Published

- 04:00 am

Integral (www.integral.com), a leading technology company in the foreign exchange market, reported today average daily volumes (ADV) across Integral platforms totaled $43.8 billion in October 2020. This represents an increase of 6.8 % compared to September 2020, and an increase of 20.3% compared to the same period in 2019.

From October 2020, reported ADV include volumes traded on the recently launched venue, TrueFXTM, and is reported in aggregate with volumes from Integral’s other trading platforms. Reported monthly ADV now represents total volumes traded across the group’s entire liquidity network.

Commenting on the growth of TrueFX, Harpal Sandhu, CEO at Integral, said: “TrueFX has made it possible for any participant – irrespective of size – to access primary sources of liquidity directly. The proposition of eliminating credit as a barrier to entry is an exciting development in FX and we are thrilled to see such high adoption of the service as participants seek increased accessibility to the markets in an organized, transparent, and low-cost manner.”

Integral’s global trading network has been designed to meet the execution needs of the widest variety of FX market participants, including banks, brokers, asset managers, and hedge funds. Our clients leverage the deep and diverse FX liquidity available through our platforms and have the choice to trade any execution style required, all within an integrated environment. For more information visit integral.com.

Related News

- 03:00 am

The SSW Group, which carries out proprietary trading in the asset classes of equities, ETPs and bonds, has launched a flagship private cryptocurrency fund as part of its expanding digital asset offering. The fund is managed in Gibraltar by SSW Group.

Founded in 2004, the Germany-based group focuses on liquidity provision, with automated trading and efficient scalability, which the company has developed into an algorithmic-trading pioneer. The group combines state-of-the-art hardware with co-locations across the world to develop intelligence trading strategies.

In addition to traditional asset classes, SSW Group has now expanded its trading business also to crypto tokens and derivative products based on these tokens.

Dr. Reto Gregory-Petersen and Jonas Hoeflich, managing directors of SSW Group, said: “We have always been focused on developing new technologies and expanding our algorithmic trading business to new asset classes. The launch of our new crypto trading fund with our highly skilled employees based in Gibraltar and the intelligent scalable trading software developed by CrypoStruct GmbH will help us to continue on that journey and to become a global key player in crypto and crypto derivatives trading.”

Dr. Julian Harm, managing director of the fund, added: “Not only will the fund benefit from the long-time experience which our Gibraltar employees have gained within SSW Group in the field of algorithmic trading and the development of sophisticated trading strategies, but we will also benefit from Gibraltar’s attractive business environment and its clear tax system, as well as a progressive ‘right touch’ approach to regulation that puts us in the right place to stay ahead of the evolving fund industry. The fact that earlier this year, in a report of the global crypto hedge fund landscape from PwC and Elwood Asset Management, the jurisdiction was ranked as the 3rd highest jurisdiction of choice for crypto hedge fund managers, only behind the US and UK, reconfirms our initial decision to set up the fund in Gibraltar.”

The team at SSW Group was advised by leading Gibraltar law firm and FinTech experts ISOLAS LLP. Led by partners Joey Garcia and Jonathan Garcia, the team’s expertise in both funds and distributed ledger technology ensured that SSW Group chose the right structure in a private fund, which are extremely flexible and can be tailored to suit individual requirements.

Domiciling its new cryptocurrency trading fund in Gibraltar has provided SSW Group numerous benefits, including legal certainty on the tax regime applicable to transactions in digital assets, as well as a dynamic and its progressive ‘right touch’ approach to cryptocurrency regulation and legislation.

Gibraltar combines these with its longstanding appeal as a centre of excellence in blockchain-based finance. Earlier this year, in a report of the global crypto hedge fund landscape from PwC and Elwood Asset Management, the jurisdiction was ranked as the 3rd highest jurisdiction of choice for crypto hedge fund managers, only behind the US and UK. This is coupled with the expert advice from ISOLAS LLP, a leader within blockchain legislation and the ongoing discussions on the regulation of distributed ledger technology.

Jonathan Garcia, ISOLAS LLP Partner and head of the firm’s investment funds practice, said: “In recent years we have seen a huge evolution within the fund's industry, both in terms of assets held and the desire to locate in jurisdictions that are, not only easy to do business in, but respected, trusted and modern.

