Knowledge Base

Product Profile

iMAL Enterprise Islamic Banking & Investment System

Product/Service Description

iMAL Enterprise Islamic Banking & Investment System is a powerful core banking platform specifically built from the ground up to support Sharia banking operations. It is truly geared to address country and region-specific Islamic banking requirements. It is offered to high-end Islamic banking, investment and financing institutions, based on an advanced open architecture with a robust integration platform.

iMAL is the only 100% Islamic banking solution as certified by AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) in 2008.

All iMAL modules adhere to the Islamic law and are in full compliance with IAS (International Accounting Standards). The system is based on the Sharia guidelines for the purpose of financing related to Murabaha, Mudaraba, Ijara, Istisnaa, Salam, project financing, real estate and others.

Customer Overview

Pricing model is based on the modular capability available in iMAL core banking system, whereby each module is priced separately providing a flexible costing structure to fulfill the following goals:

1- iMAL provides a full suite of modules that address different business requirements for the banking industry. These modules have been packaged to focus on the different business areas in a bank.

2- Provide a product-based configuration of the different core modules, whereby a base license is provided for the main module feature, and subsequently the client can select additional products to be added to the base license. This aims to optimize the product offering to the client and provide a cost effective offering.

3- Regarding the deployment in branches, Path Solutions adopts a flexible branch deployment strategy, whereby the option is availed to the Sales team to configure the deployment offering by choosing one of the following scenarios:

a. Combination of number of branches and number of users

b. Adopting the pricing based on the number of branches only

c. Adopting the pricing based on the number of users only

d. Adopting the pricing based on the projected number of customer accounts.

The above options provide the flexibility to select the most suited selling approach depending on the target market and client expectations, and accordingly provide a cost effective offering to the potential clients.

4- In addition to the above approach, an embedded quantity discount brackets is adopted to apply a reduced unit cost for the different selection criteria, which again provides a reasonable pricing for the banks operating a big branch network, or projecting a huge number of customers.

Features

- Supports all known Islamic banking instruments

- Web interface, N-Tier Java based, SOA architecture

- With high parameterization capabilities; greater process efficiency, better risk mitigation

- Multi-currency, multi-branch, multi-company enabled accounting backbone

- With strong product definition features

- Fully integrated yet modularized, with Model Bank

- Highly automated and flexible system

- Ensures quick time to market products.

The iMAL core strengths:

iMAL employs multi-tier architecture using the latest JAVA technology with either Oracle or SAP Sybase as core database servers. These powerful and at the same time affordable Relational Database Management Systems (RDBMS) provide sophisticated data protection and high-speed access to information.

The system runs on all the main platforms and operating systems requiring only an up-to-date internet browser at the client side.

iMAL is rich in opportunities for increasing revenue through cross-selling and upselling. It also enables a 360° view which enhances customer service.

It is also cloud ready and deployable on a fully scalable, multi-server n-tier architecture. It includes out-of-the-box, industry best practice processes that further support rapid implementation, team knowledge transfer and sustainable business processes.

The fully integrated front, middle and back office Islamic core banking platform, running 24/7 in real-time -iMAL- combines comprehensive business functionality with an advanced, secure, scalable and modular architecture proven to meet the market toughest challenges of today and tomorrow.

Benefits

- Built-in Islamic operations standard compliant workflows and system controls

- Various delivery channels

- Faster time to market

- Exact fit to business requirements

- Phased migration and implementation approach

- Running businesses in real-time mode

- Higher operational efficiency:

- Single integrated platform for all banking activities

- Flexibility to meet change and growth requirements

- Cost reduction by implementing STP

- Optimized business performance

- Superior customer service

- Efficient speed of service

- Precision of documentary cycle

- Electronic reconciliation (quick notices)

- Prompt dispute resolution: Legal, collection, valuation, procedures, etc.

iMAL enables Islamic financial institutions to carry out essential tasks across retail, corporate and investment banking including core banking, transaction banking, online and mobile, payments & financial messaging, trade services and cash management. These applications help Islamic financial institutions to meet business needs in areas like streamlining operations, introducing new products, improving efficiencies and customer service, and ultimately increasing revenues while reducing risk.

iMAL provides platform independence, real-time interfaces, extreme usability, full scalability, high-performance, excellent productivity for configuration and deployment, and modular components.

With iMAL, Islamic financial institutions are empowered to achieve:

iMAL is based upon customers’ serviceability. One of these backbones is the production of multilingual statements to customers of the Islamic financial institutions. This is done with minimal data entry at the outset of the system’s parameterization, whilst the production of the various statements, advices, is done automatically by the system without manual intervention by the end-user.

iMAL, which is in compliance with Basel II/III & AML, enables Islamic financial institutions to contain the risk element before they get exposed to a higher degree of risk through effective risk management built into every single transaction that is undertaken in the system.

