Fraud Detection

Product Profile

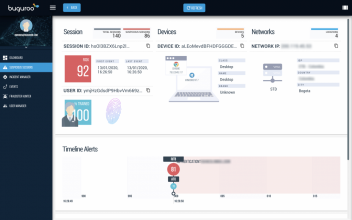

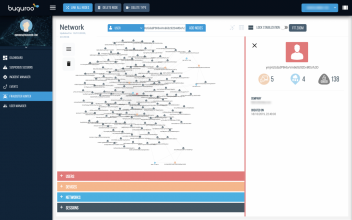

Screenshots

Product/Service Description

Buguroo is a step ahead of fraudsters. By protecting the user from login to logout with zero impact on their experience, we ensure that our proprietary behavioral biometrics technology delivers the most comprehensive online fraud prevention solution for the financial industry.

Identity theft and Account Takeover (ATO) is becoming a significant issue for the protection of the digital identity of online users. It doesn’t matter what the threat is. bugFraud ensures that the user is who they say they are and that they are not being manipulated during the whole session and in real-time, analyzing anomalies that allow the detection of fraud before it happens. Continuous authentication detects and enables prevention of attacks such as Man-in-the-middle or Man-in-the-browser.

The result of this analysis translates into a technological risk verdict on the user session provided in real-time, which makes it possible to take the correct action regarding suspicious or anomalous user behaviors.

In addition to protecting the end-user, bugFraud improves user experience thanks by reducing the number of authentication challenges. With our technology, there is no need to oblige users to install anything. The solution does not store any confidential or private user data, facilitating compliance with the GDPR and PSD2.

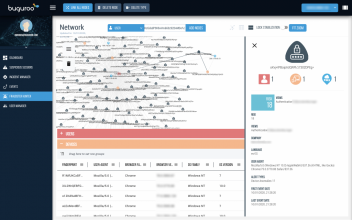

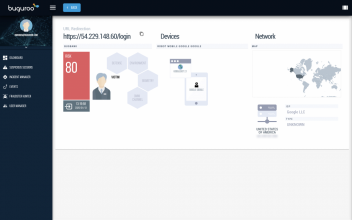

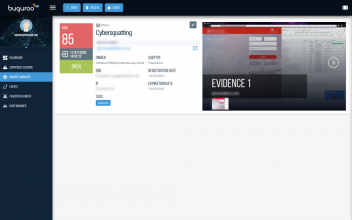

With bugFraud console, we simplify the process of identifying fraudsters by adding contextual information to the sessions. bugFraud allows pinpointing of cybercriminals and identification of modus operandi thanks to the multiple data sources combined with the deep learning process.

Customer Overview

Features

TBuguroo proposes a new solution to provide end-users' full protection and to allow the bank of each client to know and understand the origin of the attack. This system is highly attractive to the market, thanks to the following features:

•Automate your response to attacks against your customers with malware by using our unique Greylisting approach

•Prevent the effects of account take over with our per profile behavioral biometrics

•Target fraudsters with our engine that allows pinpointing the criminals by acquiring the information about the context and behavioral biometrics

Benefits

Below we present the most outstanding benefits that the bugFraud solution offers:

•An integral, holistic layer of defence that complements other BANK security systems, focusing on the protection of its customers using digital banking as these are usually the most vulnerable in the use of online banking services.

•Advanced Artificial Intelligence and Deep Learning techniques for biometric profiling of behavior are used for real-time detection of attacks that seek to supplant the identity of the user (ATO). It is also a protection layer against theft of online or offline credentials, attacks that take remote control of sessions such as RAT, or attacks by automatic bots.

•Immediate protection of 100% of digital banking users once the BANK implements it in its online web banking channels and is updated in the mobile banking application.

•Active protection during the entire online banking session: from the moment authentication through the actions such as executing queries and operations in digital banking, until they finally close and exit the online banking session. It works throughout the session and not only at certain specific static moments.

