Financial Interoperability with FinTP

- Product Reviews

- 29.05.2017 08:51 am

What does the product do?

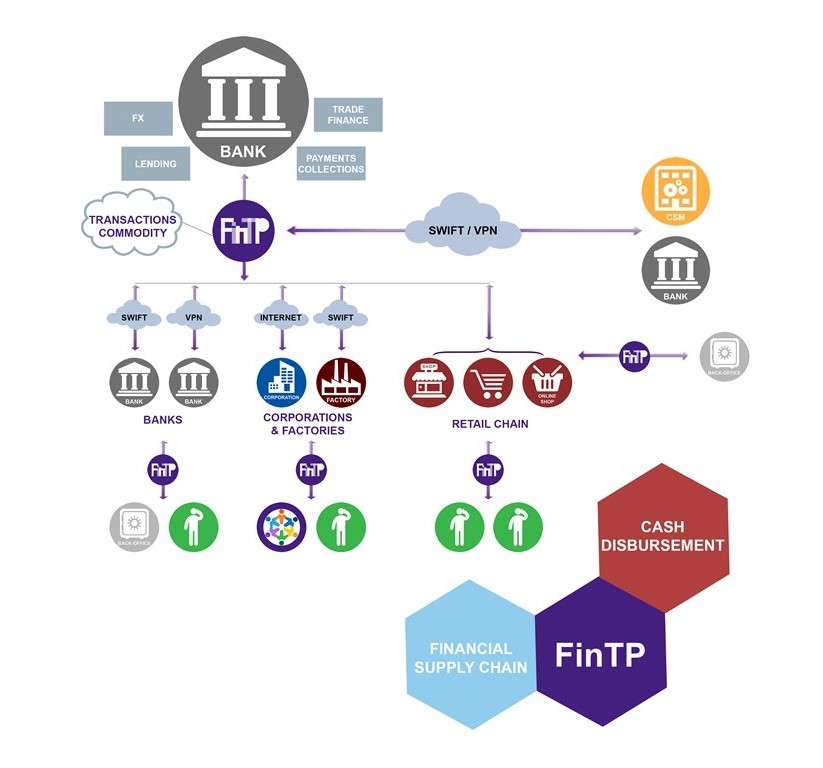

FinTP is a versatile open source solution for flow automation and seamless integration between various internal systems/applications and external market infrastructures or networks, providing operators with relevant information in a one-window approach (acting like a financial middleware), which allows banks to focus less on their internal processes, and more on designing attractive client-oriented services and products.