In addition, iMAL helps Islamic financial institutions implement a flexible, cost-efficient infrastructure with instant access to accurate, up-to-the minute financial updating in order to make informed operational and strategic decisions at a moment’s notice. This comprehensive approach produces a higher Return On Investment to our clients.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

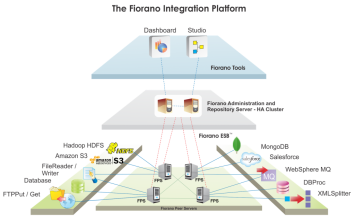

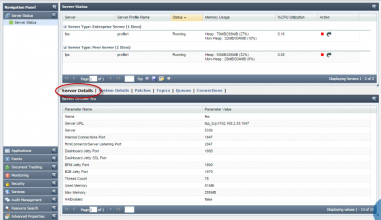

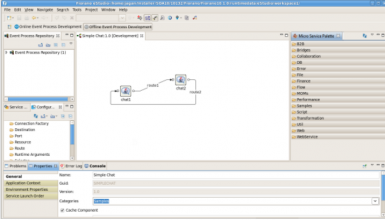

Fiorano ESB

Screenshots

Product/Service Description

An ESB acts as a high speed expressway for data flow in an enterprise, enabling seamless communication among mutually interacting software applications. Fiorano ESB obviates point-to-point integration efforts and integrates heterogeneous applications, databases, cloud and other systems streamlining the complex architecture of an enterprise.

Customer Overview

Features

- Fiorano ESB provides codeless integration between the bank's core banking system with all the channel applications. The configuration based tools enable citizen integrators to use the drag and drop interface to create integration flows without and coding

- Detailed technical product features can be found on this link: http://www.fiorano.com/products/esb-enterprise-service-bus/key-features.php

Benefits

- Secured and reliable communications Fiorano ESB is backed by an underlying standards-based messaging backbone providing scalable, enterprise class messaging with assured message delivery.

- Future proof solution Fiorano ESB's unique architecture allows parallel message flows between nodes, enabling natural and seamless integration of new applications/systems across the enterprise. This unbounded scalability makes your IT infrastructure a las

- Enhanced enterprise-wide visibility and administration Easily monitor all your information flows, manage all security authorizations and event-handling through a centralized ESB Administration Console.

- Reduced development costs Apart from obviating point-to-point integration, Fiorano pre-built adapters and Microservices allows over 80% of all integrations to be implemented out-of-the-box, with no additional programming, saving enterprises significant ti

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Real-time, instant or immediate payments describes the capability to transfer funds between two parties making funds available to the payee almost instantly, with instant confirmation. Typical processing models consist of a hub-and-spoke model such as ISO 20022 to connect financial institutions or corporations to one another through a central infrastructure (CI).

- Banks improve retention and open up new value added revenue streams

- Fintechs can use ACI’s 3rd party platform - New Access Model - to access Immediate Payments and offer services that were previously restricted to banks alone

- Consumers get faster, reliable transfers and instant, accurate account balances

- Merchants increase profits by getting paid sooner and eliminating interchange fees

Business customers can take advantage of better payment terms and improve their working capital

Customer Overview

Features

- •Payments management •Channel integration •Orchestration •CSM connectivity and compliance •Security and fraud checking •Exceptions handling •Liquidity management •FX payments •Flexible handling and special products management •Business intellige

Benefits

- •Deliver profitable services •Protect your investment by enabling real-time payments •Accelerate your time to market

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

We are a fast-growing company that makes commercial cross border payments easy and at a low cost, targeting small to medium size payments, typically ranging between $1,000-$250,000 per transaction. You can use Covercy to make your next international bank transfer without using the slow and expensive SWIFT network, and avoid the overcharged currency conversion charges of your bank.

Customer Overview

Features

- Fast, easy and secure international bank transfers for SMB’s, making sure you save both money and time for your business

Benefits

- Cross border payments within 24 hours from the moment we receive the money in our account

- Better exchange rates

- User dashboard to track outbound and inbound money transfers

- 3rd party lending option for importers

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

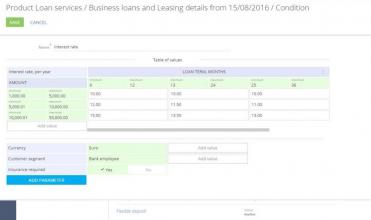

Bpm’online is a global provider of award-winning CRM software that streamlines customer-facing processes and improves operational efficiency. Bpm'online financial services is a powerful CRM designed for corporate and retail banks and financial institutions to manage a complete customer journey and enhance customer experience. The users of bpm’online financial services highly value its process-driven CRM functionality, out-of-the box best practice processes and agility to change processes on the fly. Bpm’online financial services offers products that are seamlessly integrated on one platform connecting the dots between banks’ business areas: retail banking and front-office, corporate banking, marketing.

