Solaris (Sun Microsystems)

Product Profile

Product/Service Description

Esprow is a leading provider of testing and compliance automation solutions for the financial industry. The Esprow Enterprise Testing Platform (Esprow ETP) provides an integrated suite of applications to automate testing of multi-protocol financial systems (ETP Studio), on-boarding and certification of counterparties (ETP C-Box), native exchange and broker simulation (ETP Markets), and management of exchanges APIs and specifications (ETP S-Box).

ETP Studio is sophisticated and versatile FIX-testing and simulation tool for financial markets that you can carry out FIX testing in almost no-time at all. It is also designed to satisfy the requirements of demanding technical users requiring powerful and configurable testing commands. With its modular architecture you only see the tools you need, leaving all other complexities out. Or you can power-up your toolset by adding plug-ins with advanced testing features.

ETP C-Box is the industry's most advanced platform to automate certification and onboarding of all inbound connectivity for exchanges, MTFs and brokers. ETP C-Box reduces certification cycles from months down to days. Multiple exchange members can connect simultaneously to your staging environment and carry out tests round-the-clock, reducing the time it takes to organize and execute the on-boarding process.

ETP S-Box is a centralized repository to store, browse, and edit FIX and non-FIX message specifications across the enterprise, based on the FIX Orchestra technology. ETP S-Box provides a centralized repository that makes it easy to store and share message specifications used across the company. ETP S-Box is a must-have for exchanges wanting to centralize management of FIX and non-FIX (including proprietary) message protocols specifications to avoid duplication and save time.

Customer Overview

Features

- ETP Studio delivers end-to-end automated testing of enterprise trading architectures.

- Test scripts and simulators can be executed headless and integrated within CI/CD pipelines.

- Leverage ETP Studio centralized reporting to fulfill compliance and audit requirements.

- Provide visibility into the testing and release process to all stakeholders

- Achieve complete regression testing of FIX sessions and FIX gateways before every release.

- Test individual services provided by different business modules, with FIX and other protocols.

- Exercise 100% of your business functionality, across the trade lifecycle and trading functions.

- Verify functionality verticals provided through FIX and across business areas.

- Test the integration of FIX-enabled systems within the trading architecture.

- Verify trading limits, fail-over scenarios, authorized transactions, and mission-critical capabilities.

- ETP Studio supports testing of the ION Fidessa platform.

- ETP Studio supports exchange onboarding on the NASDAQ Genium INET OMnet protocol.

Esprow ETP Studio for FIX provides a complete toolset to automate testing of FIX-based systems. Designed around the needs of technical and non-technical users, ETP Studio for FIX enables testing of FIX sessions, building of complex suites of test scenarios or replaying of large production log files. ETP Studio functionality enables creating of test scripts for regression testing, simulation of execution venues in both FIX and binary format, and interactive testing of FIX sessions. ETP Studio rich set of functionality has been designed to meet the sophisticated requirements of brokers, exchanges, vendors, MTFs, and OTFs.

INCREASE AUTOMATION

ENABLE COMPLIANCE

EXTENSIVE CAPABILITIES

Benefits

- Regression and Functional Testing

- Unit and System Testing

- Integration and Security Testing

- Performance and Static-Data Testing

- FIX Order Manager

- FIX Session Manager

- FIX Exchange Simulator

- FIX Market Data Manager

- FIX RFQ Manager

- FIX Performance Package

- FIX On-Boarding Package

- GUI Testing Package and many non-FIX protocol connectors.

- Support for ION Fidessa OpenAccess, NASDAQ Genium INET OMnet, and many binary protocols.

At a time of increasing market regulation and compliance requirements, Esprow ETP Studio delivers a modern toolset to automate testing of FIX connectivity and FIX APIs, guaranteeing system uptime and trading compliance.

