Published

- 03:00 am

Innovative trading technology provider, Tora, has today announced that it has further strengthened its fixed income offering by integrating their leading OEMS with Neptune Networks Ltd. The new connection enables clients to view pre-trade analytics from the TORA OEMS to help improve bond execution quality.

Neptune delivers high-quality pre-trade bond market data with real-time connectivity between banks and investors. The platform has 28 global dealers in the network providing the buy-side access to 65,000 axes and inventory positions daily and over $300bn in notional liquidity. Asset class coverage includes Credit, Rates and Emerging Markets. Neptune is uniquely governed by a collaboration of the largest global banks and investors wanting to deliver reliable, relevant, insight-enabled relationships between Buy-Side Investors and Sell-Side Banks.

The new functionality enables clients to see and analyze all axe and inventory data, from the Neptune network, for each bond and for each broker counterparty from within the TORA OEMS. This information is available at point of trade and can help investors to improve their success rates when trading with brokers. The insights provided by the Neptune pre-trade data are critical in helping portfolio managers and traders understand the liquidity around particular issues and so help facilitate increased trading efficiency.

Chris Jenkins, Managing Director at TORA, commented: “The new integration is key for traders looking to improve the execution process for global bonds. TORA’s OEMS allows the user to not only see live pre-trade data in the blotter, but to also see historical data from the Neptune broker network.”

Jenkins continued: “Understanding where liquidity lay historically is often a leading indicator of future sources of liquidity. The TORA OEMS allows clients to take additional steps to build trading rules and indicators based on this dataset. It ultimately, saves the trader time and protects alpha.”

Byron Cooper-Fogarty, Interim CEO of Neptune, said: “We are excited to partner with TORA. The fixed income market has become ever more data-driven in recent years and buy-side clients are continually looking for efficient ways to stream data to help improve trade outcomes. TORA’s OEMS clients are now well-positioned to consume this valuable data.”

TORA’s OEMS provides fixed income traders with sophisticated tools to help streamline their operations and improve trade execution. The platform offers broad access to bond liquidity, and dedicated fixed income OEMS trading tools such as ‘comparable bond’ searches, axe and inventory analysis tools, historical analysis of trade execution and rules to create auto-routing based on bespoke information.

Built as one of the industry’s first cloud-based integrated Order and Execution Management systems over 13 years ago, TORA’s OEMS offers a wealth of functionality covering execution, allocations, risk control, real time positions-keeping and P&L monitoring. TORA OEMS is a single trading system covering global markets in equities, bonds, futures, options and FX.

Related News

- 07:00 am

Greenly, the #1 app for tracking your carbon footprint automatically, enters a partnership with the European open banking platform Tink to offer its mobile application throughout Europe, and enable banks to enrich their own services with a measure of impact, setting a new standard for PFM

Greenly, the fintech that has first brought automated carbon tracking to the public partners with Swedish-founded Tink, to make the Greenly app available throughout Europe.

- Greenly’s users will be able to synchronize their bank accounts for all European banks, and thus benefit from an estimation of the carbon footprint for every expense, in order to make more sustainable choices

- Greenly, which had already integrated its technology into several leading European banks, is thus expanding the distribution of its Carbon Index API to all European players.

- Tracking personal carbon footprint through bank accounts becomes a new European standard. Until now, banking applications only informed users about their financial health. Now, more and more banks will be able to support their customers in their own energy transition thanks to the services offered by Greenly.

- With this partnership, Greenly becomes the first European app and API player in the emerging field of automated carbon impact analysis.

Through its French users alone, Greenly has already gathered the world's largest community of people regularly tracking their carbon footprint, and is now taking its services across Europe with Tink.

Banks across Europe will be able to integrate the Greenly Carbon Index and API into their mobile applications, to analyze every bank transaction and estimate the associated carbon footprint, carbon avoidance in case of a green merchant and suggest more sustainable alternatives automatically.

The ambition of Greenly is to set a new European standard for monitoring one's personal footprint and to encourage as many people as possible to begin acting in full awareness of their impact. In France, 2.5 million users already have the opportunity to estimate their carbon footprint either directly with the Greenly application or through one of its partner banks. The time is ripe to expand this possibility across Europe and scale this solution jointly.

