Hazeltree Partners with IHS Markit to Deliver Best-In-Class Treasury and Portfolio Finance Solutions

- 4 years 3 months ago

- Investment, Management, Alternative Finance

Hazeltree, the leading provider of integrated treasury management and portfolio finance solutions to alternative investment managers, and IHS Markit, a world leader in critical information, analytics and solutions, today announced a strategic alliance to offer clients an integrated treasury and portfolio finance solution powered by IHS Markit’s industry-leading Securities Finance dataset. Our integrated solutions enable our clients to trade and... more

Canoe Intelligence Completes Series a Extension Funding Led by Its Clients, Blackstone and Carlyle

- 4 years 3 months ago

- Fundraising News, Investment, Asset Management, Wealth Management, Alternative Finance, Data Management

Fintech to use funding to accelerate development of its award-winning alternative investment document and data processing solution

What to Know Before Refinansiering (Refinancing) Your Loans and Debts

- 4 years 4 months ago

- Alternative Finance

Applying for loan packages from financial institutions and lenders at large is not always a bad idea. This is because it can help you execute certain projects and plans right on time. Let us think about getting a new home for instance. Let us say you cannot afford to get a home currently. For some, the option is to wait till they can save up and get the property.

Chirag Shah, CEO, Nucleus Commercial Finance Comments on BVA BDRC’s Q2 SME Finance Monitor:

- 4 years 4 months ago

- Covid-19, Alternative Finance, Messaging

“The last 18 months have presented serious challenges for SMEs across the country, with many businesses simply struggling for survival, and so it’s very encouraging to see SME confidence on the rise, with over half now expecting to grow. With lockdown restrictions now lifted, SMEs are in a better place to plan for the future and are looking to external finance as a way to do this.

Žltý Melón and Salt Edge Partner for Open Banking-enabled Lending

- 4 years 4 months ago

- Lending, Open Banking, P2P Lending

Žltý melón, a Slovak P2P lending platform, joined forces with Salt Edge, leader in developing open banking solutions, to implement PSD2-integrated access to clients’ bank data and streamline the loan application journey.

Razer Merchants Services Bags Best Non-Bank FPX Acquirer Award By Paynet For Industry Leading Growth

- 4 years 4 months ago

- Payments, Alternative Finance

Razer Merchant Services awarded the Best Non-Bank FPX Acquirer at PayNet Malaysia’s Malaysian e-Payments Excellence Award 2021 for number of merchants acquired, FPX transactions volume generation and FPX volume growth.

Two Thirds of SME Leaders Anticipate Never Repaying Government Covid Support Loans

- 4 years 4 months ago

- Alternative Finance

Nearly one in 10 (9%) have defaulted on Covid loans before starting repayments Two thirds (66%) of SME leaders who received financial support from the Government’s Covid loan schemes say it’s likely their business will default on the loan, according to new research1 from Nucleus Commercial Finance. This equates to 2.3 million SMEs who anticipate never repaying their loan.2

Nucleus Commercial Finance Hires Business Development Manager as SMEs Seek Further Financial Support

- 4 years 4 months ago

- Banking, Alternative Finance, People Moves

Nucleus Commercial Finance, the fintech revolutionising how UK SMEs access finance, today announces that Sam Percival has joined as Business Development Manager for London and the South East. The appointment comes at a crucial time as SMEs show increased demand for finance following the removal of Covid-19 lockdown restrictions.

Deko Expands Multi-lender Retail Finance Ecosystem With Newpay

- 4 years 5 months ago

- Alternative Finance

Powered by leading UK credit provider NewDay, Newpay is the latest product to join Deko’s multi-lender and multi-product platform Newpay seamlessly integrates into the merchant checkout experience, offering access to a range of finance options.

Thunes Acquires Limonetik to Accelerate Rollout of Global Payment Collections

- 4 years 5 months ago

- Payments, E-Wallets, Alternative Finance, PaaS

Cross-border payments leader Thunes today announced the acquisition of Limonetik, a European Payment Methods Platform. This move will complement existing Thunes Cross-Border Payments solutions by enabling businesses to get paid in 70 countries, using over 285 local payment methods such as mobile wallets, payment by installments (BNPL), QR code payments and more. The solution will be known as Thunes Collections.

North-south Divide Exacerbated by Covid-19

- 4 years 5 months ago

- Covid-19, Banking, Alternative Finance

56% of SME leaders believe UK regions are unequal 44% say economic inequality has worsened as a result of Covid-19 Nearly a third (32%) believe the location of their business has negatively impacted their ability to access financial support during Covid-19

Millennials Dominate P2P Platform as Both Lenders and Borrowers: Study

- 4 years 5 months ago

- Platform Technology, P2P Lending

LenDenClub releases its 2020-21 study of P2P lender & borrower behaviour

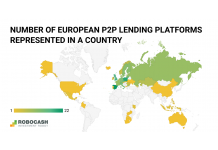

Just 1 in 10 European P2P Lending Platforms Offers Loans from Outside Europe

- 4 years 6 months ago

- P2P Lending

Only 13% of European P2P lending platforms provide diversification opportunities outside Europe, according to the latest research by the investment platform Robo.cash. As stated by the analysts, it is the European segment that is likely to take the leading position worldwide in the future.

Platforms with Smaller Shares Become Competitive on the P2P-Lending Market

- 4 years 6 months ago

- P2P Lending

Analysts of the European investment platform Robo.cash predict that in the next year or two a small number of new lending platforms will enter the P2P-market. Moreover, most of them will probably be part of financial groups and will offer more favorable conditions in order to compete with older players.

IFIN Launches the First of its kind Instant Islamic Financing Platform

- 4 years 6 months ago

- Alternative Finance

Bahrain-based Islamic FinTech provider, IFIN (Islamic Finance Initiation Network – www.ifin-services.com), has launched the first of its kind, real economy, automated Islamic financing platform. The secure, innovative technology connects retailers and Islamic finance providers, enabling them to offer consumers instant access to Islamic financing for purchases, at the point of sale.