Wealth Management Platform Stratiphy Launches Latest Crowdfunding Campaign on Crowdcube

- 1 month 1 week ago

- Crowdfunding

Wealth management platform Stratiphy has launched its latest crowdfunding campaign on Crowdcube.

Sibstar Launches Crowdfunding Campaign On Crowdcube To Boost Financial Inclusion

- 8 months 2 weeks ago

- Crowdfunding

Sibstar, the debit card and app for adults who need help managing their everyday money, today launches its crowdfunding campaign on Crowdcube’s platform, with the aim of securing a total of £350,000.

Mintos Wraps Up Crowdcube Crowdfunding Campaign With €3.1M, Second Largest in EU for 2024

- 1 year 4 months ago

- Crowdfunding

Mintos, the multi-asset investment platform offering a unique mix of alternative and traditional assets, is proud to announce the successful completion of its crowdfunding campaign on Crowdcube, Europe's largest private market investment platform. The campaign, which aimed to invite both existing investors and the broader public to become shareholders in Mintos, has surpassed expectations, raising a total of €3.1 million from over 3300 investors... more

Hello Alice Announces Expansion of Small Business Accelerators and 2024 Boost Camp Programs

- 1 year 4 months ago

- Alternative Finance

Hello Alice, the fintech platform connecting 1.5 million small businesses to capital, connections, and opportunities, has announced the expansion of its small business accelerators and additional Boost Camp programs for 2024. In partnership with top enterprise partners and the Global Entrepreneurship Network, the Boost Camps offer a combination of skill-building programs and grant opportunities to small business owners across the U.S.

Penfold Launches New Crowdfund to Accelerate Growth

- 1 year 9 months ago

- Fundraising News, Crowdfunding

Penfold, the digital pensions provider, today announced the launch of its latest crowdfunding round, following a period of significant growth. The early access launch is now open and individuals can register for this via Penfold’s crowdfunding page, with the round opening to the general public on February 27th. Penfold’s last crowdfund in 2022 sold out just hours after going live.

The Continental European P2P Market to Grow by 20% in 2024

- 2 years 4 days ago

- P2P Lending

Robo.cash forecasts that the P2P lending market in continental Europe will reach 579.2 M euros in December 2024. The main trends for the coming year include elevated market polarization, entry into new geographies and expansion of investor opportunities.

Andaria Set to Redefine Customisation With Launch Of Innovative Embedded Finance Offering

- 2 years 3 weeks ago

- Alternative Finance

Andaria, a UK and EU-regulated fintech business that aims to make digital financial services accessible, simple, and transparent, has launched its Embedded Finance solution to help non-financial businesses integrate payments services into new and existing platforms.

Lyfeguard Partners with Moneyhub to Integrate Open Finance Functionality

- 2 years 1 month ago

- Alternative Finance

Lyfeguard, the leading digital platform for comprehensive life planning, has partnered with Moneyhub, a data & intelligence platform, to deliver a 360-degree, real-time view of personal and financial information.

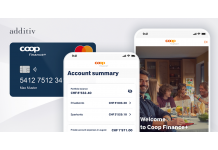

Coop Launches Coop Finance+ via additiv's Embedded Finance Platform

- 2 years 1 month ago

- Alternative Finance

additiv, a global leader in embedded finance, today announced that it is supporting Coop to launch Coop Finance+, a comprehensive new app for integrated financial services.

Andaria Announces Strategic Partnership with Discover® Global Network: Pioneering Embedded Finance Solutions

- 2 years 1 month ago

- Alternative Finance

Andaria, a regulated fintech business specialising in providing Embedded Finance, proudly announces its landmark partnership with Discover® Global Network.

Use of External Finance Across the UK Showing Signs of Recovery After a Decline in 2022

- 2 years 1 month ago

- Alternative Finance

The British Business Bank’s third annual Nations and Regions Tracker, published today, finds the use of external finance among smaller businesses is showing signs of recovery in early 2023, after a decline in most UK Nations and regions in 2022. Use of external finance declined in 2022, but was picking up again in the first half of 2023

2nd Edition Open Finance, APIs & Partnerships

- 2 years 2 months ago

- Alternative Finance

Enhance your open finance strategies to respond to growing customer demands and stay ahead of your competition

2nd Edition Open Finance, APIs & Partnerships

- 2 years 2 months ago

- Alternative Finance

Open finance strategies have advanced massively over recent months and they are being more widely implemented across financial institutions. There is a huge demand from consumers for financial institutions to take their strategies to the next level and become more advanced in their digital offerings and financial institutions need to ensure that they can meet these demands to retain their customers.

Aryza Launches New Range of Products to Revolutionise Embedded Finance

- 2 years 2 months ago

- Alternative Finance

Aryza, a leading provider of end-to-end financial software solutions, has announced the launch of a new range of products to support embedded finance. With the introduction of Aryza Originate and Aryza Lend, the cloud-hosted secure platforms support the entire lending lifecycle. The company aims to provide businesses with a simple, fully digital, and entirely automated journey that can be customised to fit their needs.

Aro Partners with Plend to Make Affordable Finance More Accessible to UK Consumers

- 2 years 2 months ago

- Alternative Finance

Aro, the UK’s go-to embedded finance partner for brands, has today announced it will be adding open-data lender, Plend, to its market-leading lending panel.