Investment Banks

Product Profile

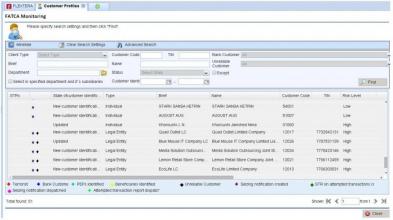

Screenshots

Product/Service Description

Financial Crime Risk Management platform from Fiserv allows financial institutions to minimize the cost and risk in their FATCA regulatory compliance. With Fiserv AML solution companies can find, review, decision, document and report customers who meet certain criteria.

Customer Overview

Features

- The solution enables to determine U.S. taxpayer status and FATCA status through a structured workflow

- Option to capture data fields, statuses and documentation in customer-centric FATCA case files.

- Streamlined monitoring and reporting process.

Benefits

- A centralized solution for compliance that includes tax evasion, money laundering, terrorist financing, sanctions, corruption and fraud.

- The ability to leverage a single investment in customer, product and transaction data for detection, investigation and resolution of specific entities and activities as required for different regulations.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

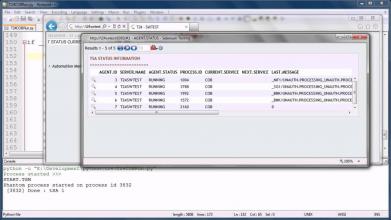

Screenshots

Product/Service Description

FLEXTERA is an innovative financial solution for front-to-back office automation of retail, corporate and universal banking, treasury and capital market operations, and insurance business. The solution is built on Java technologies in full compliance with SOA principles and was developed in tight collaboration with IBM.

Customer Overview

Features

- FLEXTERA Front Office is responsible for Multi-channel Front Office operations and customer relations management for ubiquitous client servicing

- FLEXTERA Middle Office offers a set of components for Middle Office risk management and decision making functions

- FLEXTERA Back Office provides tools for traditional Back Office and Core Banking operations including daily banking transactions processing

- FLEXTERA Accounting offers modern tools for Tax accounting and General Ledger support

Benefits

- SOA-based Modular Architecture and Workflows.

- In-built Business process-engine and Business Rules-engine.

- In-built OCR engine (ABBY FineReader)

- In-built ECM-engine allows easily convert paper document flow into electronic archive.

- Standardized configuration and security policy for better controllability of the solution.

- The only vendor in the world that automates business of all major Autobanks.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

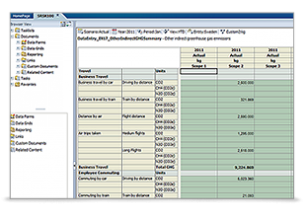

Product Profile

Screenshots

Product/Service Description

BEST is a complete banking suite covering all functionalities from back to middle and front office, data warehouse included, guaranteeing long-term profitability. BEST allows managing simultaneously and automatically operativity and consolidated balance sheets of more companies and subsidiaries regardless of their structures and relationships.

Customer Overview

Features

- Core banking functions (product, instrument, client registrers, treasury, transactions, audit and security, general ledger, etc.)

- Portfolio & asset management, Risk management

- Derivatives, Credits & Trade Finance

- Telecommunication (financial messaging, eg. swift, sic, etc., settlement and reconciliation included)

- Client workflow management (central register, contracts generation, compliance & anti money laundering, CRM)

- Internet Banking (enquiry, documentation, payment and stock exchange orders)

Benefits

- The full automation to all business transaction flows to improve efficiency by reducing time, costs and risks.

- The full multiple currency accounting and reporting.

- Full parameterization enables setting customized processes without source code modifications and creating new functionalities with minimum effort.

- The wide choice of available integrated modules and interfaced third party systems allows the clients to implement the tailor-made solution they need, containing the overall licence and implementation costs.

