Published

- 08:00 am

“I try to create an ecosystem that can bring benefit to many people in a transparent and open way,” says President at France Blocktech and speaker at the Blockchain & Bitcoin Conference France Laurent Leloup.

Blockchain & Bitcoin Conference France is a large-scale event in Paris focused on DLT and cryptocurrencies. The conference will unite top experts from leading crypto companies to discuss regulations, ICOs and look into the French blockchain future.

Laurent Leloup has 25 years of experience in the financial sphere. He is an ICO advisor and entrepreneur, Founder at Chaineum and Co-Founder at France Blocktech. The specialist will speak at Blockchain & Bitcoin Conference France and dwell on blockchain application in industry and government. In the interview, Laurent Leloup shared his success story. The expert told what served a starting point for the career in the sphere of blockchain, why he chose it and how to manage several companies.

Interviewer: Blockchain & Bitcoin Conference France (BCF)

Respondent: Laurent Leloup, President of France Blocktech (LL)

BCF: We know that you have 25 years of experience in the financial sphere. What served as a starting point for you?

LL: My career started in 1991 in the credit management field and with the creation of a debt collection firm. Then I was the commercial director in a credit management solutions software editor, before experiencing consultancy from 2003 to 2007. I launched an online magazine, Finyear.com, in 2007, few years before discovering Bitcoin.

BCF: How did you get engaged in blockchain? What helped you to understand that decentralized technology has future and determine your way towards crypto development?

LL: Like many people, I heard about blockchain technology thanks to the emergence of bitcoin in late 2008/2009. As the founder of FinYear.com, I received many questions about it, so I began working on it and trying to explain it to our readers. The more I discovered this new subject, the more I understood it, first, on a technical level, then on a societal one. I quickly understood the power of the blockchain as well as crypto and tokens.

BCF: You are the founder and CEO at two blockchain advisory companies, and two financial news organizations. How do you manage the operation of all at once?

LL: We are in a new field, and there are still so many things to create! As a Lego lover since my childhood, I love to imbricate things. All those companies are set up in a logical way because they all rely on each other. I try to create an ecosystem which can bring benefit to many people in a transparent way. It’s a “way of thinking” in the blockchain field. Fortunately, I was able to create a strong and competent team around me, approximately 20 people now. They help me every day in the creation of this ecosystem, from ICOs to blockchain development and advice, to media.

BCF: As for your company Chaineum, it is the first so-called French ICO Boutique. Was it difficult to establish Chaineum as a pioneer, or did you know that the idea would reach success?

LL: Establishing Chaineum as a pioneer was not so hard in France because we were the first one in the market. We helped the first 100% French ICO, Domraider, in 2017, and managed to raise more than 35M€. But in my mind, it is clear since 3 or 4 years that the Blockchain technology has the power to change the society, to make the world better. Chaineum was a logical evolution for me and all the people around: helping companies to be back and bankroll by people around from all over the world, no matter their age, social environment or whatever, but always in accordance with the law. As a pioneer, we also face multiple challenges. We’re the explorer of the 21st century!

BCF: How did the idea for writing a book “Blockchain, la révolution de la confiance” [Blockchain, the trust revolution] originate? What served as an inspiration?

LL: As I said, I began writing about blockchain around 2008/2009. After years of blockchain exploration, I organized two conferences about it in Paris in 2015. Demand for information about blockchain, Bitcoin and crypto were really high at this time. That’s why I also created France Blocktech association in 2016, as well as the Blockchain Valley. I truly believe that blockchain is for everyone, and naturally, I had this idea of writing a book about it. My book “Blockchain, la révolution de la confiance” was born.

The organizer of the event is the international company Smile-Expo which conducts Blockchain & Bitcoin Conference series all over the world.

The event in France will feature DLT industry experts and leading companies and startups which will present their projects. The conference will provide an opportunity of networking to find new partners and get to know crypto enthusiasts.

Related News

Anthony Hynes

Managing Director and CEO at eNett International

Competition in the travel industry is high, and margins are low. see more

- 09:00 am

First wealth management as-a-service products for financial institutions

Bolsters Orange Business Services within financial services sector

Orange Business Services and Additiv, an expert in digital solutions for the financial market, have teamed up to offer digital wealth management as-a-service products to financial institutions. The cloud-based offerings will automate wealth management and address the strong growing demand for digital financial services from clients and the urgency to reduce operating costs by many financial institutions.

