Published

- 09:00 am

Path Solutions, the global Islamic banking software company, today announced it has been awarded ‘Best Islamic Fintech Solution Provider’, whereas Mohammed Kateeb, the company’s Group Chairman & CEO won the ‘Islamic Fintech Leader Of The Year’ award of the FINTECH Prize 2020.

Kateeb is an industry veteran with over 30 years of experience having served in various leadership positions driving organizations’ innovation and transformation agendas. He has an unparalleled expertise in applied AI in financial services and assisting organizations to adapt to fintech, as well as offering knowledge into cutting-edge financial technologies to keep organisations technologically current for a more inclusive financial system. He is a founding member of some of the world’s leading incubators and advises fintech hubs on identifying, incubating and scaling new transformational businesses while utilizing emerging technologies such as Digital, AI, ML and Big Data.

“We are honored to be the winners of the FINTECH Prize in two different categories,” commented Kateeb. “The ongoing global pandemic has speeded up digital transformation, underlining the need for deep flexibility for adaptive innovation. Path Solutions clearly displays that capability, creating some of the most impactful technology for the digital financial ecosystem. We are excited to build on this momentum and continue to serve and benefit the banking industry.”

FINTECH Prize Committee recognized Path Solutions as the Islamic banking software company with the winning combination of the most advanced digital technology and the richest and broadest in terms of Islamic functionality. In early 2020, Path Solutions launched two new platforms, Path Digital and Path Intelligence, bringing to market the leading solutions for the new era of banking. By re-certifying its core banking platform by AAOIFI the same year, Path Solutions proved to be the ideal Islamic banking solutions partner of Islamic and non-Islamic banks alike.

“Winners of the FINTECH Prize 2020 are quite impressive. My heartiest congratulations to all and I wish them continued success in 2020 and beyond,” said Mustafa Kugu, President of FASTER Community. “Path Solutions leadership in innovation has differentiated it from the competition. The company is embedding the most advanced digital intelligence-driven tools into its Islamic software suite, with innovative approaches to driving growth and customer value. It deserves even greater recognition given the unprecedented challenges of 2020,” he said.

The FINTECH Prize Committee announced the 2020 winners across 15 categories via video stream on Thursday 3 December. The Awards shine a spotlight on fintech revolutionists and innovators, and fintech companies that have made sizeable contributions to the sector with their innovative approach and capacity to shape the financial services industry. The jury, an international group of executives and industry experts, selected the winners from a pool of 300 submissions received from fintechs and fintech executives. The scale of nominations indicates the huge investments and focus on innovation by fintechs across the globe.

Winners of the FINTECH Prize 2020 can be found here: https://www.fintechprize.com/2020/11/2020-winners.html.

Related News

- 06:00 am

Shopping with small and local businesses has never been more important with almost one third (31%) of the UK’s SMEs relying on the Christmas period to help them survive, according to new research released by Nucleus Commercial Finance.

The research found that one in five (20%) SMEs are anticipating a challenging Christmas trading period - comprising of 18% who think their businesses will suffer over the season, and 2% who believe they will have to close.

While the Christmas season is traditionally one of the busiest times of year for SMEs, the economic impacts of the pandemic mean SMEs are anticipating cut-backs in consumer spending this year with 69% foreseeing a reduction. This may indicate tougher times ahead for SMEs, and, in particular, those who rely on footfall to drive business.

But there may yet be hope for those businesses who have been able to - or are in the process of - integrating digital channels into their businesses models, with 80% of SMEs surveyed believing more shoppers will go online this year, while 41% anticipate an increase in customers shopping with them via online channels in the run up to Christmas.

Despite the looming leanness of the festive season and uncertainty into 2021, almost a third (30%) of SMEs also anticipate a boost in business as a result of shoppers staying local, with 11% believing they will be able to flourish over the next few months and start the new year in a good position.

Chirag Shah, CEO, Nucleus Commercial Finance, said: “2020 has been a year of disruption for people and businesses globally. Here in the UK, we’ve seen remarkable resilience as a result of both government support and the mettle of our SME landscape. The Christmas season ahead will undoubtedly reflect the economic challenges we’ve collectively faced this year, but I am pleased to see some optimism about people choosing to shop locally and support their communities.

