Comentis Launches New Vulnerability Dashboard to Help Firms Manage their Vulnerable Customers

- 4 years 1 month ago

- Alternative Finance

Dashboard will provide overview of vulnerability across the whole client base to improve insight into customer outcomes and how they can be improved The dashboard will be invaluable for firms reporting back to the Financial Conduct Authority, especially ahead of new regulations in 2022

Spandana Sphoorty Announces Shalabh Saxena as the MD and CEO, and also Announces Other Key Business Updates

- 4 years 1 month ago

- Alternative Finance, microfinance

Additionally, Ashish Damani will take over as President and Chief Financial Officer, and Abanti Mitra to take over as Chairperson of the Board, while Deepak Vaidya will continue as an Independent Director Spandana Sphoorty Financial Limited’s Board of Directors met today and discussed several critical matters related to the leadership transition and business operations. Key Leadership Updates:

PPS Powers Suits Me – the Personal Account for Everyone

- 4 years 1 month ago

- Money Transfers, Alternative Finance

PPS, an Edenred subsidiary and a one-stop-shop for prepaid and fintech programmes, today announces its partnership with alternative e-money provider for the financially excluded Suits Me, following its migration from Banking as a Service Provider, Contis.

The European P2P Market on the Way to Diversity

- 4 years 2 months ago

- Cash management, Payments, P2P Lending

According to the Robo.cash corporate statistics, the social and geographic shifts of the investors' audience is expressing the growing market potential. The Robo.cash platform has significantly expanded its active investor base in 2021, representing a more than 70% growth. In addition to engaging an increasing audience, the market continues to penetrate various segments of the society. For example, the share of female investors on Robo.cash (... more

Drawbridge Wins ‘Best Cyber Security Provider’ at the 2021 Private Equity Wire US Awards

- 4 years 2 months ago

- Investment, Alternative Finance, Security

Drawbridge, a premier provider of cybersecurity software and solutions to the alternative investment industry, today announced it was named ‘Best Cyber Security Provider’ at the 2021 Private Equity Wire US Awards.

Robocash Secondary Market Transactions Increased 11 Times in a Year

- 4 years 2 months ago

- Lending, P2P Lending

More than 50% of European P2P platforms provide an opportunity to sell or buy loans in the secondary market. Of those that publish market statistics, 66% confirm these transactions exceeding the level of 2020. The number of investors choosing a secondary market option ranges up to 74% of all investors on the platform.

Gujarat Witnesses 86% Rise in P2P Investments: LenDenClub Data

- 4 years 2 months ago

- Fundraising News, Lending, P2P Lending

Investment in Peer-to-Peer (P2P) Lending has witnessed a rise of 86% in Gujarat as per consumer analysis of LenDenClub, India’s largest P2P lending enterprise as compared with the previous year. LenDenClub analysed its data, drawing insights into the investment patterns and behaviours of investors in the state of Gujarat. The analysis was conducted on its active overall investor base of over 06 lakh for nine months starting from January 2021 to... more

Drawbridge Names Thomas Fallucco Chief Revenue Officer

- 4 years 2 months ago

- Investment, Alternative Finance, Cybersecurity

Senior Business Development Professional Joins Drawbridge to Drive Continued Global Growth Drawbridge, a premier provider of cybersecurity software and solutions to the alternative investment industry, today announced the appointment of Thomas Fallucco as Chief Revenue Officer (CRO). Fallucco will be responsible for driving continued growth while expanding a global footprint through international business and enhancing client relationships and... more

Mature P2P Platforms to Recover More Than 9% Above Average

- 4 years 2 months ago

- Covid-19, Investment, P2P Lending

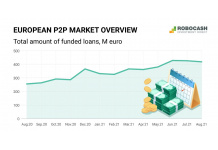

During the market recovery after COVID-19 outbreak, European P2P platforms that emerged by 2017 have rebounded at above-market growth rate. The calm upward trend is supported by a 2% increase in monthly financed loans in 2021. To assess the growth rate of P2P platforms, Robocash analysts studied 43 platforms that are present in 16 European countries and operating mainly in the consumer and business segments.

Global Covid-19 FinTech Market Impact and Industry Resilience Survey

- 4 years 3 months ago

- Covid-19, Alternative Finance

Deutsch English - United Kingdom Español Français Italiano Português 日本語 简体中文 Thank you for participating in the Global Covid-19 FinTech Market Impact and Industry Resilience Survey, collected by the Cambridge Centre for Alternative Finance (CCAF) at the University of Cambridge Judge Business School, and undertaken in partnership with the World Bank Group and World Economic Forum.

Gold Investing Reinvented with First Ever Yield

- 4 years 3 months ago

- Investment, Money Transfers, Alternative Finance, Risk Management

By distributing profits from transaction fees, Kinesis provides a genuine low-risk alternative to investors at a time of uncertainty and heightened risk among traditional investments Today, Kinesis Money, the monetary system based on 1:1 allocated gold and silver, launches its Holder’s Yield, whereby a portion of the yield pool, currently valued at $17.5 million, will be distributed every month to people who hold gold and silver with Kinesis.

NeoXam’s Datahub Platform Selected by Tikehau Capital to Support Transformation Program

- 4 years 3 months ago

- Asset Management, Alternative Finance

NeoXam’s DataHub platform has been selected by Tikehau Capital, the global alternative asset management group to support a broader IT and operational transformation program across their global multi-fund business.

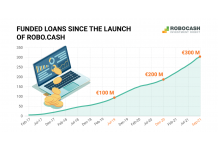

Robo.cash Exceeded 300 M Euro of Funded Loans

- 4 years 3 months ago

- Lending, P2P Lending

In September, European investment platform Robo.cash reached 300 M euro in total funded loans. The month was also recorded by another achievement - the number of investors crossed the mark of 19 thousand.

iwoca and mmob Partner to enable Banks to Respond to SME Demand for Post-Pandemic Credit

- 4 years 3 months ago

- Lending, Open Banking, Alternative Finance

Partnership to improve access to credit by enabling banks to quickly and easily embed and offer alternative lending options

DTCC's Project Ion Platform Moves to Development Phase Following Successful Pilot with Industry

- 4 years 3 months ago

- Alternative Finance, Financial, Infrastructure

The Depository Trust & Clearing Corporation (DTCC), the premier post-trade market infrastructure for the global financial services industry, today announced that its Project Ion initiative, an alternative settlement platform that leverages distributed ledger technology (DLT), will move into a development phase following a successful prototype pilot with leading market participant firms.