Published

- 09:00 am

Trading Technologies International, Inc. (TT), a global capital markets technology platform provider, and Abel Noser Solutions, LLC (ANS) announced today a definitive agreement for TT to acquire ANS, the industry-leading provider of transaction cost analysis (TCA) for investment managers, brokers, asset owners and consultants, from Abel Noser Holdings, a majority-owned portfolio company of Estancia Capital Partners. Terms of the transaction, expected to close on Aug. 31, were not disclosed.

The acquisition represents TT’s extension into the multi-asset data and analytics space, further building on its expansion into new asset classes. In June, TT announced the establishment of a new foreign exchange (FX) business line, TT FX, following its entry into the fixed income space in March with the acquisition of AxeTrading. TT has long been a leader in technology solutions for listed derivatives.

Abel Noser Solutions, the fintech subsidiary of Abel Noser Holdings, provides comprehensive pre-trade, real-time and post-trade TCA products and services to both the buy side and sell side for a range of asset classes, including global equities, FX, futures, fixed income and options. Abel Noser also offers a broad range of compliance reporting, trade surveillance and algorithmic trading solutions.

TT CEO Keith Todd said: “This acquisition enhances our appeal to the buy side with an offering that spans multiple asset classes which we can fortify with the wealth of anonymized data harnessed through our platform. Abel Noser’s pioneering solutions have for decades been critical to the success of buy-side participants across the globe who recognize that the ability to reliably analyze transaction costs is essential. We intend to introduce the tools into the listed derivatives space through our vast client base, build on Abel Noser’s FX TCA capabilities as we roll out our new TT FX initiative and offer the firm’s clients the full breadth of TT services available.”

Peter Weiler, Abel Noser CEO, said: “We are delighted to become a part of the TT family. Our complementary multi-asset platform offerings will drive our business to new heights by continuing to deliver exceptional service and additional product innovation at an accelerated pace to our clients. This strategic move represents a significant milestone in our company’s history and will enable us to leverage the global reach of TT to better serve our customers and offer broader opportunities to our employees and partners.”

As a result of the acquisition, Abel Noser’s TCA and regulatory services will be made available to TT clients. Abel Noser’s clients will be able to leverage the comprehensive services and functionality of the TT platform. Over time, Abel Noser’s analytics will be integrated into the TT platform.

Abel Noser LLC, an agency-only brokerage that provides a range of trading services and analytics for investment managers, asset owners, investment consultants and brokers, is not part of the transaction and will continue to operate as an independent agency-only execution broker-dealer.

TT will acquire START, a broker-neutral trade optimization platform, from Abel Noser LLC in a second transaction expected to close by the first quarter of 2024.

Foley & Lardner LLP is acting as legal advisor to TT. Ardea Partners LP is serving as financial advisor, and Seward & Kissel LLP is acting as legal advisor to Abel Noser Holdings.