Additiv’s established wealth management products are now offered on a software-as-a-service (SaaS) platform. This means that the SaaS products can be easily plugged into financial institutions’ existing systems. Wealth management as-a-service products are based on Additiv’s fourth generation modular Digital Finance Suite (DFS 4.0), designed for the digitalization of new and existing business segments. The SaaS product offering contains out-of-the-box solutions, such as robo advisors, client and advisory dashboards and portfolio management solutions.

Automation: Shaping the future of wealth management

The innovative service addresses the financial industry’s requirements for hosting data off premise in the cloud, but onshore in the country of origin. This is achieved by leveraging Orange Business Services’ strong cloud, data storage, connectivity and cyberdefense capabilities at a global level.

Additiv’s wealth management as-a-service products offer a wide range of configuration possibilities to achieve a personalized experience. It will be rolled out in Europe, the Middle East, Africa and Asia Pacific relying on dedicated Orange cloud platforms.

“By partnering with Orange Business Services we can provide financial institutions with a fast and highly-secure way of tapping into this new market opportunity, while improving the end-client experience and reducing operating costs. Through the joint platform, customers have access to Additiv’s Digital Finance Suite, including its global ecosystem partners, such as Saxo Bank that offers client administration, execution and custody services with access to 35,000 financial instruments across eight asset classes,” said Michael Stemmle, founder and CEO of Zurich-headquartered Additiv.

“Our highly-secure cloud platform is providing Additiv with a smart and efficient way for financial institutions to plug in a game-changing range of products and map the entire data journey to provide valuable customer insight. It will make digital wealth management easier and more convenient, which will undoubtedly broaden the appeal of wealth management,” said Helmut Reisinger, CEO, Orange Business Services.

“Financial institutions are poised to benefit from this unique offering that combines for the first time the strength of a global service provider with the leading edge finance suite of Additiv. Orange has listened to the emerging customer demands in the financial industry and has fulfilled local regulatory obligations. Together this boosts both companies’ capabilities, offerings and services on a global scale and provides the financial industry with new digital services for their differentiation,” said Martin Kull, managing director, Orange Business Services Switzerland and sponsor of the Additiv partnership.

Orange Group is already an established player in the financial services market. Orange Money, launched in 2008, links a mobile account to an Orange mobile number to meet the needs of customers in the Middle East and Africa where transactions are carried out in cash. Orange was the first mobile operator to launch contactless cash payments in Europe. In 2017, Orange Bank was launched in France.

Related News

- 01:00 am

Transformative new platform will allow SMEs efficient access to a significantly wider pool of global capital

Globacap aims to take the ICO form of capital raising into the regulated space, and into the mainstream, through issuance of equity and debt instruments in Blockchain

London, 3 July, 2018: Globacap, a digital capital-raising platform, is offering the first issuance of equity in public blockchain with oversight from the UK’s financial regulatory body, the Financial Conduct Authority (FCA). The capital raising will provide proof of concept for Globacap’s transformative new platform that will help start-ups and SMEs efficiently access a significantly wider pool of global capital.

Globacap is one of a select few companies to take part in the FCA’s six-monthly regulatory sandbox that oversees product testing in a customised regulatory environment. As part of the sandbox cohort four, Globacap will perform an end-to-end capital raising on its own platform, which will involve issuing part of its own equity as an ERC-compatible token, in its Digital Security Offering (DSO).

The “ICO” form of capital raising has grown significantly in importance in recent years, with over $4 billion of capital raised through this means in 2017. However, progress is currently limited by the lack of trust and sophistication in the system, where investors currently receive little in return for their ICO investment.

Globacap and its legal advisors, Hogan Lovells, have been working together to create a public blockchain token that forms a legal shareholding within UK company and securities law. The Hogan Lovells team is being led by corporate transactional partner, Richard Diffenthal, and financial services regulatory partner, Michael Thomas.

Globacap (GCAP) tokens are ordinary shares, with token holders having the same voting and dividend entitlements as existing shareholders. Fifteen million GCAP tokens will be issued in the DSO. Investors are required to register in order to participate.

The Platform

The Globacap Platform, to be officially launched later this year, will facilitate DSOs from start to finish, allowing businesses to raise capital from a global audience while managing all regulatory and compliance aspects. Institutional and retail investors gain access to opportunities, invest using a range of crypto and fiat currencies, and benefit from more transparent valuation and post-issuance liquidity. The platform incorporates automated due diligence processes and custom checks to mitigate regulatory AML concerns over secondary market transfers.

