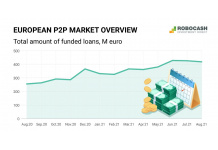

The Continental European P2P Market to Grow by 20% in...

- 05.12.2023 08:40 am

Robocash Group Served 20 mln Customers

- 28.04.2022 10:55 am

Global Currencies, Stocks and P2P Investments are...

- 21.04.2022 03:10 pm

European P2P Investors Gradually Going Mobile

- 03.03.2022 10:40 am

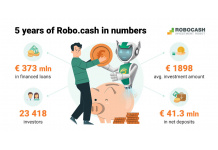

Robo.cash Celebrates Its 5th Anniversary With a Record...

- 21.02.2022 11:45 am

Interest for P2P Loans to Ggain Traction in Europe

- 21.12.2021 11:50 am

The European P2P Market on the Way to Diversity

- 11.11.2021 02:15 pm

Robocash Secondary Market Transactions Increased 11...

- 21.10.2021 03:10 pm

Gujarat Witnesses 86% Rise in P2P Investments:...

- 20.10.2021 04:30 pm

Mature P2P Platforms to Recover More Than 9% Above...

- 14.10.2021 01:10 pm

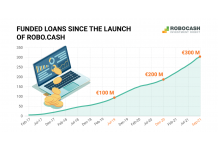

Robo.cash Exceeded 300 M Euro of Funded Loans

- 21.09.2021 02:05 pm

Žltý Melón and Salt Edge Partner for Open Banking-...

- 17.08.2021 02:20 pm