Related News

- 09:00 am

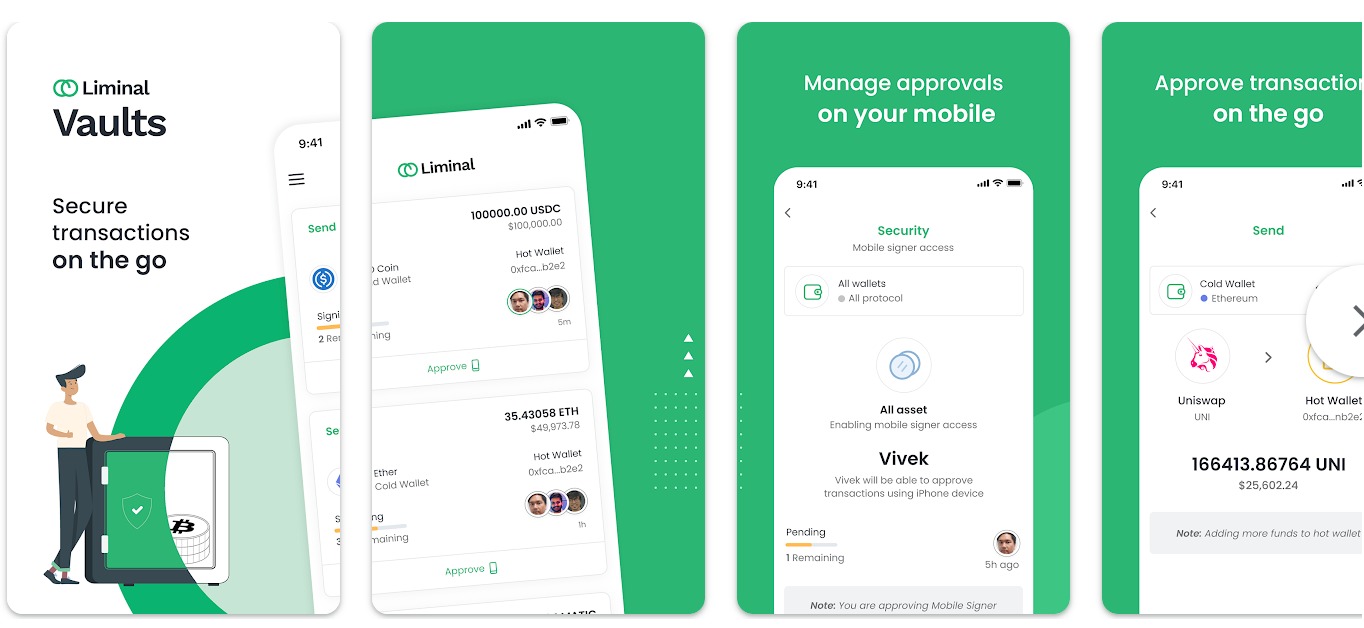

Leading regulated digital asset custody provider, Liminal, renowned for its innovative multi-party computation (MPC) wallet infrastructure, has unveiled the eagerly anticipated Vaults Android app. Building on the success of its iOS counterpart, this release represents a transformative leap in digital asset management for Web3 enterprises.

The Liminal Vaults Android app empowers users with seamless oversight of digital assets, enabling on-the-go transaction approvals and collaborative asset management. The app's user-friendly interface integrates groundbreaking secure Multiparty Computation (MPC) technology, simplifying transaction approvals while upholding stringent security standards. With an extra layer of authentication for each transaction, key control remains uncompromised, making it the preferred choice for Web3 organizations. Notably, the 'Share Shard' feature enhances collaborative asset management, enabling secure shard distribution among designated parties. Additionally, the 'Restore Shard via Recovery Zip' feature ensures effortless recovery of shards in cases of data loss or device transitions, guaranteeing continuous access to valuable digital assets.

Commenting on the launch, Dhruvil Shah, SVP of Technology at Liminal, said, "We are excited to bring Liminal's Vaults app for Android users. As the Web3 landscape evolves rapidly, we remain committed to offering a secure and convenient platform tailored to modern businesses and individuals. This app enables secure on-the-go transaction approvals, instilling confidence in managing diverse digital assets seamlessly across devices."

Rahil Shaikh, AVP of Product and Blockchain at Liminal stated, "Innovation is the cornerstone of effective digital asset management. The introduction of the Vaults Android app and the Smart Consolidation feature, alongside new protocol support, reflects our commitment to empowering users with advanced solutions that simplify the complexities of asset handling. These updates seamlessly blend security, efficiency, and convenience, addressing the evolving needs of the Web3 ecosystem."

Committed to empowering Web3 participants, Liminal introduces the Smart Consolidation feature and new protocol support. These enhancements bolster Liminal's mission to bridge the gap between user convenience and robust security, culminating in a comprehensive digital asset management experience.

Smart Consolidation: Enhancing Efficiency

Liminal's "Smart Consolidation" feature revolutionizes digital asset management by automating the consolidation of smaller balances into a single address. This innovation optimizes transaction flow, reducing gas fees and manual efforts, and enhances security by moving wallet balances above a threshold to cold wallets, thereby augmenting protection against potential threats.

