Published

- 07:00 am

P2P lending together with risky assets has all the potential to become an effective strategy for diversifying investment portfolios in terms of risk and return.

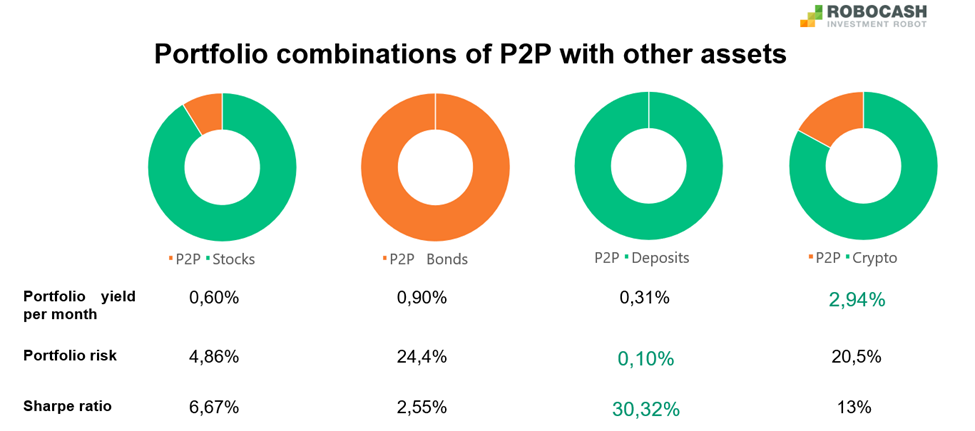

Analysts of the Robo.cash platform have studied multiple portfolio combinations using the Sharpe ratio. The maximum value of the ratio indicates the optimal asset allocation. As a result, 4 options with the highest Sharpe coefficient in each pair were chosen: P2P + Stocks, P2P + Bonds, P2P + Deposits and P2P + Crypto.

“One can see from the figures that P2P could replace bonds in terms of its fixed yield”. - the specialists comment. “But like any investment, P2P lending has certain risks, although it is proving to be effective. To cover the inflation rate, an investor still needs to take risks. As we can see from the results, the combination of P2P with riskier assets looks like a “golden mean” between bonds and deposits in the risk/return ratio.”

When comparing two assets with nearly the same expected return, investing in the asset with the higher Sharpe ratio will be less risky. “P2P lending is a fixed-income instrument, therefore, by the nature of its use it can be compared to deposits or bonds. In the case of assets with non-fixed returns, an aggressive portfolio of P2P and cryptocurrencies, for example, will be more profitable than one of P2P and stocks”. - the specialists add.

With maximum diversification of the portfolio in terms of permissible monthly risk and yield levels, investments in deposits remain the best option. Despite the fact that P2P are proving their efficiency, it will take time for conservative investors to switch from bonds or deposits to this instrument.

Related News

- 01:00 am

Cynergy Bank today announces that it has secured a £20 million Tier 2 capital facility from British Business Investments. The capital will be deployed across Cynergy Bank and Cynergy Business Finance.

The new funding from British Business Investments, a wholly-owned commercial subsidiary of the British Business Bank, will enable the challenger bank to accelerate the delivery of its current business strategy to be the UK’s premier ‘human digital’ bank and market leader in the SME lending space. The Tier 2 Capital facility will also support Cynergy Bank’s growth plans, which includes delivering over £250m of new-to-bank lending across the SME and property sectors.

The £20m subscription has been provided through British Business Investments’ Investment Programme, which is designed to increase the supply and diversity of finance for smaller businesses by boosting the lending capacity of challenger banks and non-bank lenders.

Cynergy Bank’s future growth plans will be underpinned by the rollout of their ‘human digital’ model, combining tailored customer relationship management with the full digitisation of traditional banking products, providing an enhanced range of digitally enabled products and services that serves the blended financial needs of business owners, property entrepreneurs and family businesses. In 2022, Cynergy Bank achieved a profit before tax (PBT) growth of 66% to £50.5m, with a 14% net lending growth bringing its total net lending book to £3.3bn.