Customer Overview

Features

- 360° customer view

- Customer segmentation

- Opportunity management

- Product management; product-segment matrix

- Customer weight ranking

- Account management

- Customer lifecycle management

- Omnichannel communications

- Product catalog with the possibility to configure product and pricing parameters

- Consulting and transaction contact-center with the workplaces for bank tellers, agents, supervisors

- Case management

- Knowledge management

- Contracts and documents

- Loan origination processes: unsecured loans, mortgage, auto loans, and others

- Lending application processing, managing loan applications from agents or partners

- Fraud prevention

- Verification and underwriting

- Loan maintenance

- Monitoring pledged assets

- Managing loan paperwork

Benefits

- Align marketing, sales and service on a single CRM platform for banks' business processes

- Gain the agility to change processes in the CRM faster than ever

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots & Video

Product/Service Description

Cash pooling and treasury management are key focus areas for corporate treasuries, with many corporates looking to their banks to offer these services. Additionally, regulations such as Basel III are changing bank-client relationships, putting more pressure on corporates to more effectively handle their cash positions. However, developing new banking services in-house can be time-consuming and expensive.

For banks interested in advancing their corporate banking services, the Reval INSIDE package integrates cash and liquidity management functionality seamlessly into the bank's platform and web portal. This integration provides a superior experience to corporate clients, a fast and cost-effective way for banks to differentiate themselves, and to win and retain clients.

Customer Overview

Features

- Cash Concentration: Provide your corporate clients with true end-of-day cash concentration. Enable multi-level cash pools across borders, entities and banks with one global, integrated solution

- Notional Pooling: Set up single or multi-level notional pools with cascading interest reallocation at arm's length principle. Provide full offsetting and interest enhancement schemes with optional physical interest settlement

- Investment Sweeping: Automatically repatriate idle cash on corporate accounts to on-balance sheet and off-balance sheet vehicles. Offer your corporate clients compliance reporting and analysis of their trade portfolio as a self-service within bank portal

- Intercompany Loans: As part of the cash concentration process, automatically create and update intercompany loans in real-time. Calculate and book intercompany interest based on your clients' preferences

- Incentive Management: Build incentive campaigns and reward programs to attract corporate deposits. Use a flexible product configurator to overtake competitors with a short time to market

- Cash Positioning: Offer your clients more than just cash management. Extend your value proposition with global cash visibility

- Cash Forecasting: Enable clients to forecast cash flows, using best practice categories. Pre-populate data, for your bank only

- Investments & Debt: Providing corporate clients with an online platform to centrally manage their derivative, debt, investment and trade portfolios

- Risk Management: Provide your clients with a platform to capture exposures and derivatives, including integrated FX and interest rate feeds

Benefits

- Be the primary bank through best practice cash concentration and cash pooling services

- Creating a powerful value proposition with true end-of-day cash concentration

- Share interest benefits with your corporate clients and help them minimize idle cash without building complex inter-company loan structures

- Create additional bank revenue through effective use of corporate cash, while automating investments based on your client's individual preferences

- Attract new deposits through targeted incentive campaigns

- Offer better pricing to corporate clients, depending on the value of their deposits

- Reward customers for keeping funds on operating accounts, adding funds or showing transactional activity

- Flexibly build new products, overtaking competitors with a short time to market

- Extend your value proposition with global cash positioning and corporate cash forecasting

- Partner with corporate clients in their treasury transformation, helping them centralize and automate cash, liquidity and risk management

- Differentiate the bank through a superior banking experience

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

FICO Falcon Fraud Manager provides core analytic processing power to handle an organization’s transactional fraud detection needs such as debt, credit, deposit, ePayments and mobile. It can be used to process events, develop strategies to detect fraud and create cases, and execute associated decisioning across an institution’s products, channels and customers.

FICO® Falcon® Fraud Manager provides deep insight into fraud trends and activity. Powered by FICO’s market-leading predictive analytics, it detects up to 50% more fraud than rules-based systems.