New Protocol Support: Expanding Possibilities

The update introduces support for new protocols, including zkEVM, BSC, and AVAX, empowering Web3 enterprises to manage EVM-based assets on the zkEVM chain while benefiting from Liminal's Gas Fee Saver feature. With BSC and AVAX testnet support added to the existing BSC and AVAX mainnet support, Liminal users can now build and test web3 applications across multiple networks.

These advancements underscore Liminal's commitment to remain at the forefront of digital asset management, offering users tools that redefine the secure management of assets.

App download link - https://play.google.com/store/apps/details?id=com.liminal.app

Related News

- 03:00 am

Global sports and entertainment agency, Paradigm Sports, has entered into a strategic partnership with TransferMate, the world’s leading B2B global payments infrastructure provider, to exclusively manage their international FX transfers.

Paradigm represents over 90 elite athletes across more than 32 countries and has negotiated over $1BN worth of contracts to date. As a multi-sport athlete representation, business venture and media platform, Paradigm has created several business ventures that are international in scope. Their businesses span across all sports-related verticals, including consumer products, well-being, fitness, apparel and sports tech.

Paradigm Sports represents athletes all over the world and, with the economic value of combat sport continuing to accelerate, they wanted to find a ‘black-belt’ partner to work on a B2B basis. They found that partner in TransferMate, whose unrivalled global payments infrastructure will enable Paradigm to transfer institutional funds at highly competitive FX rates.

Under the leadership of founder Terry Clune and CEO Sinead Fitzmaurice, TransferMate, a subsidiary of CluneTech, has built the world’s most comprehensive and advanced payments network covering more than 200 countries and territories and 140+ currencies, allowing businesses and individuals to make cross-border payments as easily as if making a domestic funds transfer.

“With the rapid trajectory of growth the sport of MMA has experienced over the last 15 years, the business opportunity around combat sports will continue to evolve even further, as it becomes mainstream in the institutional world,” said Azhar Muhammad Saul, Chief Operating Officer of Paradigm. “Our partners, much like our athletes, are global and that highlighted the requirement to efficiently manage cross-border foreign exchange flows. Transfermate provide a trusted and robust solution to allow us to facilitate that.”

“We are delighted to partner with Paradigm Sports, which has transformed the sports management industry and set itself apart as a multi-sport, media and ventures platform,” said Sinead Fitzmaurice, CEO, TransferMate. “We look forward to supporting them as FX partner across all verticals with our global payments service.”

Related News

- 07:00 am

Tap to Pay on iPhone is now available for SumUp customers in the UK and Netherlands. Using Tap to Pay on iPhone, SumUp merchants can now seamlessly and securely accept all forms of contactless payments, including Apple Pay, contactless credit and debit cards and other digital wallets, using only an iPhone and the free SumUp iOS app, with no additional hardware needed.

The availability for SumUp customers means that merchants - even the smallest, or most recently launched ventures - can accept contactless payments anywhere, as long as they have a compatible iPhone and the SumUp iOS app. Tap to Pay on iPhone is an ideal stepping stone for nano merchants as they look to scale their business and consider payment solutions, alongside other business tools. The service is therefore an important step in democratising digital payments, something which SumUp has pioneered and led for over a decade.

Giovanni Barbieri, SumUp Senior Strategic Growth Manager, said: “SumUp is pleased to announce the availability of Tap to Pay on iPhone. Our mission is to make business simple for our merchants and this roll-out is an extension of our existing work supporting SMEs and merchants of all sizes to get paid. Importantly, Tap to Pay on iPhone is easy, secure and private; protecting both sides of the transaction. I am especially pleased with the exceptional functionality of the product and the fact it lowers barriers to entry, with the potential to fuel entrepreneurship.”

As well as being used by nano merchants as a standalone product, Tap to Pay on iPhone can also be used as a complementary product to card readers and point of sale systems - for example, by service staff at eateries. In

testing, the product was considered by merchants and consumers as being very easy to use.

