SecuredTouch: Mobile Identity to Trust

- Product Reviews

- 15.05.2017 08:21 am

SecuredTouch is the first leading provider of behavioral biometrics for mobile services that offers digital-world authentication solutions to strengthen security and reduce fraud, at the same time allowing smooth digital experiences.

Idea Behind the Launch of Behavioral Biometrics

There has always been a big trade off between functionality, user-friendliness, and security. On one hand companies want to allow users the best functional experience and on the other hand, they want to avoid friction. In order to balance all these factors together, the company tried to think about the technique that could provide the best option. The solution was considered to be invisible to users, as well it had to be very strong in terms of functionality and security.

Moreover, as a financial organization that delivers or allows doing a lot of sensitive operations in the mobile channel, the user needs to feel very safe to do all the things, without being stopped at every place. So this is how SecuredTouch came up with behavioral biometrics, something that should be run at the background, just by leveraging the existing things that are already out there.

Behavioral Biometrics

Mobile behavioral biometrics refers to the stage when a user is analyzed by different physical interactions with several types of connected devices, in order to draw significance of identity of the user, who will specifically be deploying the device.

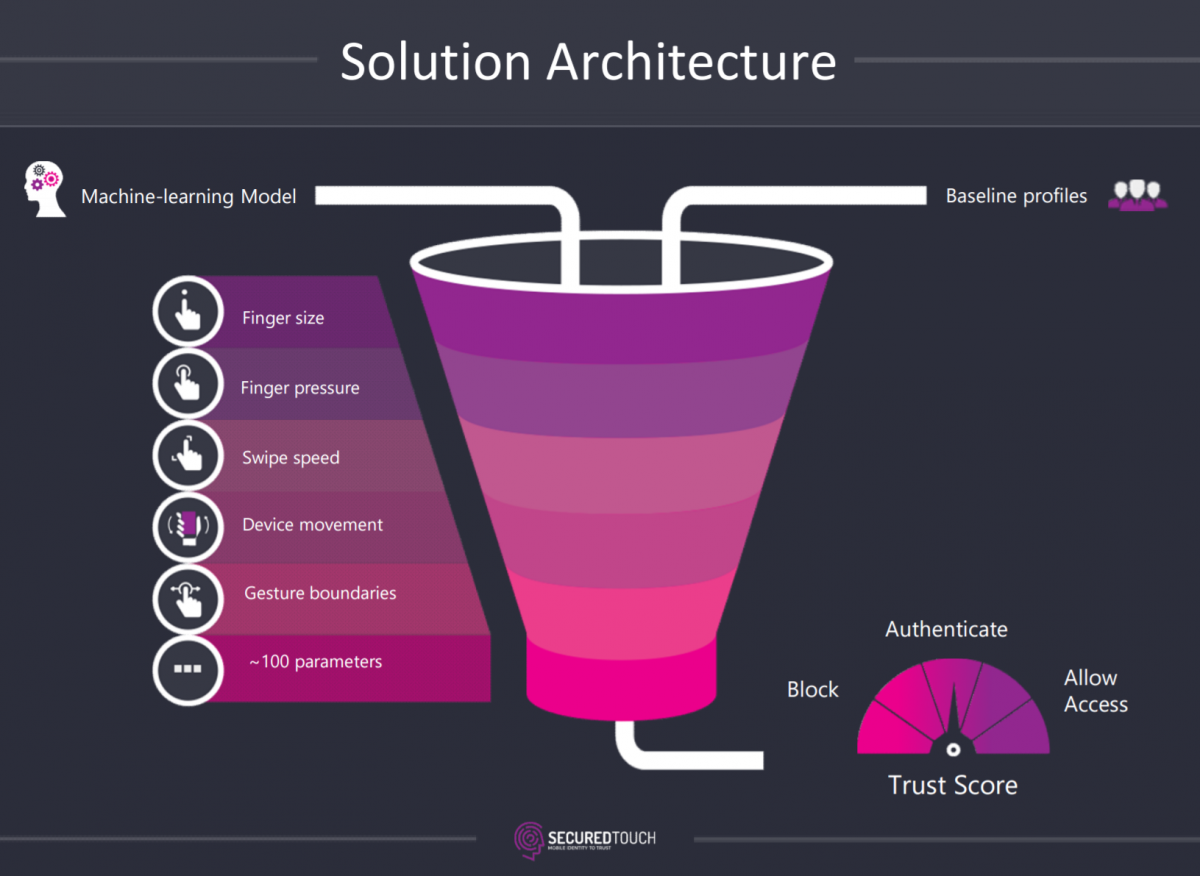

Furthermore, the way users interact with the mobile device is analyzed and measured by 100 different parameters. For instance, how big is the user’s finger that touches the device, how much of the pressure does the user’s finger put on the device, how fast you move your finger across the screen or how fast you scroll. As a result, about hundred parameters are collected, so later on they can be compared between the current behavior and the user’s profile that will come behind the scene. This way, we can make sure that this is a real user using a device just by looking at the behavior and see if there is a match.

Target Market

Currently, target market includes financial organizations that provide any kind of mobile service, or mobile application, where authentication or identification is a big issue. Mostly, these applications involve money transfers, or e-commerce applications, and every other application that involves authentication or knowing that this is a real user behind every transaction.

Integration Process

The integration is done to a specific mobile application. The process normally takes a few hours and consists of two parts. It is very easy and fast to integrate into the application and that is the application side. There is also integration on the back end, which takes approximately two or three days.

Real-life Example of Applying Behavioral Biometrics within Financial institutes

As an example, in Israel the company works with one of the credit card issuers, Leumi card. The company develops a mobile wallet, which can be downloaded by users and deals with all sorts of transactions. Behavioral biometrics was integrated into the mobile wallet platform, for both the IOS and Android. This collaboration allowed better user experience and simplified authentication process. Normally, every time customers want to transfer money, or want to look at the card bank and do something sensitive, they will act like putting a password or a pin code to proceed with further transaction. When it comes to transaction with a SecuredTouch, user behavior is continuously monitored. Then, when the user wants to do a transaction, the wallet calls to SecuredTouch and asks for a trust code, which is an out-code of the technology. It is kind of a confidence level and if the technology recognizes over 90%, the user does not need to enter a pin code and customers can proceed to the transaction, without being stopped on the way.

Challenges and Opportunities

The main challenge is to provide mobile users with the best of the user experience in all aspects. In terms of service, while staying very competitive, SecuredTouch is looking for the edge of making the services even better than it is now. There is a need to have security biometrics that complements one another, and choose the best one to make it more functional, user-friendly, and secure.