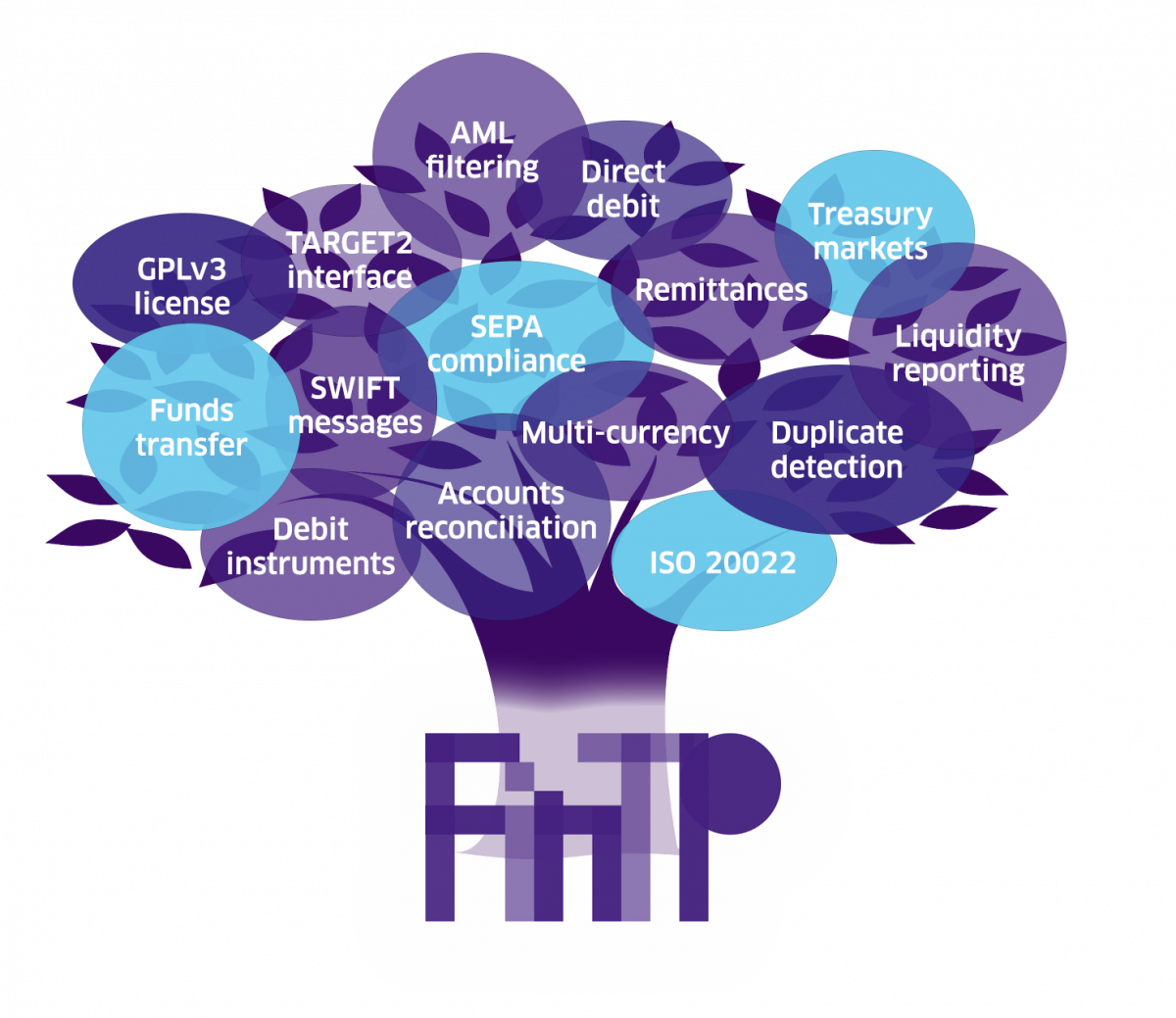

On top of its core function, FinTP provides support for the most used funds transfer instruments (credit transfer, direct debit, debit instruments) and includes features for operational risk containment (transaction filtering, duplicate detection, accounting reconciliation), liquidity reporting, treasury operations management, end-to-end management of remittances, competitive reporting and SEPA & TARGET2 compliance.

FinTP use cases are in solutions for transaction broker, payment factories, corporation financial consolidation, management of microfinance operations, optimization of payment flows for public administrations, public debt management etc.

Who needs the product?

FinTP is tailored for banks, transaction banks, corporations, state treasuries and public administrations, microfinance institutions and market infrastructures.

What are the main features of the product?

Financial instruments:

- Funds transfer (MT, MX message types)

- Direct debit

- Debit instruments

- Remittances

- Treasury operations

- SEPA (credit transfer – SCT; direct debit – SDD) compliance

- SEPA for corporates

- Statements (MT940/MT950, MT900/MT910)

- Corporate to bank connectivity

Operational features:

- Duplicate detection

- Accounts reconciliation

- Transactions filtering

- Competitive reports & alerts

- Liquidity reporting and forecasting

- Business continuity

- Loan disbursements and repayment matching

What is special about FinTP?

The distribution model is open source GPLv3 license, which empowers institutions to take control over the software. No need for an extra escrow agent, no dependency on the vendor!

This licensing framework allows rapid contracting and implementation, a short time to market, as most of the cost structure is operational, rather than a traditional investment in capital.

Allevo, the developer of FinTP, has a customer-intimate approach, closely discussing every feature and part of the flow with the customer, to best accommodate their non-standard requirements.

What other background features are relevant?

What is the pricing strategy?

