AIX (IBM)

Product Profile

Screenshots

Product/Service Description

Nuxeo is helping shape the future of financial services with an innovative platform that digitally transforms the business at speed & delivers value throughout the organization. Using modern technologies like open source, cloud, microservices, and AI; Nuxeo accelerates application & solution delivery to solve today’s biggest information management challenges.

Our approach to legacy IT modernization maximizes current IT investments, mitigates risks and minimizes business disruptions - while strategically modernizing for the future. Nuxeo helps financial services organizations realize measurable results faster and;

• Deliver Richer Customer Experiences

• Reduce Time to Market

• Increase Operational Efficiency

• Meet Compliance Requirements

Customer Overview

Features

ECM, DAM, document management, AI, IT modernisation, workflows, process automation

Benefits

- Deliver rich customer experiences

- Provide a centralised view of all your information regardless of where it is stored

- Increased productivity and operational efficiency

- Meet compliance requirements

Platform & Workflow

The Nuxeo Audit Service listens to all events that may occur on the platform (document creation, user logging in, workflow started ...) and according to the configuration an Audit record will be created. Nuxeo provides a default admin dashboard with analytics and metrics, which can be extended using the built-in reporting elements

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

ICS BANKS Digital Banking

Product/Service Description

Ever since digital disruption started, ICSFS embraced business agility as a primary core driver in providing its customers with real value in this global competitive market. ICSFS provides its customers with:

- Innovation as a Core Function, ICSFS is one of the first users in utilising the latest technologies such as blockchain

- Open Banking; open solutions through open APIs architecture to satisfy fintech roles and make their threat an opportunity

- Complete cloud platforms – Cloud available

- Enriched customer service and experience

- Customer analytics

- Unification of all digital systems – omnichannel experience

- Increase customer’s confidence and engagement, hence, increase customer satisfaction and loyalty

- Dynamic products for new business trends

- High security, scalability, and flexibility

- RegTech solutions

- Improved efficiency to drive business agility

- Increase profitability and reduce revenue leakage

- Continuous technological advancement with lower TCO (Total Cost of Ownership)

- Vast business coverage to assist the full cycle of any banking sector

- Delivering more touchpoints to reach more banking customers and overcome human touch element

- Future-proof digital banking products

ICSFS believes to be truly digital, a bank must reengineer the way it does business, creating a new strategy of digitalising its business model. A bank must first face growing competition from fintech start-ups and tech giants, with endless disruptive innovation. ICSFS has the foresight to capitalise on the digital banking future, as it is recognised by many official independent bodies for its excellence, progressiveness, and innovation within the banking and financial sector.

Customer Overview

Features

ICS BANKS Digital Banking enables the bank to service its customers by providing essential features and vast touchpoints, utilising facilities, and the latest technologies.

Rapid progress in disruptive technologies is bringing a paradigm shift in banking and financial institutions’ thought process, towards technology adoption and transformation. The key principle to successful transformation is choosing the right partner to drive innovation, generate new opportunities, and elevate market advantages over competitors. This is where ICSFS’ innovation lays in flexibility, simplicity, and efficiency. With decades of experience, ICSFS is recognised by its success through its strong- long-term customer base, all over the world.

ICS BANKS Digital Banking platform is used for rendering personal banking services and supporting processes through its latest technologies and touchpoints such as:

- Cloud Technology (Cloud available)

- Blockchain (deployed in production)

- Open banking and Open API’s

- Agency Banking

- Embedded Business Process Management (BPM)

- Embedded Document Management System (DMS)

- Artificial Intelligence, machine learning, and smart processes

- Cash Management System (CMS)

- Chatbots, smart customer social and interactive engagements

- Robotics

- Smart Contracts

- Cardless Payments

- Digital Customer onboarding

- Wearable Banking and internet of things (IoT)

Artificial intelligence and robotics utilisation in ICS BANKS enable the bank to boost process efficiency and accuracy, both, in internal processes and customer interactions.

Benefits

Key benefits of ICS BANKS Digital Banking software suite:

• End-to-End Digital Platform and Architecture

Built on a three-layer architecture, ICS BANKS Digital Banking platform orchestrates the processes between the front, mid, and back-end layers that are connected through standardised APIs, to drive digital transformation and financial inclusion across all digital banking channels, hence, to enable a fully digital customer experience. With ICS BANKS Digital Banking’s Service-Oriented-Architecture (SOA), rich functionalities accompanied with the latest cutting-edge technologies, and comprehensive out-of-the-box fully integrated digital banking touchpoints, a bank is digitally enabled to empower its customers by offering a true virtual digital journey across all its products and touchpoints.