•Execution of automatic countermeasures for the BANK clients to protect them in real-time against the cyberattacks.

•Transparent and without impacting the user experience in the use of online banking through "agentless" or "frictionless protection" that does not require any action or software installation on the user's device, but works transparently and automatic within the digital banking session itself.

•Protection of both web channel and in the mobile app analyzing and relating dozens of device parameters, user behavior biometrics and advanced malware detection techniques.

•Detection of fraud attacks at an early stage such as phishing campaigns as well as more sophisticated attacks directed against bank clients. Attacks based on web injections, MITB, even in unknown malware (Zero Day), or any use of digital banking that does not belong to the real user.

•Real-time insight and intelligence about the victims of the fraud. Based on that information BANK knows from the beginning and without delay, which of its users are attacked as well as how, when and where they became victims of an attack.

•Easy installation, commissioning and subsequent maintenance by the BANK as it is a component that works embedded in the web portal or within the digital banking app that, thanks to its design and architecture, allows for hot updating and execution without affecting the performance of the users.

•Acquisition of non-sensitive information related to customers or bank operations and information, complying regulations and regulations with data protection personal (e.g. GDPR);

•Support service that works in the cloud with 24x7 support in English and Spanish under the significant benefits related to the availability and security of the solution.

•An optional graphical console for monitoring and visualization of alarms with anomalies and technological risk of users in online sessions detected in real-time, as support in analysis activities of said alarms.

•Optional integration with other systems or applications existing in the BANK such as SIEM, transaction monitors, risk analysis engines and others). Thanks to integration options bugFraud provide risk information, alarms and events, which can be processed with other tools and sources of information from the BANK. It allows the creation of advanced actions of greater scope, trigger research flows, analyze risks and present alarms in a single user interface that could already exist deployed.

Both Buguroo’s solution and their competitors detect online fraud and anticipate potential cases that can end up in fraud (early detection, before it happens). However, as much as they detect attacks, fraudsters will keep trying.

Buguroo proposes a new solution to provide end users’ full protection and to allow the bank of each client to know the origin of the attack. This system is highly attractive to the market thanks to the following features:

•Their inability to guarantee sufficient confidence of the two fundamental principles of fraud prevention: to ensure the legitimate identity of end-users and to ensure they are not deceived during the online session.

•Non-full session protection. They are often only valid for specific moments of the online service and not capable of protecting users during the entire duration of the online session "continuous authentication".

•A smaller scope of detection capabilities and less adaption to changes in cyber-attacks techniques, since they use predictive models not based on AI.

•Disregarding User Experience (UX). Several solutions do not care about the end-user experience: friction is created to them because software must be installed in the end-user devices or because users must overcome more security challenges to confirm their identity. Such an approach reduces the business simplicity of the processes.

Presented arguments render the majority of existing solutions inefficient and incomplete to solve the variety and complexity of current and future attacks in online fraud.

Platform & Workflow

With bugFraud console, we simplify the process of identifying fraudsters by adding contextual information to the sessions. bugFraud allows pinpointing of cybercriminals and identification of modus operandi thanks to the multiple data sources combined with the deep learning process

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

The Yobota Platform is a cloud-based operating platform, offering a leaner, faster and cheaper way for our clients to set up and run their financial businesses. Our clients pick the functional components they want, and with consumption-based pricing they pay for exactly what they use, rather than bearing would otherwise be large fixed IT costs. Our platform provides access to the financial services ecosystem, enabling a full, front-to-back operational capability without the need for countless integrations.

