Power of personalization in mobile banking

- Product Reviews

- 27.10.2016 12:01 pm

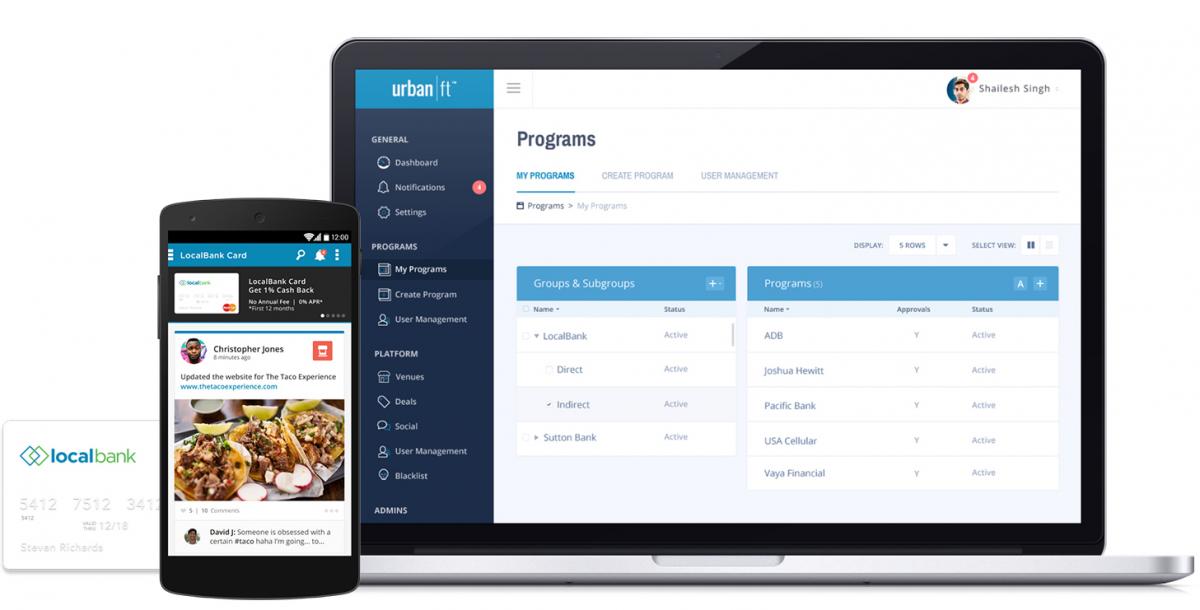

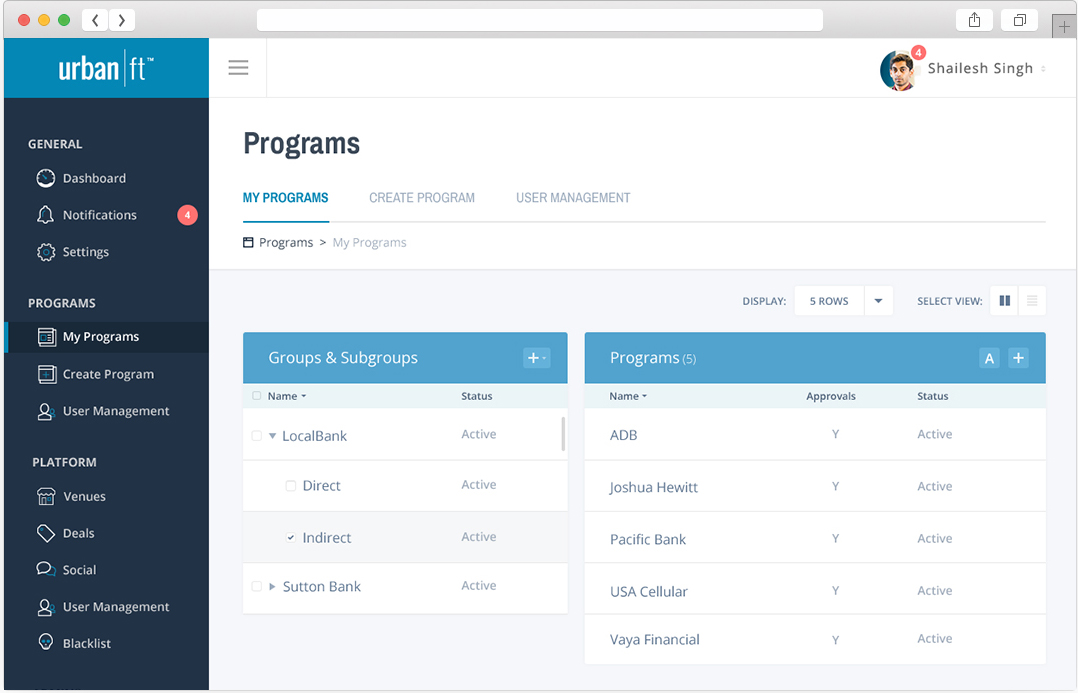

Usually when you think of mobile banking apps, the first thing that comes to mind is minimalism, formal design and focus on the functional components. However, the latest apps coming to market go in a slightly different direction, enriching the mobile banking proposition with a layer of personalization and individuality. The Lifestyle Banking App from Urban FT enables banks to engage with customers by bringing financial and social features together in one lifestyle application. Additionally, to help banks get to market with this new proposition, the company recently released its Workshop admin portal that enables financial institutions to rapidly create, deploy, and manage such apps without coding or custom development.

A lot has been written about the best customer experience in the mobile banking. According to the recent research paper released by Kony, users really value simplicity, personalization and seamless experience in their app. Unless you are a large bank with vast resources at hand, it might be hard to identify the preferences and touch a right chord in communication with clients. Making sense of both the financial and personal life of the consumer can be a challenging goal, but worth having in order to keep the loyalty of existing customers while reeling in the new ones. Users of the Urban FT Workshop are able to enjoy the advantages of both.

Revenue Generator

Target clients of the solution encompass banks and credit unions as well as non-FIs such as wireless carriers, payroll and insurance companies, retailers as well as loyalty organizations that wish to offer digital banking services to their customers. In addition to the Workshop and app platform, Urban FT also provides prepaid card program management services to such non-FI clients, acting as a one-stop shop for branding and marketing in addition to the technology itself. The main benefit of Urban FT’s Lifestyle Banking App for end users is the ability to conduct mobile banking on any device with a mix of lifestyle features in a single app. Thanks to venue and deal content from providers like Groupon and Yelp! which is aggregated and pushed through the app, users can save time and money on deals in local restaurants and retail businesses, as well as with online purchases such as electronics and gift cards. Urban FT’s clients share in the commissions generated from these services.

Banking Functionality