The high-level list of Esprow ETP Studio capabilities includes:

ETP Studio is easily extensible with many functionality plugins, including:

Esprow ETP's technology roadmap is mostly driven by our clients, through their feedback and requirements. Whether through training, installation service or custom application enhancements, our professional services team is ready to support you, whichever testing project you are embarking on.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

ICS BANKS Digital Banking

Product/Service Description

Ever since digital disruption started, ICSFS embraced business agility as a primary core driver in providing its customers with real value in this global competitive market. ICSFS provides its customers with:

- Innovation as a Core Function, ICSFS is one of the first users in utilising the latest technologies such as blockchain

- Open Banking; open solutions through open APIs architecture to satisfy fintech roles and make their threat an opportunity

- Complete cloud platforms – Cloud available

- Enriched customer service and experience

- Customer analytics

- Unification of all digital systems – omnichannel experience

- Increase customer’s confidence and engagement, hence, increase customer satisfaction and loyalty

- Dynamic products for new business trends

- High security, scalability, and flexibility

- RegTech solutions

- Improved efficiency to drive business agility

- Increase profitability and reduce revenue leakage

- Continuous technological advancement with lower TCO (Total Cost of Ownership)

- Vast business coverage to assist the full cycle of any banking sector

- Delivering more touchpoints to reach more banking customers and overcome human touch element

- Future-proof digital banking products

ICSFS believes to be truly digital, a bank must reengineer the way it does business, creating a new strategy of digitalising its business model. A bank must first face growing competition from fintech start-ups and tech giants, with endless disruptive innovation. ICSFS has the foresight to capitalise on the digital banking future, as it is recognised by many official independent bodies for its excellence, progressiveness, and innovation within the banking and financial sector.

Customer Overview

Features

ICS BANKS Digital Banking enables the bank to service its customers by providing essential features and vast touchpoints, utilising facilities, and the latest technologies.

Rapid progress in disruptive technologies is bringing a paradigm shift in banking and financial institutions’ thought process, towards technology adoption and transformation. The key principle to successful transformation is choosing the right partner to drive innovation, generate new opportunities, and elevate market advantages over competitors. This is where ICSFS’ innovation lays in flexibility, simplicity, and efficiency. With decades of experience, ICSFS is recognised by its success through its strong- long-term customer base, all over the world.

ICS BANKS Digital Banking platform is used for rendering personal banking services and supporting processes through its latest technologies and touchpoints such as:

- Cloud Technology (Cloud available)

- Blockchain (deployed in production)

- Open banking and Open API’s

- Agency Banking

- Embedded Business Process Management (BPM)

- Embedded Document Management System (DMS)

- Artificial Intelligence, machine learning, and smart processes

- Cash Management System (CMS)

- Chatbots, smart customer social and interactive engagements

- Robotics

- Smart Contracts

- Cardless Payments

- Digital Customer onboarding

- Wearable Banking and internet of things (IoT)

Artificial intelligence and robotics utilisation in ICS BANKS enable the bank to boost process efficiency and accuracy, both, in internal processes and customer interactions.

Benefits

Key benefits of ICS BANKS Digital Banking software suite:

• End-to-End Digital Platform and Architecture

Built on a three-layer architecture, ICS BANKS Digital Banking platform orchestrates the processes between the front, mid, and back-end layers that are connected through standardised APIs, to drive digital transformation and financial inclusion across all digital banking channels, hence, to enable a fully digital customer experience. With ICS BANKS Digital Banking’s Service-Oriented-Architecture (SOA), rich functionalities accompanied with the latest cutting-edge technologies, and comprehensive out-of-the-box fully integrated digital banking touchpoints, a bank is digitally enabled to empower its customers by offering a true virtual digital journey across all its products and touchpoints.