Nick Fahy, Chief Executive, Cynergy Bank, comments: “We’re pleased to be working with British Business Investments, and this investment is a truly exciting milestone in our commitment to supporting the financial needs of SMEs and businesses in the UK. This additional funding will boost growth in our business and deliver our strategic objectives over coming years, while also significantly increasing our lending capabilities for SMEs, property entrepreneurs and family businesses.”

Judith Hartley, CEO, British Business Investments, said: “At British Business Investments, our mission is to increase the overall supply and diversity of finance for smaller businesses across the UK. This £20m Tier 2 commitment to Cynergy Bank supports that mission and will help more smaller businesses across the UK access the capital they need to grow.”

Related News

- 08:00 am

ICS Financial Systems Ltd, a leading provider of cutting-edge banking and financial software solutions, is thrilled to announce being named the recipient of the “Best Digital Banking & Finance Software Solutions Award” for the year 2023 by World Finance, the Voice of the Financial Market.

This recognition highlights ICSFS’ unyielding efforts to delivering innovative and transformative software solutions that drive growth and efficiency for Banks and Financial Institutions around the globe.

World Finance is a highly regarded international publication known for its comprehensive coverage of the financial industry. Each year, WF acknowledges the most influential companies and technologies that significantly shaped the banking and finance landscape. This year, ICSFS stood out among the competition for its exceptional software solutions and its profound contribution to the disruptive growth of the banking sector.

With a sharp focus on security, scalability, and open API backend; ICSFS’ award-winning software solution, ICS BANKS® Digital Banking, empowers banks and financial institutions to streamline their operations, enhance customer experiences, adapt to the fast-paced digital ecosystem, and meet the demands of an increasingly tech-savvy customer base.

The recognition by World Finance further solidifies ICSFS’s position as a trusted partner for banks and financial institutions looking to drive digital transformation and achieve sustainable growth. By combining innovative technology with industry expertise, ICSFS continues to revolutionise the banking and finance landscape.

“WORLD FINANCE is delighted to recognize ICS Financial Systems as the winner of the ‘2023 Best Digital Banking & Finance Software Solutions’ award. ICSFS has demonstrated unparalleled technical expertise, innovation, and a commitment to excellence in delivering cutting-edge software solutions to financial institutions worldwide. Their leadership and dedication have allowed them to become a preferred partner for new banks seeking to enhance their operational efficiency, provide a better customer experience, and tackle future challenges. This award is a testament to ICSFS’s outstanding contributions to the banking and finance industry and their steadfast pursuit of excellence.” - Mr. Mustapha Belkouche, Project Director & Investment Consultant - World Finance

"Wael Malkawi, the Executive Director of ICS Financial Systems Ltd, expressed his delight upon receiving this recognition, saying, “We are honoured to be recognized as the “2023 Best Digital Banking & Finance Software Solutions provider” by World Finance. This award validates our continuous efforts to innovate and enable banks and financial institutions to navigate the highly-promising landscape of the digital era, enhance the digital banking experience, offering a wider and more accessible range of touchpoints and services. We remain committed to delivering cutting-edge solutions that enable our clients to stay ahead of the curve and thrive in the ever-changing financial industry." - Mr. Wael Malkawi, Executive Director - ICS Financial Systems Ltd.

ICSFS invests in its software suites by utilising modern technology in launching new products, constructing a secured and agile integration, and keeping pace with new standards and regulations worldwide. ICS BANKS® software suites future-proof banking activities by providing a broad range of features and capabilities with more agility and flexibility, to enrich customers journey experience, hence improving the trust and confidentiality between the customer and the bank. ICS BANKS® has always been a pioneer in utilising the latest technology to serve financial institutions. In addition to its embedded Service-Oriented-Architecture (SOA), the system can be deployed on-premises, hybrid, or cloud.

Related News

- 03:00 am

Paystand, the B2B payments company with the world's largest commercial blockchain, has defied market conditions and experienced a more than 600% growth rate over the past three years. At a time when inflation is an ongoing issue, the stock market remains volatile, and crypto is still in the winter doldrums, Paystand and its customers are growing significantly. This extraordinary ongoing growth has catapulted the company to its fourth straight placement on the Inc. 5000 list of fastest-growing companies. A DeFi fintech unicorn, Paystand enables businesses to pay each other nearly instantly, with zero fees, automating more than $6 billion in payments on its commercial blockchain with more than 600,000 payers across the Americas.