Due to the breadth of configurable features available in the Urban FT Workshop, banks are able to create their own mobile banking app to reflect the mission and proper picture of their organization. Function-wise the app provides account aggregation, mobile check deposit, bill pay, international remittance, intrabank transfer along with P2P, real-time transaction notifications, and personal financial management (PFM) tools. Besides the typical set of mobile banking features, there is an ability to control appearance of the bank’s app through the customization features such as logos, branding, font styles, colour schemes and other visual themes. Once launched in the Apple® App Store and Google Play™ store, the conversation with the customer moves outside the branch and into the digital realm. The venue and deal information tied up with social media accounts are all manageable through the app. This gives more social interaction opportunities for the end users and more exposure online for the bank and their brand.

Deployment & Pricing

The app supports PCI compliance standards and runs on Amazon Web Services. As far as security is concerned, the identity verification and KYC processes are powered by IDology. For those banks that have arrangements with their existing KYC vendors, it is possible to do a third party integration. Urban FT positions its app as a truly multichannel solution and offers a variety of delivery modes - a SaaS solution for issuing banks and credit unions, a fully managed service including prepaid program for non-FIs, or through Urban FT’s APIs and web services for those clients that want to embed specific Urban FT features into their own existing digital assets connection. In regards to the pricing there is an upfront fee for the implementation of the platform with further consumption based pricing.

Digital Customer Experience

As it was mentioned earlier, satisfying today’sdigital customers can be a daunting task. The most valuable customer experience as envisaged by Urban FT lies in the convergence of performance, convenience, and speed together with the social aspect of life. Interestingly, the initial concept behind the app was to inspire college students to start using credit/debit cards. But the idea of lifestyle banking found wider acceptance among users of all ages. Traditionally in the banking technology world it was function that precedes form. In the case ofUrban FT, banks can balance between the functional capabilities and the broader experience using the app by combining banking necessity with hundreds of everyday delightsthrough social engagement and commerce discovery. Today Urban FT has been selected by many small institutions including its latest deal with $10B-asset Banc of California. Additionally the app is in use with Boost Mobile, Sprint, and other mobile operators and a handful of undisclosed clients in the insurance and investment verticals. The company is just beginning to move into other markets including Europe and the Asia Pacific region. As consumer preferences are moving more in the digital and social direction, lifestyle mobile banking apps are set to gain traction across the industry.