Customer Overview

Features

- Robust neural network models with patented service, account, and customer profiling and monitoring of global entities

- Real-time rule creation, rule simulation, and rule implementation

- Efficient investigations with sophisticated case management system

- Seamless integration with your authorization and payment systems for up to 100% real-time scoring

- Region and portfolio-specific fraud models leverage industry-wide consortium data

- Adaptive models generate fraud scores based on analyst feedback

Benefits

- Detects more fraud with lower false positives to provide minimal impact on good customers

- Delivers earliest possible warning of fraud activity

- Boosts analyst productivity and improves effectiveness of fraud operations

- Identifies fraud sooner to give you more opportunity to reduce losses

- Leverages known fraud patterns to achieve highest fraud detection levels

- Adjusts to your findings about fraud dispositions

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

FICO®Siron® Anti-Financial Crime Solutions

Product/Service Description

FICO® Siron® Anti-Financial Crime Solutions consists of flexible and highly integrated software modules for:

• Anti-Money Laundering

• Tax Compliance (FATCA, CRS/AEOI)

• Counter-Terrorism Financing

• Know Your Customer

• Business Partner Due Diligence

The building-block design allows variable combination of the products. This paves the way to genuine cost efficiency, transparent total cost of ownership and solutions that can grow along with the challenges of our customers.

Key Features:

• Coverage of all statutory requirements

• Risk-based approach according to FATF

• Full check of customers and transactions

• No IT-knowledge necessary to configure detection scenarios

• Best-practice research scenarios from more than 1,000 of customer installations

• Multi-clients and multi-lingual user interfaces

• Easy integration with existing systems through standardized and flexible interfaces

• 100% audit-proof documentation

FICO® Siron® solutions consistently follow the risk-based approach and support all phases of the compliance process with integrated solution modules: from business risk analysis and customer risk classification to monitoring of transactions and behavioral patterns, and central case management with risk and compliance dashboards.

FICO® Siron® products are highly standardized and parametrizable. They can be combined at will to create custom solutions. Numerous best-practice scenarios from a large number of customer installations have made their way into our standard research products. They guarantee fast roll-out of professional solutions based on the latest compliance knowledge.

FICO® Siron® technology is robust, interoperable, platform-independent and highly scalable. This facilitates integration of our products into existing system environments and provides seamless interaction with third-party applications and databases. The field of application of our products extends from the lean departmental to a cross- and multi-national group solution.

Customer Overview

Features

- Coverage of all statutory requirements

- Risk-based approach according to FATF

- Full check of customers and transactions

- No IT-knowledge necessary to configure detection scenarios

- Best-practice research scenarios from more than 1,000 of customer installations

- Multi-clients and multi-lingual user interfaces

- Easy integration with existing systems through standardized and flexible interfaces

- 100% audit-proof documentation

Benefits

- Largely automated driving the daily surveillance with as little effort as possible

- System-independently integrated into the IT-infrastructure – investments in additional hard- and software not necessarily needed

- Good performance even for high volume of data

- Easily adaptable to regulatory changes and highly flexible support of any individual definition of suspicion criteria according to the specific risk of the bank

- End user-friendly dialog to bring in the compliance officer’s experience and knowledge of what seems to be suspicious

- Audit trail protocols of all operations and definitions including changes - to protect employees from being accused of carelessness

- Reasonable costs for license and implementation

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

SAS Anti-Money Laundering

Screenshots

Product/Service Description

The SAS solution allows clients to uncover suspicious financial activity efficiently. Get a complete view of threats across your entire institution. And streamline your monitoring, review and investigation processes. SAS provides a common analytics platform and module-based solutions for enterprise fraud, customer due diligence, anti-money laundering and enterprise case management.

Customer Overview

Features

- Money Laundering and Terror Financing Transaction Monitoring, Watchlist and Sanctions Batch Monitoring, Alert and Case Management with Workflow Governance, Regulatory Report Creation, Management, and E-Filing

Benefits

- High Performance scalability to cover very large transaction volume across many lines of business, Transparent system with open data model and no black box monitoring processes or models, Robust and mature data model provided with the solution, Extensive

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

FlexFinance IFRS

Product/Service Description

FlexFinance IFRS. FERNBACH offers a modular solution system. It consists of several blueprints, which in their entirety cover the finance & risk process chain including valuation, financial accounting, reporting and analyses. Each of these blueprints consists of components (“calculation kernels”) which can easily be integrated. One can install selected individual components or the entire range of blueprints. The blueprints for IFRS include the latest rule sets such as IFRS 9 and IFRS 13.

Customer Overview

Features

- FlexFinance IFRS provides, for risk provisioning in particular, a comprehensive catalogue of instruments that includes calculation, simulation, accounting, analysis and reporting. Since different organisational units in a financial institution are usually

Benefits

- Comprehensive IFRS solution which includes valuation of financial instruments, calculation of impairment and hedge management; consolidation with multi-currency capability. • The IFRS solution supports FinRep in accordance with the European Banking Author