Cashaa: Uniting Cryptocurrency Traders and Cash Senders

- Product Reviews

- 20.12.2016 06:05 pm

What does the product do?

Cashaa is a peer-to-peer marketplace for cryptocurrency traders and cash senders, founded in July 2016. Prior to that, it had been operating on a trial basis in Indonesia since April 2016. Cashaa is based in Level 39, a fintech accelerator in Canary Wharf, London, and is now going to launch publicly in January 2017.

Cashaa is developed by Auxesis Group, India`s leading blockchain development company based at IIT Bombay and focused on fintech and blockchain projects across the globe,

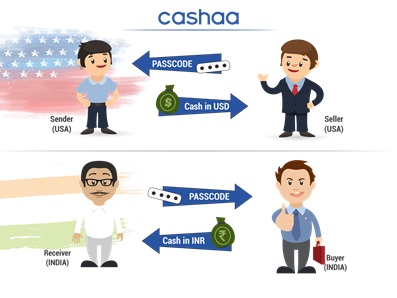

A cash sender specifies the amount and currency that they wish to send. They also identify the currency in which the recipient is to be paid. A cryptocurrency seller (who is perhaps in the same country as the cash sender) will bid for the currency that is being offered by the cash sender. A cryptocurrency buyer (who is possibly in the same country as the recipient) will offer the currency that is required by the recipient. Two separate passcodes will validate the transaction on the sender and receiver side.

The security and the integrity of the platform comes from its use of blockchain technology, which is not controlled by any centralized source, therefore, its network fully secured and reliable. A blockchain system can be said to be a very specialized version of a cryptographically secure, transaction-based state machine.

Who needs the product?

Cashaa simultaneously meets the needs of two different constituencies. There are 2.5bn unbanked people and a growing migrants community which is sending money back home. On the other side, a growing amount of cryptocurrency users, who are now mainly speculating on its price to make money.

On one hand, it helps people who want to remit cash across national borders (cash senders). Currently, there are 2 options: Either a bank account transaction where the recipient needs to have a bank account or a mobile wallet, or cash collection, where the recipient has to collect cash at Western Union, MoneyGram, Ria, etc.

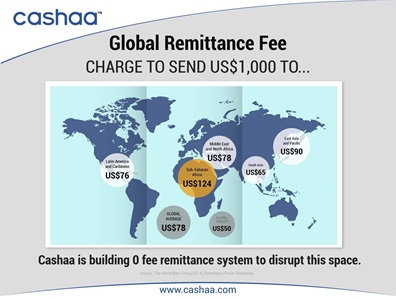

Cashaa`s initial product targets the second group, cash-to-cash transfer, which is mainly controlled by services like Western Union. As fees are often very high, senders (and recipients) lose up to one fifth of the amount being transferred in fees and expenses. Furthermore, there is often a lack of transparency in the determination of exchange rates, with the result that transactions take place at rates that cause disadvantage to the cash sender or the recipient.

Cashaa does not require that either party has a bank account or a mobile wallet. Transactions are undertaken in real time and at prevailing exchange rates. Transfer fees are zero for the cash sender. This system provides cash senders to continue using Cashaa rather than other platforms.

On the other hand, Cashaa helps cryptocurrency traders who are speculating to make money and who form a market of ca. $70bn/year. It boosts the absolute size and the liquidity of markets for various cryptocurrencies.

Due to separate seller and buyer market, price spreads play an important factor which is normally 4-5%. Trades may be executed more quickly due the price advantage compare to trading in same market. Cashaa also provides safe and secure escrow accounts.

What other background features are relevant?

The markets served by Cashaa are huge. On average, around $250bn is remitted annually in cash by individuals where at least one of the cash sender and the receiver are in a developing country. Annual trading volumes in the world’s cryptocurrency markets are around $70-100 bn.

Cashaa started as a peer-to-peer Bitcoin marketplace on 3 April 2016. Over the following 100 days, over $1.5 million in cash was exchanged for 2077 bitcoins. The network of traders expanded to 1,040 cities in 124 countries: They dealt with 101 different currencies and cryptocurrencies. At the end of the period, there were over 7,000 traders operating within the system. Cashaa Limited was registered as a UK company on 24 June 2016.

Cashaa is the first platform that unites cash senders with cryptocurrency traders. It is easy to use, relies on transparent and live exchange rates, imposes no costs on any party and is peer-to-peer in concept. Cashaa makes advantage of cryptocurrency speculation in two markets - the cash transaction only happens when Cashaa makes a minimum of 1% profit.

Cashaa is agnostic in relation to cryptocurrencies that are used. Among others, it can handle Monero, Ether and Ripple, as well as Bitcoin.

Cash senders can specify whether they want to send money abroad within 6, 12 or 24 hours.

Cashaa may be used via personal computers, smartphones or tablets.

Cashaa will be launched publically in January in Nigeria and India, given the importance of remittances and widespread use of English, higher fee and huge speculation in Bitcoin price in business (which means that there is less need for Cashaa to accommodate additional languages).

Who is the competition?

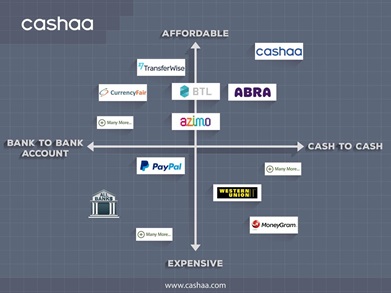

Cashaa considers that the universe of cross-border payments platforms can be categorized in two ways. They may be cheap (from the point of view of the cash sender) or expensive. They may focus exclusively on bank-to-bank account transactions or cash-to-cash transactions. Cashaa sees its platform as being a leading player in cheap/affordable platforms that focus on cash-to-cash transactions. Western Union, MoneyGram and Ria are major leading facilitators of cash-to-cash transactions, but are expensive from the point of view of the cash sender. Transferwise, Azimo and World Remit are the major players notwithstanding their orientation towards bank account based transactions only.