Post-issuance services are also automated, including dividend distributions and coupon payments, electronic shareholder voting, investor communications, shareholder registry management and regulatory reporting.

The Importance of SMEs

SMEs form a vital part of the European economy and are all too often overlooked. In 2017 across Europe, SMEs accounted for 67% (90 million people) of overall private sector employment and 57% of value added (€3.9 trillion).

An ECB task force estimated that 36% of European SMEs could not get a bank loan in 2016, while many more ruled out bank loans entirely due to prohibitively high interest rates. In an attempt to fill this void, nearly $700bn of direct lending has been channelled to SMEs since 2008 from investment funds, however, much of that has gone to SMEs at the larger end of the spectrum.

Globacap seeks to bridge this gap through providing a means for SMEs to access capital on a global scale, whilst affording both institutional and retail investors the full rights associated with equity and debt securities.

Myles Milston, CEO and co-founder of Globacap, commented:

“This is transformative to the securities industry, paving the way for small and mid-sized businesses to more efficiently access a wider pool of global capital. The Innovate team at the FCA have been pivotal in this milestone, allowing us a quicker route to launch our proof of concept while having regulatory oversight.”

Related News

- 03:00 am

This is a history day for Exscudo project and the whole modern economy. Today, we are launching Exscudo Exchange with all functionalities, so from now on you can start trading, and get a test of how our core products works together. Use combination of Exscudo products and services, like Exchange and Channels App to experience the fastest and easiest trading. Join Exscudo project right now and get the once-in-a-lifetime opportunity to trade on Exscudo Exchange without any fees till September 1.

You can enjoy next-level trading with functionalities of Exscudo Exchange:

1. Deposit money in five different currencies: EON, BTC, BTH, ETC and ETH

2. Update (Fill) KYC information and verify your identity with Google 2FA on your mobile device to protect your money

3. Track quotations of currency pairs you are interested in: check the last price for a currency pair, 24-hour trading volume and 24-hour price change

4. Make orders in two tabs - trade currency on BTC and EON market. Follow the best price for currency you want to buy and see the maximum amount of currency that you can purchase

5. Use withdrawal function and transfer money to Exscudo Channels App or any other wallet you want

6. Check transaction history widget to stay abreast of your strides

Our Team made a big step towards the financial evolution. But this is not our last word, Exscudo only starts its integration on the global market of cryptocurrencies. By partnering with banks, Exscudo will implement fiat trading this year - it will enable altcoin/fiat trading and give vast opportunities for business integration and tokenization.

There are several reasons why exchanges fail. Among there are security breaches caused by hackers or other criminal activities, but also new regulations of the governments. Exscudo found a solution that allows users to control money and never lose them. Our solution is to combine deposits and wallets of the user, making trading simple and secure. Exscudo Exchange is not involved in the deposit storage, deposits are stored directly in users’ wallets, that are based on EON blockchain. Exscudo Exchange plays a role of an escrow agent who signs transactions and guarantees swaps. Safety of the deposits are guaranteed by EON blockchain – so, as a storage option, Exscudo deposit system has maximum safety, convenience and effectiveness.

Related News

- 06:00 am

Thierry adds over 25 years of Murex experience to Excelian Luxoft’s team

Excelian, Luxoft Financial Services, the financial services division of Luxoft Holding, Inc (NYSE:LXFT), today announced that Thierry Noufele has joined as Director Head of Vendor Solutions for Excelian Luxoft in the United States and Latin America.

Thierry Noufele brings over 25 years of experience within the capital markets technology industry to Excelian Luxoft. Thierry began his career as a Software Engineer at BNP Paribas and joined Murex, one of the largest trading, risk management and processing solutions for capital markets, in 1992. At Murex, he held several Executive positions in Software Development in Paris and Account Management & Business Development across North and Latin America.

Thierry will leverage this unique experience to develop Excelian Luxoft’s delivery capabilities around nearshore and offshore locations. In addition, with the help of the existing team, he will enhance the profile of the Vendor Solutions practice and extend its clients base & service offering.

“Our proven track record and commitment to being the world’s number one Murex integrator has driven our desire to expand across Europe, APAC and North America,”said Nick Thomas, Global Director of Vendor Solutions at Excelian, Luxoft Financial Services. “Thierry’s unparalleled experience and sizeable network within the industry, combined with our team’s unrivalled delivery quality, make him a natural fit for Excelian. This addition will help us continue to strengthen our technical expertise, both locally and globally, as we deliver outstanding results to our clients and grow our client base in the region.”

