Reuters Events Commodities Trading 2021

- 14.10.2021 07:18 am

Gunvor, Vitol and Mercuria CEOs confirmed at Reuters...

- 03.08.2020 05:24 am

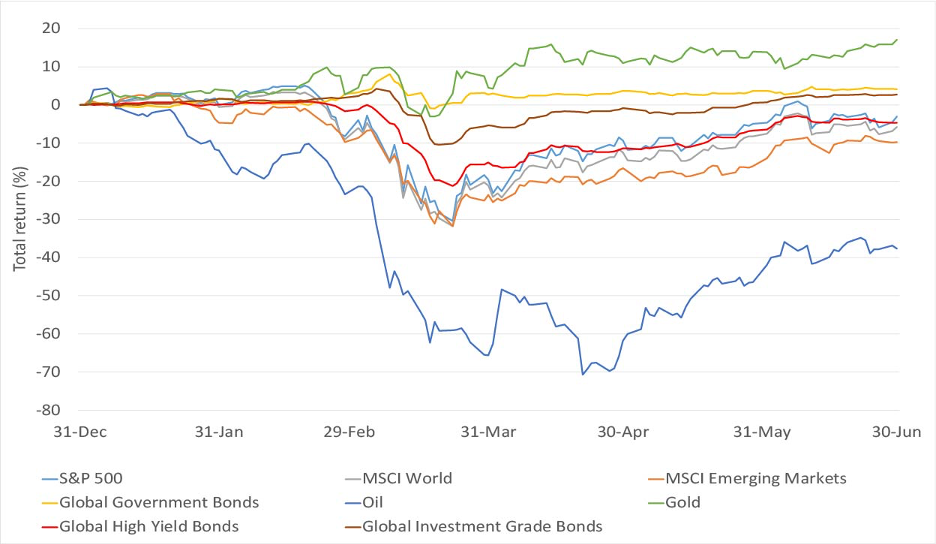

Reuters Events Discuss the Resilience of the Energy...

- 03.07.2020 12:34 pm

OpenLink Voted Top Commodity Vendor in Asia Risk 2016...

- 28.09.2016 11:45 am

X Open Hub and PFSOFT Partner to Deliver Unique Multi-...

- 17.06.2016 01:00 pm

Allegro Named Commodity Trading and Risk Management...

- 26.05.2016 01:30 pm

OpenLink & Baringa Release Whitepaper Exploring...

- 16.05.2016 11:15 am

Fidessa’s Asian Trading Platform Wins New Client

- 09.05.2016 03:15 pm

TickVault Accumulates All Stock Trading Activity for...

- 22.04.2016 08:30 am