Customer Overview

Features

- Flexible

- Modular

- Easy to Implement

- Supports very high degree of innovation of financial products

- Pricing based on usage

Benefits

- Derisks the provision of banking technology capability

- Enables customers to create game changing products

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

iSHRAQ Advanced Investment & Financing Management Model

Product/Service Description

iSHRAQ provides Islamic based Financial and Investment solutions to clients, specializing in Sharia investments to bring the best of Stock Markets, Mutual Funds, Portfolio Management Services, Real Estate Investment, and Wealth Management Services in a Sharia-compliant way. Consisting of 6 modules: iSHRAQ*Invest, Finance, Sukuk, Fund Management, Treasury and General Ledger covering all aspects of investment, finance and banking available on the market, while providing a user-friendly interface with the ultimate performance and an accurate calculation and speedy data retrieval.

iSHRAQ’s in-depth research, technical analysis and powerful trading tools coupled with highest standards of service are tailored to suit the requirements of financial institutions. iSHRAQ is a reliable, flexible and innovative platform that delivers an unparalleled client experience.

Customer Overview

Features

Enables customers to invest in most asset classes, in multiple markets, using one or more currencies.

Improved operational performance and productivity through its fully centralized database along with full scalability for unlimited growth and large volume processing capabilities.

Offers comprehensive and consolidated reports, market updates, and portfolio yields.

Enables portfolio managers to manage money of one or more portfolios in a specified currency which saves front officers of all back office accounting details.

Stock markets support in single and multi-currencies including setting deals, commission and fees rates in each currency allowed by the dealing market.

Automatic calculation of fees at specified periods or with each transaction, whether it is per-transaction, fixed amount or fixed lump sum at a specific period.

Fully integrated web based application allowing employees and customers real time access to investment information.

Ability to maintain several transactions simultaneously with independency in saving different forms allowing users to create, edit and save several records at once.

Murabaha

Mudaraba

Musharaka

Deminishing Musharaka

Tawarruq

Qard Hassan

Musawma

Ar-Rahnu

Istisnaa

Leasing

No collaterals, guarantors, or bank accounts

No penalties for late payments

Loan full or partial dropping in case of customer death or inability to repay

Grouping concept to mitigate collection risk

Takaful concept: Customer performance tracking for further loan programs.

iSHRAQ*Invest provides real time access to investment information through a user friendly web interface that offers 3 levels of information in a single page as well as a multi tabbing feature that makes the navigating experience through the system more effective while saving all the data coherently. Every transaction applied on the system is calculated and reflected automatically, minimizing the overall time consumed to run the portfolio calculations and enhancing the system performance. This advantage is useful when generating reports in previous dates since these reports take almost the same time to generate as the current report.

Key benefits are:

iSHRAQ*Finance provides financial facilitators with a comprehensive Islamic finance platform rich in tools to maximize investment performance through a wide range of Islamic products that are specially tailored to meet the diverse needs of their corporate and retail customers, while being fully compliant with the Sharia regulations. It is a complete customizable and innovative solution that includes all the finance facility cycles starting from the approval workflow, managing legal entities, setting repayment plans, connecting the business parties with the following Islamic products:

iSHRAQ*Microfinance Loan Programs Business Features:

Benefits

Back date facility that can undo the effect of posting transactions backward until a specific date; to add missed transactions in the past and affect balances in the past and update or delete one or more posted transaction.

Built-in data mart for quick generation of complex and multiple-domain reports without affecting the application performance. The data mart also allows getting reports as of any date in the past with the same performance as of current date.

Friendly user interface in terms of facilitating application usage through multi-pages, multi-tabs and customizable favorite list for quick and easy access of day-to-day tasks.

Solid approval workflow engine to guarantee that each transaction has its own approval path, starting from the transaction submission until the final decision is made.

Allows remote approval for application requests.

Task list that shows the current transaction pending for action from the current user. When a transaction is done, it disappears from the list, saving the user from searching, with the option of creating a mass action for bulk transactions.

N-tier architecture with two common presentation and database tiers, in addition to the middle-tier which is composed of control-logic enabling data-access tier directly or through the business tier.

Fully web based structure that grants access to any location (branch) without any installation or maintenance efforts.

