Reuters Events Commodities Trading 2021

- 4 years 4 months ago

- Trading Systems, Commodity Trading Solutions

Covid 19 has led to unprecedented market volatility and changing consumer demands. This coupled with digital transformation, energy transition and an intense geopolitical landscape r, 2021 changed the face of the industry forever. A global shift toward environmental accountability, major technological disruptions and unexpected economic activity are all creating exciting opportunities and stark challenges for trading houses, investors, producers... more

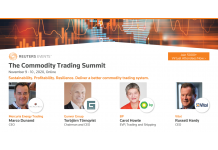

Gunvor, Vitol and Mercuria CEOs confirmed at Reuters Events Flagship Commodity Trading Summit

- 5 years 6 months ago

- Commodity Trading Solutions

Reuters Events have just announced their flagship Commodity Trading Summit (November 9-10, Online) with confirmed CEOs from Gunvor Group, Vitol and Mercuria all stepping forward to set the commodity trading agenda. Unprecedented volatility, changing consumer and governmental demands, digital transformation and an intense geopolitical landscape are impacting every commodity, meaning it has never been more important for stakeholders to collaborate... more

An Extraordinary Six Months

- 5 years 7 months ago

- Commodity Trading Solutions, Consultancy

It has been an extraordinary six months, not just from a social perspective but also from an economic and financial market perspective. This week we pause for reflection and show the year to date performance of several major asset classes. The data runs from 31st December 2019 to 30th June 2020, showing total returns in US dollars.

Reuters Events Discuss the Resilience of the Energy Market Through Volatility

- 5 years 7 months ago

- Trading Systems, Commodity Trading Solutions

Reuters Events will be hosting a free online webinar series focused on commodity trading and commodity value chains. The energy industry has never seen a year like it. Demand dips, supply cuts, negative oil price, volatility, disrupted trade flows, bankruptcies, debt all over, green investment and through it all... opportunity.

OpenLink Voted Top Commodity Vendor in Asia Risk 2016 Technology Rankings

- 9 years 4 months ago

- Commodity Trading Solutions

OpenLink, the global leader in trading and risk management solutions for the energy, commodities, corporate and financial services industries, today announced that it has been voted as the top technology vendor for commodities derivatives pricing and risk analytics and commodities trading systems (front to back office) in the Asia Risk 2016 Technology Rankings. The Asia Risk rankings are voted on by users of technology services for banks and... more

X Open Hub and PFSOFT Partner to Deliver Unique Multi-Asset Solution

- 9 years 8 months ago

- Trading Systems, Commodity Trading Solutions

X Open Hub, a multi-asset liquidity provider partners with PFSOFT, a multi-asset technology provider, in order to integrate X Open Hub's liquidity and market data into PFSOFT's Protrader brokerage solution. The new integration will include market data and execution for over 1500 global instruments divided among FX, Indices, Commodities, Shares and ETFs.

Allegro Named Commodity Trading and Risk Management Software House of the Year

- 9 years 8 months ago

- Commodity Trading Solutions, Risk Management

Allegro Development Corporation, a leading provider of commodity management software, announced today that Energy Risk Magazine’s editorial board selected Allegro as the Commodity Trading and Risk Management Software House of the Year in its 2016 awards, based on an evaluation of brand awareness, product innovation, ease of use, customer satisfaction and software delivery and support.

OpenLink & Baringa Release Whitepaper Exploring Treasury Management

- 9 years 9 months ago

- Commodity Trading Solutions, Treasury

OpenLink, the global leader in trading and risk management solutions for the energy, commodities, corporate and financial services industries, and consultancy Baringa have launched a whitepaper exploring best practice in treasury management for commodity intensive corporates. The paper looks at the business case for integrated treasury and commodity risk management.

Fidessa’s Asian Trading Platform Wins New Client

- 9 years 9 months ago

- Trading Systems, Buy-Side Back and Middle Office, Buy-Side Front Office, Commodity Trading Solutions, Derivatives and OTC Derivatives, Equities Trading, OMS and EMS

Tokai Tokyo Securities (Asia) Limited, a wholly-owned subsidiary of Tokai Tokyo Financial Holdings, Inc., has gone live in Hong Kong with Asian trading platform from Fidessa group plc as a fully outsourced service.

TickVault Accumulates All Stock Trading Activity for National Bank of Canada

- 9 years 9 months ago

- Trading Systems, Algo and HFT, Commodity Trading Solutions, Derivatives and OTC Derivatives, Equities Trading, Data, Messaging, Market and Reference Data

TickSmith’s TickVault Platform was recently implemented for use by National Bank of Canada. Based on Hadoop technology, TickVault accumulates and rebuilds all Canadian stock trading activity and is used for post-trade analysis and back testing.