“SSW Group’s decision is a reflection of Gibraltar’s strengths in these areas, and we are looking forward to continuing our relationship with them and to welcoming even more funds, new and old, to the rock thanks to Gibraltar’s accessible and flexible re-domiciliation legislation.”

ISOLAS LLP has been at the forefront of the development of blockchain law, advising established players such as LMAX Digital and Huobi, Xapo, Bitso and LMAX to their Gibraltar DLT licenses, and taking part in the global conversation on digital assets across a variety of organisations.

Joey Garcia, ISOLAS LLP Partner and head of the FinTech practise, added: “It is great to welcome yet another established business to Gibraltar, seeking to offer exposure to digital assets through a fund structure that also takes into account the specific features of the asset class. The new fund is a further vote of confidence in our evolving and respected regulatory model which has always been aimed at setting and maintaining the highest, purpose built standards. The successful launch of the fund is a testament to the work of the team at SSW Group, as well as, of course, our expert team here at ISOLAS.”

Related News

- 08:00 am

SIA, a leading European hi-tech company in payment services and infrastructures controlled by CDP Equity, will enable banks, corporates, public administrationbodiesand fintechs for the new service “Request to Pay” (R2P) on EBA Clearing’s technology infrastructure, compliant with the European Payments Council (EPC) scheme.

"Request to Pay" is an innovative payment method that allows a beneficiary to send a request in real time, through different digital channels, to a payer who can then approve and execute the operation. It is an especially useful, convenient and flexible service to manage payment transactions, even one-off payments, between companies, organizations and individuals with advantages in terms of security, efficiency and transparency.

The new service by EBA Clearing is integrated with the digital platform SIA EasyWay, created to support financial institutions and other Payment Service Providers at European level in the management of cloud-based payments and to facilitate significantly the consolidation of instant payments and the development of innovative Open Banking services introduced by PSD2.

Thanks to SIA's solution, it will be possible to use the "Request to Pay" service to meet the needs of the various market players who will be able to develop dedicated use cases for their end users.

Banca Sella, a leader in the payment systems sector thanks to its capacity to innovate and at the forefront among the 27 partners in the financial sector supporting the development of the EBA Clearing infrastructure in 11 European countries, has chosen SIA to subscribe to the new "Request to Pay" service through the SIA EasyWay platform already used to manage instant payments.

"With the launch of Request to Pay by EBA Clearing, SIA will further strengthen the value proposition of innovative services for the development of digital payments at European level, thus contributing to the creation of an ecosystem in which all the actors - from banks to corporates, to the public sector - can implement new business models, also thanks to the opportunities offered by PSD2 regulations. The choice of Banca Sella, which has always been at the forefront in the offering of solutions for its retail and corporate customers and one of the first banks in Italy to launch this new service, confirms that the path of innovation undertaken by SIA is recognized by the market and is effectively contributing to the digital transformation that Italian corporates increasingly need to be competitive in a global market," stated Roberta Gobbi, Director of Sales Italian Region at SIA.

"Our subscription to the Request to Pay scheme is in line with Banca Sella's strategy to implement innovative solutions in the field of payments, achieving a significant improvement in end-to-end financial transactions for all customers operating in the European ecosystem. The project will enable our customer companies to provide a service that aims to increase the transparency and speed of payment processes, with a high added value relating to the reduction of risks and with significant advancements in the reconciliation and governance systems of the collection cycle. The partnership with SIA, leader in payment services and infrastructures, is consolidated thanks to cooperation in the realization of Request to Pay, which allows us to continue offering our customers cutting-edge, technologically advanced digital solutions," commented Andrea Massitti, Head of Corporate and Small Business at Banca Sella.

Related News

- 04:00 am

Fime and Bridge powered by Bankin’, one of Europe’s leading open banking solutions, have partnered to help banks fast-track the functional and security testing of their APIs to achieve exemption from the fall back mechanism under the PSD2 regulation. Their co-developed end-to-end API testing platform works in a production environment, allowing Fime to automatically test banks’ open banking APIs are in line with the European regulations.