SOA (Services-Oriented Architecture) compliant which allows exposing web services to bank clients in order to create application requests, application follow-ups, or any other inquiries.

Fully compliant with Sharia principles.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

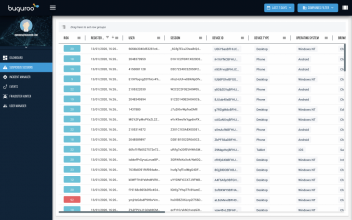

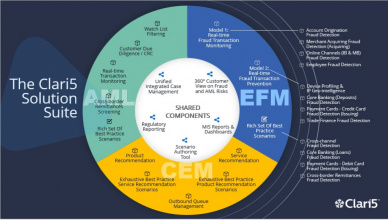

Product Profile

Clari5 Enterprise Fraud Management

Screenshots & Video

Product/Service Description

Clari5 is a next gen enterprise platform for real-time intelligence, using the best of technology for the most cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks. Clari5 Enterprise Financial Crime Management Solution suite provides real-time anti-fraud and anti-money laundering capabilities on a unified real-time intelligence platform.

Clari5 Enterprise Fraud Management (EFM) is a real-time Enterprise Wide Fraud Detection, Monitoring and prevention solution that monitors suspicious patterns across transactions, events, users, accounts, systems in real-time and responds with the right action to pass or block transaction, or generate real-time alerts for manual investigation.

Customer Overview

Features

- Proactively combats cross channel, cross product fraud across the enterprise real-time

- Customer aware solution that monitors 360 degrees digesting all transactions and actions

- Silo Breaker solution that combats sophisticated fraud with real-time, actionable insights

- Employs intelligent models based on neural network, time series and complex analytics to deliver insight

Benefits

- Perform fraud prevention in real-time as banking transactions occur

- Prepackaged Scenarios and built-in interfaces across Products/Channels to achieve quick ROI

- Dynamically profiling suspicious devices, cards, merchantsor payees for preventing fraudulent transactions

- Expedited fraud investigation based on Investigation Workbench and Integrated case management

- Integrated reports and dashboard giving insights on the efficiency and effectiveness of the fraud prevention

Platform & Workflow

Cash Transaction Reports, Suspicious Transaction Reporting / Suspicious Activity Reporting, Non-Profit Transaction Reporting, Counterfeit Currency Reporting, Cross-border Transaction Reporting. Management Reporting - Role based Management Reporting and Dashboarding using embedded Enterpsise BI platform

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Clari5 Customer Experience Management

Screenshots & Video

Product/Service Description

Clari5 is a next gen enterprise platform for real-time intelligence using the best of technology for cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks.

Clari5 Customer Experience Management solution delivers instant contextual intelligence across 3 dimensions: Tacit, Actionable and Conversational. Insights offering contextual, real-time recommendations across all channels helps grow cross-sell/ up-sell revenue exponentially.

Customer Overview

Features

- Cross-sell/ Upsell in Real-time

- Next Best Product Recommendation

- Lead Generation

- Intelligent Prompts

- Real-time Customer Detect at Branch

- Automated Service Messages

- Enhanced User Effectiveness

- User-friendly Analytics

Benefits

- Unified and holistic customer experience at every touch point

- Helps customer facing staff make intelligent and relevant conversations

- Enables banks to proactively improve customer experiences across all communication channels

- Solution leans from transactions, interactions, responses and factors them using mathematical models and fuzzy logic to arrive at right conversation pointers, right messages and right sales opportunity

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Clari5 Anti-Money Laundering Solution

Screenshots & Video

Product/Service Description

Clari5 is a next gen enterprise platform for real-time intelligence using the best of technology for cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks.

