Acronis' Mid-Year Cyberthreats Report Reveals 464% Increase in Email Attacks

- 2 years 8 months ago

- Cybersecurity

Acronis, a global leader in cyber protection, today released the findings of its

Sologenic Launches SOLONEX and CBDC Tokenization Solutions, Integrates Fireblocks for Institutional Custody

- 2 years 8 months ago

- Blockchain

Sologenic, a global forerunner in blockchain tokenization technology, today announces the launch of two groundbreaking solutions:

Volante Technologies Powers Major Custodian Bank to Successfully Complete Pilot Testing on the FedNow Instant Payments Network

- 2 years 8 months ago

- Payments

Volante Technologies, the global leader in cloud payments modernization, today announced it has been working with a leading U.S. banking customer to help the custodian bank successfully complete pilot testing on the FedNowSM instant payments service.

gigaroo Raises $2.5M in Pre-Seed Funding to Revolutionize GenZ Financial Stability

- 2 years 8 months ago

- Fundraising News

gigaroo, an innovative startup dedicated to empowering GenZ individuals with financial stability, announced today that it has successfully raised $2.5M in pre-seed funding. Since its app launch in early January, the company has garnered a substantial user base of thousands of GenZ individuals and is working with dozens of service industry customers.

Bitpanda Pro Rebrands to One Trading, Raises $33M Series A

- 2 years 8 months ago

- Fundraising News

Fintech startup Bitpanda is splitting into two companies as Bitpanda Pro — the company’s cryptocurrency exchange — is going to become its own independent company called One Trading. As part of this move, One Trading is also raising $33 million (€30 million) in funding.

Visa to Acquire Pismo for US$ 1 Billion

- 2 years 8 months ago

- Payments

Visa today announced it has signed a definitive agreement to acquire Pismo for $1 billion in cash. Together, we will be positioned to provide core banking and issuer processing capabilities across debit, prepaid, credit and commercial cards for clients via cloud-native APIs. Pismo’s platform will also enable Visa to provide support and connectivity for emerging payment rails, like Pix in Brazil, for financial institution clients.

5 Benefits of Open Banking Accounting Companies Should Look Upon

- 2 years 8 months ago

- Open Banking

In today’s rapidly evolving financial landscape, accountants are acutely aware of the need to embrace technological advancements and digitalisation to remain competitive. A fact supported by a recent Sage study, revealed that 82% of accountants claimed their clients demanding a broader service offering. Since its inception in 2018, open banking has emerged as a transformative force for accounting firms and software, enabling a way to improve...

Laser Digital Acquires Elysium Technology Group, Bringing Innovative Cross-asset Post-trade Solutions to Digital Finance

- 2 years 8 months ago

- Trading Systems

Nomura's digital assets subsidiary, Laser Digital, today announces the acquisition of Elysium Technology Group, a leading provider of post-trade solutions for over-the-counter (OTC) foreign exchange (FX) and digital assets. Founded in 2007 by ex-UBS executives Andy Siciliano and Ed Mount, along with tech pioneers Mark Rosenfeld and Lo Shih, Elysium is an innovator of post-trade solutions for the foreign exchange industry.

Planixs Announces the Launch of Realiti(R) Cloud at its Global Customer Forum

- 2 years 8 months ago

- Cloud

Planixs, the leading provider of real-time, intraday cash, collateral and liquidity management solutions, today announced the launch of Realiti Cloud, a full-service cloud offering covering all Planixs Realiti modules.

Saxo Bank Announces Sale of Fintech Joint Venture to Geely Group, Receiving Saxo Bank Shares in Return

- 2 years 8 months ago

- Banking

Strengthening its focus on core business and markets, Saxo Bank divests its stake in Saxo Geely Tech Holding A/S (Saxo Fintech) with the sale to Geely Group and receives Saxo Bank shares as part of the transaction. After a process of diligent evaluation and strategic assessment, Saxo Bank can today announce the sale of its stake in the joint venture Saxo Geely Tech Holding A/S (Saxo Fintech) to Geely Group.

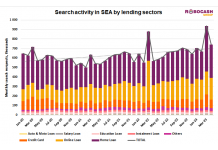

Interest in Lending Products in SEA Has Risen by 15% Since 2020

- 2 years 8 months ago

- Lending

These are the findings of analysts from Robocash Group who have studied search requests for lending products.

Worldline Named One of The Times Top 50 Employers for Gender Equality 2023

- 2 years 8 months ago

- Payments

Worldline, a global leader in payment services, announces that its UK&I entity has been listed as one of The Times Top 50 Employers for Gender Equality 2023, for its commitment to addressing gender inequalities in the workplace.

Rimes Appoints Sam Barber as Head of Data Services

- 2 years 8 months ago

- People Moves

Rimes is pleased to announce the appointment of Sam Barber as Head of Data Services. Sam has over nine years’ experience operating at the Executive Director level for S&P Global and brings a wealth of specialist data and client management experience. A key highlight of Sam's career was spearheading S&P’s global business development unit, selling ETF and index products to tier-one banks, asset managers, market makers and ETF issuers.

Financial Planning Platform Lyfeguard Scales Up with Centropy PR

- 2 years 8 months ago

- Personal Finance

Lyfeguard, a life planning assistant and document management platform, has selected Centropy PR to handle its external communications following a competitive pitch process.

TISE & Shieldpay Announce Strategic Partnership to Transform Private Market Transactions

- 2 years 8 months ago

- Money Transfers

The International Stock Exchange (TISE), the innovative provider of financial markets and securities services, and