Video Tutorials

Product Profile

Product/Service Description

ETHIX by ITS offers a technology solution for the effective delivery of all Islamic banking instruments such as Murabaha, Financing Ijarah, Tawarruq, Salam, Istisnaa and more. The ETHIX Islamic Finance and Microfinance modules facilitate:

- The Establishment of finance according to the Shariaa workflow

- Instalment Payments

- Rescheduling of instalments

- Payoffs

- Roll Over Deals

- Early Payments

- Inventory Management

Customer Overview

Features

- The building of a transaction or business rule once and multiple re-uses.

- Flexibility to adapt to changes in technologies, networks and communications and scale-up

- Multi-Language user interface with bilingual screens, forms, contracts, vouchers and reports generated as per the preferred language of each user or customer.

- Built-in engines that facilitate efficient operations while complying with business requirements and validations.

- Multi-currency on all levels.

- Ability to view and effectively manage customer risk.

- Comprehensive messaging and broadcast facility.

- Straight Through Processing (STP).

- Flexibility to modify reports dynamically

- Signature Verification for automatic retrieval and validation of signatures.

- Journaling capability stores all transactions details.

ETHIX by ITS is a flexible, easy to use, user configurable and efficient technology solution that addresses current and future business needs - so that your financial institution can grow, capture market share, and focus on innovation.

Highly parameterized and secure, ETHIX is an end-to-end Islamic Banking solution that meets the full spectrum needs of the Retail and Corporate Banking business including Treasury and Investment and improves branch and department operational efficiency.

Features include:

Rule-based to allow creation and testing of new products.

Real-time online transactions.

Comprehensive printing module for contracts, receipts and reports (in preferred language).

Benefits

Platform & Workflow

ETHIX reporting module, ETHIX-360 supports comprehensive daily, monthly and yearly reporting as well as complying with Central Bank reporting requirements and the reporting needs of the Risk, Operation, and Security divisions.

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

Built using the latest security standards, the ETHIX Digital Solutions range can be integrated into any core banking system to allows banks to serve, communicate, and market to their customers fast and cost effectively. The software suite enables financial institutions to offer an exceptional online banking experience whilst improving operational performance. ETHIX Digital provides customers with improved security, stability and high performance on PC’s, smart phones and tablets, as well as 24x7 access to their account information, in addition to a range of financial services previously only available in branch.

Customer Overview

Features

ETHIX Digital Solution includes Advanced Dashboards and Widgets, Flexible Omni Channels, Generic Integration Layer, GUI Implementation Toolkit, and various customer communication channels including push notifications allow multi-channel customer communication using SMS, Email, or built-in Message Center.

Benefits

- Generic Integration Layer for easy and fast Integration with any third-party application and ensures high maintainability levels.

- GUI Implementation Toolkit to tailor page components to suit a User’s specific needs.

- High security standards such as Open Web Application Security Project (OWASP), in compliance with the Payment Card Industry Data Security Standard (PCI DSS) guidelines.

ETHIX Digital Suite features advanced dashboards and widgets to deliver a rich, cutting-edge User Experience (UX).

Flexible Omni Channels enable interactions across multiple customer touch points where intents are captured, insights are captured, and conversations are personalized and optimized. Features include:

Push notifications and multi-channel customer communication using SMS, Email, or built-in Message Center.

Platform & Workflow

ETHIX reporting module (ETHIX-360) supports the delivery of comprehensive reporting daily, monthly and yearly, as well as reporting requirements of Central Banks, and Bank Risk, Operations, Security and more.

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots & Video

Product/Service Description

Epos Now’s newest hardware innovation, POStoGO, is an exciting step in mobile point of sale technology. A fully mobile POS solution with best in class integrated payment technology, allows you to take payments on the move, with ease, accuracy and speed.

POStoGO provides everything required to trade in one box:

- An intuitive, detachable android tablet complete with our most innovative software to date, Athena™

- Smart base unit, complete with 80mm thermal receipt printer

- Full access to our award-winning AppStore. 120+ integrations with our best in class partners, including Sage, Xero and PsConnect

- A fast, hassle-free start, with the system fully operational in under 15 minutes.