• Open Banking, Unified Omnichannel Integration

To become customer-centric more than product-centric, ICS BANKS Digital Banking software suite supports open banking via unified omnichannel integration. Our software suite offers a bank’s customers a true omnichannel banking experience, meaning, a customer may initiate a transaction on one of the bank’s touchpoints, such as a mobile device and finish this transaction on another touch point, such as ATM or through the bank’s internet banking system. Many digital banking software providers offer multichannel banking instead of omnichannel, the difference is, when a bank uses multichannel banking, its touchpoints will not be seamlessly connected, hence the bank’s customers will not enjoy the consistency and real-time access between any channel, anytime, anywhere, which is the heart of the customers’ omnichannel journey.

• Integrated with ICS BANKS Software Suites

ICS BANKS users have the privilege of easily integrating ICS BANKS Digital Banking software suite with any of ICS BANKS’ family of products. Whether they are using the full universal package, Islamic, or one suite such as ICS BANKS Investment & Treasury.

• Available on the Cloud

ICS BANKS Digital Banking is available on the Oracle Cloud Marketplace, providing a one-stop shop for customers seeking trusted business applications and service providers, offering unique business solutions. Banks users of ICS BANKS Digital Banking on the cloud will leverage a global automation of communications and transactions with greater flexibility and agility, security and lowered costs throughout their entire delivery channels and touchpoints. Banks will not only save big portion of costs by going digital, but also, by using cloud, it can save up to 50% of its operation and infrastructure costs.

• Future-Proof Digital Banking Platform

ICSFS invests in its software suites by utilising modern technology in launching new products, constructing a secured and agile integration, and keeping pace with new standards and regulations worldwide. ICS BANKS Digital Banking software suite future-proof your bank by providing a broad range of features and capabilities with more agility and flexibility to enrich the bank’s customers journey experience, where personal customer analytics are provided through embedded analytics for activity-based reporting and customer performance, hence improving the trust and confidentiality between the customer and the bank.

• Leverage Fintech Innovations

ICS BANKS Digital Banking software suite encompasses an ecosystem of third-party services, as banks who want to survive and stay ahead of their competitors in this age of digital disruption, have to collaborate and engage with fintech. ICS BANKS Digital Banking software suite controls how fintech digital business applications and services are accommodated and delivered to banks’ customers, to maintain a competitive edge and improve customer satisfaction, with minimal cost and time for integration.

• Proven Track-Record

ICSFS started since the inception of ICS BANKS to perform tests and high-watermark benchmarks with tech giants such as Oracle, HP and IBM, and have set a highly competitive edge over software providers in record-breaking performance and unmatched results. ICSFS usually generates ICS BANKS’ data representative of tier 1 and tier 2 universal banking activities. One of its main high record-breaking performance on the cloud was conducted on Oracle’s database machines, where ICSFS is the first Oracle ISV partner worldwide to perform high-watermark benchmark on Oracle Database Enterprise Edition 12c and 18c.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

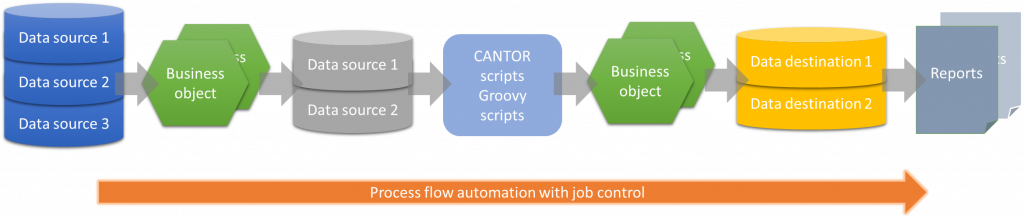

Jabatix is a comprehensive, component-based software development and software production environment for batch applications on application servers based on standard technologies. The Jabatix Community Edition is an all-in-one Eclipse-based Interactive Development Environment. It is a comprehensive workbench for developing information management and reporting solutions.