“SMEs are vital to the UK economy, so it is crucial we keep supporting them. Adaptability has been key this year - and we are likely to see those businesses who have been able to flex their models to accommodate lockdown restrictions and a need for online channels really reap the rewards this Christmas. And while the road ahead may be rocky, this gives the alternative lending space a chance to step up and demonstrate both commitment and support to our SMEs.”

For more information please visit www.nucleuscommercialfinance.com

Related News

- 07:00 am

OutSystems, a global leader in modern application development platforms, today announced it has entered into a multi-year Strategic Collaboration Agreement (SCA) with Amazon Web Services (AWS). This collaboration will enable OutSystems to deliver deeper integrations with AWS services in the OutSystems Cloud, allowing customers around the world to quickly put to work enhanced DevOps, data and analytics, artificial intelligence/machine learning (AI/ML), and other AWS services in the applications that make a difference to their business.

OutSystems is a modern application platform that helps customers build, run, and manage enterprise applications such as customer experience transformation, workplace innovation, process optimisation, and application modernisation. The combination of OutSystems and AWS provides customers with a better, more efficient way to move even the most complex, mission-critical software to the cloud. With OutSystems and AWS, customers will not only be able to build applications quickly and easily, they can be confident those applications meet the most stringent requirements for scalability, reliability, availability, and security, and those applications will continuously adapt to any changing requirement of the business.

This SCA between OutSystems and AWS will focus on evolving the OutSystems Cloud offering which helps customers of all sizes and types to practice rapid development while streamlining the deployment process into fully managed environments. OutSystems and AWS will collaborate to invest in people, technologies, and processes that will enable more customers to have a seamless experience in adopting OutSystems Cloud whether they are migrating from existing OutSystems offerings or by moving away from traditional development environments already implemented in their organisation. Furthermore, OutSystems and AWS will work together to address the challenges of software developers to innovate faster, remove the constraints of legacy software tools, and accelerate the ability to integrate advanced cloud-based services into applications. OutSystems and AWS will enable a simplified consumption model for OutSystems Cloud by making it available in AWS Marketplace, and invest in the OutSystems Forge marketplace to democratise innovation by the developer community.

“Our relationship with AWS is a foundational component for delivering on our mission to give every organisation the power of innovation through software,” said Paulo Rosado, OutSystems CEO. “OutSystems Cloud enables our customers to develop their applications faster and easier, while leveraging the advantages of AWS. We will continue to support our customer and developer communities by further investing and optimising our platform, as this Strategic Collaboration Agreement provides resources and commitment by both companies to stay focused on providing dramatically greater value.”

“OutSystems shares AWS’s commitment to innovate on behalf of our shared customers, and to create the services and products that they need today,” said Doug Yeum, Head of Global Partner Organization, Amazon Web Services, Inc. “We are delighted to continue our collaboration with OutSystems on augmenting their cloud offering with the breadth and depth of AWS services in areas such as developer tools, data and analytics, and machine learning to provide our shared customers the ability to develop and run applications leveraging the scalability, security, and flexibility that AWS provides.”

“Providing modern digital experiences for our agents and our customers is critically important for Humana,” said Bruce Buttles, Digital Channels Director at Humana. “OutSystems gives us a productivity advantage, along with a single approach to application development that helps us rapidly meet our business needs. The combination of OutSystems and AWS provides us with the agility and enterprise-class capability on which our business depends.”

Related News

- 04:00 am

THETA, the specialist provider of buy-side trading technology as a service, has appointed Neena Dholani as Head of Business Development and a Board Member.

Neena has 25 years of experience in Capital Markets, specialising in fixed income e-commerce and technology sales to the buy-side. She has an in-depth knowledge of applying technology solutions for multi-asset trading across the full order-execution life cycle, including front to back workflows and regulatory frameworks.

Neena joins THETA from FIX Trading Community, where she was Global Marketing and Membership Director. Previous roles include Head of e-Commerce Sales at Commerzbank and Societe Generale, and senior fixed income sales positions at MarketAxess, Credit Suisse and Deutsche Bank.