- Full visibility of your business with access to hundreds of detailed reports, allowing you to make informed decisions

Customer Overview

Features

- An intuitive, detachable android tablet complete with our most innovative software to date, Athena™

- Smart base unit, complete with 80mm thermal receipt printer

- Full access to our award-winning AppStore. 120+ integrations with our best in class partners, including Sage, Xero and PsConnect

- A fast, hassle-free start, with the system fully operational in under 15 minutes

- Full visibility of your business with access to hundreds of detailed reports, allowing you to make informed decisions

Benefits

- POStoGO is unrivalled in its ability to cut queues and give customers a seamless experience in both retail and hospitality. Waiting staff can print branded receipts and take payments at the table, while retail staff boost customer satisfaction by taking a chip and pin, contactless and apple pay payments in the queue.

- A versatile and scalable solution, POStoGO utilises cloud technology, allowing you to access your data at any time, from anywhere, on any device. Intelligent and comprehensive reporting functions safeguard the profitability of your business.

- "POStoGo is a dynamic development in the world of mobile POS, empowering retail and hospitality businesses to sell on the move. Many SMEs attend trade shows, craft fairs, and outdoor festivals - environments where traditional EPOS systems just aren’t viable. POStoGO offers the same benefits and insights as it’s fully-sized counterpart, with a fully mobile, ergonomic design." Jacyn Heavens CEO

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

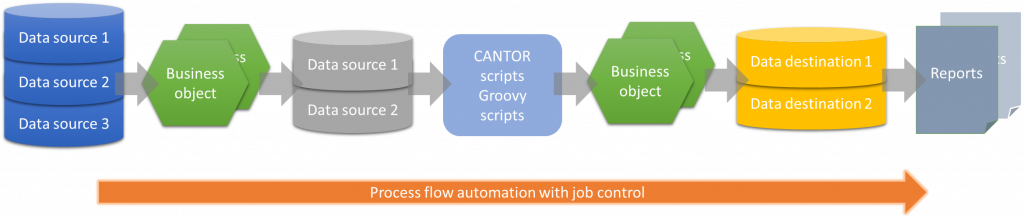

Jabatix is a comprehensive, component-based software development and software production environment for batch applications on application servers based on standard technologies. The Jabatix Community Edition is an all-in-one Eclipse-based Interactive Development Environment. It is a comprehensive workbench for developing information management and reporting solutions.

The key enabling tools and features are:

• Encapsulated access to a wide variety of data sources, from flat files (.csv), to Excel spreadsheets, to relational databases; specific queries can even be directly integrated with the logical data source binding

• Business Objects (BOs): object-based containers that serve to integrate data sources, apply the required functionality (format consistency, data cleansing, aggregation, calculations), to produce and visualize results quickly

• With the Jabatix Cantor scripting language, a Groovy DSL (Domain-Specific Language), with an easy-to-use, pointerless, Microsoft Visual Basic-like syntax, customization scripts can be quickly and efficiently programmed and deployed, even by junior programmers and savvy web developers

• Jabatix workbench also supports Groovy scripts and integrating Java classes: this flexibility makes the Jabatix “layer” between data sources and destinations highly efficient and capable of even the most sophisticated processing

• The Jabatix process flow feature provides workflow automation capabilities in real-time, it can also be activated event- or time-section-controlled

• Jabatix supports report generation with the Jabatix's own Datapoint Report Generator or with Eclipse BIRT; other forms of visualization can be generated programmatically

Customer Overview

Features

- Cantor Script

- Process Flow

- Data Mart Designer

- Business Objects

- Business Object Mapping

Benefits

- All-in-one Eclipse-based Interactive Development Environment

- Cantor scripting language (a Groovy DSL) is similar to Visual Basic. Alternatively Groovy and Java classes can be used

- Free download, no strings attached for independent program development

- Updates and upgrades available free of charge

- Faster development of high-quality software

- Reduction of training costs for software development

- Easy development of software solutions by staff with little IT knowledge

Platform & Workflow

Jabatix supports report generation with the Jabatix's own Datapoint Report Generator or with Eclipse BIRT; other forms of visualization can be generated programmatically

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Clari5 Enterprise Fraud Management

Screenshots & Video

Product/Service Description

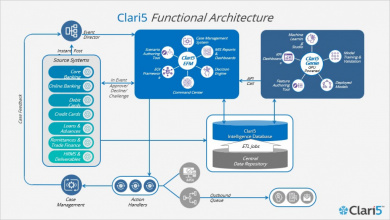

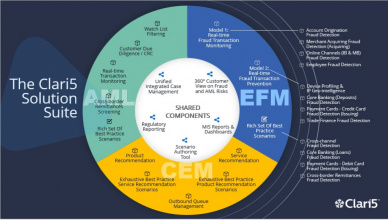

Clari5 is a next gen enterprise platform for real-time intelligence, using the best of technology for the most cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks. Clari5 Enterprise Financial Crime Management Solution suite provides real-time anti-fraud and anti-money laundering capabilities on a unified real-time intelligence platform.