The key enabling tools and features are:

• Encapsulated access to a wide variety of data sources, from flat files (.csv), to Excel spreadsheets, to relational databases; specific queries can even be directly integrated with the logical data source binding

• Business Objects (BOs): object-based containers that serve to integrate data sources, apply the required functionality (format consistency, data cleansing, aggregation, calculations), to produce and visualize results quickly

• With the Jabatix Cantor scripting language, a Groovy DSL (Domain-Specific Language), with an easy-to-use, pointerless, Microsoft Visual Basic-like syntax, customization scripts can be quickly and efficiently programmed and deployed, even by junior programmers and savvy web developers

• Jabatix workbench also supports Groovy scripts and integrating Java classes: this flexibility makes the Jabatix “layer” between data sources and destinations highly efficient and capable of even the most sophisticated processing

• The Jabatix process flow feature provides workflow automation capabilities in real-time, it can also be activated event- or time-section-controlled

• Jabatix supports report generation with the Jabatix's own Datapoint Report Generator or with Eclipse BIRT; other forms of visualization can be generated programmatically

Customer Overview

Features

- Cantor Script

- Process Flow

- Data Mart Designer

- Business Objects

- Business Object Mapping

Benefits

- All-in-one Eclipse-based Interactive Development Environment

- Cantor scripting language (a Groovy DSL) is similar to Visual Basic. Alternatively Groovy and Java classes can be used

- Free download, no strings attached for independent program development

- Updates and upgrades available free of charge

- Faster development of high-quality software

- Reduction of training costs for software development

- Easy development of software solutions by staff with little IT knowledge

Platform & Workflow

Jabatix supports report generation with the Jabatix's own Datapoint Report Generator or with Eclipse BIRT; other forms of visualization can be generated programmatically

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

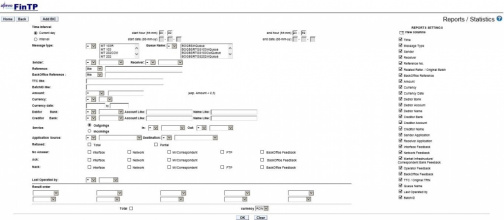

Screenshots

Product/Service Description

FinTP is a versatile open source solution for flow automation and seamless integration between various internal systems/applications and external market infrastructures or networks, providing operators with relevant information in a one-window approach (acting like a financial middleware), which allows banks to focus less on their internal processes, and more on designing attractive client-oriented services and products.

On top of its core function, FinTP provides support for the most used funds transfer instruments (credit transfer, direct debit, debit instruments) and includes features for operational risk containment (transaction filtering, duplicate detection, accounting reconciliation), liquidity reporting, treasury operations management, end-to-end management of remittances, competitive reporting and SEPA & TARGET2 compliance.

FinTP use cases are in solutions for transaction broker, payment factories, corporation financial consolidation, management of microfinance operations, optimization of payment flows for public administrations, public debt management etc.

Customer Overview

Features

- Financial instruments:

- Funds transfer (MT, MX message types)

- Direct debit

- Debit instruments

- Remittances

- Treasury operations

- SEPA (credit transfer – SCT ; direct debit – SDD) compliance

- SEPA for corporates

- Statements (MT940/MT950, MT900/MT910)

- Corporate to bank connectivity

- Operational features:

- Duplicate detection

- Accounts reconciliation

- Transactions filtering

- Competitive reports & alerts

- Liquidity reporting and forecasting

- Business continuity

- Loan disbursements and repayment matching

Benefits

FinTP lowers the total cost of ownership (ensuring nil capital expenses and optimized operational expenses – via shared development and maintenance), while eliminating the common vendor lock-in dependence and aiming to achieve a better level of interoperability - by encouraging a wide adoption, due to financial attractively and short time-to market.

The innovation factor consists in its open source distribution model, allowing banks/corporations/public institutions who use it to contribute updates and improvements to benefit all users. This enables an unprecedented level of transparency and collaboration between clients, being possible because middleware is not a competitive differentiator for them. It is in the best interest of all involved parties that this collaboration happens, so that everyone can focus on primary client oriented attractive services.

Last, but not least, FinTP is highly flexible and configurable and can be adjusted to fit the exact needs of the customer.