SumUp has always championed businesses of all sizes. With a portfolio of products, from card readers to invoicing, the online store builder to a business account (and so much more), SumUp makes it easier for merchants to get paid doing what they love. As the needs and demands of business have evolved since the company’s founding in 2012, SumUp has diversified its product suite and expanded its solutions ecosystem.

Tap to Pay on iPhone is the second Apple and SumUp integration, following the 2021 announcement that SumUp would accept Apple Pay across its software and hardware solutions.

Using the built-in features of the iPhone keeps business’ and customers’ data private and secure. Tap to Pay on iPhone accepts all forms of contactless payments, including contactless credit and debit cards, Apple Pay, and other digital wallets. Tap to Pay on iPhone will appear as a payment method in the SumUp app.

The service is available for those with an iPhone XS or later. Apple does not store card numbers on the device or on Apple servers.

Related News

- 08:00 am

Silverbird, a leading fintech platform and an innovator in employee lifecycle solutions, is thrilled to announce that it has been recognized as a finalist in the prestigious 2023 Stevie Awards for Great Employers. This achievement marks a significant milestone for Silverbird and underscores its commitment to revolutionizing the employee experience.

Silverbird has been honored for its outstanding contributions in implementation of HR tech solutions aimed at fostering team productivity, engagement, and retention. Its inclusion as a finalist reflects the company’s commitment to excellence and the profound impact its work has had on reshaping the modern workforce.

More information about Silverbird and its revolutionary employee lifecycle solutions can be found on the company's official website and careers page.

Related News

- 07:00 am

Koverly, a global B2B payments solution providing payment flexibility alongside reduced foreign exchange rates, introduces the only buy now, pay later (BNPL) solution to give a 30-day extension on FX payments at no cost to the buyer or seller. Through the new KoverlyPay service, businesses also have the flexibility to further extend payments over four, eight or 12 fixed weekly installments.

Founded in 2021, Koverly has raised $7.6 million in seed funding from Accomplice VC, Vinyl Capital, and One Way Ventures to build the first payment platform that combines foreign currency and B2B cashflow management designed for international business trade, such as importing. Koverly is currently on target to originate $70 million in new loans over the next year.

Koverly currently processes $200 million annualized volume for both domestic and international payments. Global payment capabilities were introduced to the platform in July 2022 and today account for 50% of Koverly’s volume.

“Inventory is the lifeblood for importing businesses and it is directly impacted by cash flow,” said Igor Ostrovsky, CEO of Koverly. “Our KoverlyPay offering for FX transactions is designed to give businesses enough extra working capital to unlock at least one additional inventory turn per year. For a typical importing business this can boost annual profitability by 50-100%. This is a game changer for global trade.”

Koverly provides U.S. businesses with fast customized underwriting of up to $500,000, determined within 24 hours. The underwriting process does not affect the applicant’s credit score and, once approved, KoverlyPay payment deferral options are seamlessly integrated into the user’s Koverly checkout flow.

When a business chooses KoverlyPay at checkout, Koverly ensures the funds are transferred to the recipient within 1-3 business days after checkout and provides the business with transparent, fixed repayment options.

Some ways global businesses save money and improve their cash flow using Koverly are:

Reduced foreign exchange rates - up to 50% less

No wire transfer fees - up to $40 savings per transaction

Defer FX payments by 30 days at no cost

Further extend bill payments for up to 12 weeks

“Koverly’s option to extend payments over time has been extremely helpful for managing cash flow,” says Roger Scommegna, owner of Flying Blue Imports LLC. “We do a lot of work with holiday gift packages that are sold in large volume to retail outlets, like Costco. As a result, we have to pay for an enormous amount of product 10 months before sales begin. Spreading payments over several months gives us more buying power during this time and frees up capital for other business initiatives, like sales and marketing.”

Related News

- 05:00 am

Account-to-account (A2A) payments provider, EchoPay, and open banking payment infrastructure leader, Token.io, have today announced their partnership to bring A2A payments to wholesale merchants across the United Kingdom.