FinTP is distributed as open source, hence:

- No cost for license

- No capital investment

- Only OPEX costs – based on the client’s demand

How user friendly and accessible is the product?

FinTP is derived from an application that has been live since 2004, having become a critical tool for its users, by ensuring flawless business flows. Customers of this application agreed to migrate to the open source version of FinTP, once it was released. New customers went ahead and adopted FinTP, reinforcing its efficiency in managing day to day operations.

Generally speaking, FinTP users do not have a deep technical background, but they are experts in the banking business. FinTP is thus fairly easy to use for the common payments officer. Continuous improvements are also being made, not only in terms of adding more functional features, but also in the way that users interact with the product.

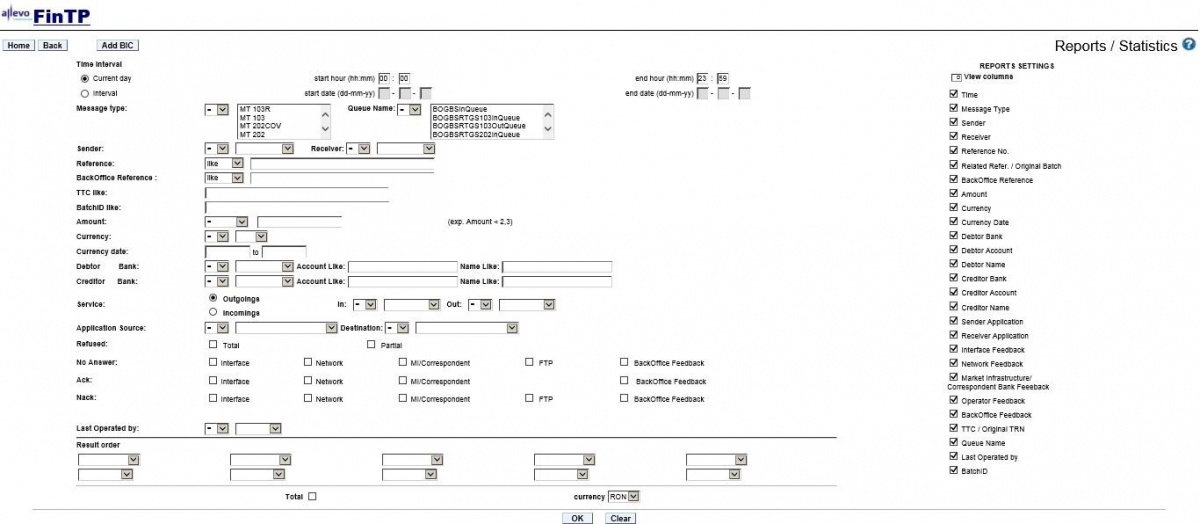

What are the reporting capabilities?

1. In the Reports module, all the data passing through FinTP can be filtered by multiple criteria, such as the time interval, message type, sender, receiver, reference number, back-office reference, amount, currency, various debtor/creditor details, queue name, batch/ID, and many more. Reports can be run both on current and archived data.

2. Liquidity Reporting – extracts relevant data from the messages transported by FinTP and builds up real-time liquidity reports. This can be done at geographical level (on each branch) or at the business level (on operation type). It can also provide forecast management and can compare forecasts with the real status of payments and collections.

3. Traffic Reports (Competitive reports: Distribution reports & Evolution reports) – message traffic monitoring reports, based on the ordering/beneficiary bank, transaction type, communication channel or message type. Results are displayed in both graphical form and as a table, easy to use and view during presentations.The real-time monitoring of message traffic leads to a competitive analysis of the bank's relations with different counterparties (correspondent banks or large corporates).

Behavioral analysis highlights the bias from standard traffic (e.g. an increase in traffic or amounts), for a chosen period of time, offering clues on the potential development of relationships with a certain bank/client (e.g. delivery of new banking services, applying retention policies, etc.), as well as early alerts in case the traffic for a certain banking correspondent/client decreases and further measures are necessary in order to attract/keep it.

Reports can be further configured according to client requests.