Published

Clifford Bennett

Chief Economist at ACY

- 02:00 am

The summit will feature more than 35 expert speakers, including Cathie Wood, CEO of Ark Invest, and Jane Castor, Mayor of Tampa

Cutting Edge Events LLC is excited to announce additional developments taking place as it prepares for the upcoming Florida Bitcoin & Blockchain Summit (“FBBS”), set to be held at the Amalie Arena in Tampa, Florida, November 4-5th, 2021. Designed to bring together fintech communities, businesses, evangelists and political leaders from all over the world, FBBS aims to become an integral part making Florida a leader within the blockchain and emerging financial technology sectors.

Cutting Edge Events has established a strong reputation for hosting new media and tech-driven conferences. Having earned back-to-back Guinness World Record titles for the largest attendance of a virtual podcasting conference, Cutting Edge Events has proven its ability to stage large and highly engaging events.

FBBS is set to feature more than 35 expert speakers and industry luminaries, including Cathie Wood, CEO of Ark Invest and evangelist of the tech and blockchain industry as a whole, and Jane Castor, Mayor of Tampa. Presenters will share their collective views and thoughts on how best to create and execute strategies that drive growth for the bitcoin and blockchain industries – both inside and outside the State of Florida.

The global economy is increasingly being disrupted through the emergence of novel fintech solutions, which includes cryptocurrencies, non-fungible tokens, decentralized finance, utility tokens and stable coins. The Florida Bitcoin & Blockchain Summit will help attendees develop strategies for successful cryptocurrency and blockchain implementation, learn from real-world case studies, and discover how cryptocurrencies can enable financial inclusion and drive participation within the global financial ecosystem.

In addition to the keynote presentations and panel discussions on the agenda, the Florida Bitcoin & Blockchain Summit will play host to the Reach Dev Workshop, an educational event that will take place on November 5th to help expand attendees’ capabilities in building blockchain applications rapidly and efficiently. Hosted by Reach, the workshop’s overall goal is to empower and enable junior developers to gain familiarity with building blockchain applications, a stepping-stone towards ensuring the continued propagation of decentralized finance applications.

Related News

- 04:00 am

Financial Services digital leaders are invited to learn how Unblu can help them convert customer touch points into transactions that drive revenue

"Digital experiences have become high stakes. Gen Z is building wealth earlier. Getting digital transformation right is critical," said Lisa Joseph, President of Unblu, Americas. "Unblu enables financial institutions to provide the personalized and customer-centric experience through the omnichannel that this emerging mass affluent demographic demands," Joseph explained.

Unblu's enterprise-ready Conversational Platform is at the core of customer conversations, with digital tools that take advisors and clients to next-level engagement.

- Loans: Increase product purchases while reducing complexity and abandonment through seamless journeys that delight customers and give you a +15% lift in conversion rates.

- Digital Advice: Get closer to clients and offer personalized advice with digital tools that increase convenience leveraging your existing authentication technologies.

- Online Meetings: Seize on opportunity by collaborating and co-browsing with clients in an on-demand video meeting that resides inside the institution's security and authentication environment.

- Onboarding: Increase engagement and eliminate friction points through productive 1:1 conversational flow to create a personalized experience that prevents churn.

- Customer Support: Embed assistance inside each touchpoint in the omnichannel to boost customer satisfaction while reducing support calls by as much as +50%.

"Our enterprise platform, industry expertise and loyal customer base of 160+ installations worldwide, is what differentiates Unblu in the market," said Luc Haldimann, CEO of Unblu. "We understand the complex compliance requirements of our customers, and our solutions are designed to exclusively serve the financial industry," Haldimann added.

Unblu enables customers to design exceptional collaboration experiences by embedding them seamlessly into their digital client journeys. Unblu always assures the compliant handling of client data while leveraging the enterprise's existing authentication technology investments.

Related News

- 01:00 am

Lead Sponsor Will Join Major Financial Institutions and Consultancies to Focus on Fixing Data Quality Issues that Impede Regulatory Compliance

Insightful Technology is advising financial institutions planning to pivot to a risk-based electronic communications (eComms) surveillance, to begin working with regulators, to prove the merit of the new approach. The UK company, relied upon by more than 150 banks globally to provide fixed price holistic surveillance and reporting fully inclusive of software, hardware and services across all regulatory data sources, including e&v comms, market data and order management, will make its recommendation at XLoD Global.

Taking place on 17th and 18th November 2021, XLoD Global is a virtual event where the world's leading financial institutions and regulators will discuss the future of non-financial risk and control. Insightful Technology is a lead sponsor for the event, alongside organisations including Accenture, Deloitte, and PwC.