Underpinned by Token.io’s best-in-class connectivity for A2A payments, EchoPay enables businesses to accept A2A payments at point of sale, providing an additional low-cost payment option with instant settlement and enhanced security.

Recent analysis conducted by EchoPay reveals that the average wholesale transaction amounts to £1,800, incurring average bank charges of £18. Furthermore, since interchange for most commercial cards is not capped in the United Kingdom, wholesale merchants also face higher card fees than consumer-oriented merchants. Harnessing the benefits of open banking-enabled payments to eliminate intermediaries from the payment flow, EchoPay can significantly reduce these charges, resulting in substantial benefits for wholesale merchants.

EchoPay's A2A payment solution can be easily installed on Point of Sale (POS) terminals as a custom tender, allowing merchants to generate QR codes for customers to initiate a frictionless A2A payment directly from their mobile phones. Notably, members of Unitas Wholesale, the UK's largest independent wholesale buying group, with more than 150 independent wholesale members across retail, out-of-home, and specialist channels, have already realised considerable advantages through EchoPay's solution.

Unitas anticipates saving its wholesale members up to £5 million in banking charges this year, thanks to this strategic partnership. Additional cost savings will derive from eliminating the need to share or store sensitive card data, reducing Payment Card Industry Data Security Standard (PCI DSS) scope.

EchoPay's commitment to streamlining payments for wholesalers extends beyond the point of sale. In addition to enabling A2A payments via ‘Clover’ POS terminals, EchoPay also enables Unitas merchants to accept A2A payments through a branded app or credit management dashboard, with support for payment requests via email or WhatsApp through a branded webpage.

James Ward, CEO and Founder of EchoPay, stated: "Our ambition is to help independent wholesalers across the country improve their profitability by reducing their banking charges. Our new partnership with industry leaders Token.io is an important step in enabling even more businesses to discover the benefits of open banking-enabled payments."

A2A payments (often called ‘Pay by Bank’) are a fast and secure way to move money between bank accounts. Open banking-powered A2A payments do not require registration or error-prone data entry, and have Strong Customer Authentication (SCA) built-in, making them a seamless payment method. Payers authenticate A2A payments directly with their bank for a frictionless payment experience that also delivers higher success rates than market standards, particularly for wholesale merchants with high average transaction values.

James Ward continued: "Open banking payments present an opportunity for merchants to offer their customers a fast and convenient alternative to traditional card payments. Transactions using EchoPay cost the wholesaler a flat rate. This is particularly valuable for wholesale merchants operating in a B2B environment with high average transaction values. With EchoPay, merchants can effortlessly generate QR codes to accept A2A payments at the point of sale, ensuring instant payment processing, improved cash flow, mitigated risk of chargebacks, and a clearer view of funds for customers."

Todd Clyde, CEO of Token.io, commented: "We are thrilled to partner with EchoPay to bring the benefits of Pay by Bank solutions to new verticals. The launch of EchoPay is a big step forward in making Pay by Bank available at the point of sale and expanding the benefits of A2A payments to more merchants. In addition to cost savings, Pay by Bank enables better cash flow as payments are settled instantly, and can also be allocated seamlessly for faster, easier reconciliation than invoicing and accepting bank transfers.”

Related News

- 02:00 am

Join the world's leading data conference for top investment banks, asset managers, and insurance groups - FIMA Europe, at the QEII Centre in London this November. Despite the looming macroeconomic crisis, financial institutions are investing in data management to remain competitive.

At FIMA, gain insights on how to adapt your data team, strategies, and capabilities to stay ahead of the curve and drive more significant business impact. You will learn to leverage generative AI responsibly, implement the cloud to access multi-source data faster, adopt a data mesh approach for federated access to more data products, and support your business with necessary data for ESG strategy and sustainable investments.

Join CDOs and their senior leadership teams at FIMA to benchmark your organisation and gain practical insights on managing your data best. Take advantage of this opportunity to connect with leading data leadership teams.

