Hello Alice Announces Expansion of Small Business...

- 24.07.2024 12:15 pm

Andaria Set to Redefine Customisation With Launch Of...

- 13.11.2023 10:15 am

Lyfeguard Partners with Moneyhub to Integrate Open...

- 25.10.2023 10:05 am

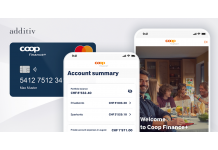

Coop Launches Coop Finance+ via additiv's...

- 24.10.2023 09:20 am

Andaria Announces Strategic Partnership with Discover...

- 16.10.2023 01:25 pm

Use of External Finance Across the UK Showing Signs of...

- 12.10.2023 09:30 am

2nd Edition Open Finance, APIs & Partnerships

- 10.10.2023 12:10 pm

Aryza Launches New Range of Products to Revolutionise...

- 04.10.2023 11:25 am

Aro Partners with Plend to Make Affordable Finance...

- 27.09.2023 10:45 am

Divido Bolsters Merchant Capabilities to Supercharge...

- 19.09.2023 09:30 am

DIGISEQ Partners with ekko to Embed Sustainability and...

- 12.09.2023 10:20 am

Weavr’s Whitepaper Highlights Huge Appetite for...

- 06.09.2023 11:00 am