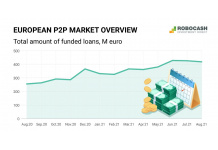

The Continental European P2P Market to Grow by 20% in 2024

- 1 year 6 months ago

- P2P Lending

Robo.cash forecasts that the P2P lending market in continental Europe will reach 579.2 M euros in December 2024. The main trends for the coming year include elevated market polarization, entry into new geographies and expansion of investor opportunities.

Robocash Group Served 20 mln Customers

- 3 years 1 month ago

- P2P Lending

In the first quarter of 2022, Robocash Group hit the record 20 M registrations, providing consumer financing in the cumulative volume of over 1.7 Bn USD. The repeated clients have contributed significantly, with the highest consumer demand in the Philippines and Kazakhstan. Targeting the underserved population with limited access to traditional financial services, Robocash Group has issued 266.3 M USD worth of loans in Q1 alone - up by 81.4% to... more

Global Currencies, Stocks and P2P Investments are Emerging as Top Assets in 2022

- 3 years 1 month ago

- Lending, P2P Lending

In the top assets ranking, alternative investment instruments give way to traditional ones due to the simplicity of the latter. At the same time, P2P lending ranks third in the aggregate of all factors, having proven itself to be a profitable and reliable asset.

Rise in Investments by Millennial Women in P2P Lending by 430%: LenDenClub Study

- 3 years 3 months ago

- P2P Lending

430% and 150% rise in women investors and borrowers respectively in FY 21-22 Mumbai and Hyderabad ranked top in terms of women investing in P2P lending Witnesses 150% Y-o-Y growth in women borrowers across the country More than 36% of all female borrowers returned to reapply for a loan

European P2P Investors Gradually Going Mobile

- 3 years 3 months ago

- P2P Lending

One in seven P2P investors use their smartphones primarily as financial instruments. At the same time, computers are preferable for investors when working with P2P sites. These are the results of the latest survey conducted by the investment platform Robocash. Almost 30% of P2P investors have a mobile experience in one way or another connected with financial and investment activity. In addition to direct tracking of funds (13,1%), another 9%... more

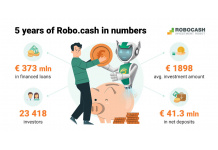

Robo.cash Celebrates Its 5th Anniversary With a Record Growth

- 3 years 3 months ago

- P2P Lending

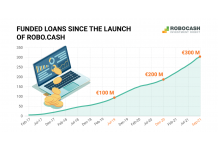

More than 370 M euros have been funded over the 5 years of Robocash operation. In 2021, the growth was 117% YoY and the customer base was replenished with another 10 thousand new investors. In the near future, the platform plans to introduce automatic investment strategies.

Interest for P2P Loans to Ggain Traction in Europe

- 3 years 5 months ago

- P2P Lending

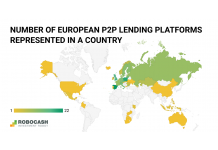

The number of Google requests for P2P lending in Europe has been growing steadily in 2021. An analysis of the investment platform Robo.cash showed that Europeans are increasingly interested in P2P loans, with developed countries leading the way. Spain has one of the highest numbers of Google queries for the period, and every month the amount is growing by an average of 2.1%. At the same time, the concentration of P2P platforms for the business... more

The European P2P Market on the Way to Diversity

- 3 years 7 months ago

- Cash management, Payments, P2P Lending

According to the Robo.cash corporate statistics, the social and geographic shifts of the investors' audience is expressing the growing market potential. The Robo.cash platform has significantly expanded its active investor base in 2021, representing a more than 70% growth. In addition to engaging an increasing audience, the market continues to penetrate various segments of the society. For example, the share of female investors on Robo.cash (... more

Robocash Secondary Market Transactions Increased 11 Times in a Year

- 3 years 7 months ago

- Lending, P2P Lending

More than 50% of European P2P platforms provide an opportunity to sell or buy loans in the secondary market. Of those that publish market statistics, 66% confirm these transactions exceeding the level of 2020. The number of investors choosing a secondary market option ranges up to 74% of all investors on the platform.

Gujarat Witnesses 86% Rise in P2P Investments: LenDenClub Data

- 3 years 7 months ago

- Fundraising News, Lending, P2P Lending

Investment in Peer-to-Peer (P2P) Lending has witnessed a rise of 86% in Gujarat as per consumer analysis of LenDenClub, India’s largest P2P lending enterprise as compared with the previous year. LenDenClub analysed its data, drawing insights into the investment patterns and behaviours of investors in the state of Gujarat. The analysis was conducted on its active overall investor base of over 06 lakh for nine months starting from January 2021 to... more

Mature P2P Platforms to Recover More Than 9% Above Average

- 3 years 8 months ago

- Covid-19, Investment, P2P Lending

During the market recovery after COVID-19 outbreak, European P2P platforms that emerged by 2017 have rebounded at above-market growth rate. The calm upward trend is supported by a 2% increase in monthly financed loans in 2021. To assess the growth rate of P2P platforms, Robocash analysts studied 43 platforms that are present in 16 European countries and operating mainly in the consumer and business segments.

Robo.cash Exceeded 300 M Euro of Funded Loans

- 3 years 8 months ago

- Lending, P2P Lending

In September, European investment platform Robo.cash reached 300 M euro in total funded loans. The month was also recorded by another achievement - the number of investors crossed the mark of 19 thousand.

Žltý Melón and Salt Edge Partner for Open Banking-enabled Lending

- 3 years 10 months ago

- Lending, Open Banking, P2P Lending

Žltý melón, a Slovak P2P lending platform, joined forces with Salt Edge, leader in developing open banking solutions, to implement PSD2-integrated access to clients’ bank data and streamline the loan application journey.

Millennials Dominate P2P Platform as Both Lenders and Borrowers: Study

- 3 years 11 months ago

- Platform Technology, P2P Lending

LenDenClub releases its 2020-21 study of P2P lender & borrower behaviour

Just 1 in 10 European P2P Lending Platforms Offers Loans from Outside Europe

- 3 years 11 months ago

- P2P Lending

Only 13% of European P2P lending platforms provide diversification opportunities outside Europe, according to the latest research by the investment platform Robo.cash. As stated by the analysts, it is the European segment that is likely to take the leading position worldwide in the future.