Clari5 Enterprise Fraud Management (EFM) is a real-time Enterprise Wide Fraud Detection, Monitoring and prevention solution that monitors suspicious patterns across transactions, events, users, accounts, systems in real-time and responds with the right action to pass or block transaction, or generate real-time alerts for manual investigation.

Customer Overview

Features

- Proactively combats cross channel, cross product fraud across the enterprise real-time

- Customer aware solution that monitors 360 degrees digesting all transactions and actions

- Silo Breaker solution that combats sophisticated fraud with real-time, actionable insights

- Employs intelligent models based on neural network, time series and complex analytics to deliver insight

Benefits

- Perform fraud prevention in real-time as banking transactions occur

- Prepackaged Scenarios and built-in interfaces across Products/Channels to achieve quick ROI

- Dynamically profiling suspicious devices, cards, merchantsor payees for preventing fraudulent transactions

- Expedited fraud investigation based on Investigation Workbench and Integrated case management

- Integrated reports and dashboard giving insights on the efficiency and effectiveness of the fraud prevention

Platform & Workflow

Cash Transaction Reports, Suspicious Transaction Reporting / Suspicious Activity Reporting, Non-Profit Transaction Reporting, Counterfeit Currency Reporting, Cross-border Transaction Reporting. Management Reporting - Role based Management Reporting and Dashboarding using embedded Enterpsise BI platform

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Clari5 Customer Experience Management

Screenshots & Video

Product/Service Description

Clari5 is a next gen enterprise platform for real-time intelligence using the best of technology for cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks.

Clari5 Customer Experience Management solution delivers instant contextual intelligence across 3 dimensions: Tacit, Actionable and Conversational. Insights offering contextual, real-time recommendations across all channels helps grow cross-sell/ up-sell revenue exponentially.

Customer Overview

Features

- Cross-sell/ Upsell in Real-time

- Next Best Product Recommendation

- Lead Generation

- Intelligent Prompts

- Real-time Customer Detect at Branch

- Automated Service Messages

- Enhanced User Effectiveness

- User-friendly Analytics

Benefits

- Unified and holistic customer experience at every touch point

- Helps customer facing staff make intelligent and relevant conversations

- Enables banks to proactively improve customer experiences across all communication channels

- Solution leans from transactions, interactions, responses and factors them using mathematical models and fuzzy logic to arrive at right conversation pointers, right messages and right sales opportunity

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Clari5 Anti-Money Laundering Solution

Screenshots & Video

Product/Service Description

Clari5 is a next gen enterprise platform for real-time intelligence using the best of technology for cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks.

Clari5 Anti-Money Laundering (AML) solution helps banks and financial institutions automate, streamline and comply with existing and emerging regulatory AML/CFT compliance programs. Clari5 AML suite consists of following solutions, available individually or as an integrated whole namely: Suspicious Activity Monitoring, Customer Risk Categorization, Entity Identity Resolution/Watch List Filtering, Regulatory Reporting (CTR/STR/SAR and any other reports to be submitted to central bank), Scenario Authoring Tool for creating new scenarios, Integrated Case Management, Investigation Tools, Entity Link Analysis and Comprehensive Management Reporting.

Customer Overview

Features

- Automation of entire AML compliance program, from customer on-boarding to steady relationship monitoring

- Comply to risk-based AML approach with on-going customer risk rating and risk-based Transaction Monitoring

- Comprehensive investigation capability based on the risk level of the suspicious transactions through integrated case management with the power of Investigation Tools

- Entity Link Analysis with graphical analysis to discover money laundering rings and funds structuring

- Automated STR/SAR/CTR generation as part of the regulatory reporting

Benefits

- Real-time approach to monitor and detect suspicious money laundering transactions

- Improved regulatory compliance and customer confidence

- Quicker implementation because of pre-packaged AML scenarios and built-in interfaces for integration

- Low cost commodity hardware infrastructure leading to reduced TCO

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Clari5 Loan Early Warning Signals Detection

Screenshots & Video

Product/Service Description

Clari5 is a next gen enterprise platform for real-time intelligence. We have used the best of technology to bring in the most cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks and this is manifestation of our innovation in technology.