During 2023, interest rates continue to climb, and the recent string of bank failures have shaken the economy. At the same time, Paystand has helped companies—and, by extension, the U.S. economy—to grow. The company provides payments services to the 'real economy' – industries such as manufacturing, logistics, distribution, insurance, solar and renewable energy, and more. These industries have continued to show resilience and growth.

"Since its founding, Paystand has had an unwavering commitment to revolutionize finance," said Jeremy Almond, Paystand co-founder and CEO. "We have helped to radically transform how B2B organizations transact, catalyzing growth not just for us, but for our customers. Last year Paystand processed a full one percent of all U.S. direct account-to-account business payments, which is quite remarkable."

"Our mission is clear: to transform and democratize the global financial network. Our journey extends beyond rewriting financial infrastructure; it's about propelling growth, contributing to American progress, and enabling businesses to defy market conditions with significantly better capital efficiency," Almond said.

"On the heels of Paystand's acquisition of Yaydoo last year and continued expansion into LATAM, Paystand is poised to reshape the future of finance, not just in the U.S., but on a global scale," continued Almond.

Paystand's 'real economy' customers experience a radically outsized impact on their bottom line when they process their payments through the blockchain-enabled Paystand Network. They are able to get their revenue (the lifeblood of their business) in a faster, more scalable way, and ultimately with much lower costs. With Paystand, businesses can avoid the transaction fees associated with credit card usage, which can be as high as 3%, as well as reinvest AR labor costs from staff mired down processing huge numbers of paper checks that are still rampant in the B2B economy.

The decentralized Paystand Network transforms the way merchants transmit and manage money. The Payments-as-a-Service solution significantly streamlines the process and lowers costs; network transactions are zero-fee, settle within one banking day, and are automated with smart AR and AP accounting tools.

According to Paystand customer Kristen Parisien, controller, Global Prescription Management at Covetrus, "Paystand allows us to free up resources, reduce costs, and expedite payments with real-time posting of transactions. It gives us the ability to grow with confidence because our AR process is equipped to handle the pace of our business."

In the past twelve months, Paystand has continued to innovate with the release of several products designed to help its customers prevail in the face of economic challenges. New Paystand products include:

- Smart Treasury Management for AR – Businesses can route receivables automatically as they come in, directing the funds to the bank accounts they deem appropriate. By enabling deposit routing between unlimited banks and financial networks, CFOs can diversify AR Deposits and Treasury, sweeping between multiple institutions and maximizing the FDIC insurance benefits they offer.

- Instant Bill Pay Using AR Funds – As receivables come in, merchants can immediately direct funds to their Paystand Spend Cards without leaving the Paystand Network. With no need to interact with bank accounts, they can use their cards to seamlessly pay vendors and manage operating expenses without the risk, delay or friction associated with first settling to a bank. Merchants also earn 1% back in bitcoin on every card purchase.

- Dynamic Discounting for AR Teams – Seller AR teams can offer early payment discounts, incentivizing buyers to pay sooner. This promotes earlier access to cash and reduces days sales outstanding (DSO), which is especially helpful to businesses during an inflationary period.

"Running a business has only gotten harder since the end of the pandemic," says Inc. Editor-in-Chief Scott Omelianuk. "To make the Inc. 5000—with the fast growth that requires—is truly an accomplishment. Inc. is thrilled to honor the companies that are building our future."

Complete results of the Inc. 5000 list—including company profiles and an interactive database that can be sorted by industry, region, and other criteria—can be found at www.inc.com/inc5000.

Related News

- 05:00 am

Europe has recently witnessed the launch of its first live Central Bank Digital Currency (CBDC) project launched by The Central Bank of Hungary, with Perfinal taking center stage as the fintech backbone of this monumental transition. This remarkable initiative places Perfinal at the forefront of a digital currency revolution, as the financial world grapples with blending traditional mechanisms with new-age digital innovations.

