s-peek Helps to Assess the Reliability of your Сlients

- Product Reviews

- 16.03.2017 10:24 am

What does the product do?

s-peek is a web and mobile application that includes information on economic and financial solvency of almost every company in Europe, which accounts to more than 25 million companies in 40 countries. Simple and easy-to-understand three-colour-scale is used for the ratings, whereby green is for healthy companies, yellow for balanced companies and red is for vulnerable companies. Additionally, any company can access and download any European company`s data with s-peek`s Freemium model (FLASH or Extended2M report).

s-peek tracks user`s experience with any company both as a supplier and a client to shed more light on the company`s profile, to enable users come to more informed decisions.

Who will benefit from the solution?

s-peek is targeted on SMBs, freelancers, business and investment consultants and individuals as it easies the access to credit ratings. The solution is developed mostly for European companies and those companies worldwide that partner with European companies.

What should you know about the product?

1. All you need to know about information in s-peek

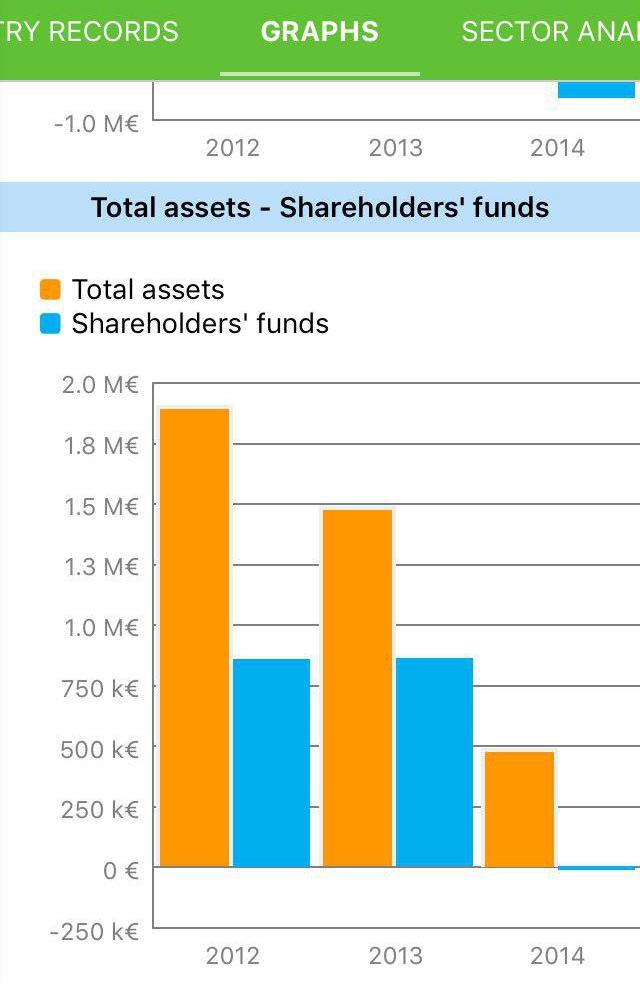

The evaluations in s-peek are based on company registration, financial statements and company belonging sectors. The available data is collected from national official public offices that annually collect accounts in each country. If there is no central official source in some countries, the information provider collects the data directly from the companies. The data is updated in real time as soon new information on the companies is available. Financial statements of the last three years are available for registered s-peek users.

s-peek analyzes any official and public negativity of the companies

s-peek supports English and Italian

All reports are downloadable as PDF, and accessible offline

2. Mobile app

s-peek app is available for iOS and Android. Along with basic three-colors rating, the user may get:

The type of report purchased (FLASH or Extended12M).

Some company's registration information.

Each company's detail page link.

A link to personal experience with each company.

A list of the latest user interactions with that company, by clicking on the "view the next 10 interactions" the latest interactions history is available.

What is special about S-Peek?

s-peek takes care of those users, who cannot read depth financial data, by allowing them to know immediately credit ratings and limits.