Clari5 Loan Fraud Monitoring automates the entire Early Warning Signal Detection. Each of the Early Warning Signals, if represented through a comprehensive set of rules, identifies the pattern of the Loan Account. In addition, it interacts with your Core Banking System and Loan Origination System to identify all early warning signals of interest for the Loan Account Monitoring system. A fully integrated Case Management System and Regulatory Reporting Framework enables the bank to control the end-to-end activities.

Customer Overview

Features

- Comprehensive Early Warning Signal (EWS) Pattern Detection Engine with an ability to dynamically add new EWS and launch them

- Integration with multiple Core Systems to factor in the entire Customer behavior to identify any suspicious behavior

- Fully Integrated Case Management System to monitor all early warning signals generated by the system and performing additional investiga-tion to authorize an account as a Red Flagged Account

- Regulatory Reporting Workbench to electronically generate and file any report required either by the RBI or Law Enforcement Agencies

- Management Reporting Workbench to keep the management abreast of Fraudulent Behavior Accounts and general daily activities

- Flexibility to Implement either On-Premise or Cloud Based.

Benefits

- Comprehensive Investigation workbench –integrated case management, link analysis

- Flexible modes of deployments-Real-time monitoring & Real time Transaction Stopping

- Business friendly interface for decision and case workflow policies

- Cross Channel and Cross Product Coverage

- Proven Architecture for Scalability and Performance –Easier Integration

- 100% scanning of transactions rather than using transaction sample based fraud detection

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Fiorano ESB

Screenshots

Product/Service Description

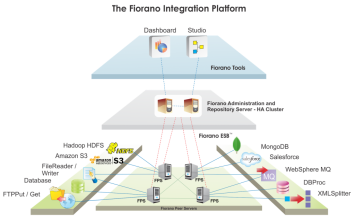

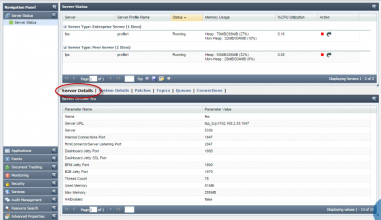

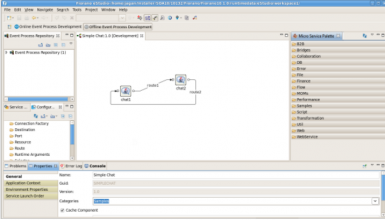

An ESB acts as a high speed expressway for data flow in an enterprise, enabling seamless communication among mutually interacting software applications. Fiorano ESB obviates point-to-point integration efforts and integrates heterogeneous applications, databases, cloud and other systems streamlining the complex architecture of an enterprise.

Customer Overview

Features

- Fiorano ESB provides codeless integration between the bank's core banking system with all the channel applications. The configuration based tools enable citizen integrators to use the drag and drop interface to create integration flows without and coding

- Detailed technical product features can be found on this link: http://www.fiorano.com/products/esb-enterprise-service-bus/key-features.php

Benefits

- Secured and reliable communications Fiorano ESB is backed by an underlying standards-based messaging backbone providing scalable, enterprise class messaging with assured message delivery.

- Future proof solution Fiorano ESB's unique architecture allows parallel message flows between nodes, enabling natural and seamless integration of new applications/systems across the enterprise. This unbounded scalability makes your IT infrastructure a las

- Enhanced enterprise-wide visibility and administration Easily monitor all your information flows, manage all security authorizations and event-handling through a centralized ESB Administration Console.

- Reduced development costs Apart from obviating point-to-point integration, Fiorano pre-built adapters and Microservices allows over 80% of all integrations to be implemented out-of-the-box, with no additional programming, saving enterprises significant ti

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Real-time, instant or immediate payments describes the capability to transfer funds between two parties making funds available to the payee almost instantly, with instant confirmation. Typical processing models consist of a hub-and-spoke model such as ISO 20022 to connect financial institutions or corporations to one another through a central infrastructure (CI).

- Banks improve retention and open up new value added revenue streams

- Fintechs can use ACI’s 3rd party platform - New Access Model - to access Immediate Payments and offer services that were previously restricted to banks alone

- Consumers get faster, reliable transfers and instant, accurate account balances

- Merchants increase profits by getting paid sooner and eliminating interchange fees

Business customers can take advantage of better payment terms and improve their working capital

Customer Overview

Features

- •Payments management •Channel integration •Orchestration •CSM connectivity and compliance •Security and fraud checking •Exceptions handling •Liquidity management •FX payments •Flexible handling and special products management •Business intellige

Benefits

- •Deliver profitable services •Protect your investment by enabling real-time payments •Accelerate your time to market