For the end user, the main objective is to support lifestyle changes, by setting a carbon budget and saving money while helping the planet. According to Greenly estimations, changes in individual behavior could reduce users’ personal footprint by 10 to 20%, simply by adopting greener habits, for example by reducing meat consumption, switching to green energies or moving towards low carbon transports. At a country level, the involvement of individuals is essential to achieve the objective set by the United Nations for reducing emissions by 7.6% per year by 2030, to limit global warming to less than 2 °, in line with the Paris Agreement.

Alexis Normand, CEO and co-founder of Greenly, said: “We are at the start of a revolution in payments which will soon all include some measure of impact. Ultimately, if we can help each European save a ton or tow of CO2 emissions per year, this already amounts to planting more than 500 million trees. And the effect is more immediate. Fighting climate change should not be a punishment. On the contrary, we must start rewarding good behavior and what better way to do this than with budgeting apps”.

Jérôme Albus, Director, France and Benelux at Tink, added: “Greenly is leading the way in France thanks to its carbon expertise, and we are delighted to help them accelerate their services across Europe while consolidating their position in France. Helping more people and businesses understand their carbon footprint and enabling them to take action is needed now more than ever."

Related News

- 06:00 am

Reality Gaming Group and Coinify have announced a global partnership for virtual currency payment processing, with the first implementation deployed for the Doctor Who: Worlds Apart digital trading card game.

Doctor Who: Worlds Apart is an officially licensed digital trading card game based on the popular BBC Studios TV series, Doctor Who.

It allows fans of the show to collect digital versions of their favourite Doctor Who characters for the very first time. What’s more, each digital trading card is certified on the blockchain for its authenticity and can never be altered, or have its ownership disputed.

Reality Gaming Group’s new partnership with Copenhagen-based Coinify ensures Doctor Who: Worlds Apart (www.doctorwho-worldsapart.com) players can buy and sell their digital trading cards as part of a secure, financially compliant and completely transparent payment process.

The platform will also be used to power transactions for other Reality Gaming Group digital trading card games, including Emojibles and Smighties Universe.

Morten Rongaard, CEO and Co-Founder of Reality Gaming Group, said: “Doctor Who: Worlds Apart is an extremely important blockchain-based game that will attract a global fan community, so it was a natural step by Reality Gaming Group to partner with the leading payment processor in the virtual currency space, Coinify.”

Coinify CEO Mark Højgaard said: “We are always excited to see initiatives where blockchain technology is being applied in new innovative ways and Doctor Who: Worlds Apart is a perfect example of this.”

To start collecting Doctor Who: Worlds Apart digital trading cards, fans can visit www.doctorwho-worldsapart.com.

Related News

- 09:00 am

LiveMore Capital has become the latest lender to join Criteria Hub, the criteria-based sourcing solution from mortgage technology expert Mortgage Brain.

Criteria Hub provides advisers with the ability to search across thousands of different criteria to identify suitable lenders for their clients, including a host of additional criteria which may not be included on the websites of individual lenders. The range of criteria included on Criteria Hub was expanded in September following feedback from advisers to include the likes of sole application joint proprietor, the maximum number of stories with no lift present, and whether applicants on furlough are considered.

LiveMore Capital is the newest addition to Criteria Hub, with advisers now able to include its range of interest-only products, specifically for people aged 55 and over, in their criteria searches. There are currently more than 70 lenders live on Criteria Hub.

Alison Pallett, Director of Sales at LiveMore Capital, said: “We are delighted to be a part of Criteria Hub. As a specialist lender we are keenly aware of the crucial role played by advisers and eager to support technological innovations like Criteria Hub which can help ease their workloads.”

Neil Wyatt, sales and marketing director at Mortgage Brain, added: “This is an incredibly fast-moving time in the mortgage industry, with lenders changing their products and criteria. We know from the feedback we’ve had from advisers that Criteria Hub has proven invaluable in helping advisers keep on top of these changes and quickly pick out which lenders will consider their clients.”

Related News

- 08:00 am

Fabrick, the Open Banking platform and ecosystem, and Nets, a leading provider of payment solutions and Instant Payments processing, have come together to launch a strategic partnership for creating products, services and new ecosystem business opportunities in the Instant Payments space.

