Eurobits:Transforming the Way People & Businesses Interact with Financial Services

- Product Reviews

- 28.07.2017 09:05 am

Eurobits Technologies, founded in 2004, is a leading provider of services that enhance development of digital economy through cooperative innovation in advanced digital services.

What is the service?

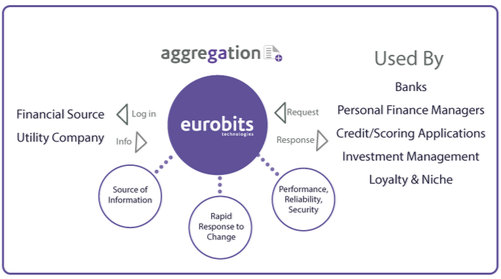

Eurobits Technologies provides data aggregation online services, electronic invoicing, and E-banking benchmarking. It allows secure retrieval and delivery of all relevant Financial & Non-Financial end-user online account information, returning it to a single access point. The service consists of a RESTful API operating under a request-response model, allowing implementation of a variety of scalable and mission critical end-use applications.

What does the service do?

The content aggregation platform for both financial and non-financial organizations, allows developing applications and services that offer users a single point of access for all their positions with financial institutions, as well as billing and contract information from their utility companies.

The content aggregation platform for both financial and non-financial organizations, allows developing applications and services that offer users a single point of access for all their positions with financial institutions, as well as billing and contract information from their utility companies.

Electronic invoicing enables companies to reduce costs and optimize processes by reducing management time, while gaining security and error control. Eurobits’ eFactura system is a powerful, modern comprehensive technology platform that offers a one-stop solution in the space of electronic invoicing. As well as covering the entire invoicing process, both for issued and received bills.

In case of Monitoring, Eurobits reveals “eqanimus” service that allows a real-time comparison between the quality of service of the main online banking systems, available to individuals and companies. Taking into consideration users’ experience, it offers both a detailed analysis of each online banking system, as well as a comparison of performance, reliability, and functionality between all the entities being monitored.

Who needs the service?

Eurobits’ services provide solutions for banks, personal finance managers, and other financial institutions, along with scalable FinTech companies.

What are the key features of the service?

- Evolutionary Design: Continuous iterative development, PSD2 Compliant.

- RESTful Architecture: A modern, robust, and scalable platform using JSON Web Tokens (RFC 7519).

- Support for Multiple Login Mechanisms: Including 2 Factor/Channel authentication (OTP, Captcha etc).

- Communications Infrastructure: TLS protocol with preventive Data Breach encryption and VPN option.

- High Performing: High concurrency environment with no Single Point of Failure.

- Security: Complying with the strictest EU Compliance & Regulations. A pure gateway, no End User data is stored by Eurobits. Client implementations have been ISO 27001 Certified.

What are the benefits?

Eurobits has years of expertise in the provision of innovative services that allow generation of economies of scale, standardization, and network effects. Users can outsource technological component of advanced digital services, thereby reducing and transforming fixed costs into variable, reducing risks, cutting deployment time and helping focus on their core business. In addition, there are such benefits as:

- Cross Selling & Up-Selling

- Credit Scoring

- PFM Solutions

- Reconciliation

How user friendly and accessible the service is?

Eurobits made it extremely easy to spend or save, as clients’ money is automatically categorized so they can easily check weekly and monthly expenses and make relevant decisions. In other words, personal or corporate financial information can be checked and monitored in one spot at a convenient time.