- A fully multilingual system

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

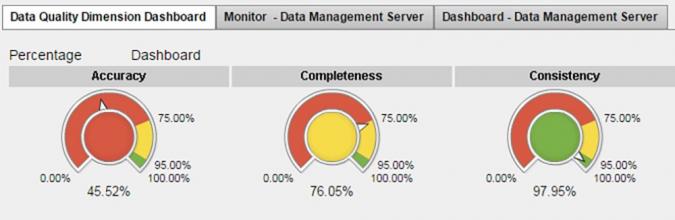

Screenshots

Product/Service Description

SAS delivers a single solution that combines powerful analytics and visualization with robust data management capabilities, providing a solid foundation for all facets of risk data aggregation, governance and reporting – and enhancing your ability to identify and manage risk. SAS Risk Data Aggregation and Reporting connects data silos across your bank for a single, consolidated look at all your data.

Customer Overview

Features

- A comprehensive data store for all regulatory requirements.

- The ability to aggregate risk data using nonlinear methodologies

- Data quality rules for multiple dimensions

- Self-service visual analytics to convert data into meaningful metrics and information for a holistic view of your bank’s risk.

- Centralized capability for business analysts to develop and refine business rules that govern their data.

- Risk aggregations for banking and trading book

- Updateing business rule logic within a single rule-management environment

- Ability to categorize and assign responsibility for data quality errors

- Top-down correlated aggregation

- Bottom-up approaches

Benefits

- A single foundation for a complete data governance platform of risk data governance, data quality information accuracy, integrity and completeness

- Integration with many major platforms with a flexible and adaptable architecture that doesn’t require replacing existing technology investments.

- Processing of risk data calculations with high-performance, in-memory aggregation of positions (banking and trading book), exposures and data to the highest level of detail

- A high-performance risk engine to aggregate risk measures on demand (VaR, ES, etc.)

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

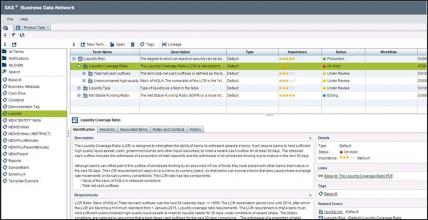

Product Profile

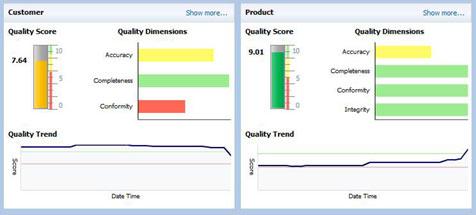

Screenshots

Product/Service Description

SAP data quality management for the enterprises consists of SAP® Data Services and SAP Information Steward software. Enhanced data profiling, quality metrics together with data matching and consolidation options enable financial institutions to make more informed decisions and speed up business processes. The solution is complemented with concise analytic tools for advanced data quality support.

Customer Overview

Features

- Data quality management functionality to support trusted data

- Data cleansing tools to parse, standardize, and cleanse data from any source, domain, or type

- Data profiling to enhance understanding of data

- Customized management of data policies, data quality

Benefits

- Easy and user friendly solution of data problems

- Deep view of data quality metrics with intuitive dashboards and scorecards

- Option to improve data by parsing, standardizing and cleansing data from any source, domain or type

- Numerous data enhancements with internal or external sources to maximize the value of your data

- Data consolidation to uncover hidden relationships and provide a single version of the truth

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

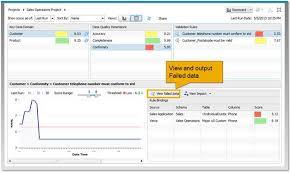

Product Profile

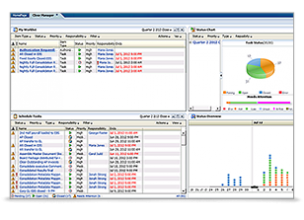

Hyperion Financial Data Quality Management

Screenshots

Product/Service Description

Oracle Hyperion Financial Data Quality Management represents a packaged solution for finance users that helps develop standardized financial data management processes with its Web-based guided workflow user interface and powerful integration engine. Financial Data Quality Management's data preparation server can ease integrating and validating financial data from any source system. And to further reduce data integration costs and data mapping complexities, Hyperion Financial Data Quality Management includes prepackaged Enterprise Performance Management (EPM) adapters for Hyperion Financial Management, Hyperion Planning, Hyperion Enterprise, Hyperion Strategic Finance and Oracle Essbase.