Platform & Workflow

Custom reporting capabilities: users can tailor their own reports. A set of standard reports already is available in the application, as most frequently asked by bank or treasury operators

Competitive reports: offers several analyses and reports of the market trends, along with early alerts

Liquidity reporting: ensures real-time cash reports and forecasts using several reporting criteria, in a consolidated view

Auditing: detailed logs of user activity, payment status updates with full information on timestamps, originating application, end application, device information, etc.

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

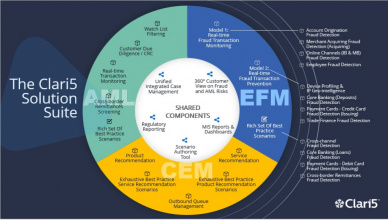

Clari5 Enterprise Fraud Management

Screenshots & Video

Product/Service Description

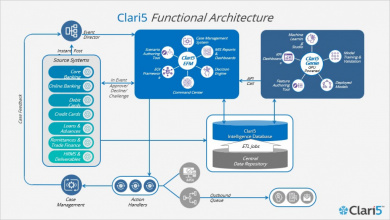

Clari5 is a next gen enterprise platform for real-time intelligence, using the best of technology for the most cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks. Clari5 Enterprise Financial Crime Management Solution suite provides real-time anti-fraud and anti-money laundering capabilities on a unified real-time intelligence platform.

Clari5 Enterprise Fraud Management (EFM) is a real-time Enterprise Wide Fraud Detection, Monitoring and prevention solution that monitors suspicious patterns across transactions, events, users, accounts, systems in real-time and responds with the right action to pass or block transaction, or generate real-time alerts for manual investigation.

Customer Overview

Features

- Proactively combats cross channel, cross product fraud across the enterprise real-time

- Customer aware solution that monitors 360 degrees digesting all transactions and actions

- Silo Breaker solution that combats sophisticated fraud with real-time, actionable insights

- Employs intelligent models based on neural network, time series and complex analytics to deliver insight

Benefits

- Perform fraud prevention in real-time as banking transactions occur

- Prepackaged Scenarios and built-in interfaces across Products/Channels to achieve quick ROI

- Dynamically profiling suspicious devices, cards, merchantsor payees for preventing fraudulent transactions

- Expedited fraud investigation based on Investigation Workbench and Integrated case management

- Integrated reports and dashboard giving insights on the efficiency and effectiveness of the fraud prevention

Platform & Workflow

Cash Transaction Reports, Suspicious Transaction Reporting / Suspicious Activity Reporting, Non-Profit Transaction Reporting, Counterfeit Currency Reporting, Cross-border Transaction Reporting. Management Reporting - Role based Management Reporting and Dashboarding using embedded Enterpsise BI platform

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Clari5 Customer Experience Management

Screenshots & Video

Product/Service Description

Clari5 is a next gen enterprise platform for real-time intelligence using the best of technology for cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks.

Clari5 Customer Experience Management solution delivers instant contextual intelligence across 3 dimensions: Tacit, Actionable and Conversational. Insights offering contextual, real-time recommendations across all channels helps grow cross-sell/ up-sell revenue exponentially.

Customer Overview

Features

- Cross-sell/ Upsell in Real-time

- Next Best Product Recommendation

- Lead Generation

- Intelligent Prompts

- Real-time Customer Detect at Branch

- Automated Service Messages

- Enhanced User Effectiveness

- User-friendly Analytics

Benefits

- Unified and holistic customer experience at every touch point

- Helps customer facing staff make intelligent and relevant conversations

- Enables banks to proactively improve customer experiences across all communication channels

- Solution leans from transactions, interactions, responses and factors them using mathematical models and fuzzy logic to arrive at right conversation pointers, right messages and right sales opportunity

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Clari5 Anti-Money Laundering Solution

Screenshots & Video

Product/Service Description

Clari5 is a next gen enterprise platform for real-time intelligence using the best of technology for cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks.

Clari5 Anti-Money Laundering (AML) solution helps banks and financial institutions automate, streamline and comply with existing and emerging regulatory AML/CFT compliance programs. Clari5 AML suite consists of following solutions, available individually or as an integrated whole namely: Suspicious Activity Monitoring, Customer Risk Categorization, Entity Identity Resolution/Watch List Filtering, Regulatory Reporting (CTR/STR/SAR and any other reports to be submitted to central bank), Scenario Authoring Tool for creating new scenarios, Integrated Case Management, Investigation Tools, Entity Link Analysis and Comprehensive Management Reporting.