• Open Banking, Unified Omnichannel Integration

To become customer-centric more than product-centric, ICS BANKS Digital Banking software suite supports open banking via unified omnichannel integration. Our software suite offers a bank’s customers a true omnichannel banking experience, meaning, a customer may initiate a transaction on one of the bank’s touchpoints, such as a mobile device and finish this transaction on another touch point, such as ATM or through the bank’s internet banking system. Many digital banking software providers offer multichannel banking instead of omnichannel, the difference is, when a bank uses multichannel banking, its touchpoints will not be seamlessly connected, hence the bank’s customers will not enjoy the consistency and real-time access between any channel, anytime, anywhere, which is the heart of the customers’ omnichannel journey.

• Integrated with ICS BANKS Software Suites

ICS BANKS users have the privilege of easily integrating ICS BANKS Digital Banking software suite with any of ICS BANKS’ family of products. Whether they are using the full universal package, Islamic, or one suite such as ICS BANKS Investment & Treasury.

• Available on the Cloud

ICS BANKS Digital Banking is available on the Oracle Cloud Marketplace, providing a one-stop shop for customers seeking trusted business applications and service providers, offering unique business solutions. Banks users of ICS BANKS Digital Banking on the cloud will leverage a global automation of communications and transactions with greater flexibility and agility, security and lowered costs throughout their entire delivery channels and touchpoints. Banks will not only save big portion of costs by going digital, but also, by using cloud, it can save up to 50% of its operation and infrastructure costs.

• Future-Proof Digital Banking Platform

ICSFS invests in its software suites by utilising modern technology in launching new products, constructing a secured and agile integration, and keeping pace with new standards and regulations worldwide. ICS BANKS Digital Banking software suite future-proof your bank by providing a broad range of features and capabilities with more agility and flexibility to enrich the bank’s customers journey experience, where personal customer analytics are provided through embedded analytics for activity-based reporting and customer performance, hence improving the trust and confidentiality between the customer and the bank.

• Leverage Fintech Innovations

ICS BANKS Digital Banking software suite encompasses an ecosystem of third-party services, as banks who want to survive and stay ahead of their competitors in this age of digital disruption, have to collaborate and engage with fintech. ICS BANKS Digital Banking software suite controls how fintech digital business applications and services are accommodated and delivered to banks’ customers, to maintain a competitive edge and improve customer satisfaction, with minimal cost and time for integration.

• Proven Track-Record

ICSFS started since the inception of ICS BANKS to perform tests and high-watermark benchmarks with tech giants such as Oracle, HP and IBM, and have set a highly competitive edge over software providers in record-breaking performance and unmatched results. ICSFS usually generates ICS BANKS’ data representative of tier 1 and tier 2 universal banking activities. One of its main high record-breaking performance on the cloud was conducted on Oracle’s database machines, where ICSFS is the first Oracle ISV partner worldwide to perform high-watermark benchmark on Oracle Database Enterprise Edition 12c and 18c.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Jabatix is a comprehensive, component-based software development and software production environment for batch applications on application servers based on standard technologies. The Jabatix Community Edition is an all-in-one Eclipse-based Interactive Development Environment. It is a comprehensive workbench for developing information management and reporting solutions.

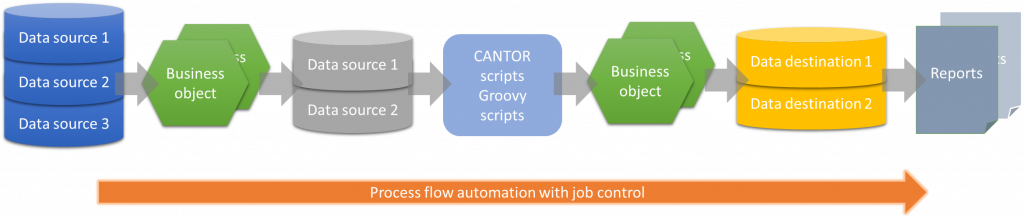

The key enabling tools and features are:

• Encapsulated access to a wide variety of data sources, from flat files (.csv), to Excel spreadsheets, to relational databases; specific queries can even be directly integrated with the logical data source binding