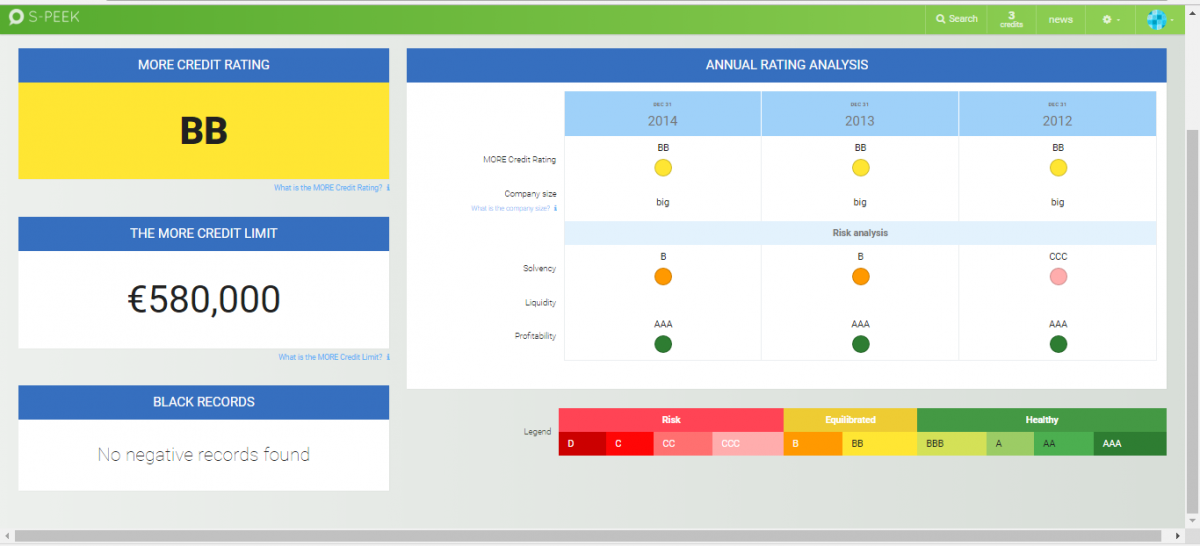

Rating based on MORE methodology

s-peek evaluates credit rating through an innovative MORE methodology, provided by modeFinance, Rating Agency officially registered by the European Securities and Markets Authority – ESMA.

MORE stands for the Multi Objective Rating Evaluation, which studies the company as a complex system, using big data analysis and machine learning methodologies and analyses the following factors:

- Solvency

- Debt coverage

- Liquidity

- Cash conversion cycle

- Profitability

- Fixed asset coverage

Those factors are compared to other players within the field and with the country they operate in.

Commercial credit limit based on MORE methodology

modeFinance counts how much the user can expose with the company’s credit limit in a year. It calculates the company's credit limit based on the following factors:

- Size.

- Years in business.

- Average number of suppliers.

- Funds dedicated to be paid to suppliers.

- Liquidity and a comparison with the sector.

- Ability to repay debts (the MORE rating).

The benefit of MORE Methodology

The MORE Methodology is based on a multi-dimensional and multi-objective algorithm. It aggregates coherently quantitative, qualitative, economic and financial aspects of the analyzed company. This innovative numerical methods, coupled with modern-day economic and financial theories allows to assign the most accurate and transparent final rating.

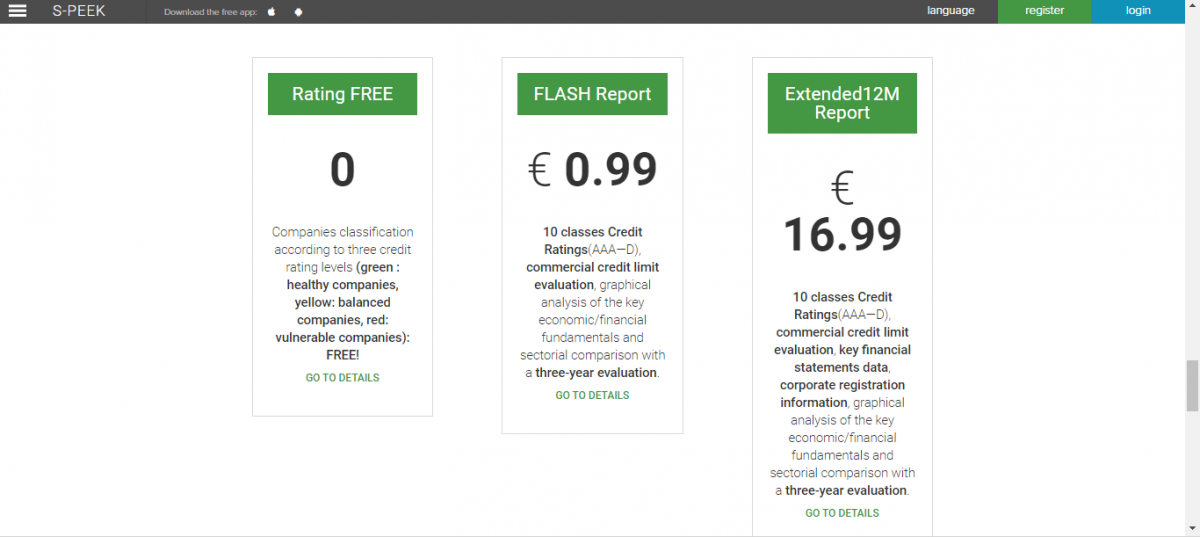

What is the pricing model?

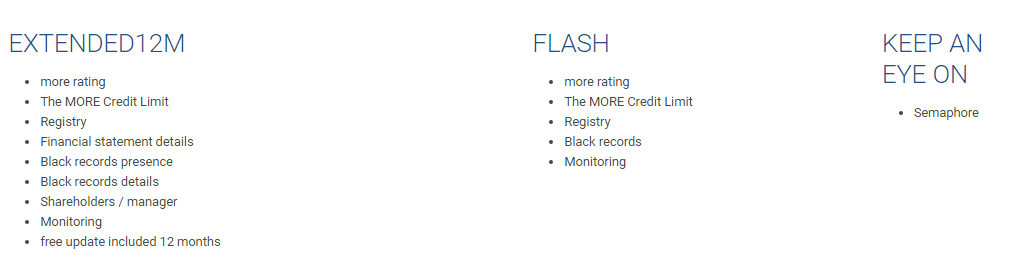

s-peek operates on a Freemium basis. Credit ratings of 25 millions companies in Europe are free and ready to use. For more detailed information, two further options are available: a Flash or an Extended12M report.

What are the rival products of s-peek?

s-peek is one of its kind web/mobile app on the market at the moment. Big rating agencies, focused on bigger companies are considered to be its possible rivals.