On 17th November 2021 at 09:25 (GMT), Founder, CTO and Technical Evangelist at Insightful Technology, Robert Houghton, will join a panel that includes Deutsche Bank, Goldman Sachs and Westapac, to debate the move towards Risk-Based E-Comms Surveillance. Panellists will discuss - What does risk-based surveillance mean in practical terms? Is it feasible for firms to cease their surveillance on low-risk individuals? What is the regulatory support for taking a risk-based approach?

“There are currently no parameters from regulators of the financial sector to permit risk-based surveillance,” advises Houghton. “If you opt for a risk-based approach, it is imperative to keep the regulator informed regarding the guidelines and processes that will be followed, along with the reporting metrics that demonstrate the outcomes of your risk-based assessments have merit.”

Houghton adds: “The elephant in the room when discussing risk-based surveillance is the fact that many Compliance Officers do not have complete confidence in their data. Solve this bigger problem and a change in surveillance approach isn’t necessary.”

At 16:25 (GMT), Houghton will join representatives from HSBC and Goldman Sachs in a Surveillance Technology Leaders Debate, chaired by Alan Lovell CBE, Former Managing Director, Global Head of Surveillance at HSBC. The 50-minute session will consider the shift from building to buying surveillance technology, question whether teams have the budgets needed to acquire the solutions they need, and what are the opportunities for surveillance teams within technology to integrate across other technology teams?

“Today there are often departmental disconnects, particularly between compliance and IT. As a result, a massive void exists between the actual deployment of systems that capture communications channels and the ability to derive meaningful insight from the data produced.” Concludes Houghton: “It is our responsibility as a market-leading technology vendor to work with financial institutions and consultancies to bridge the gaps. In doing so it will not only facilitate compliance but has the potential to realise and drive value throughout the organisation.”

Related News

- 06:00 am

: Leading online pension provider, PensionBee, has adopted software from global RegTech firm Clausematch to manage its internal policies and controls.

In preparation for its listing on the London Stock Exchange, PensionBee first engaged Clasematch in late 2020. It needed to review and prepare a multitude of documents, and having all of its compliance documentation on a single platform helped to automate several processes.

PensionBee started by using the Clausematch editor which provided a centralised view on all the policies, procedures, standards and controls. It enables the team to collaborate on documents in real-time and track any edits that are made, providing a full audit trail of changes. Staff members can also interact with the policy owners via a designated Q&A function, should they have any questions. The system allows PensionBee to efficiently review and prepare all of its documentation, reducing the amount of time the compliance team spends on low-value administrative compliance tasks, and increasing the team’s overall efficiency.

PensionBee recently on-boarded another product module - the Clausematch Policy Portal - which gives staff members access to the most up-to-date company policies. Every member of the 170-strong team is able to access the platform, which gives users the option to confirm that they have read any new policies and that they will adhere to them. They can search the library of policies, mark their most-viewed documents as favourites, and receive email notifications every time a new policy is released.

Romi Savova, CEO of PensionBee, commented: "PensionBee is committed to transparency and high standards of corporate governance, and compliance automation is an important part of this. Clausematch has helped us organise our company policies in one place to make it as simple as possible for staff to find the information they need while providing a comprehensive audit trail. Streamlining our policy management has removed the need for manual reminders and repetitive admin tasks, freeing up the team to spend more time doing what they do best - helping our customers look forward to a happy retirement.”

Evgeny LIkhoded, CEO and Founder of Clausematch, commented: "We're delighted to be working with such an innovative business as PensionBee empowering the team with our tools for compliance management. Our companies share a lot in common: PensionBee allows savers to combine their pension pots all in one place, while Clausematch allows teams to consolidate all of their compliance documents in a single place in a dynamic format. PensionBee solves the problem of having lots of pension paperwork, and that's what Clausematch does in compliance. We're both on a mission to simplify and deliver the best possible outcomes for our customers: our innovation is a marathon, and we're happy that we're working together."

Related News

- 02:00 am

FSS (Financial Software and Systems), a leading global provider of integrated payment products and a payments processor, announced its Business Support Suite enables BancNet, the Philippines ATM switch operator, bring efficiencies of speed and scale to automate billing, and settlement for all switched transactions among participants, and to provide their members with an efficient dispute platform facility. In 2020, BancNet processed a record one billion transactions through its platform, significantly contributing to the growth of the country’s digital payments economy.