• Business Objects (BOs): object-based containers that serve to integrate data sources, apply the required functionality (format consistency, data cleansing, aggregation, calculations), to produce and visualize results quickly

• With the Jabatix Cantor scripting language, a Groovy DSL (Domain-Specific Language), with an easy-to-use, pointerless, Microsoft Visual Basic-like syntax, customization scripts can be quickly and efficiently programmed and deployed, even by junior programmers and savvy web developers

• Jabatix workbench also supports Groovy scripts and integrating Java classes: this flexibility makes the Jabatix “layer” between data sources and destinations highly efficient and capable of even the most sophisticated processing

• The Jabatix process flow feature provides workflow automation capabilities in real-time, it can also be activated event- or time-section-controlled

• Jabatix supports report generation with the Jabatix's own Datapoint Report Generator or with Eclipse BIRT; other forms of visualization can be generated programmatically

Customer Overview

Features

- Cantor Script

- Process Flow

- Data Mart Designer

- Business Objects

- Business Object Mapping

Benefits

- All-in-one Eclipse-based Interactive Development Environment

- Cantor scripting language (a Groovy DSL) is similar to Visual Basic. Alternatively Groovy and Java classes can be used

- Free download, no strings attached for independent program development

- Updates and upgrades available free of charge

- Faster development of high-quality software

- Reduction of training costs for software development

- Easy development of software solutions by staff with little IT knowledge

Platform & Workflow

Jabatix supports report generation with the Jabatix's own Datapoint Report Generator or with Eclipse BIRT; other forms of visualization can be generated programmatically

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

iMAL Enterprise Islamic Banking & Investment System

Product/Service Description

iMAL Enterprise Islamic Banking & Investment System is a powerful core banking platform specifically built from the ground up to support Sharia banking operations. It is truly geared to address country and region-specific Islamic banking requirements. It is offered to high-end Islamic banking, investment and financing institutions, based on an advanced open architecture with a robust integration platform.

iMAL is the only 100% Islamic banking solution as certified by AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) in 2008.

All iMAL modules adhere to the Islamic law and are in full compliance with IAS (International Accounting Standards). The system is based on the Sharia guidelines for the purpose of financing related to Murabaha, Mudaraba, Ijara, Istisnaa, Salam, project financing, real estate and others.

Customer Overview

Pricing model is based on the modular capability available in iMAL core banking system, whereby each module is priced separately providing a flexible costing structure to fulfill the following goals:

1- iMAL provides a full suite of modules that address different business requirements for the banking industry. These modules have been packaged to focus on the different business areas in a bank.

2- Provide a product-based configuration of the different core modules, whereby a base license is provided for the main module feature, and subsequently the client can select additional products to be added to the base license. This aims to optimize the product offering to the client and provide a cost effective offering.

3- Regarding the deployment in branches, Path Solutions adopts a flexible branch deployment strategy, whereby the option is availed to the Sales team to configure the deployment offering by choosing one of the following scenarios:

a. Combination of number of branches and number of users

b. Adopting the pricing based on the number of branches only

c. Adopting the pricing based on the number of users only

d. Adopting the pricing based on the projected number of customer accounts.

The above options provide the flexibility to select the most suited selling approach depending on the target market and client expectations, and accordingly provide a cost effective offering to the potential clients.

4- In addition to the above approach, an embedded quantity discount brackets is adopted to apply a reduced unit cost for the different selection criteria, which again provides a reasonable pricing for the banks operating a big branch network, or projecting a huge number of customers.

Features

- Supports all known Islamic banking instruments

- Web interface, N-Tier Java based, SOA architecture

- With high parameterization capabilities; greater process efficiency, better risk mitigation

- Multi-currency, multi-branch, multi-company enabled accounting backbone

- With strong product definition features

- Fully integrated yet modularized, with Model Bank

- Highly automated and flexible system

- Ensures quick time to market products.