Related News

- 04:00 am

ESG (Environmental, Social, and Governance) has become a top focus for many organisations as customer and shareholder demands for greater commitment grow, coupled with increasing regulatory expectation.

With ESG now a strategic priority and not just an investment or marketing strategy, organisations are implementing these objectives across all business activities. Adding greater relevance to ESG context in particularly pertinent to anti-financial crime controls as there is a tightly woven relationship between the two:

- Environmental crimes - according to The Financial Action Task Force (FATF), environmental crimes like illegal logging, mining, land clearing, waste trafficking, forestry crime, and the illicit wildlife trade generate up to $281 billion per year in unlawful gains. The American FinCen asking banks to watch for transactions linked to environmental crime in 2021.

- Migrant smuggling and human trafficking – human trafficking is one of the most profitable international crimes, generating up to $150 billion every year and affecting almost 50 million people globally and nearly every country in the world.

- Corruption – this can take many forms, such as bribery, embezzlement, or kickbacks, and leads to a souring of an organisation’s governance and could prevent complete compliance with an AML framework.

As such, risktech company, Facctum has outlined three ways organisations can improve the effectiveness of ESG frameworks by optimising AML controls:

1. Ensure the right financial crimes controls are in place, especially in high risk industries

Perpetrators in illegal business practices, such as those outlined above, hide illicit funds via money laundering. As such having stringent and strong AML controls and technology in place is vital to ‘following the money’ and putting an end to such activity. For industries closest to these crimes, such as logging, mining, waste trafficking, and forestry, such stringent controls are vital.

Alongside ensuring an organisation has the right policies and processes in place, subject matter knowledge must be continuously updated, with teams keeping on top of the different crimes that can impact ESG, especially within their industry. Additionally, technology will be key to keeping up with this evolving landscape, with the cloud having already proven to be a key partner in AML tools and AI becoming a potential technology to be leveraged when appropriate.

2. Build a positive AML culture

Regulators such as FinCen and the FCA have highlighted the importance of a positive AML culture, with it being a key element in ensuring a commitment from top to bottom of an organisation in tackling money laundering and terrorism financing as well as see a strong implementation of controls to meet compliance objectives.

To build a positive AML culture, organisations can:

- Re-examine their corporate governance, building ESG and other compliance requirements into its a code of conduct and other policies.

- Provide training for staff on money laundering and financing terrorism, specifically highlighting any compliance obligations around ESG.

- Identify and understand risks – no matter the size. All risks facing a company should be identified and mitigated, and done so regularly, with AML frameworks updated in line with ongoing global guidance and legislation focusing on ESG.

3. Due diligence internally and externally

Know Your Customer practices are well-known within AML practices, but it’s important to consider suppliers and other organisations leveraged across the supply chain as these can often play a large role in ESG activity. Curating a more sustainable and ethical supply chain can be challenging with money laundering often perpetuated through the supply chain, but by taking a KYC approach to suppliers, a more ESG-compliant supply chain can be built.

For this, organisations need to create a thorough due diligence process. This encompasses accessing and verifying companies’ extended ownership structures to highlight the person running the business, regularly. These assessments require a lot of data, from both traditional and alternative sources such as news headlines, social media, and company registries. When building the supply chain due diligence process, and collecting this data, those who are prioritising ESG can build in checks for alignment across their organisations’ values and activities, such as including a check for an anti-slavery policy.

Chrisol Correia, Head of Strategy at Facctum notes:

“AML practices have long helped companies to detect and address financial crime, but they also have a critical role to play in uncovering increasingly sophisticated environmental criminals too. The benefits to this approach are twofold, rewarding those who play by the rules, but also fighting to protect the environment and the degradation of ecosystems by denying the means of those who break the rules to profit from their crimes.”

Related News

Ronald Soans

Principal Advisor at BYLD Group

Financial risk management is a multidimensional endeavour that requires collaboration and engagement from various departments within an organisation. see more