Customer Overview

Features

- Automation of entire AML compliance program, from customer on-boarding to steady relationship monitoring

- Comply to risk-based AML approach with on-going customer risk rating and risk-based Transaction Monitoring

- Comprehensive investigation capability based on the risk level of the suspicious transactions through integrated case management with the power of Investigation Tools

- Entity Link Analysis with graphical analysis to discover money laundering rings and funds structuring

- Automated STR/SAR/CTR generation as part of the regulatory reporting

Benefits

- Real-time approach to monitor and detect suspicious money laundering transactions

- Improved regulatory compliance and customer confidence

- Quicker implementation because of pre-packaged AML scenarios and built-in interfaces for integration

- Low cost commodity hardware infrastructure leading to reduced TCO

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Clari5 Loan Early Warning Signals Detection

Screenshots & Video

Product/Service Description

Clari5 is a next gen enterprise platform for real-time intelligence. We have used the best of technology to bring in the most cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks and this is manifestation of our innovation in technology.

Clari5 Loan Fraud Monitoring automates the entire Early Warning Signal Detection. Each of the Early Warning Signals, if represented through a comprehensive set of rules, identifies the pattern of the Loan Account. In addition, it interacts with your Core Banking System and Loan Origination System to identify all early warning signals of interest for the Loan Account Monitoring system. A fully integrated Case Management System and Regulatory Reporting Framework enables the bank to control the end-to-end activities.

Customer Overview

Features

- Comprehensive Early Warning Signal (EWS) Pattern Detection Engine with an ability to dynamically add new EWS and launch them

- Integration with multiple Core Systems to factor in the entire Customer behavior to identify any suspicious behavior

- Fully Integrated Case Management System to monitor all early warning signals generated by the system and performing additional investiga-tion to authorize an account as a Red Flagged Account

- Regulatory Reporting Workbench to electronically generate and file any report required either by the RBI or Law Enforcement Agencies

- Management Reporting Workbench to keep the management abreast of Fraudulent Behavior Accounts and general daily activities

- Flexibility to Implement either On-Premise or Cloud Based.

Benefits

- Comprehensive Investigation workbench –integrated case management, link analysis

- Flexible modes of deployments-Real-time monitoring & Real time Transaction Stopping

- Business friendly interface for decision and case workflow policies

- Cross Channel and Cross Product Coverage

- Proven Architecture for Scalability and Performance –Easier Integration

- 100% scanning of transactions rather than using transaction sample based fraud detection

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

iMAL Enterprise Islamic Banking & Investment System

Product/Service Description

iMAL Enterprise Islamic Banking & Investment System is a powerful core banking platform specifically built from the ground up to support Sharia banking operations. It is truly geared to address country and region-specific Islamic banking requirements. It is offered to high-end Islamic banking, investment and financing institutions, based on an advanced open architecture with a robust integration platform.

iMAL is the only 100% Islamic banking solution as certified by AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) in 2008.

All iMAL modules adhere to the Islamic law and are in full compliance with IAS (International Accounting Standards). The system is based on the Sharia guidelines for the purpose of financing related to Murabaha, Mudaraba, Ijara, Istisnaa, Salam, project financing, real estate and others.

Customer Overview

Pricing model is based on the modular capability available in iMAL core banking system, whereby each module is priced separately providing a flexible costing structure to fulfill the following goals:

1- iMAL provides a full suite of modules that address different business requirements for the banking industry. These modules have been packaged to focus on the different business areas in a bank.

2- Provide a product-based configuration of the different core modules, whereby a base license is provided for the main module feature, and subsequently the client can select additional products to be added to the base license. This aims to optimize the product offering to the client and provide a cost effective offering.

3- Regarding the deployment in branches, Path Solutions adopts a flexible branch deployment strategy, whereby the option is availed to the Sales team to configure the deployment offering by choosing one of the following scenarios:

a. Combination of number of branches and number of users

b. Adopting the pricing based on the number of branches only

c. Adopting the pricing based on the number of users only

d. Adopting the pricing based on the projected number of customer accounts.

The above options provide the flexibility to select the most suited selling approach depending on the target market and client expectations, and accordingly provide a cost effective offering to the potential clients.