Thierry Noufele said, “Financial services firms are searching for ways to close the gap between front office, back office and risk now more than ever before. As the complexity of these integrations increase, so too does the risk to the business. That’s why it’s important to work with highly experienced individuals with a deep knowledge of both packaged software and the day-to-day operations of a bank. It’s this delivery philosophy, client focus and trusted reputation that make Excelian well-positioned to support its clients and I look forward to joining these efforts in the United States and Latin America.”

Related News

- 02:00 am

Mitek, a global leader in digital identity verification solutions, today announced it will provide automated ID verification for new cryptocurrency trading platform, DXE. Mitek’s Mobile Verify solution will help DXE provide KYC-compliant identity verification for all customers from the platform’s go live date, as part of DXE’s ambition to stay ahead of future regulatory requirements. Mitek’s technology is part of DXE’s efforts to provide compliant customer onboarding ahead of the enforcement of the revised Anti-Money Laundering Directive (AMLD5), which has been extended to cryptocurrency wallets and exchanges.

DXE’s vision is to provide a service that makes cryptocurrency trading more accessible for its customers. Aimed at those less proficient in digital currencies, Netherlands-based DXE will simplify the process of buying and selling cryptocurrency for its customers. Also part of DXE’s goal is to ensure proper due-diligence and KYC processes are adhered to. The anonymity of cryptocurrency has put it in danger of being seen as the newest form of “shadow banking” – attracting the attention of regulators. With increasing regulatory pressure in the industry, DXE has enlisted the help of Mitek in its efforts to ensure the company can be as transparent and compliant as possible right from the launch date.

Using Mobile Verify, which employs advanced AI and machine learning algorithms, DXE can verify all new customers that register for the platform in real-time. New applicants can capture an image of their ID documents using the camera on their smartphone. Mitek’s software provides data to allow our customers to authenticate the documents submitted to them. This enables fast, frictionless on-boarding that helps DXE satisfy future KYC onboarding regulations.

“We wanted to partner with Mitek to demonstrate that we are a platform that could be trusted, by both regulators and the public, said Ernstjan Overduin, CEO, DXE. We pride ourselves on making cryptocurrency trading simple and accessible for the everyday user. Mitek’s Mobile Verify offers a solution that helps us be both compliant with future regulations and is compatible with our vision for a simple customer experience.”

“As cryptocurrency continues to become mainstream there is a greater responsibility for legitimate businesses to adopt the KYC processes used in other regulated markets,” said René Hendrikse, Managing Director for EMEA, Mitek. “Pressure from regulators is growing fast so companies like DXE are right to get everything “above board” with measures in place to verify the identity of their customers. At Mitek we want to ensure that the introduction of secure identity verification is seamless for the customer to speed up the registration process.”

Related News

- 03:00 am

Sungard Availability Services ® (Sungard AS), a leading provider of information availability through managed IT, cloud and recovery services, has appointed Chris Huggett as its Senior Vice President, Sales for EMEA & India. Chris will lead the European sales team, covering markets including the United Kingdom, Ireland, France, Belgium, Luxembourg, Poland and Sweden. Chris will also lead Sungard AS’ sales team in India.

Chris Huggett’s appointment comes at an important juncture for Sungard AS, as it increases its reach and capabilities within the EMEA region, including the expansion of its Channel Partner Programme into EMEA and significant investments in its Workplace Recovery Facilities across the U.K. and Europe. Sungard AS has refreshed several workplace recovery sites including Mansell Street and Southwark Bridge, as well as expanding sites overseas in Luxembourg, France and Dublin. The availability expert has also grown its offering to include expanded cloud, production and recovery solutions that will enable a new generation of customers to benefit from the company’s legacy of more than 40 years in the availability arena.

Chris brings with him more than 20 years of sales, marketing and leadership experience, having worked with several leading technology firms including Hewlett Packard (HP), Vodafone, Cisco Systems and Dell. Chris has developed wide-ranging experiences working in the UK and international markets, across sales, marketing, and account-management. He has a proven track record as a senior sales leader and for re-engineering go-to-market (GTM) strategies.

Most recently, Chris served as Managing Director, Daisy Corporate Services, where he was tasked with the integration of four different business units. He worked to create a single go-to-market structure from these multiple acquisitions. Harnessing his entrepreneurial experience, Chris succeeded in creating one single governance model, including a unified sales organization, portfolio improvements, and a unified sales methodology. Previously, Chris spent a number of years at HP, where he led a specialist global account team for HP Networking, including OEM sales.