Neena is responsible for business development globally, as THETA moves from beta towards launching Apollo, its trading system for the buy-side, in Q1 2021. The platform will provide multi-channel liquidity aggregation and trading, initially for Fixed Income, by integrating with clients’ existing P/OMS systems via FIX and REST APIs. FX and Equities trading will be added later in 2021.

Abdullah Hiyatt, THETA Founder & CEO, commented: “Engaging with niche and leading asset managers, equivalent to $5 trillion AUM, we have built the next generation cloud native SaaS multi-asset trading platform, which plugs the gap between current EMS capabilities and the evolving new trading landscape demanded by traders and regulators. Neena’s experience in fixed income and technology sales to the buy-side will be key to our progress, as will her extensive industry relationships.”

Neena Dholani commented: “I have followed THETA’s progress throughout the development of Apollo and am excited to be joining as we progress towards launch. Driven by regulation and cost constraints, buy-side firms have been forced to adopt electronic trading and THETA provides an ideal technology platform to automate these trading workflows.”

Related News

- 06:00 am

Modulr, the payments as a service FinTech, has today announced the Alpha Launch of its Payments Dashboard and accountancy Pathfinder programme, as it gears up to revolutionise the way accountants and bookkeepers manage and make payments for their clients.

The new Payments Dashboard powered by Modulr will deliver greater control, visibility and access to payments capabilities for accountants through accounting and payroll platform connections, multi-step approvals, granular access control and workflow management. The Payments Dashboard forms part of Modulr’s commitments to delivering better banking and payments services to SMEs, funded by the £10m they were awarded from Pool C of the Capability and Innovation Fund (CIF) under the RBS Alternative Remedies Package.

The Payments Dashboard has been built with accountants and for accountants, with a shared belief that too many accountants and bookkeepers, and in turn their SME clients, are held back by slow systems and manual processes. Modulr brings the best technology the fintech sector has to offer, via its intuitive API, as a digital alternative to traditional banking and payments software.

As part of the Alpha Launch, the launch of the Pathfinder programme has seen key thinkers and well known professionals in the accountancy space sign up to be a part of building the future of accountancy innovation. This includes Lucy Cohen, Co-founder of Mazuma Accountants, the leading online accountants for SMEs; Lisa Newton, Founder of Boogles Bookkeeping, the award winning bookkeeping service; Shane Lukas, Managing Director at AVN, leading accountancy coaching and training experts; and Stephen Paul, Chief Executive Officer at Valued, the leading technology based accountancy firm.

Lucy Cohen, Co-Founder at Mazuma accountants, says: “As someone who works with small and micro businesses, I can see how payments can be a real pain point, which is why I wanted to join Modulr’s new Pathfinder programme to help solve this issue.

“Having a dashboard that gives you greater control and visibility, will enable businesses to greatly improve their efficiencies and allow them to concentrate on the parts of the business that drive growth. And for any business, systems like this sit at the core of sustainable growth and control. Getting involved in the Pathfinder programme allows me to help be part of the solution to a universal problem.”

Tom Kelly, strategic accountancy, payroll and employment services lead at Modulr at Modulr, comments: “We see accountants as allies in our bid to drastically improve the financial technology available to SMEs and their accountants today. SMEs have been poorly served when it comes to how their accountants access and manage their financial information and complex payment workflows that keep them running as usual. The slow, manual processes - due to integrations with business banks - are lacking real-time insight and workflow sophistication to be both valuable and useful for their day-to-day needs.

“Working with accountants across the industry, and software providers too, we’re building a product that will give businesses greater control, and their accountants proper and useful insights. All with the aim of driving better business performance and improved financial forecasting.”