4- In addition to the above approach, an embedded quantity discount brackets is adopted to apply a reduced unit cost for the different selection criteria, which again provides a reasonable pricing for the banks operating a big branch network, or projecting a huge number of customers.

Features

- Supports all known Islamic banking instruments

- Web interface, N-Tier Java based, SOA architecture

- With high parameterization capabilities; greater process efficiency, better risk mitigation

- Multi-currency, multi-branch, multi-company enabled accounting backbone

- With strong product definition features

- Fully integrated yet modularized, with Model Bank

- Highly automated and flexible system

- Ensures quick time to market products.

The iMAL core strengths:

iMAL employs multi-tier architecture using the latest JAVA technology with either Oracle or SAP Sybase as core database servers. These powerful and at the same time affordable Relational Database Management Systems (RDBMS) provide sophisticated data protection and high-speed access to information.

The system runs on all the main platforms and operating systems requiring only an up-to-date internet browser at the client side.

iMAL is rich in opportunities for increasing revenue through cross-selling and upselling. It also enables a 360° view which enhances customer service.

It is also cloud ready and deployable on a fully scalable, multi-server n-tier architecture. It includes out-of-the-box, industry best practice processes that further support rapid implementation, team knowledge transfer and sustainable business processes.

The fully integrated front, middle and back office Islamic core banking platform, running 24/7 in real-time -iMAL- combines comprehensive business functionality with an advanced, secure, scalable and modular architecture proven to meet the market toughest challenges of today and tomorrow.

Benefits

- Built-in Islamic operations standard compliant workflows and system controls

- Various delivery channels

- Faster time to market

- Exact fit to business requirements

- Phased migration and implementation approach

- Running businesses in real-time mode

- Higher operational efficiency:

- Single integrated platform for all banking activities

- Flexibility to meet change and growth requirements

- Cost reduction by implementing STP

- Optimized business performance

- Superior customer service

- Efficient speed of service

- Precision of documentary cycle

- Electronic reconciliation (quick notices)

- Prompt dispute resolution: Legal, collection, valuation, procedures, etc.

iMAL enables Islamic financial institutions to carry out essential tasks across retail, corporate and investment banking including core banking, transaction banking, online and mobile, payments & financial messaging, trade services and cash management. These applications help Islamic financial institutions to meet business needs in areas like streamlining operations, introducing new products, improving efficiencies and customer service, and ultimately increasing revenues while reducing risk.

iMAL provides platform independence, real-time interfaces, extreme usability, full scalability, high-performance, excellent productivity for configuration and deployment, and modular components.

With iMAL, Islamic financial institutions are empowered to achieve:

iMAL is based upon customers’ serviceability. One of these backbones is the production of multilingual statements to customers of the Islamic financial institutions. This is done with minimal data entry at the outset of the system’s parameterization, whilst the production of the various statements, advices, is done automatically by the system without manual intervention by the end-user.

iMAL, which is in compliance with Basel II/III & AML, enables Islamic financial institutions to contain the risk element before they get exposed to a higher degree of risk through effective risk management built into every single transaction that is undertaken in the system.

In addition, iMAL helps Islamic financial institutions implement a flexible, cost-efficient infrastructure with instant access to accurate, up-to-the minute financial updating in order to make informed operational and strategic decisions at a moment’s notice. This comprehensive approach produces a higher Return On Investment to our clients.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Real-time, instant or immediate payments describes the capability to transfer funds between two parties making funds available to the payee almost instantly, with instant confirmation. Typical processing models consist of a hub-and-spoke model such as ISO 20022 to connect financial institutions or corporations to one another through a central infrastructure (CI).

- Banks improve retention and open up new value added revenue streams

- Fintechs can use ACI’s 3rd party platform - New Access Model - to access Immediate Payments and offer services that were previously restricted to banks alone

- Consumers get faster, reliable transfers and instant, accurate account balances

- Merchants increase profits by getting paid sooner and eliminating interchange fees

Business customers can take advantage of better payment terms and improve their working capital

Customer Overview

Features

- •Payments management •Channel integration •Orchestration •CSM connectivity and compliance •Security and fraud checking •Exceptions handling •Liquidity management •FX payments •Flexible handling and special products management •Business intellige

Benefits

- •Deliver profitable services •Protect your investment by enabling real-time payments •Accelerate your time to market