Commenting on the appointment, Alfred Binford, Executive Vice President, Worldwide Sales and Solutions, Sungard Availability Services said: “Throughout his career, Chris has established himself as a commercially astute sales leader and a pragmatic innovator with an entrepreneurial instinct that has seen him develop new and innovative ideas within large corporations. I am very excited to welcome Chris to the leadership team at Sungard AS.”

About his appointment Chris commented: “I’m delighted to be joining Sungard AS at such an exciting time for the company. The business has four decades as an innovative and leading provider of resilient production and disaster recovery services, while continually striving to meet its customers’ ever-changing needs. Sungard AS is now ideally placed to make a significant impact across an expanding EMEA market. I look forward to leading my team to even greater successes as part of this process.”

Related News

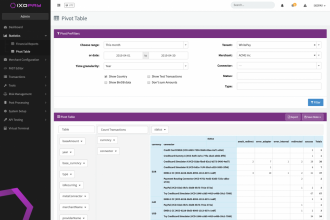

Product Profile

Screenshots

Product/Service Description

IXOPAY is a payment orchestration SaaS solution enabling independent and scalable payment processing for enterprise merchants of all branches in a PCI-DSS certified environment. Its extendable architecture offers e-businesses a solid payment infrastructure enabling transaction management and optimization.

IXOPAY is part of the IXOLIT Group, founded in Vienna (Austria) in 2001. The owner-led and financed company focuses on building innovative solutions for eCommerce, provides the necessary features to enter new markets, and eases the management of multiple payment methods.

IXOPAY’s intelligent solution supports PSPs, acquirers and enterprise organizations to maximize profit, reduce fraud and decline rates, and save money through automated processes.

IXOPAY Benefits at a glance:

- Smart Transaction Routing

- Real-time Transaction Monitoring & Reporting

- Reconciliation & Settlements

- Recurring Payments with easy scheduler

- Transaction Pooling

- Fee Management

- Risk Management & Fraud Prevention

- Customer Payment Profiles

- Various Integration Options

- Secure Payouts

- Access to multiple Acquirers & PSPs via a single API

- PCI-compliant Card Vaulting

- White Label Solution

Customer Overview

Features

- Transaction Monitoring

- Reporting & Analytics

- PCI-compliant Storage

- Fee Management Engine

- Smart Routing Engine

- Risk Management Engine

- Reconciliation & Settlement

- Adapter World

Benefits

- 150+ national, international and alternative (APM) payment methods with just one seamless API integration

- 20 years experience in the IT & Payment Industry

- In-depth analysis of every single transaction in real-time

- Strategically selected transaction routes based on various parameters, e.g. credit card type,

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

- 01:00 am

Technology firm accepted onto government cloud services framework

VST Enterprises, which developed the technology allowing genuine users to authenticate themselves across online transactions and interactions, has been accepted onto the latest version of the government’s cloud services framework, G-Cloud 10.

The G-Cloud framework is an agreement between the government and suppliers who provide cloud-based hosting, software or support services. Public sector organisations use this digital marketplace to buy services more quickly and cheaply than if they had to enter into individual procurement contracts with each supplier.

Since the basic terms of use have already been agreed between the government and suppliers, public sector buyers can purchase services from VST Enterprises without running a full OJEU (Official Journal of the European Union) procurement process each time.

“There are several elements to our VCode/VPlatform that are valuable to public sector enterprises,” explains Melissa Henry, Operations Director of VST Enterprises. “The technology can be used to authenticate the identity of users and secure transaction data, increasing the security of personal information and confidential records. It also enables full traceability, helping authorities to tackle counterfeiting and piracy and improve tax and excise practices.”

In 2014, the EU commission passed legislation stating that all items entering the EU must prove their provenance. A report produced by the European Innovation Network identified VCode as the only standalone technology that could address this issue and VST Enterprises has received the EU Seal of Excellence for its solution.

Having a presence on G-Cloud is not a guarantee of winning public sector business. However, VST Enterprises already has a number of deals in the works with those such as Isle of Man Post Office and York Council, proving the robustness of its offering.

One of the remits of the G-Cloud framework is to encourage smaller firms to pitch for business. As of the end of last year, almost half (48%) of the £2.85bn of sales generated went to SMEs.

“This is clearly a healthy trend,” says Hendry. “By working with innovative UK companies like us, the public sector gets access to a wider range of skills and expertise. A more diverse supply chain is a key element in achieving value for money in procurement as well as further developing the UK technology sector.”