To join Modulr’s new programme and become an accountancy pathfinder,

you can register your interest here (practitioners only): www.modulrfinance.com/accountancy-pathfinder

Related News

- 02:00 am

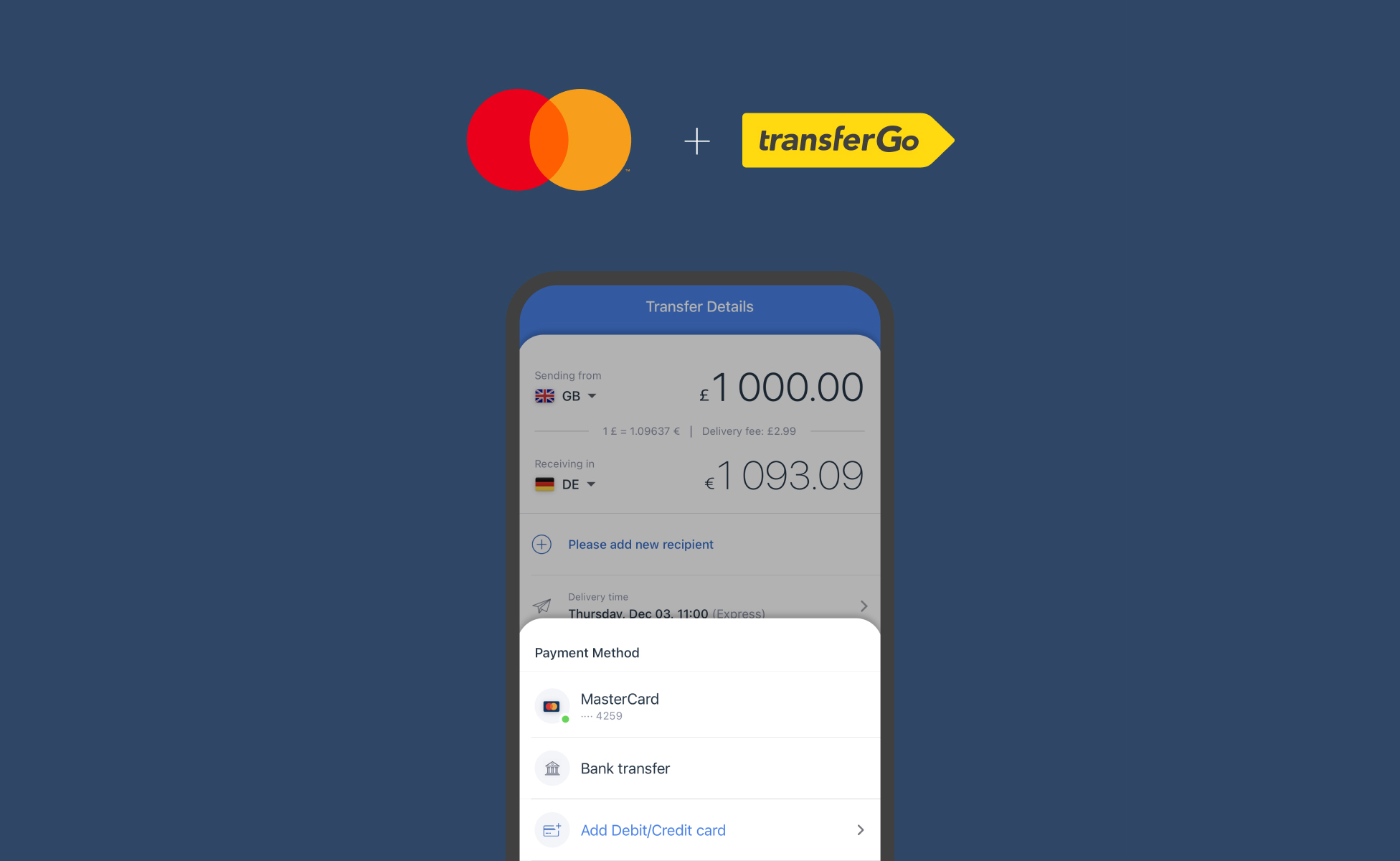

TransferGo and Mastercard have today announced a partnership that enables customers across 20 European countries to make international money transfers from any payment card or bank account directly to a Mastercard debit or credit card.

