An omnibus solution for payments – especially in high volumes

- Product Reviews

- 08.06.2016 07:24 am

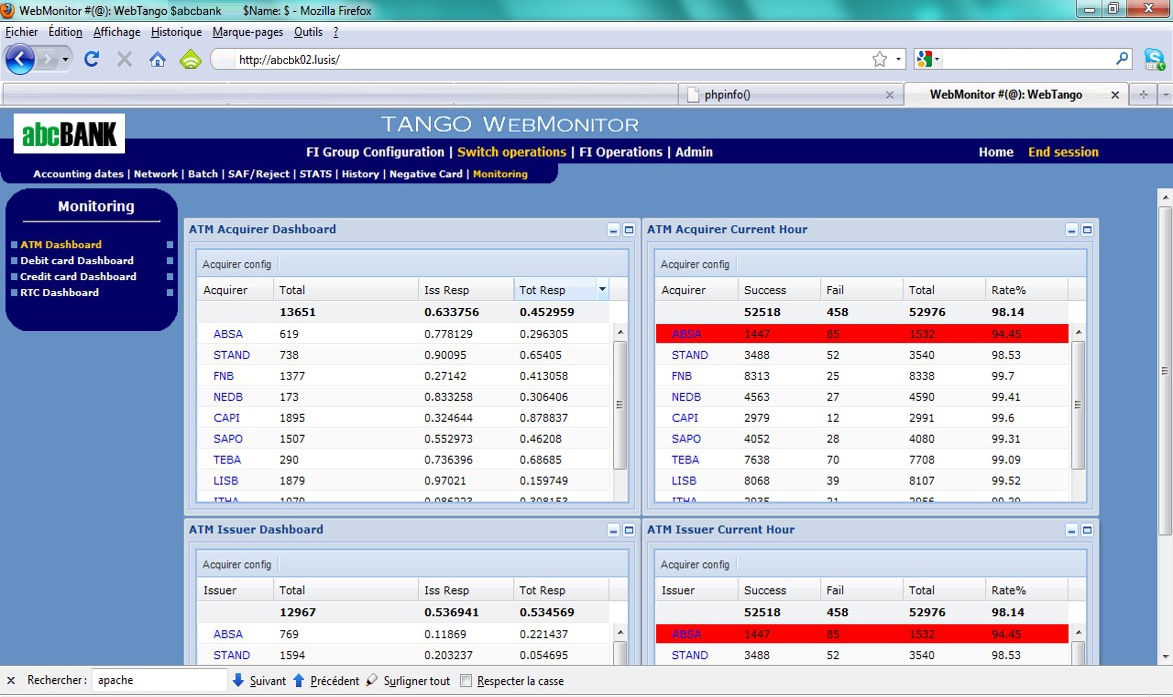

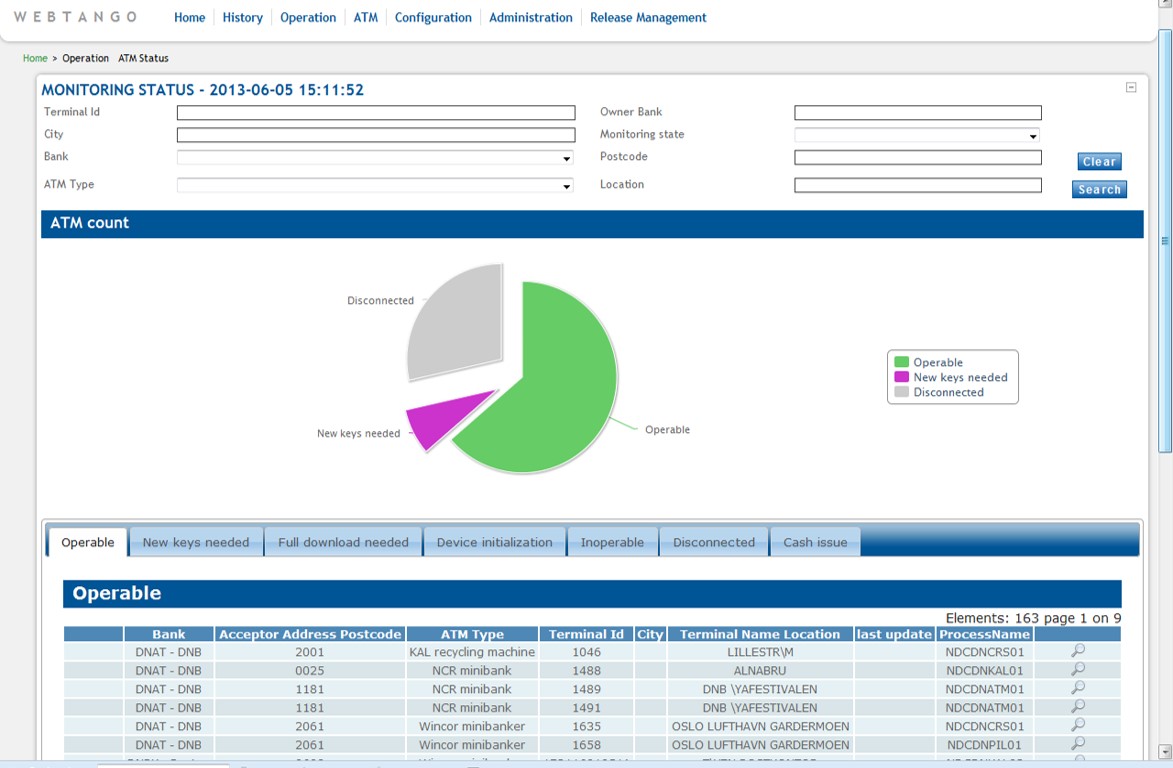

TANGO is the transaction processing system developed by Lusis Payments for banks, merchants, processors and retail companies that deal with large volumes of payments. It is hardware and software agnostic. That means that it can run on any hardware and operating environment including HP NonStop™. The main strength ofTANGO is in its ability to handle any type of payment. It works for all industries, and not just banks and financial institutions. Lusis has customers in all regions of the world.