The automated testing platform helps banks validate compliance with the Regulatory Technical Standards, The Berlin Group standards and the STET standards. It is available for AIS1, PIS and CBPII APIs. To complete the process, Fime experts provide compliance services to deliver the compliance report to the NCA (National Competent Authority).

“APIs need to be thoroughly tested before they can be exempted (article 33.6 b of the RTS - Regulatory Technical Standards related to the implementation of the PSD2). There was no solution on the market today to answer some needs which was slowing the adoption of open banking and causing frustration amongst some stakeholders,” comments Alexis Roque, Head of Operations at Bridge powered by Bankin’.

Raphaël Guilley, VP Testing Solutions at Fime, adds: “Regulatory pressures are mounting for banks. This platform empowers banks to ensure the performance and security of their APIs, as well as alignment with some of the largest open-access API standards in Europe. This is a significant step towards greater stability and compliance in the open banking ecosystem.”

Learn more about the test platform, and complimentary services, and how it is supporting the growth of the open banking ecosystem here.

__________________

1AIS: Account Information Services

2PIS: Payment Initiation Services

3CBPII: Card Based Payment Instruments Issuing

Related News

- 05:00 am

International payment service provider and direct bank card acquirer, ECOMMPAY, has today announced the launch of its new payment solution for the rapidly evolving mobility industry.

With shared mobility schemes on the rise in urban spaces worldwide offering greater convenience, lower cost of ownership, and reduced environmental impact, ECOMMPAY’s new payment solution enables mobility companies to expand successfully into new markets and deliver the perfect customer journey.

The EU and UK regulated company’s new offering functions in the UK, Europe, Central Asia, Russia and CIS, and can be tailored to individual business’ needs. ECOMMPAY allows mobility companies to offer their customers familiar payment methods, while at the same time building a unified payment process to ensure brand continuity and accessibility in all markets.

Companies can accept rides and facilitate bookings both online and via smartphone, while customers can use any available payment method to complete their transactions, including Apple and Google Pay. Card payment details can be saved and stored safely and securely for future payments using tokenisation.

Other features of ECOMMPAY’s multiple solutions include a zero-amount authorisation so riders can verify their cards without being charged, customisation based on language, currency and design preferences, and fully native SDK integration. Payments linked to a mobile app facilitate the withdrawal of a small amount of money at the end of a ride so that companies can authorise a predetermined amount and only need to charge for the precise time the vehicle was rented. This means users can pay as they go without needing to commit to longer-term usage or forward-planning.

The offering integrates seamlessly and effectively into existing mobility ecosystems, and can be used for ridesharing and carsharing, taxi and ride-hailing, bike and scooter sharing, and delivery services.

ECOMMPAY’s solution comes in the wake of declining car ownership and law changes in the UK to allow electric scooters to be used on roads as consumers and Governments act to cut C02 emissions.

ECOMMPAY has enjoyed steady growth since its launch in 2012, and has built a global presence with six international offices and operations in key markets including Asia, Europe, Africa, Russia and the UK.

The company is a principal member of Visa and Mastercard, and a member of Visa Direct and MoneySend, as well as being the first payment provider on the PayPal Commerce Platform and the first acquirer to implement a Mastercard Dashboard.

Paul Marcantonio, Executive Director of ECOMMPAY, commented: “We are witnessing a major transformation in the way we travel around urban spaces, with micromobility and mobility-as-a-service set to become the future for transport.

“For growing mobility companies, payment infrastructure needs to be a priority if a flawless customer experience is to be created and maintained across all markets. Our new solution is designed to help businesses keep pace with a constantly moving industry. We understand the pain points that occur for scaling mobility companies, and we are here to help you overcome them.”