Leveraging Mastercard Send™, TransferGo customers can now transfer money in real-time to Mastercard card holders in 20 countries: Austria, Bulgaria, Czech Republic, Denmark, Estonia, Germany, Greece, Hungary, Latvia, Lithuania, Poland, Portugal, Romania, Russian Federation, Slovakia, Spain, Sweden, Turkey, Ukraine and the United Kingdom. The payment can be made from any card or bank account directly to a Mastercard card in those countries, thus giving people more choice in how they want to pay and get paid.

Mastercard Send™ enables secure, secure, near real-time payment transfers to and from billions of card, bank and digital accounts around the world, and is part of Mastercard’s multi rail proposition, which enables people and organisations to send and receive money how, where and when they choose.

Commenting on the Mastercard partnership, CEO and co-founder Daumantas Dvilinskas said: “Our partnership with Mastercard comes at a time where this a growing need for strong international digital payments structures – something that has only accelerated during the COVID-19 pandemic. We will continue to be relentless in our support of the evolving needs of both new and existing customers as we develop and implement new technology that allows us to react fast, meet new challenges head-on and achieve new outcomes.”

“Providing people with choice is at the heart of what we do here at Mastercard. Be it domestic or cross-border payments, we want empower people to decide what method of payments best fits their needs at a particular moment,” comments Milan Gauder, Executive Vice President, Products & Innovation at Mastercard Europe. “To that end we are delighted to partner with an innovative company such as TransferGo to reach millions of people around the world to benefit from a fast, safe and reliable international payment solution,” adds Gauder.

With this new offering, customers who want to make international transfers will be able to benefit from the highest security standards provided both by Mastercard and TransferGo. As a licensed authorised payment institution in the UK, TransferGo is held to very strict security standards including keeping personal and financial information safe through modern security technology, including SSL encryption between its servers and the individuals browser. Meanwhile Mastercard’s best-in-class security tools and capabilities provides an additional layer of security for managing regulatory, financial and fraud risks.

One of the world’s fastest growing money transfer companies, TransferGo’s partnership with Mastercard is the latest in its constant cycle of innovation – listening to its customers and looking at ways it can help provide fast, cost-effective money transfer solutions to migrants and businesses. It simplifies people’s payment experiences by bypassing complex online banking services, or look for details that aren’t always easy to find – such as an individual’s International Banking Account Number (IBAN). In just two months (Sept & Oct) TransferGo has doubled its volume of transactions in Ukraine and Russia when sending direct to a recipient’s card.