The iMAL core strengths:

iMAL employs multi-tier architecture using the latest JAVA technology with either Oracle or SAP Sybase as core database servers. These powerful and at the same time affordable Relational Database Management Systems (RDBMS) provide sophisticated data protection and high-speed access to information.

The system runs on all the main platforms and operating systems requiring only an up-to-date internet browser at the client side.

iMAL is rich in opportunities for increasing revenue through cross-selling and upselling. It also enables a 360° view which enhances customer service.

It is also cloud ready and deployable on a fully scalable, multi-server n-tier architecture. It includes out-of-the-box, industry best practice processes that further support rapid implementation, team knowledge transfer and sustainable business processes.

The fully integrated front, middle and back office Islamic core banking platform, running 24/7 in real-time -iMAL- combines comprehensive business functionality with an advanced, secure, scalable and modular architecture proven to meet the market toughest challenges of today and tomorrow.

Benefits

- Built-in Islamic operations standard compliant workflows and system controls

- Various delivery channels

- Faster time to market

- Exact fit to business requirements

- Phased migration and implementation approach

- Running businesses in real-time mode

- Higher operational efficiency:

- Single integrated platform for all banking activities

- Flexibility to meet change and growth requirements

- Cost reduction by implementing STP

- Optimized business performance

- Superior customer service

- Efficient speed of service

- Precision of documentary cycle

- Electronic reconciliation (quick notices)

- Prompt dispute resolution: Legal, collection, valuation, procedures, etc.

iMAL enables Islamic financial institutions to carry out essential tasks across retail, corporate and investment banking including core banking, transaction banking, online and mobile, payments & financial messaging, trade services and cash management. These applications help Islamic financial institutions to meet business needs in areas like streamlining operations, introducing new products, improving efficiencies and customer service, and ultimately increasing revenues while reducing risk.

iMAL provides platform independence, real-time interfaces, extreme usability, full scalability, high-performance, excellent productivity for configuration and deployment, and modular components.

With iMAL, Islamic financial institutions are empowered to achieve:

iMAL is based upon customers’ serviceability. One of these backbones is the production of multilingual statements to customers of the Islamic financial institutions. This is done with minimal data entry at the outset of the system’s parameterization, whilst the production of the various statements, advices, is done automatically by the system without manual intervention by the end-user.

iMAL, which is in compliance with Basel II/III & AML, enables Islamic financial institutions to contain the risk element before they get exposed to a higher degree of risk through effective risk management built into every single transaction that is undertaken in the system.

In addition, iMAL helps Islamic financial institutions implement a flexible, cost-efficient infrastructure with instant access to accurate, up-to-the minute financial updating in order to make informed operational and strategic decisions at a moment’s notice. This comprehensive approach produces a higher Return On Investment to our clients.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

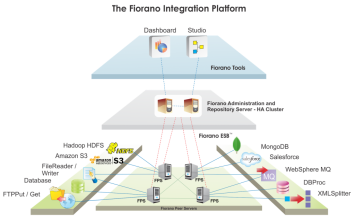

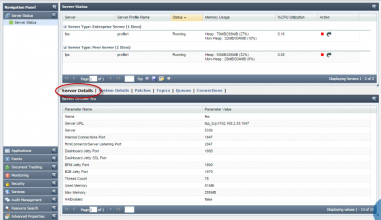

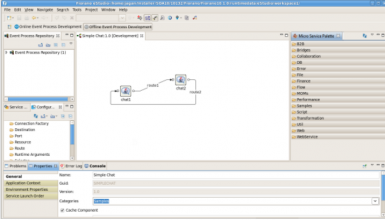

Fiorano ESB

Screenshots

Product/Service Description

An ESB acts as a high speed expressway for data flow in an enterprise, enabling seamless communication among mutually interacting software applications. Fiorano ESB obviates point-to-point integration efforts and integrates heterogeneous applications, databases, cloud and other systems streamlining the complex architecture of an enterprise.