At the helm of Perfinal's involvement is Mate Brezovszki, a seasoned finance expert whose career is a mosaic of top-tier achievements. From institutional banking at renowned international banks in London to pioneering decentralized finance solutions, Mate's journey reflects a rare blend of traditional finance acumen and a foresight into the future of digital currencies. His instrumental role in ushering crypto into the regulated arena highlights his vision for the future of finance.

Mate Brezovszki articulates the current financial zeitgeist, saying, "We are living in the era of a monetary metamorphosis. The number of money-like asset issuers is evolving and expanding. One shared priority emerges amidst this evolution: the safe and transparent management of client holdings. Where this transparency and safety don't exist, they must be addressed."

Perfinal has ingeniously engineered its technology keeping these pivotal principles in mind. By embracing the latest regulatory standards while preserving adaptability, Perfinal ensures its tech is versatile enough to cater to diverse financial use-cases. This duality in design and vision is precisely what impressed the Central Bank of Hungary to commission Perfinal for the CBDC project.

Anikó Szombati, Chief Digital Officer (CDO) at the Central Bank of Hungary, expressed the institution's transformative approach, asserting, "… a central bank not only has to cooperate with FinTechs, but also, feel and act like FinTechs, exploring and serving client needs with the help of agility and technology. Perfinal's role in this achievement was vital, and we are looking forward to future collaborations."

As the financial landscape evolves at breakneck speed, Perfinal firmly positions itself at the vanguard, aligning with institutions eager to pioneer the next wave of financial innovations. The future promises more convergences of traditional and digital finance, and Perfinal stands ready to lead this exciting confluence.

Related News

- 07:00 am

Gate.io, a leading cryptocurrency exchange, announces its plan to upgrade its Proof of Reserves (PoR) guarantees by integrating zero-knowledge (ZK) proof technology. This innovation is expected to bolster the privacy and security of users' asset verification processes during PoR validation.

A Pioneer in Proof of Reserve

Cryptocurrency exchanges have long grappled with concerns over the misappropriation of user deposits, a risk that can trigger fund losses, insolvency, and even bank run-like scenarios.

Gate.io, a pioneer in the realm of reserve guarantees, became the first mainstream exchange to introduce third-party audited Proof of Reserves using the Merkle tree methodology in 2020. This method enabled users to independently verify that their account balance was included and assessed by a licensed external accounting firm.

Gate.io's commitment to transparency and user empowerment was reaffirmed in 2022 when the PoR process was replicated, revealing reserves exceeding user deposits with 108% of BTC and 104% of ETH deposits securely maintained in the exchange's reserves. Striding toward enhancing industry-wide trust, Gate.io made its PoR method open source, inviting fellow digital asset platforms to participate in producing verifiable PoR data.

The next evolution of PoR

This pursuit of innovation continues as Gate.io embarks on the next phase of PoR evolution. The exchange, which currently employs Merkle tree data structures in its PoR method, is set to embrace zero-knowledge proof tech for users' asset verification, which provides additional security and privacy when conducting PoR.

By implementing zero-knowledge tech, which enables data verification without revealing specific information, users are afforded a more central role in verifying their assets are held in reserve. In addition, this shows Gate.io's larger commitment to increasing confidence in the digital asset space, alongside other efforts such as sharing PoR methods publicly and supporting peers through the industry support fund.

"Gate.io's efforts in security, transparency, and user trust within the digital asset landscape define our role in shaping cryptocurrency exchanges. By embracing cutting-edge zero-knowledge proof tech and empowering users, Gate.io aims to foster enhanced security and trust — a new industry standard," said Dr. Lin Han, Founder and CEO of Gate.io.

Related News

- 04:00 am

Velo Payments, Inc. is acquiring YapStone Inc., a leading payment processing platform in the short-term and vacation rental industry, known for its premier payment solution, VacationRentPayment.

The definitive merger agreement signifies a strategic alignment of vision and technology, combining Yapstone's established payfac and MSB licensure with Velo's leading complex disbursements platform for next-generation e-commerce and marketplace business models. Through technologies such as Velo's open banking platform, this merger promises to deliver seamless global payment experiences for businesses and individuals by reducing the cost and complexity of payments, especially across borders.