Related News

- 08:00 am

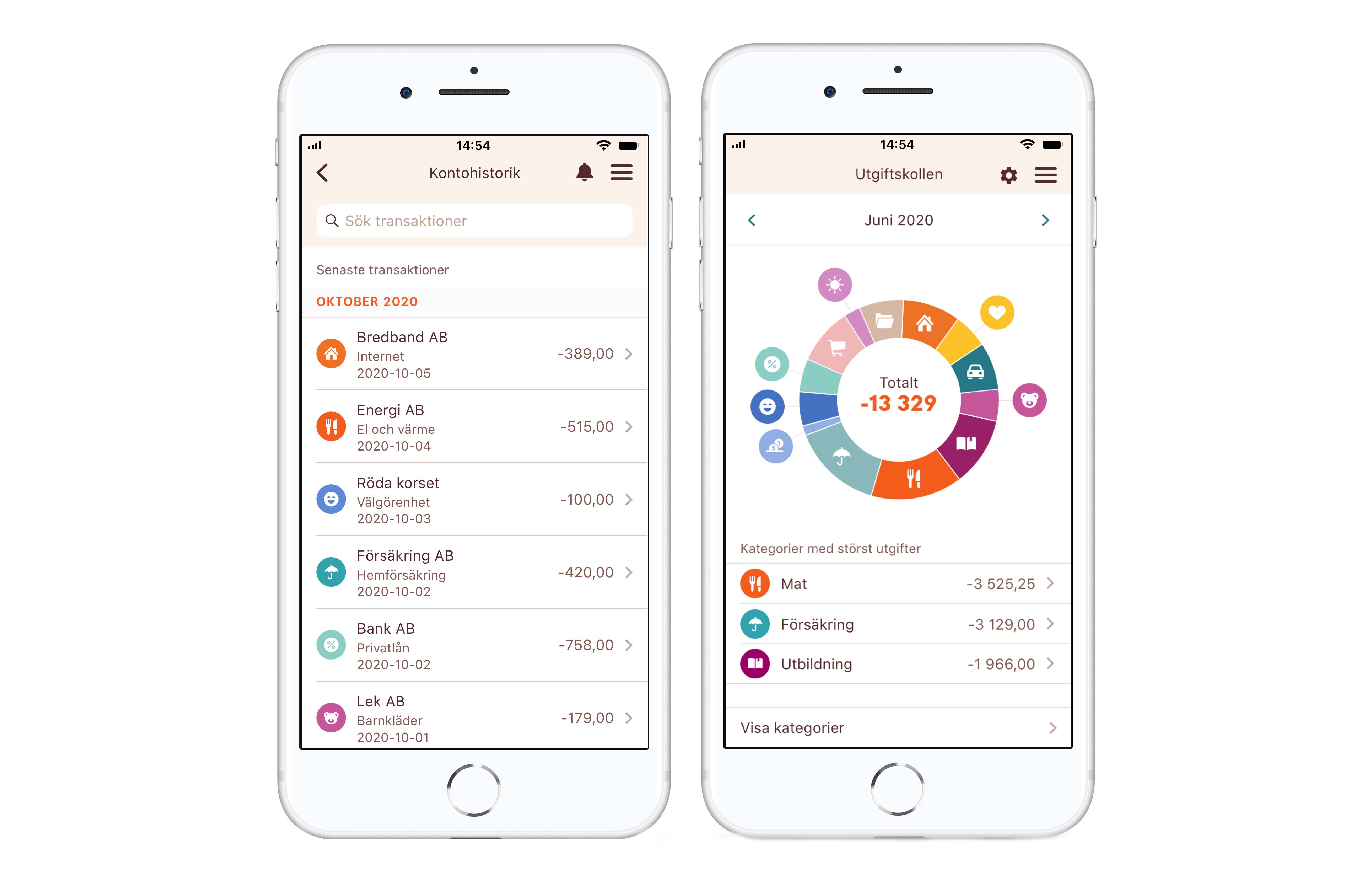

Meniga (www.meniga.com), the global leader in AI-driven digital banking solutions, has partnered with Swedbank, a leading bank in the home markets of Sweden, Estonia, Latvia and Lithuania, to launch new services to increase customer engagement.

The new digital banking solution, now live within all of Swedbank’s markets in Sweden, Estonia, Lithuania and Latvia, is the first product to stem from Meniga’s partnership with Swedbank. Utilising Meniga’s data-driven digital banking technology, the Internet Bank and mobile bank app has been developed to boost customer engagement and improve the overall digital user experience of Swedbank’s customers.

The new functionalities, which are driven by personalised banking data, will offer an easy-to-use and secure solution for everyday banking, helping users to better understand and take control of their finances

The solution relies on Meniga’s platform for the categorisation and enrichment of all transaction data and account history. This provides Swedbank customers with a more immersive and interactive experience, granting them access to real-time data on their spending behavior, while maintaining high customer data integrity

The new services strengthen Swedbank’s digital channels as an everyday financial advisor for its users, with added functionality including:

- Personalised insights & reports

- User friendly budgeting & financial planning

- Dynamic google-like search for specific transactions

- A new mobile bank app start page offering a personalized at-a-glance overview of a customer's financial life

Swedbank’s new digital banking solution is free-to-use and available via the App Store and Google Play.

Georg Ludviksson, CEO & co-founder of Meniga, comments: “We are very excited to have established this great partnership with one of the most reputable financial institutions in the Nordics, which takes us another step closer to strengthening our position as the leading provider of digital banking solutions across Europe and beyond. Meniga has been working meticulously with Swedbank to develop a first-class personal finance management solution with an innovative, engaging and intuitive interface, which will ensure the best possible user experience for its customers. We are delighted to be able to support Swedbank with these services, which we are confident will help millions of potential new customers across the Nordics and Baltics better manage their finances and take control of their own financial health.”