Consumers today can no longer understand or accept that their payments are not processed instantaneously. It makes no sense to them that transactions can be pending on their accounts for days. Instant Payments are driving a transformational shift in the payments landscape, meeting the demands of consumers for immediate and secure payments.

Leveraging the strengths of their respective technologies and platforms, Fabrick and Nets aim to develop innovative solutions that deliver new revenue streams for new and existing clients, such as Slovenian payment processing company Bankart.

Siniša Jančić, Business Development & Innovation Director at Bankart, said of the collaboration: “Launching a nationwide SEPA Instant Credit Transfer (SCTInst) ecosystem with 15 banks and additional services including mobile apps, merchant solutions and fraud prevention was never going to be an easy project. But we are pleased to have achieved it with the help of our friends at Nets and Fabrick, who provided our Flik ecosystem with a state-of-the-art clearing and settlement system, and white label mobile apps. Together, we believe they can help make the dream of a pan-European SCTInst scheme a reality.”

Marco Casartelli, Deputy CEO of Fabrick, said: “This is a compelling initiative for Fabrick. Instant Payments is an integral part of the trend towards a cashless society and it is an important space for us to operate in. Working together, Fabrick and Nets have proven that we deliver quality solutions for our clients and I expect this partnership to build on that record.”

Paul Walvik-Joynt, SVP Payments International Business Development at Nets, said: “Our partnership with Fabrick creates new opportunities to leverage the benefits from instant payments and realise the value of our new OmniBilling platform. Today, we provide instant payment processing across Europe, and further broadening our array of services, adding to Fabrick’s state-of-the-art wallet solution, will boost our efforts to digitise societies and provide an easier tomorrow for our customers.”

Fabrick and Nets have previously cooperated with Bankart on the successful development and launch of Flik, the instant payment solution for Slovenia, which combined Fabrick’s award-winning wallet running on Nets’ Instant Payment solution.