BancNet is a consortium of 124 members comprising banks, cooperatives, electronic money issuers, affiliate switch networks and independent ATM deployers in the Philippines. It has a 31-year track record of building digital payments infrastructure and currently operates a network that spans more than 22,000 ATMs and 400,000 POS terminals.

In the wake of a rapid shift to digital, FSS Business Support Suite helped BancNet modernize legacy, disparate Billing and Settlement systems and improved flexibility and agility to respond to evolving market and regulatory requirements. A full stack offering, the Business Support Suite consolidates critical operations, such as Partner Management, Fees Computation, Partner Settlement, , Billing and Dispute Management, for a wide set of transactions, onto a single platform. The resulting benefits of an integrated approach include reduced operational costs, improved control and visibility across payment processes and lower risk exposure for member banks.

Speaking on the partnership, Krishnan Srinivasan, Chief Operating Officer, FSS PayTech stated, “The Asean market is of strategic importance to FSS. We are proud to collaborate with Philippines’ largest payments consortium to modernise core billing, settlement processes and dispute management among participants for smooth functioning of the payments system. The partnership affirms FSS’ ability to work with central institutions and deliver large-scale digital transformation projects. We remain fully committed and confident that this partnership will contribute to significant digital payments growth in the Philippines and the region.”

BancNet Chief Operations and Technology Officer Arnel Lim said, “For three decades, BancNet has been at the forefront of the payments revolution in the Philippines, building critical payments infrastructure to enable its members to make formal financial services accessible to more people, including financially underserved segments. The efficiency from automating billing and settlement processes, including dispute management among the participants, helps us gain member trust, attracts more participants and more transactions onto our network, advancing our efforts to build inclusive digital payment ecosystems at scale.”

The Business Support Suite automates critical back-office functions and helps maintain financial integrity of the ecosystem, mitigate risk, and foster trust amongst scheme participants. With the Business Support Suite, BancNet can streamline billing, settlement, and dispute management between member institutions for transactions originating from any delivery channel such as ATM, POS, and Internet Gateway. Through partnerships with multiple interchanges – Visa, MasterCard, KFTC , JCB and UnionPay -- the system supports billing and settlement for transactions between member and non-member institutions. Built on a standards-based, open architecture framework, the Business Support Suite simplifies integration with upstream and downstream financial systems such as partner systems, multiple Interchanges, Switch and Core Banking systems. The system is PADSS and OWASP compliant.

Related News

Michael Moran

Senior Currency Strategist at ACY

EUR Climbs, GBP Slips, AUD Flat, EMFX Mixed, Bond Yields Drop see more

- 03:00 am

Award-winning accounting software firm iplicit is on-track to onboard six-times the amount of active daily users taking advantage of its true cloud solution – in under four years.

Launched in January 2019 by the founders of finance solution Exchequer Software Ltd, iplicit integrates with other cloud applications and provides users – from industries including accounting, not-for-profit, recruitment, and education – with real-time reporting capabilities, automated data migration, rapid implementation, and a public API to break down data silos.

More than 350 organisations and 5,000 active users currently access iplicit’s software daily. The London-headquartered organisation also now has international customers in 52 countries and recorded a 162% growth in revenue last year.

To continue its upward trajectory, the business has since deployed an experienced in-house team to specifically build partner relationships with accounting and finance software resellers, and is on-track to deliver its solution to over 2,000 organisations and 30,000 daily users by 2025.

Paul Sparkes, an iplicit director, said: “We’re already speaking to vendors who are frustrated and shackled by legacy, inflexible systems because they no longer want to work this way – effectively with one arm tied behind their backs.

“They’ve outgrown previous software and don’t want the cost or complexity that many software platforms currently offer on the market. They’re looking for efficiency and a way to alleviate overwhelming workloads and time-pressures, utilising the myriad benefits delivered by today’s modern cloud solutions.

“Finance and accounting resellers are absolutely vital when ensuring our product gets into the right mid-market organisations, at the right time. It’s another step forward for iplicit in how we continue to add value for customers, and build on momentum that supports our nationwide and overseas growth ambitions.”

Further software feature roll outs include authorisation workflows to provide organisations with transactions and approvals control, automated currency rates with live updates of exchange rates, dashboards – via iplicit’s mobile app – to better understand KPIs, and purchase-to-pay solutions so businesses have visibility of requisitions, orders, goods received, and invoices. A stock control function is set to be launched before the end of the year.

Additionally, iplicit is on course to becoming an international provider of leading-edge Enterprise Resource Planning (ERP) software, and a mid-market Original Equipment Manufacturer (OEM) partner of choice for existing vendors who currently have legacy, on-premise systems and require a true cloud solution.

