAS, Accenture, IBM, Oracle and other providers of combined offers for DA and BI in the financial services sector.

In general tracking of profitability on a highly customized level is not common place for the most financial institutions yet. Although, profitability monitoring is already turning into a standard for many enterprise real time systems. In fact Baker Hill’s developers are inspired by Salesforce as an embodiment of a very well structured and implemented system and strive to make ProfitGen a new Salesforce in financial data analytics.