Related News

- 08:00 am

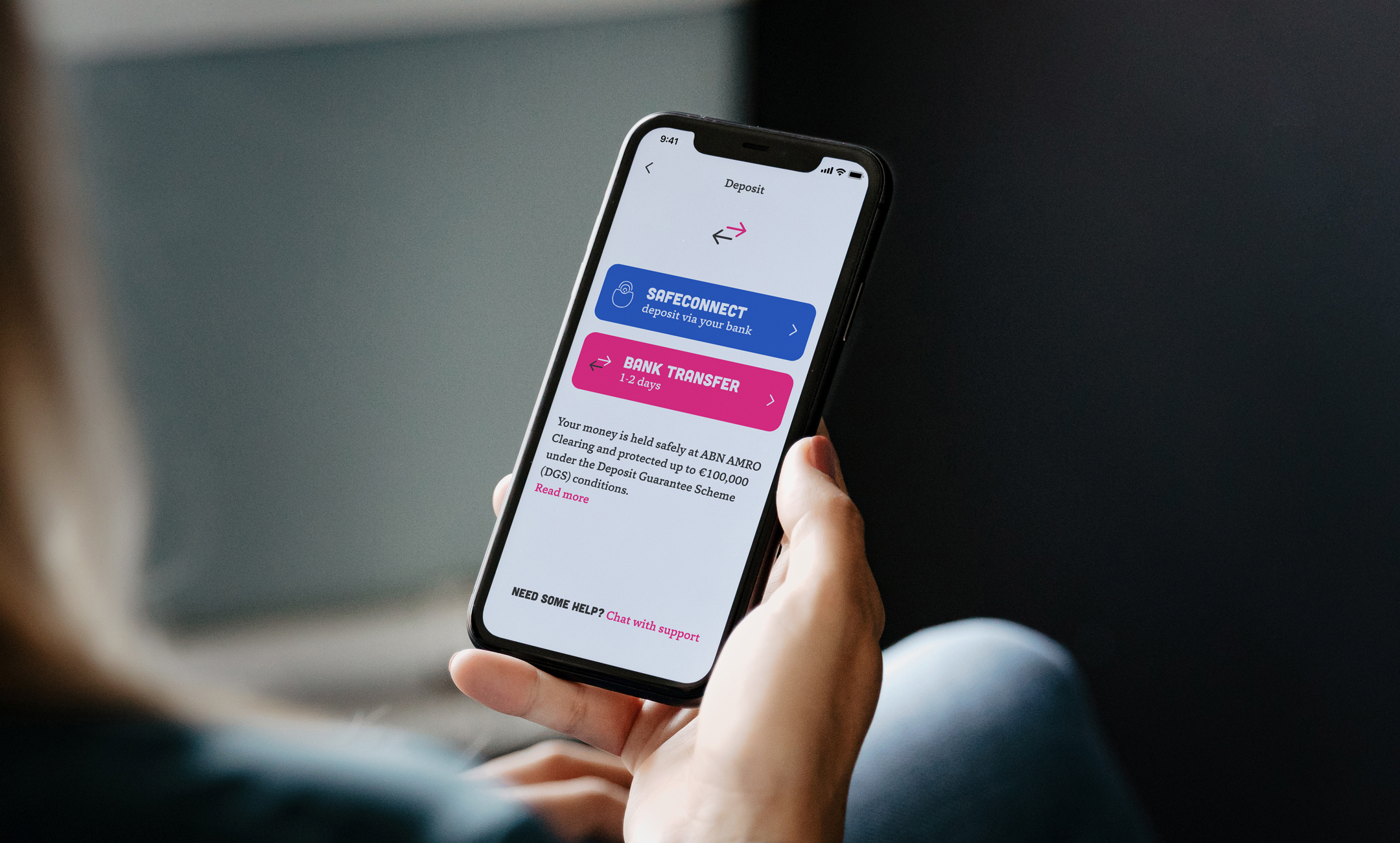

BUX, Europe’s largest neobroker, has announced it has extended its partnership with leading enterprise connectivity platform Yapily to France and Austria. The move will enable French and Austrian BUX Zero users, along with German users already taking advantage, to seamlessly fund their accounts and quickly build an investment portfolio.

Through extending the partnership, even more BUX Zero customers can now conveniently make deposits to their BUX Zero accounts from within their bank’s mobile banking app. Removing the friction involved in investing and opening access to bank accounts.

The market for fintech services has increased significantly across both France and Austria since the implementation of PSD2, to meet the demand from consumers who now expect a more accessible, and friction-free way to manage their finances.

The extension of the BUX and Yapily partnership meets this growing demand head-on - allowing French and Austrian BUX Zero users to begin investing in the brands and companies they care about commission-free, in an easy, and intuitive way. With a simple and quick onboarding solution that benefits from the enhanced security of open banking already in place, funding an account is now equally as quick and simple.

Typically, French and Austrian BUX Zero users funded their accounts through bank transfers; taking on average one working day to arrive. The integration of Yapily’s open banking API enables BUX Zero to enhance even more of its customers’ experience by removing the friction, which speeds up the process in making deposits to their BUX Zero accounts.

The expansion of the partnership further consolidates Yapily’s position in Europe as the backbone of open banking, and the infrastructure that partners need in order to take advantage of the benefits that open finance will bring. Yapily now has near total European coverage.

Nick Bortot, Founder & CEO of BUX, said: "Efficiency and high usability are the core of BUX Zero, which we clearly prove by integrating the Yapily API.

"We are constantly looking for innovations to make the investment experience of our digital native customers even easier. This new generation of investors needs an investment experience that fits their mobile lifestyle. BUX Zero is the first choice for these investors because it offers the right solution for this target group. In the long term, we want to launch BUX Zero throughout Europe and with Yapily, we can best adapt to local markets.”

Stefano Vaccino, CEO of Yapily, said: “We are pleased to announce the extension of our partnership with Bux to France, which is in line with our pan-European strategy. Drawing on our open banking expertise, we have rolled out connectivity in three countries - Germany, France and Austria - which allows regional Bux Zero users to receive a better in-app experience.

“Across Europe, we have seen increasing demand to provide robust infrastructure to support our customers in rolling out the benefits of open banking beyond their native market. We look forward to continuing our work with Bux across Europe.”

Related News

- 03:00 am

Fime has launched India’s first EMV®* Level 1 contactless testing laboratory and certification services in support of the national Make in India initiative. Along with Fime’s comprehensive expertise and technical consultancy services, this latest EMVCo qualification gives manufacturers access to local lab services when launching their contactless payment and transport solutions.

Saving them both time and costs, these services support Indian terminal manufacturers to define, design, deliver and test their contactless terminals. This expanded offering combined with consultancy services boosts Fime’s support for India’s EMV migration, complementing its existing Level 2 and 3 testing.