Related News

- 08:00 am

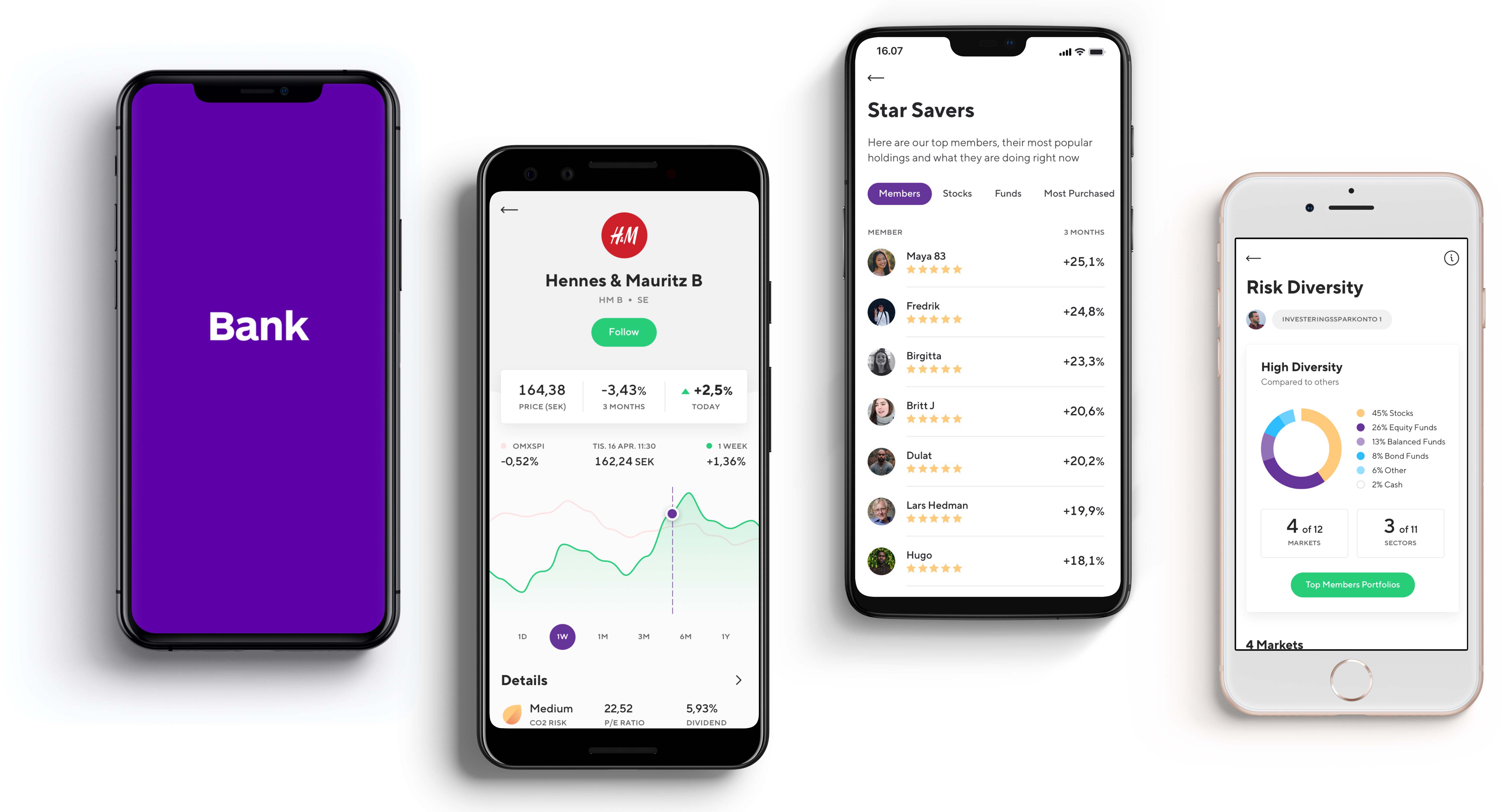

Swedish open investment platform StockRepublic and one of Europe’s leading fintechs Enfuce partnered up this year to provide a trailblazing fund and stock solution for established financial institutions.

Banks hold consumers’ trust when it comes to keeping money safe, but they have historically struggled with serving growth-oriented, digital-savvy retail investors. Ignoring the need of this segment for intuitive investment services available 24/7 means billions lost in fund management fees over the coming years and overall lower customer satisfaction.

How can financial institutions appeal to the growing young, digital-first audience? Open Banking creates an unprecedented opportunity for banks to bridge the gap between the traditional banking services that heavily rely on in-person sales and the technology demands of a modern retail investor.

Stockholm-based StockRepublic is now offering a scalable white-label open investing application that allows consumers to access peer-to-peer investment guidance from star investors in real-time. Implementing this app enables banks to quickly launch an innovative product that will help them remain relevant in today’s competitive financial industry landscape rife with neobank competition.

