The Road To Decision Management Maturity

- Product Reviews

- 13.09.2016 08:09 am

We are knee-deep in a digital transformation era, and yet the banking and insurance industries are struggling to overcome resistance to change and adopt new methods in operational and management processes. As this transformation continues, financial institutions using the right automation solution for core operational elements of the business are experiencing an increase in speed in critical decision making and execution.

In the past, it’s been difficult to structure and manage business logic that formulate decisions, and even more so, convert that logic into code for implementation. Sapiens DECISION offers a software suite that helps businesses manage critical business processes and logic to drive business decisions. The software enables enterprises in the banking, insurance and mortgage industries to externalize and build business logic from existing applications, based on the strategic goals and customer needs of the organization.

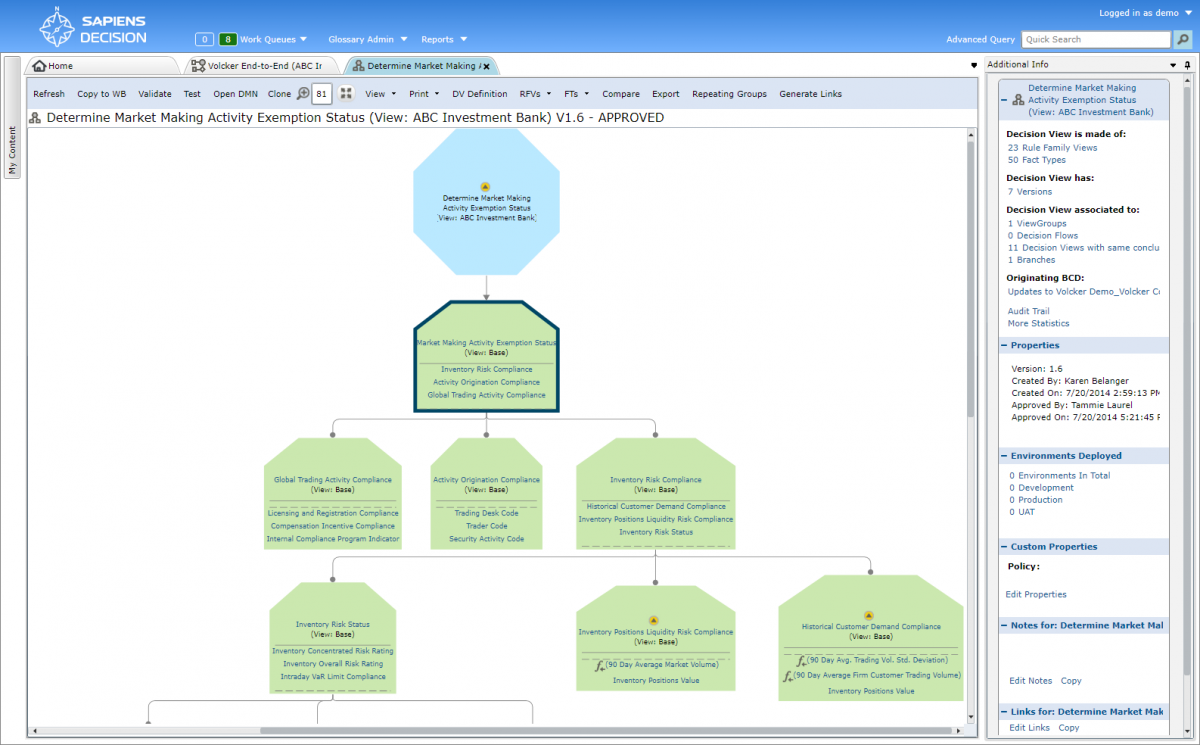

The Sapiens DECISION platform is powered by The Decision Model, a methodology to structure business logic in a way that is complete and consistent with its 15 guiding principles, providing rigor and compliancy to external regulatory standards, change management and governance. Moreover, the tool generates executable code for easy implementation by IT, and to meet the business’ needs. The suite consists of several modules that include DECISION Manager (DM), DECISION Execution (DE), DECISION Deployment Adaptors (DD), DECISION InfoHub (DI) and DECISION STEP(DS).

DECISION Manager is a modeling and management component for testing, verification and change management processing.

DECISION Execution controls the execution run time, where many customers are in one environment.

DECISION Deployment Adaptors and SDK enables features for virtualintegration with a destination run time.

DECISION InfoHub includes a very sophisticated data virtualization capability and extensive ETL for information integration, along with security and data management capabilities.

DECISION STEP is an adoption and implementation package for the suite.

Notably, each of the above modules can be implemented separately or altogether. The point often overlooked by many enterprises is the ability to deal with the entire cycle of business logic and decision management in a single solution. Sapiens DECISION positions itself as the only technology vendor in the financial services market whose software suite encompasses all decision management functionalities completely.

The illustration of challenges that Sapiens DECISION addresses in the banking sector include liquidity reporting and risk. In light of the financial instability in capital markets recently, many banks are struggling to report on liquidity in compliance with stringent regulatory requirements like BASEL III regulation. This complex process requires pulling chunks of data from various resources and processing complex logic dependent on various sub-logic. In this situation, the DECISION suite enables business user to understand the logic of the regulation, structure it into the model, and further implement it correctly. Thanks to the code generated by the solution, the model can be virtually setup in any system including the organization’s own environment or other platforms like IBM or Red Hat.

In terms of pricing, Sapiens DECISION mostly operates on subscription-based model, although other options are available. The usual deployment period of the solution is within two or three months, depending on complexity of the project. The suite has been implemented by some of the leading global 1000 companies including JP Morgan, Wells Fargo and Barclays. Due to its transformative nature and scope of functional coverage, Sapiens DECISION competes with just a few rivals who are either business rule management system vendors or providers of complimentary services such as IBM, Oracle, Microsoft, Signavio, Sybase or Unisys.

Overall Sapiens DECISION would be a good choice for companies who want to break through the resistance to new digital paradigms and those willing to gain a better control of their critical business assets, rules and processes at a rapid speed in a digital world.