The Secretary at the Ministry of Housing & Urban Affairs, Government of India, Mr. Durga Shanker Mishra, comments: “With Fime, Indian terminal manufacturers no longer need to travel overseas to obtain their EMVCo Level 1 contactless certification. Fime has already supported a number of local payment and transport projects. This additional support comes at the right time, as the large-scale proliferation of NCMC and AFC Gates in our urban mobility ecosystem is driving demand for EMV terminals.”

The Secretary at Ministry of Electronics & Information Technology, Government of India, Mr. Ajay Prakash Sawhney, adds: “This is a great step forward in supporting the “Make in India” initiative. This facility complements the availability of indigenous quality assurance infrastructure for local payment and transport projects to boost urban mobility ecosystem.”

Mr. Angaj Bhandari, Managing Director of India and South Asia at Fime, adds: “Our consultancy and testing services for India continue to support players with terminal innovation and development. Our experts support every stage of business model and technical development to cut costs and timelines, and achieve successful certifications. With our support, Indian vendors can address local requirements while thinking globally.”

To learn more about how Fime is supporting Indian players to define, design, deliver and test their products and services, visit our website.

*EMV® is a registered trademark in the U.S. and other countries and an unregistered trademark elsewhere. The EMV trademark is owned by EMVCo, LLC.

Related News

- 04:00 am

BidFX, the leading cloud-based provider of electronic foreign exchange (FX) trading solutions, today announced that State Street, one of the world’s leading providers of financial services to institutional investors, has made its four FX algorithmic strategies available on the BidFX platform.

Clients can now access State Street’s FX Algo Suite directly on BidFX. Each strategy offers a wide range of flexibility on executions suited to client requirements and trading preferences.

Mary Leung, Global Head of Client Algos at State Street, commented: “Heightened market volatility caused an unprecedented increase in FX algo volumes back in March, proving that algos are a valuable tool for clients to reduce the cost and increase the efficiency of their execution. With State Street’s unique franchise liquidity, our versatile suite of algorithms are designed to adapt to our clients’ execution style and philosophy, bringing unparalleled value to their performance. As part of our continued commitment to our clients, we’re delighted to expand our algo offering onto BidFX.”

Scott Gold, BidFX Head of Americas Sales, commented: “BidFX has had a long-standing relationship with State Street and it’s exciting to see State Street extending their integration with BidFX through the addition of their four FX algorithmic strategies. Given the premium put on liquidity due to the current circumstances in global markets, our clients have been utilizing more algorithmic strategies to execute efficiently. With that in mind, having the addition of State Street’s algos will deliver further value to the BidFX client base. We therefore welcome State Street as the latest algo provider on BidFX,” he adds.

Related News

- 06:00 am

Onfido, the global identity verification and authentication provider, is today launching its Identity Fraud Report 2020, which reveals that the risk of identity fraud has increased significantly with attacks occurring more frequently since the start of the pandemic.

Over the past 12 months, the average identity document (ID) fraud rate increased by 41% over the previous year as first-time fraudsters appear to be more prevalent, likely due to increased economic hardships during the pandemic. The average ID fraud rate reached 5.8% - up from 4.1% the previous year (Oct 2018-2019). The increase is largely reflective of the significant spike in fraud since April 2020 when most of the world was entering the first phase of lockdown, as rates remained stable during the first few months of the year.

Onfido partners with international criminal police organization INTERPOL on fraud techniques and learnings. The agency contributed to the report noting: “Identity document fraud can take different forms, and both false and genuine documents are used to perpetrate a variety of frauds. The fraudulent use of identity and travel documents therefore presents a threat to the security of countries and their citizens, the economy, and global commerce, and is often linked to organized crime, money laundering and terrorism. Onfido’s Fraud Index addresses specific topics and includes real-life statistics based on their work to uncover deception before it leads to criminal activity.”

