Harvesting Data for Smarter Decisions

- Product Reviews

- 23.09.2016 07:25 am

The volume of data loaded on the C-level executives intensifies day by day. Most interestingly the enterprises are way more proficient in producing the big data rather than processing and analyzing it. FI Navigator helps financial institutions and fintech vendors to tame the big data beast for greater quality assurance and analytics in their product and service tactics. FI Navigator specializes in the vertical analytics delivering a web based bank data and analytics platform for quantitative market research. Over 13,000 financial institutions are covered within FI Navigator’s database comparing the performance of their mobile banking apps and customer behaviour in comparison to other peers. Additionally the platform helps to identify the trends and growth opportunities on the market. For the fintech vendors FI Navigator gives an insight into their app consumption along with helpful data for the further app development. The first analytical module produced by FI Navigator encompasses data on nearly 7,000 financial institutions and their chosen fintech providers in the sphere of mobile banking.

Generally speaking the vertical intelligence database with the industry wide coverage of both vendor and industry analytics in real time is quite a new phenomenon on the financial services market. The online platform aggregates the unstructured data from the websites of financial institutions and fintech vendors integrating it with the conventional data. As a result FI Navigator delivers the vendor analytics with the following indicators: market share position and accretion; client churn rates; customer utilization; customer satisfaction; and client demographics. The industry analytics covers the industry wide or segment mobile adoption; customer utilization and satisfaction; and detailed mobile feature provision.

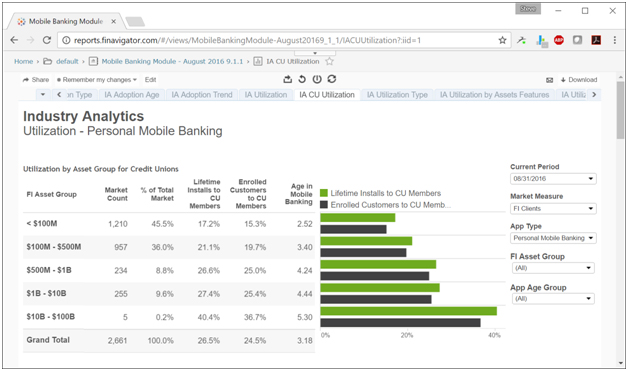

All the information is presented with the visual graphs and easy to browse in the user friendly interface. Subscribers can analyze the app’s select feature or service within a certain time span. For example, if you take a closer look at the enrolment rates of personal mobile banking for U.S. credit unions based on the asset group it shows that enrollment rates relative to members increases with every increase of the asset segment.The initial inference would be that larger credit unions have product or marketing advantages, but examination of the average mobile banking age of these institutions reveals that larger institutions have just been at it longer enabling greater enrolment tallies.

With the help of FI Navigator financial institutions and their vendors can measure up the volume, structure and development dynamics of the market expressed in numbers and enriched with illustrative visualisations. Additionally the platform identifies the patterns of consumer behaviour pointing out certain user preferences, such as the most needed or perspective functions of the product. In terms of pricing, FI Navigator’s data are available on the subscription base or as an industry report. Mobile banking module is just the starting point in FI Navigator’s journey into decision analytics. Next steps will be online banking, social media, core processing, payments and treasury management. As UK mathematician Clive Humby noted “Data is the new oil. It’s valuable, but if unrefined it cannot really be used.” The thoroughly refined and filtered information gathered from multiple web resources and delivered through a single channel helps companies to turn the big data challenge into competitive advantage.