Clari5 Anti-Money Laundering (AML) solution helps banks and financial institutions automate, streamline and comply with existing and emerging regulatory AML/CFT compliance programs. Clari5 AML suite consists of following solutions, available individually or as an integrated whole namely: Suspicious Activity Monitoring, Customer Risk Categorization, Entity Identity Resolution/Watch List Filtering, Regulatory Reporting (CTR/STR/SAR and any other reports to be submitted to central bank), Scenario Authoring Tool for creating new scenarios, Integrated Case Management, Investigation Tools, Entity Link Analysis and Comprehensive Management Reporting.

Customer Overview

Features

- Automation of entire AML compliance program, from customer on-boarding to steady relationship monitoring

- Comply to risk-based AML approach with on-going customer risk rating and risk-based Transaction Monitoring

- Comprehensive investigation capability based on the risk level of the suspicious transactions through integrated case management with the power of Investigation Tools

- Entity Link Analysis with graphical analysis to discover money laundering rings and funds structuring

- Automated STR/SAR/CTR generation as part of the regulatory reporting

Benefits

- Real-time approach to monitor and detect suspicious money laundering transactions

- Improved regulatory compliance and customer confidence

- Quicker implementation because of pre-packaged AML scenarios and built-in interfaces for integration

- Low cost commodity hardware infrastructure leading to reduced TCO

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

iMAL Enterprise Islamic Banking & Investment System

Product/Service Description

iMAL Enterprise Islamic Banking & Investment System is a powerful core banking platform specifically built from the ground up to support Sharia banking operations. It is truly geared to address country and region-specific Islamic banking requirements. It is offered to high-end Islamic banking, investment and financing institutions, based on an advanced open architecture with a robust integration platform.

iMAL is the only 100% Islamic banking solution as certified by AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) in 2008.

All iMAL modules adhere to the Islamic law and are in full compliance with IAS (International Accounting Standards). The system is based on the Sharia guidelines for the purpose of financing related to Murabaha, Mudaraba, Ijara, Istisnaa, Salam, project financing, real estate and others.

Customer Overview

Pricing model is based on the modular capability available in iMAL core banking system, whereby each module is priced separately providing a flexible costing structure to fulfill the following goals:

1- iMAL provides a full suite of modules that address different business requirements for the banking industry. These modules have been packaged to focus on the different business areas in a bank.

2- Provide a product-based configuration of the different core modules, whereby a base license is provided for the main module feature, and subsequently the client can select additional products to be added to the base license. This aims to optimize the product offering to the client and provide a cost effective offering.

3- Regarding the deployment in branches, Path Solutions adopts a flexible branch deployment strategy, whereby the option is availed to the Sales team to configure the deployment offering by choosing one of the following scenarios:

a. Combination of number of branches and number of users

b. Adopting the pricing based on the number of branches only

c. Adopting the pricing based on the number of users only

d. Adopting the pricing based on the projected number of customer accounts.

The above options provide the flexibility to select the most suited selling approach depending on the target market and client expectations, and accordingly provide a cost effective offering to the potential clients.

4- In addition to the above approach, an embedded quantity discount brackets is adopted to apply a reduced unit cost for the different selection criteria, which again provides a reasonable pricing for the banks operating a big branch network, or projecting a huge number of customers.

Features

- Supports all known Islamic banking instruments

- Web interface, N-Tier Java based, SOA architecture

- With high parameterization capabilities; greater process efficiency, better risk mitigation

- Multi-currency, multi-branch, multi-company enabled accounting backbone

- With strong product definition features

- Fully integrated yet modularized, with Model Bank

- Highly automated and flexible system

- Ensures quick time to market products.

The iMAL core strengths:

iMAL employs multi-tier architecture using the latest JAVA technology with either Oracle or SAP Sybase as core database servers. These powerful and at the same time affordable Relational Database Management Systems (RDBMS) provide sophisticated data protection and high-speed access to information.

The system runs on all the main platforms and operating systems requiring only an up-to-date internet browser at the client side.

iMAL is rich in opportunities for increasing revenue through cross-selling and upselling. It also enables a 360° view which enhances customer service.