Customer Overview

Features

- Fiorano ESB provides codeless integration between the bank's core banking system with all the channel applications. The configuration based tools enable citizen integrators to use the drag and drop interface to create integration flows without and coding

- Detailed technical product features can be found on this link: http://www.fiorano.com/products/esb-enterprise-service-bus/key-features.php

Benefits

- Secured and reliable communications Fiorano ESB is backed by an underlying standards-based messaging backbone providing scalable, enterprise class messaging with assured message delivery.

- Future proof solution Fiorano ESB's unique architecture allows parallel message flows between nodes, enabling natural and seamless integration of new applications/systems across the enterprise. This unbounded scalability makes your IT infrastructure a las

- Enhanced enterprise-wide visibility and administration Easily monitor all your information flows, manage all security authorizations and event-handling through a centralized ESB Administration Console.

- Reduced development costs Apart from obviating point-to-point integration, Fiorano pre-built adapters and Microservices allows over 80% of all integrations to be implemented out-of-the-box, with no additional programming, saving enterprises significant ti

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

FICO®Siron® Anti-Financial Crime Solutions

Product/Service Description

FICO® Siron® Anti-Financial Crime Solutions consists of flexible and highly integrated software modules for:

• Anti-Money Laundering

• Tax Compliance (FATCA, CRS/AEOI)

• Counter-Terrorism Financing

• Know Your Customer

• Business Partner Due Diligence

The building-block design allows variable combination of the products. This paves the way to genuine cost efficiency, transparent total cost of ownership and solutions that can grow along with the challenges of our customers.

Key Features:

• Coverage of all statutory requirements

• Risk-based approach according to FATF

• Full check of customers and transactions

• No IT-knowledge necessary to configure detection scenarios

• Best-practice research scenarios from more than 1,000 of customer installations

• Multi-clients and multi-lingual user interfaces

• Easy integration with existing systems through standardized and flexible interfaces

• 100% audit-proof documentation

FICO® Siron® solutions consistently follow the risk-based approach and support all phases of the compliance process with integrated solution modules: from business risk analysis and customer risk classification to monitoring of transactions and behavioral patterns, and central case management with risk and compliance dashboards.

FICO® Siron® products are highly standardized and parametrizable. They can be combined at will to create custom solutions. Numerous best-practice scenarios from a large number of customer installations have made their way into our standard research products. They guarantee fast roll-out of professional solutions based on the latest compliance knowledge.

FICO® Siron® technology is robust, interoperable, platform-independent and highly scalable. This facilitates integration of our products into existing system environments and provides seamless interaction with third-party applications and databases. The field of application of our products extends from the lean departmental to a cross- and multi-national group solution.

Customer Overview

Features

- Coverage of all statutory requirements

- Risk-based approach according to FATF

- Full check of customers and transactions

- No IT-knowledge necessary to configure detection scenarios

- Best-practice research scenarios from more than 1,000 of customer installations

- Multi-clients and multi-lingual user interfaces

- Easy integration with existing systems through standardized and flexible interfaces

- 100% audit-proof documentation

Benefits

- Largely automated driving the daily surveillance with as little effort as possible

- System-independently integrated into the IT-infrastructure – investments in additional hard- and software not necessarily needed

- Good performance even for high volume of data

- Easily adaptable to regulatory changes and highly flexible support of any individual definition of suspicion criteria according to the specific risk of the bank

- End user-friendly dialog to bring in the compliance officer’s experience and knowledge of what seems to be suspicious

- Audit trail protocols of all operations and definitions including changes - to protect employees from being accused of carelessness

- Reasonable costs for license and implementation

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

SAS Anti-Money Laundering

Screenshots

Product/Service Description

The SAS solution allows clients to uncover suspicious financial activity efficiently. Get a complete view of threats across your entire institution. And streamline your monitoring, review and investigation processes. SAS provides a common analytics platform and module-based solutions for enterprise fraud, customer due diligence, anti-money laundering and enterprise case management.