Fraudulent activity peaked in July and August. But with large parts of Europe encountering a ‘second wave’ and re-entering lockdown, coupled with the spike in online activity for the holiday shopping season, Onfido predicts fraud rates will start to climb again in the last few months of the year. The explosion in ID fraud since the beginning of the pandemic has also given rise to a number of new trends for identity fraud:

- Fraud is becoming the new ‘side hustle’ – Fraudulent activity tends to increase during crises as the three primary factors of fraud are intensified: opportunity, rationalization and pressure. This year, the proportion of unsophisticated fraud grew 23% year-over-year, from 57% in 2019’s Fraud Report to 70%. Given that the amount of sophisticated attacks stayed the same, at under 1%, this suggests that first-time fraudsters might be trying unsophisticated attacks as a new side hustle outside of their regular work to shield them from the economic downturn.

- ID Fraud is no longer just a 9-5 job – In 2019, Onfido identified that many fraudsters treated it as a 9-5 job: attacks were higher on weekdays and dropped off over the weekends. This year, that has changed. Now, the suspected fraud rate is staying almost level over all seven days of the week. Professional fraudsters appear to be working overtime with the activity level at these times further bolstered by the growing ‘talent pool’ of non-professionals.

- Emerging trends in biometric fraud – In 2020, Onfido has identified a growing use of 2D and even 3D masks to attack both our selfie and video verification products. More troubling still, there has been an increase in replay attacks, where fraudsters attempt to circumvent cameras entirely and upload stolen videos or deep fakes. This was the first year Onfido saw deep fakes used; a tactic likely to quickly grow in popularity as they are cheaper to create than good 3D masks.

- Suspicious behavior now harder to detect – Many legitimate individuals’ purchasing habits have dramatically changed as a result of the pandemic, which has rendered suspicious behavior even harder to spot. With so much volatility in the market, businesses across all industries need to be extra-vigilant and recalibrate their friendly friction threshold; the difficult balance between fraud risk and customer experience.

Michael Van Gestel, Head of Global Document Fraud at Onfido, comments: “There is no question that Covid-19 has catalyzed massive growth in identity fraud attempts, with industries like financial services disproportionately affected. And with sensitive and personally identifiable information easily gleaned from social media and available for sale on the dark web, database checks are just not fit for purpose in this escalated fraud environment. Baking in more sophisticated identity verification methods, such as document and biometric authentication, will ensure that no matter how fraudsters try to capitalize on the changing situation, businesses can significantly lower the risk of fraud to their organization and customers.”

Methodology

The Onfido team of document fraud specialists process millions of identity documents every year, helping over 1,500 clients detect fraud across 4,600 document types from 195 countries. The Identity Fraud Report shares the insights gained on the state of remote identity fraud over the past year, based on analysis of data collected from October 2019 - October 2020 and normalized by client and industry distribution.

Request a demo of Onfido’s award-winning Identity verification technology.

Related News

- 01:00 am

Linedata (LIN:FP), a global provider of credit finance and asset management technology, data and services, today announced an expansion of its strategic partnership with HCL Technologies, a leading next-generation global technology company that helps large global enterprises reimagine their businesses for the digital age. This follows agreements with Inetum (GFI) and Amazon Web Services (AWS) that underpin Linedata’s private and public cloud infrastructure.

In partnership with HCL, Linedata will implement new technologies and processes to enhance the quality, resilience and scalability for its core data center hosting and IT services. Linedata will leverage HCL’s state-of-the-art security services, provided by its global network of Cybersecurity Fusion Centers, and introduce new digital workplace practices with next-generation technologies.

Anvaraly Jiva, founder and CEO of Linedata, said: "Our clients are engaged in wide-ranging processes of digital transformation that touch all aspects of their businesses. With HCL, and our other technology partners, we are accelerating the transformation of our own products, services, and organization to enable and support this. HCL is at the cutting-edge of digital transformation and this partnership improves the scalability of our infrastructure and gives us access to some of the most advanced practices in the industry.”

This new agreement builds on Linedata’s success in working with HCL over the past 7 years on its CapitalStream solution, recently relaunched as a fully cloud-enabled, global platform for commercial loans.

Sudip Lahiri, SVP and Head of Financial Services, Europe, HCL Technologies, said: “We are delighted to be expanding our relationship with Linedata. There is a fantastic synergy between both organizations when it comes to innovation and experience working with financial services clients. This partnership is a great example of how HCL can provide end-to-end hosting platform and product development services for major fintech’s as they look to scale their businesses. Our engagement with Linedata is also further evidence of the great strides HCL has made in the French market in recent years.”