It is also cloud ready and deployable on a fully scalable, multi-server n-tier architecture. It includes out-of-the-box, industry best practice processes that further support rapid implementation, team knowledge transfer and sustainable business processes.

The fully integrated front, middle and back office Islamic core banking platform, running 24/7 in real-time -iMAL- combines comprehensive business functionality with an advanced, secure, scalable and modular architecture proven to meet the market toughest challenges of today and tomorrow.

Benefits

- Built-in Islamic operations standard compliant workflows and system controls

- Various delivery channels

- Faster time to market

- Exact fit to business requirements

- Phased migration and implementation approach

- Running businesses in real-time mode

- Higher operational efficiency:

- Single integrated platform for all banking activities

- Flexibility to meet change and growth requirements

- Cost reduction by implementing STP

- Optimized business performance

- Superior customer service

- Efficient speed of service

- Precision of documentary cycle

- Electronic reconciliation (quick notices)

- Prompt dispute resolution: Legal, collection, valuation, procedures, etc.

iMAL enables Islamic financial institutions to carry out essential tasks across retail, corporate and investment banking including core banking, transaction banking, online and mobile, payments & financial messaging, trade services and cash management. These applications help Islamic financial institutions to meet business needs in areas like streamlining operations, introducing new products, improving efficiencies and customer service, and ultimately increasing revenues while reducing risk.

iMAL provides platform independence, real-time interfaces, extreme usability, full scalability, high-performance, excellent productivity for configuration and deployment, and modular components.

With iMAL, Islamic financial institutions are empowered to achieve:

iMAL is based upon customers’ serviceability. One of these backbones is the production of multilingual statements to customers of the Islamic financial institutions. This is done with minimal data entry at the outset of the system’s parameterization, whilst the production of the various statements, advices, is done automatically by the system without manual intervention by the end-user.

iMAL, which is in compliance with Basel II/III & AML, enables Islamic financial institutions to contain the risk element before they get exposed to a higher degree of risk through effective risk management built into every single transaction that is undertaken in the system.

In addition, iMAL helps Islamic financial institutions implement a flexible, cost-efficient infrastructure with instant access to accurate, up-to-the minute financial updating in order to make informed operational and strategic decisions at a moment’s notice. This comprehensive approach produces a higher Return On Investment to our clients.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Compliance for Mobile Messaging KyoLAB bridges the gap between compliance and mobile messaging for regulated financial services. KyoLAB’s platform offers monitoring and archiving, as well as real-time Compliance alerts and analytics, for popular mobile messaging apps such as WhatsApp, WeChat, Facebook Messenger, Skype Mobile, Yahoo Mobile, iMessage, and others. Our aim is to be the reference solution for popular mobile messaging with respect to compliant audit trail and dispute resolution.

Customer Overview

Features

- Monitoring

- Archiving

- Analytics

Benefits

- Compliant messaging

- Customer engagement

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

The Pendo Data Platform (PDP)

Screenshots & Video

Product/Service Description

The Pendo Data Platform (PDP) is a data management and intelligence solution that provides exploration and discovery capabilities across multiple disparate data sources. It is used by large financial institutions to quickly complete incremental projects focused on “dark data” -- data held in legacy systems across the organization where there is little to no transparency. Our Platform and self-service model focus on extraction of metadata from systems, indexing source systems, and quickly gaining insight into how these systems align in a taxonomy. Once in place, we determine if existing relationships endure or if they need reconstructing. Based on decades of experience in approximate matching of data, our algorithms create match sets that align all data sources. Our Platform is shining the light on “dark data”. Finding insight and valuable information enabling financial institutions to provide required transparency. A component to assist in the “Living Will” - our solution can provide the intelligence in the data to free up capital that has a positive impact on Shareholder value. The most critical component of the PDP is the open API’s that enable not only data extraction, but the overhaul of business models and elimination of massive investments in core functional system replacements. PDP will pave the way for disintermediation of legacy systems, processes and workflows. It delivers data that can provide not only the regulatory insight for executives and customers but the ability to understand capital requirements and mitigate fines. Ultimately, our data platform can provide the insight to create more shareholder value.