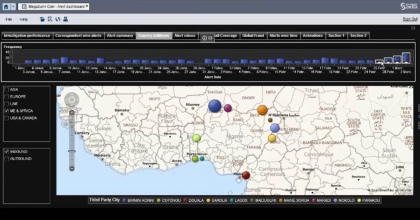

Customer Overview

Features

- Money Laundering and Terror Financing Transaction Monitoring, Watchlist and Sanctions Batch Monitoring, Alert and Case Management with Workflow Governance, Regulatory Report Creation, Management, and E-Filing

Benefits

- High Performance scalability to cover very large transaction volume across many lines of business, Transparent system with open data model and no black box monitoring processes or models, Robust and mature data model provided with the solution, Extensive

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

FlexFinance IFRS

Product/Service Description

FlexFinance IFRS. FERNBACH offers a modular solution system. It consists of several blueprints, which in their entirety cover the finance & risk process chain including valuation, financial accounting, reporting and analyses. Each of these blueprints consists of components (“calculation kernels”) which can easily be integrated. One can install selected individual components or the entire range of blueprints. The blueprints for IFRS include the latest rule sets such as IFRS 9 and IFRS 13.

Customer Overview

Features

- FlexFinance IFRS provides, for risk provisioning in particular, a comprehensive catalogue of instruments that includes calculation, simulation, accounting, analysis and reporting. Since different organisational units in a financial institution are usually

Benefits

- Comprehensive IFRS solution which includes valuation of financial instruments, calculation of impairment and hedge management; consolidation with multi-currency capability. • The IFRS solution supports FinRep in accordance with the European Banking Author

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Qbonds is valantic's high-performance solution for electronic bond trading. Market making, bond pricing, as well as the connection to electronic markets, exchanges and data platforms (e.g. Reuters, Bloomberg, Eurex and MTS) are integrated into one application.

Customer Overview

Features

- Complete solution for pricing, quoting and trading of bonds like cds, etf, rates and more

Benefits

- The “visual separation” of quotes and instruments on different screens enables the trader to manage quotes individually

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Finacle is the industry-leading universal banking solution from EdgeVerve Systems. The solution helps financial institutions develop deeper connections with stakeholders, power continuous innovation and accelerate growth in the digital world.Over the past 25 years, the solution has been helping financial institutions develop deeper connections with stakeholders, power continuous innovation and accelerate growth in the digital world. Today, Finacle is the choice of banks across 94 countries and serves over 848 million customers – estimated to be nearly 16.5 percent of the world’s adult banked population.Finacle solutions address the core banking, e-banking, mobile banking, CRM, payments, treasury, origination, liquidity management, Islamic banking, wealth management, and analytics needs of financial institutions worldwide. Assessment of the top 1000 world banks reveals that banks powered by Finacle enjoy 50 percent higher returns on assets, 30 percent higher returns on capital, and 8.1 percent points lesser costs to income than others.

Customer Overview

Features

- A comprehensive, integrated yet modular agile business solution

- Addresses all the core needs of the bank, in easy-to-configure modules

- Multi entity capabilities to support multiple legal entities, across various geographies, currencies and time zones on a single instance of application

- Easy to configure modules and components

Benefits

- Comprehensive coverage so that you can enter into new business segments confidently

- Proven technology, which is consistently rated as best-in-class by leading industry analysts

- Enterprise-class components to create operational hubs across business units to enhance the agility and efficiency of the operations as well as improve customer experience across channels

- Built-in global best practices repository and rich repository of processes

- Product factory and product bundling infrastructure for business users to accelerate new product creation

- 360-degree view of customers across global relationships

- Powerful customer analytics driving right-sell opportunities and personalized offerings

- Cloud-ready platform to enhance infrastructure costs

- Reduced time to compliance with real-time view across enterprise data

- Ready-made integration adaptors and compliance to industry standards reduce your integration costs and enable enhanced STP (straight-through processing)