Enabled by the premium APIs by Enfuce, StockRepublic was able to develop a fully compliant and secure application that helps players within the banking sector embrace the new opportunities opened by Payment Services Directive 2 (PSD2). Together, the two fintech partners form a strong offer to banks and financial institutions worldwide.

Ultimately, the StockRepublic platform powered by Enfuce boosts engagement among consumers holding stocks, funds or other investments, dramatically increasing the transaction volumes per customer and hence directly contributes to the bottom line. Through the platform, they can share, follow, analyze, and benchmark portfolios in real time.

“This is in my mind a perfect match and we really look forward to working with an industry leader like Enfuce to implement this application for banks. The infrastructure and technology Enfuce provides make life a lot easier for both us and banks that want to step up and offer the next generation of competitive and innovative solutions,’’ said Fabian Grapengiesser, CEO of StockRepublic.

Both fintech partners are on a mission of helping end users make more sustainable choices. In November 2019, Enfuce announced their new sustainability service My Carbon Action that calculates the CO2 emissions of every purchase and helps customers take sustainable actions. Similarly, StockRepublic’s Climate Impact Rating function calculates the carbon footprint of a customer investment account and gives benchmarks and suggestions on how to improve.

”We’re very happy to enter into this collaboration with StockRepublic that will help banks offer value-adding services to their customers. StockRepublic is an innovator within its field and the investment platform is a great example of the next-generation solutions that can emerge from the PSD2 regulation,“ said Monika Liikamaa, Co-Founder & CEO of Enfuce.

The open investment platform is now available for banks and financial institutions in Europe.

Related News

- 03:00 am

A new study by global analytics software provider FICO has highlighted the biggest barriers to digital interaction between bank and customer at a time when digital has become ‘king’. According to the data, based on a survey of decision makers by independent research firm OMDIA of 172 banks across 8 countries, including 27 UK banks, the inability to complete identity verification online is a stumbling block for banks.

For more information visit https://www.fico.com/en/latest-thinking/ebook/germany-and-uk-banking-survey-2020

“Historically, identity solutions were developed for face-to-face interactions and have since been adapted to the needs of new channels and products,” explained Sarah Rutherford, senior director of identity fraud marketing at FICO. “As digital interaction is accelerated by the impact of COVID-19, it exposes the weaknesses inherent in using identity verification processes that were not intended for digital channels.”

Consumers Want Fully Digital Account Opening

A FICO consumer study conducted earlier this year found that consumers have a strong appetite for digital interaction. Most people in the UK (82 percent) are prepared to open accounts digitally. But consistency of identity validation across channels is a challenge for 54 percent of UK banks.

According to the FICO-commissioned study, whilst 72 percent of UK banks use digital methods to capture identity for personal bank accounts, they are not integrated into a seamless experience. Only 36 percent of banks said they capture customer identities and verify them in the same channel. A lack of integration means that only 29 percent of document capture is integrated into the same channel, leaving clients much more likely to abandon an application, for example after being forced to download another app or scan and email documents.

Indeed, the FICO consumer study found that nearly one in three UK consumers (32 percent) said they would abandon an application process if forced to take action through a non-digital channel. Yet only about 7 percent of banks surveyed have adopted a streamlined approach with capture and verification methods fully integrated, in real time, into the digital application process.

Banks in the UK also noted challenges around authentication of existing customers, including complying with legislation. This was a concern for 54 percent of respondents, probably driven by the Payment Services Directive 2 (PSD2), which establishes technical and operational rules around verifying the real payer, both for banking and payment card accounts. The lack of integration between authentication systems across customer channels is a concern for half of UK banks.

Banks Missing Important Data

Lack of the right customer information is another big stumbling block for banks in the digitalisation arms race. Up-to-date contact information is crucial for one-time passwords (OTP) or codes for customer and payment verification, a common strategy for PSD2 compliance. Yet only 83 percent of UK consumers in a prior FICO survey said their bank has their mobile number, and a third of banks say they have contact data for less than 70 percent of their customers. When PSD2 forces the use of Strong Customer Authentication to secure e-commerce transactions, this could mean a failure rate that isn’t acceptable to merchants or their customers — who are likely to blame the bank that issued the debit or credit card the customer tried to use.