Customer Overview

Features

- Viewing of structured and unstructured data

- Structure multiple data types into table form

- Universal Search through all data

- Automatically create profile of data set: dimensions, attributes, hierarchy

- Visually identify and associate common relationships across multiple datasets.

- Identify & associate attributes and index

- Create a logical data mode

- Extract tables and/or targeted data from unstructured sources and create tables and fields.

- User-generated data cleansing

- Machine Learning capabilities

- Data quality detection

- Provide banking / financial service domain expertise, particularly familiarity with industry issues, data and processes

- Provide expertise with banking / FS industry data models and integration to address industry issues I opportunities

- Machine learning techniques for anomaly, identification, classification and mapping

Benefits

- We believe we can have a social impact on global financial services.

- Our business has the ability to grow trust in banks, governments and larger establishments as a whole.

- We focus on matters requiring attention and speed and agility in data exploration, discovery and matching.

- The PDP will expose suspect data that is not visible through manual, human intervention.

- We shine the light on the dark data held hostage in legacy systems and processes throughout the financial industry.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

FICO®Siron® Anti-Financial Crime Solutions

Product/Service Description

FICO® Siron® Anti-Financial Crime Solutions consists of flexible and highly integrated software modules for:

• Anti-Money Laundering

• Tax Compliance (FATCA, CRS/AEOI)

• Counter-Terrorism Financing

• Know Your Customer

• Business Partner Due Diligence

The building-block design allows variable combination of the products. This paves the way to genuine cost efficiency, transparent total cost of ownership and solutions that can grow along with the challenges of our customers.

Key Features:

• Coverage of all statutory requirements

• Risk-based approach according to FATF

• Full check of customers and transactions

• No IT-knowledge necessary to configure detection scenarios

• Best-practice research scenarios from more than 1,000 of customer installations

• Multi-clients and multi-lingual user interfaces

• Easy integration with existing systems through standardized and flexible interfaces

• 100% audit-proof documentation

FICO® Siron® solutions consistently follow the risk-based approach and support all phases of the compliance process with integrated solution modules: from business risk analysis and customer risk classification to monitoring of transactions and behavioral patterns, and central case management with risk and compliance dashboards.

FICO® Siron® products are highly standardized and parametrizable. They can be combined at will to create custom solutions. Numerous best-practice scenarios from a large number of customer installations have made their way into our standard research products. They guarantee fast roll-out of professional solutions based on the latest compliance knowledge.

FICO® Siron® technology is robust, interoperable, platform-independent and highly scalable. This facilitates integration of our products into existing system environments and provides seamless interaction with third-party applications and databases. The field of application of our products extends from the lean departmental to a cross- and multi-national group solution.

Customer Overview

Features

- Coverage of all statutory requirements

- Risk-based approach according to FATF

- Full check of customers and transactions

- No IT-knowledge necessary to configure detection scenarios

- Best-practice research scenarios from more than 1,000 of customer installations

- Multi-clients and multi-lingual user interfaces

- Easy integration with existing systems through standardized and flexible interfaces

- 100% audit-proof documentation

Benefits

- Largely automated driving the daily surveillance with as little effort as possible

- System-independently integrated into the IT-infrastructure – investments in additional hard- and software not necessarily needed

- Good performance even for high volume of data

- Easily adaptable to regulatory changes and highly flexible support of any individual definition of suspicion criteria according to the specific risk of the bank

- End user-friendly dialog to bring in the compliance officer’s experience and knowledge of what seems to be suspicious

- Audit trail protocols of all operations and definitions including changes - to protect employees from being accused of carelessness

- Reasonable costs for license and implementation