Customer Overview

Features

- Guided workflow interface

- Complete data validations and error checking

- Automated data mapping and loading

- Prepackaged system adapters

- Detailed audit reviews and reconciliations.

- Support for standard file formats as well as direct connections to transaction systems.

Benefits

- Increase your confidence in the numbers.

- Lower the cost of compliance.

- Simplify financial data collection and transformation.

- Standardize with repeatable financial processes.

- Deliver process transparency through audit trails.

- Achieve timeliness of data with a Web-guided workflow process.

- Improve the productivity of finance

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

TCS BaNCS, from Tata Consultancy Services, is a globally acclaimed software brand that enables transformation in financial services through a superior and holistic suite of solutions for banks, capital market firms, insurance companies, and other diversified financial institutions.

Each solution in the TCS BaNCS family has been designed to fully integrate with existing business models, enterprise infrastructures and technology architectures. Adopted as a platform of choice by financial institutions around the world of all sizes, TCS BaNCS addresses critical industry needs and enables business transformation by providing customers with scalable, customizable, market-ready solutions.

Built on open architecture, this component-based product suite leverages service-oriented and event-driven architectures. Based on TCS’ in-depth market understanding through numerous interactions with more than 280 customers across 80 countries, this product suite offers one of the broadest end-to-end functionalities for financial services

Customer Overview

Features

- The TCS BaNCS platform for Banking encompasses an array of pre-configured, customizable banking products such as Universal Banking, Core Banking, Payments, Risk Management & Compliance, Financial Inclusion, Islamic Banking, Treasury, Wealth Management, Pr

Benefits

- Flexible configuration features.

- SOA-enabled infrastructure.

- Centralized Customer Information Facility and Risk Management.

- Cross channel communication within Branch,

- ATM/Kiosk

- IVRS/Contact Centre

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Temenos T24 is an integrated core banking solution that is often referred to as “all in one” technology resource. T24 equips financial institutions with all the necessary tools for managing the entire workflow of banking operations from both back and front end in addition to client relationship management. T24 has established strong reputation in financial services market over the past 14 years.

Customer Overview

Features

- Availability of T24 Biometrics identification and multi-factor authentication component for meeting regulatory norms and controlling risks internally/externally.

- An integrated front to back office add-on solution for the management of Margin Loans.

- Repos and Securities Lending component equipped with STP functionality for smooth processing and handling of trading volumes and risks associated with lending.

- Trade finance - supporting complex trade finance structures

Benefits

- A complete service-oriented architecture.

- An integrated front-to-back office, CRM and product lifecycle management software platform

- full rapid, cost-efficient and precise lifecycle management of lending process

- Delinquency management - monitors, ages and manages your customer repayment obligations

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

Misys FusionCapital brings together cloud-based components with trading system in one business-wide, cross-silo solution. FusionCapital allows seamless front-to-back customized workflow and easy integration. The componentised trading solution consists of Core Workflow, Curves, Pricing, eTrading, Securities Inventory and can be combines with other components as well.

Customer Overview

Features

- Front-to-back trade processing. Computational elasticity and real-time risk with full valuation. Cross-asset coverage includes processing of OTC derivatives (interest rate, credit, FX, equity), exchange traded derivatives, inflation, fixed income, FX/MM,

Benefits

- Enterprise-wide consistency due to component-based, open architecture. In the front office, FusionCapital enables to manage trading, positions and exposure, what-if scenarios and hedging with screens designed precisely for traders. A rich set of developme

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

midQORT is an automated broker’s middle office enabling monitoring and control of positions and risks with due respect to all markets and groups of participants and providing the representation of financial results.

Customer Overview

Features

- Estimation and control of positions

- Risk management relative to counterparties, clients and own position

- Entry and settlement of OTC transactions

- Financial performance estimates

- Analytics (turnover, commissions, etc.)

Benefits

- Enhanced workflow capabilities.

- Business inteligence.

- Customization.

- Variety of APIs