Lusis Payments built the TANGO platform around the concept of a single payment hub that connects all the functions and devices necessary to process a transaction in a single chain. The core architecture of the product is written in C++ and is service oriented which makes it interoperable with information from multiple sources.

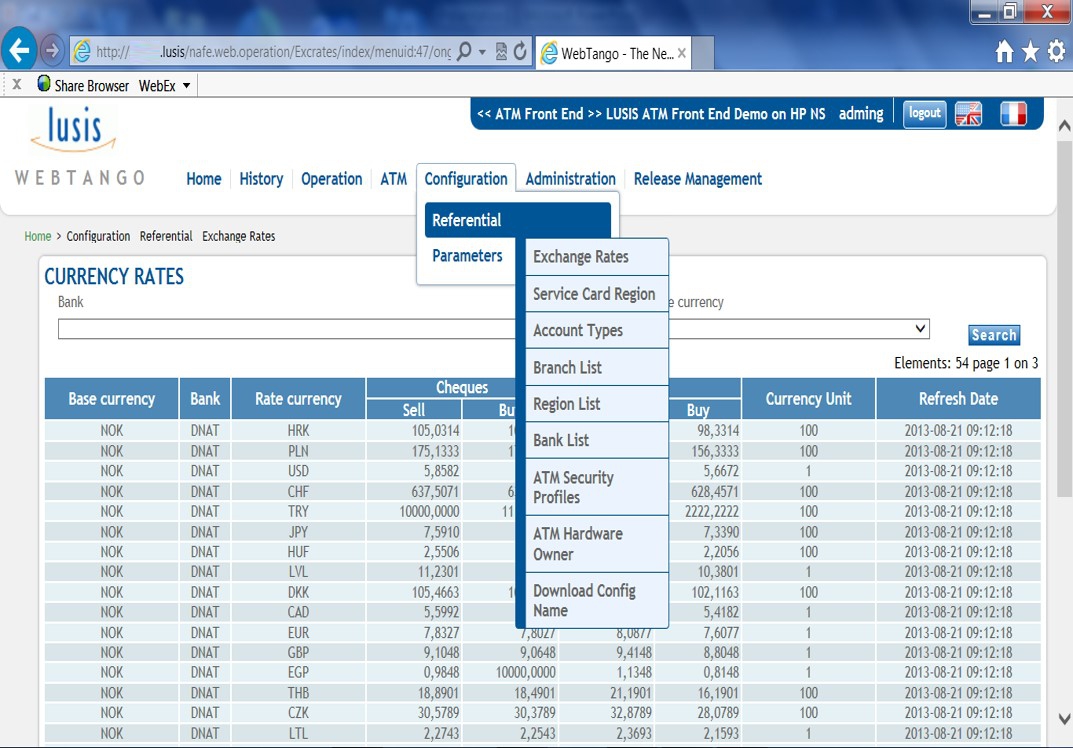

However, the most compelling feature of TANGO is its flexible configuration. This allows users to deploy the solution as an entire payment ecosystem or choose a certain functional component and integrate it with their own existing transaction processing system. And it can be integrated with the user’s own KYC, CRM or other application.

There are five functional components. They are Acquiring, Authorization and Issuing, Routing and Switching, Clearing and Settlement as well as Loyalty. In terms of Acquiring, TANGO can drive many different devices and acquire transactions from ATM’s, POS, Mobile, e-commerce and others. Authorization and Issuing involves the full cycle of card management and transactionprocessing (card issuing, award management etc.). In the Routing and Switching phase, TANGO handles both internal routing, using routing rules, and the external switching of the transaction outto the proper networkssuch as Visa and MasterCard to name just a few.

It’s important to note that TANGO easily interfaces with other external systems and solutions using Java API’s or XML interfaces. And it may be customized to meet the specific requirements of the user. For instance, the process of Authorization can work based on the business rules logic back in the client’s host system as well as the rules used by TANGO to pre – authorize and authorize the transaction. The database of TANGO represents the warehouse of transactional information which can take the form of any relational database like Oracle, DB2 or MySQL.

In terms of Clearing and Settlement, users can choose several options depending on their preferences. Usually, bigger customers prefer using their own settlement system running on their mainframe. In this case TANGO, connects real time through web services and APIs. Some smaller customers prefer clearing within TANGO and the solution can accommodate that. All the clearing can be done in-house or sent to another system. In most cases users prefer to store data in their own datacenters but the possibility of keeping the data in a private cloud is also available.

TANGO can also be a good solution for the brokerage and FX trading firms who need real time updates. Many banks use TANGO for dynamic currency conversion or DCC. Additionally, specialists in retail marketing might use TANGO to trend the movement of their products in the store.

Talking about target users TANGO is as suitable for smaller companies as it is for large companies. Because TANGO can perform replication at the application level rather than at the database level, the cost of large scale processing is a lot lower than it would have been otherwise. Thanks to the partnership with HP, Lusis Paymentsperformed a benchmark running on HP NonStop hardware and were able to process 2,500 transactions per second (TPS) for 48 hours straight without failure at HP’s Advanced Technology Center in Palo Alto.In preliminary tests, running on the new X86 chipset the same test would provide over 50%improved performance.

Request a one-on-one demo of TANGO and experience why one of the largest banks in Canada and others like it have chosen TANGO by Lusis Payments.