An Accounting Excellence ‘mid-market and enterprise accounting software of the year’ 2020 winner, iplicit is also focused on welcoming 20 new recruits in the next 18 months and has recently opened a third office, a Customer Services Centre in Bournemouth, adding to its London and Dublin presence.

Related News

- 08:00 am

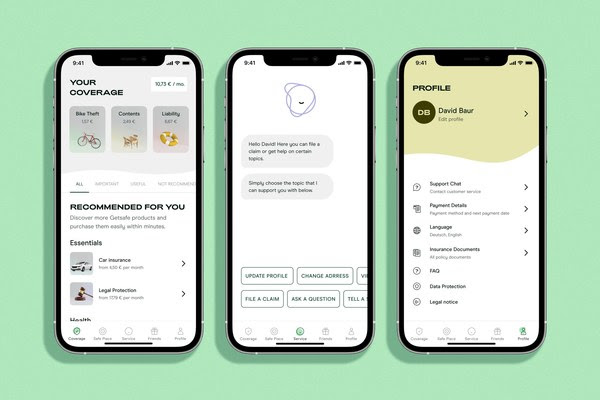

The digital insurer Getsafe received its insurance license from Germany's financial regulator, BaFin. The license will allow Getsafe to accelerate its expansion to the rest of Europe.

"The license is a significant milestone – especially when considering that the German regulator has set out stricter rules for new registrations following the Wirecard scandal", Christian Wiens, CEO and founder of Getsafe, states. The company that started in 2017 as an MGA has high ambitions of becoming Europe's leading digital insurer, and has already started its expansion by launching in the UK. It is serving 250,000 customers.

With a license of its own, Getsafe can now both accelerate its European expansion and build products and innovations quicker than before. The company has closed a reinsurance agreement with Swiss Re, that co-lead its $93m Series B round. "We can now passport our license within the European Union and take full advantage of our technological platform", Wiens says. New European markets like France are under consideration for expansion next year.

Getsafe currently offers home and car insurance and has plans to expand into more verticals – like life and health – in the coming years. Via the app, customers can buy, manage, and adapt their policies as well as file a claim on the go – all in just a few seconds.

"We don't only want to do insurance differently, but we want to make it unconditionally better," Christian Wiens explains. Customers already benefit from a transparent and digital process. Going forward, Getsafe plans to develop new approaches in product development and claims handling. Christian Wiens states: "We will reduce the time it takes to regulate claims and offer even more services via the app. At the end of the day, Getsafe customers are also benefiting from better prices."

Only a couple of weeks ago, the company announced the extension of its series B funding round, which takes Getsafe to $115 million raised to date. With the new capital and a quarter of a million customers, the company ranks among the largest insurtechs in Europe. It is backed by several notable Venture Capital Funds like Earlybird and CommerzVentures as well as Swiss Re.

Following the fundraise and the license, Getsafe is eyeing a public debut in the future. "We have a quarter of a million young customers who will grow with us for an IPO," Wiens says. "We're growing our customer base faster than our competitors and can soon offer more complex products. The insurance license gives us the necessary freedom to take unconventional paths and to realise innovations quicker than before. In the long term, we want to offer our customers holistic insurance coverage from a single source. Now we're really getting started."

Related News

- 05:00 am

ControlUp, the industry leader in Digital Employee Experience management announced today that the Globee® Awards, organizers of world’s premier business awards programs and business ranking lists, has named ControlUp a Gold winner in the 8th Annual 2021 International Best in Business Awards. ControlUp’s employee Digital Experience Management platform was recognized as the Best Product to Reduce the Impact of COVID-19.

ControlUp allows IT administrators to centrally manage both their physical and virtual devices, automate tasks, troubleshoot issues remotely and in real time and automate critical updates to enable seamless access to corporate applications while working remotely.

After the outbreak of the pandemic, ControlUp customers were able to scale up quickly to handle thousands of home offices with the ability to ensure quick and easy access to corporate applications, while keeping load time to a minimum. This was especially critical for the healthcare industry where there was a huge increase in inquiries and requests due to the coronavirus, as well as virtual call centers that were opened immediately for retail, car and home rental, insurance, banking, and investment companies.

“Helping the work-from-anywhere enterprise deliver a great user experience is what customers expect from ControlUp”, said Alexander Rublowsky, Executive Vice President of Marketing at ControlUp. "We are proud to have helped so many organizations around the world meet the changing needs of their employees during the COVID-19 pandemic. This experience is now helping even more enterprises create the flexible, work-from-anywhere experiences that employees demand."