“Our new study shows that banks need to move fast to work out how identity fits into their digital onboarding and authentication strategies,” concluded Rutherford. “The fragmented approach is impacting the customer experience. The benefits of moving to a single identity infrastructure across all channels and product lines should be assessed as a matter of priority. This approach reduces unnecessary friction and confusion for customers, avoids multiple copies of documents being held across the institution and facilitates faster onboarding of cross-sell opportunities. Banks that still rely on processes first developed for branches will be disadvantaged.”

To download the white paper visit https://www.fico.com/en/latest-thinking/ebook/germany-and-uk-banking-survey-2020.

Related News

- 09:00 am

ZUBR, the cryptocurrency derivatives platform, has fully integrated ClearLoop, a settlement tool from London-based digital currency custodian, Copper – allowing clients to settle digital currency transactions off-exchange within milliseconds.

Having previously been rigorously stress-tested by Exact Pro, an internationally recognised specialist firm for quality assurance of exchanges, the integration of ClearLoop into ZUBR provides another layer of security and efficiency for institutional and sophisticated traders who usually move their holdings from crypto exchanges to secure custodian services or cold wallets. ClearLoop eliminates the settlement delay due to the blockchain network congestion and reduces settlement times, which can take anything up to an hour to complete.

With the ClearLoop integration, both ZUBR and its clients will have assets allocated to cover any position submitted by a trader before it is opened. When the trade is closed, ClearLoop instantly settles fiat and crypto trades between the parties. Clearloop also enables traders to move assets on to the ZUBR almost instantly, a huge benefit to traders employing high-frequency arbitrage strategies. This will allow ZUBR’s clients to react faster and optimise their use of capital.

ZUBR joins other exchanges such as Deribit, AAX, Bitfinex, CoinPass, Diversifi and Xena which have also integrated Copper’s CleapLoop.

All assets which are under Copper’s client segregated custody or traded through ClearLoop are protected by award-winning multi-party computation (MPC) wallets. Copper’s clients are also covered by a full crypto crime insurance policy, provided by A+ rated insurers and tailormade for digital assets.

ZUBR has earlier enhanced its compliance and due diligence measures using tools such as risk scoring and transaction tracking through the Crystal Blockchain platform, analytics and investigative division of Bitfury designed to bolster due diligence and track bad actors in the blockchain space.

Since March 2020, Crystal’s database considers wallets managed by ZUBR exchange to have a "Trusted Exchange” label, meaning that this entity is running Anti-Money Laundering (AML) and Know Your Customer (KYC) checks on all onboarded customers according to the Financial Action Task Force and the European Union’s 5th Anti-Money Laundering Directive (AMLD5) recommendations for digital asset businesses.

ZUBR received in-principle approval for its Distributed Ledger Technology (DLT) Provider licence (Gibraltar) in May 2020 and is expected to be in the first generation of European regulated cryptocurrency exchanges.

Ilgar Alekperov, CEO of ZUBR, said: “ZUBR puts user experience and security above all else – so integrating Copper’s ClearLoop was a natural and obvious next step as de-risking settlement and cutting down on delays will allow our users to push their capital even further.

“Our users already enjoy guaranteed microsecond connection speeds to our exchange. Now, with ClearLoop, we can offer market-leading settlement times too.

“We have already strengthened our platform with tools such as the Crystal Blockchain platform and are also pursuing other certification to verify the trust and security of the platform. With ClearLoop, we are taking digital arbitrage to the next level with the most highly secure trading environment for our clients.”

Dmitry Tokarev, Founder and CEO of Copper, said: “At Copper, we committed to ensuring that all institutional crypto investors can store and trade cryptoassets efficiently and securely. ClearLoop is the culmination of years of work to make that commitment a reality, and brings us one step closer to making crypto mainstream.

“Integrating with ZUBR is a natural next step for the ClearLoop system. Our MPC-secured wallets ensure assets are protected throughout the entire life cycle of a trade. For institutions, this is not just a nice to have – it is essential.”

Related News

- 09:00 am

Truata, the privacy-enhanced data analytics solutions provider, has partnered with Mastercard for the launch of its new customer self-service portal - Privacy Enhanced Analytics Platform.