John Partridge, CEO of Velo Payments, shared his vision for the forthcoming acquisition: "Since we started Velo Payments, our team has been on a mission to create exceptional payment experiences that make our customers' lives easier. YapStone shares our passion for building thoughtful and customer-centric solutions that reduce the complexity of payments, and I am delighted for the team to join us with a singular shared mission. I'm incredibly excited to see what we can build together for customers in the years ahead."

Velo Payments and YapStone customers will benefit from faster payments and reduced transaction fees, delivered via a unified advanced global payment management system built on innovative technologies, including Open Banking, agnostic rails, and robust fraud prevention.

Michael Orlando, CEO of YapStone, expressed his enthusiasm for the future: "The prospect of partnering with Velo Payments sparks an exciting new chapter for YapStone. We can strengthen our commitment to simplifying and optimizing the billions of payments for our customers in the short-term and vacation rental industry (STVR) while expanding our reach into other marketplaces."

The acquisition process will commence within this quarter, subject to standard regulatory approvals and closing conditions.

Related News

- 05:00 am

LexisNexis® Risk Solutions announced its LexisNexis® RiskNarrative™ platform ranked as a Functionality Standout in Celent's 2023 AML (anti-money laundering) Transaction Monitoring (TM) Report.

Celent evaluated 40 software providers worldwide with the final report featuring 17 profiled vendors. Celent used its proprietary ABC methodology to position companies across three dimensions: Advanced Technology, Breadth of Functionality and Customer Base and Support.

As a result of shifts in technology and the supplier landscape, half of the systems profiled in Celent's AML TM systems report were developed by new entrants over the past five to ten years. LexisNexis Risk Solutions began offering AML TM when it launched its RiskNarrative platform in late 2022 shortly after its TruNarrative acquisition earlier in the year.

"The supplier landscape has expanded dramatically with the addition of numerous new regtech entrants offering digitally-enabled solutions," said Neil Katkov, Ph.D, Risk Director at Celent. "The AML TM solution from LexisNexis Risk Solutions is differentiated by its no code platform and AI-based process automation to support fincrime workflows. RiskNarrative earned high marks to place them squarely in the Functionality Standout category."

RiskNarrative is a customer lifecycle management tool specializing in financial crime compliance and fraud prevention. It leverages core technology, capabilities from the company's Dynamic Decision Platform and alternative, third-party services to prevent fraud at the point of application. It allows customers to do this via a single, unified platform utilizing a highly intuitive and easy-to-operate user interface for all financial lifecycle journeys with simple integration and no coding.

Ryan Morrison, vice president of platform strategy, LexisNexis Risk Solutions, said, "We are thrilled with this recognition by Celent as it signifies the success of our team's dedication and work to bring a cutting-edge transaction monitoring solution to market so quickly. We fully intend to take this solid foundation and tirelessly innovate the platform and grow its services to meet customers right where they need it. Customers around the world are already benefiting from our capabilities within a platform that makes risk management as easy to use as a drag-and-drop application. I'm looking forward to seeing how this platform continues to evolve."

Key RiskNarrative platform benefits:

- Helps customers and businesses comply with regulations and protects against fraud.

- Clearly demonstrates AML controls and regulatory compliance to regulators.

- Integrates transaction monitoring with risk scoring at onboarding and ongoing throughout the customer journey, enabling a true single customer view.

- Manages transactional risk effectively across the full customer lifecycle.

- Creates and customizes transaction monitoring strategies, journeys and rulesets easily and as required with reduced reliance on technical support.

- Eliminates irrelevant referrals and alerts, using the virtual agent machine learning algorithm.

- Dynamic risk and compliance management with a more complete view of all transactions.

Related News

Elena Bazhenova

Payment Expert at Exactly.com

In the world of online transactions, businesses have traditionally placed a strong emphasis on payment fees, often striving to minimise them to maximise profi see more

Joe Rodriguez

Sr. Managing Director in Financial Services at Cloudera

The notable failures of regional banks in the US, such as Silicon Valley Bank (SVB) and First Republic, have acted as a warning to financial institutions across the glo see more