Lotta Lovén, Head of Digital Banking & IT and CIO, Swedbank, said: “We chose Meniga as a strategic partner with innovation capabilities and a broad experience in creating digital customer engagement to support Swedbank in taking the next step in personalized digital services. Key to behavior-based services is the customers’ trust that underlying data integrity and consistency remains intact, which has been a focus throughout our collaboration, and I am very happy with the end result. We now look forward to continue building on the foundation we jointly have created.”

Related News

- 07:00 am

Bittrex Global (Bermuda) Ltd. (Bittrex Global) announced that it will be listing tokenized stocks on its digital asset exchange in cooperation with DigitalAssets.AG. This product will allow traders and investors direct access to listed companies without having to use an external broker or pay additional fees. Shares can be purchased using either US dollars (USD), Tether (USDT) or Bitcoin (BTC), twenty-four hours a day, seven days a week.

The tokenized stocks available through Bittrex Global will allow customers to purchase a fraction of a stock without needing to purchase entire shares, where the underlying risk of the tokens is derived from the tokenized company. Bittrex Global plans to quickly increase their offerings by giving its customers exposure to ETFs, indices, and additional asset classes.

“The traditional stock exchanges of the world’s financial capitals have for centuries set the terms for engagement and trading. Clearing systems are inefficient and complex and trading small volumes can be expensive and take days, all of which is totally unnecessary given the technological advances that have been made in the last decade,” said Bittrex Global’s CEO Tom Albright. “Blockchain technology has the potential to radically broaden access to financial services, and Bittrex Global is very proud to provide people with a portal to build their capital and private wealth in a way that was unimaginable a decade ago.”

Bittrex Global’s diverse customer base can now purchase and trade the following tokenized stocks:

· Tesla (TSLA)

· SPDR S&P 500 ETF (SPY)

· Alibaba (BABA)

· Beyond Meat Inc (BYND)

· Pfizer (PFE)

· Apple (AAPL)

· BioNTech (BNTX)

· Facebook (FB)

· Google (GOOGL)

· Netflix (NFLX)

· Amazon (AMZN)

· Bilibili (BILI)

These tokenized stocks are available even in countries where accessing US stocks through traditional financial instruments is not possible. The tokenization of stocks is the first step towards creating more dynamic and accessible markets where securitized token offerings (STOs) can harness more mature and varied investors. Tokenized stocks can be traded alongside over 250 digital assets listed on the Bittrex Global exchange and marks a significant milestone in the adoption of blockchain technology by traditional financial services.

Related News

n/a

n/a at n/a

There is passive investing in which you don’t have to do much to allow your money to see more

- 04:00 am

FinecoBank today announced that funds from the independent asset manager Carmignac will be available on the Fineco investing platform.

Fineco customers can now access a range of Carmignac products that are managed by a team of experienced fund managers and have a flexible approach combined with active risk management. Products on offer include FP Carmignac European Leaders, a high-conviction, bottom-up European ex-UK Equity strategy and FP Carmignac Patrimoine, a global multi-asset solution focused on long-term growth with a strong track record built up over more than 30 years.

Paolo Di Grazia, deputy general manager, Fineco, said: “We’re proud to offer to our growing customer base the access to a new series of highly recognised products, as we’re noticing a continued demand from our clients for innovative active management solutions. We’re on track to delivering our commitment to further broaden the number of asset managers available on Fineco’s one-stop-solution, through which we’re offering banking, investing and trading services in a single, unified online platform.”

Maxime Carmignac, Managing Director UK Branch, Carmignac, comments: “Fineco has been a long-term partner for Carmignac in Italy and we are delighted to extend this trusted relationship to the UK. At Carmignac, we are committed to actively managing our clients’ savings over the long-term through a concentrated range of funds that have strong expertise. This reinforced partnership with Fineco will allow us to fuel our sustainable development in the UK and provide more investors with investing solutions that meet their long-term objectives and aspirations.”

These new funds further increase the available choices for investors. This year, Fineco has also announced partnerships with JP Morgan Asset Management, Fidelity Investments, Aberdeen Investments, M&G Investments, and Columbia Threadneedle Investments.