The portal empowers Mastercard customers in Europe to conduct analysis on their payment card transaction data within a fully anonymized solution that was built with a privacy-by-design approach to be compliant with data protection regulations.

Truata’s independent anonymization service enables Mastercard’s customers to benefit from Business Intelligence KPI dashboards and Machine Learning (ML) models, built using a comprehensive anonymized data universe, including past and present customers, whether consented or non-consented.

Felix Marx, Chief Executive Officer at Truata, said: “For banks and financial services to grow and prosper in today’s highly competitive climate, they need to generate insights from their customer data. However, it is paramount that this is done in a way that is ethical, preserves consumer privacy and adheres to data protection regulations.

“Placing the individual at the centre of everything it does, Mastercard’s commitment to privacy by design is reflected in the way it embeds privacy and individuals’ rights, needs and interests into the design and operation of all its products, services and technologies. We’re honored to provide our data anonymization services to Mastercard's customers.”

The Privacy Enhanced Analytics Platform leverages Truata’s proprietary data anonymization and analytics technology to provide qualifying issuers with key performance and operational metrics via pre-defined dashboards. It tracks measurement and performance on consumer clearing data, and offers a scalable function designed to accommodate growing datasets.

These attributes enable customers using the solution to draw upon key end user insights such as spending attrition, card usage, travel payments, and details on recurring payments.

Gurpreet Atwal, Mastercard’s Senior VP, Data and Services, said: “We know how important data is to our issuing banks, but we also know the importance of privacy to individuals. That’s why we’ve worked closely with Truata, drawing upon its proprietary technology and expertise in data anonymization and analytics, to bring the Privacy Enhanced Analytics Platform to the market.

“This move is part of our commitment to promoting the responsible use of data. Working with Truata enables our customers to close their analytical gaps in a GDPR compliant way.” For more information about Truata and its latest solutions, visit www.truata.com.

Related News

- 04:00 am

Leading payments issuer processor, Global Processing Services (GPS), today announces its partnership with fintech challenger Lanistar, ahead of the launch of their alternative banking product later this year.

Through the partnership with GPS, Lanistar leverages GPS’ proven Apex issuer processing platform, taking advantage of the rich suite of APIs which are continuously growing and evolving, as well as utilising real-time data feeds to directly manage account holder balances, transactions, enriched data, and the latest innovations in security & fraud protection. The partnership also enables Lanistar to manage its partner network and enhance the features of its proposition through PSD2 Open Banking.

Gurhan Kiziloz, Chief Executive Officer of Lanistar, commented: “Lanistar is here to disrupt the banking industry entirely, and we need to work with the best partners to make that happen. By working with GPS, we will be able to manage and process our cardholders’ transactions seamlessly and provide the slick customer experience that traditional banks are lacking.”

Launching in 2020 Q4, Lanistar is a hassle-free banking alternative that is revolutionising how customers streamline their money. The company will provide a customer-centric alternative to the personal finance offerings provided by incumbents in the sector, enabling users to consolidate eight bank cards into one.

Inspiration to start the fintech came from Kiziloz, who had himself experienced disappointment with the money management tools provided by high-street banks. Eager to provide a remedy, Kiziloz applied his business nous to the world of fintech by bringing a game-changing product to market.

With the expertise of its partners, Lanistar aims to reach a £1bn valuation in the next few years and hopes to tap into the lucrative millennial and Gen-Z market, creating a customer base which is looking to take advantage of lifestyle brands to enrich and make their daily lives easier.

Neil Harris, Group Chief Commercial Officer of GPS, added: “As The PayTech PioneerTM, GPS prides itself on working with some of the most innovative fintechs in the ecosystem, and Lanistar is no exception. Their use of cutting-edge technology, particularly polymorphic technology, as well as their innovative engagement on social media, are clear differentiators that sets them apart from other fintechs in the market, all whilst seeking to disrupt the status quo and shaking the banking stalwarts from their slumber. Lanistar are a truly engaged and exciting fintech to work with, and we very much look forward to supporting their journey as they look to establish themselves as the go-to banking alternative product of choice for millennials and Gen-Z.”