Published

- 03:00 am

The award recognizes Asahi Beverages’ GTreasury-powered cloud treasury transformation, which has equipped the company with new automation-driven treasury capabilities

GTreasury, a treasury and risk management platform provider, today announced that customer Asahi Beverages has been named a highly commended winner as the Best in Class Treasury Solution in ASEAN in the 2021 Adam Smith Awards - Asia. Presented by Treasury Today, the Adam Smith Awards are recognized as an industry benchmark for corporate treasury achievement.

In 2020, Asahi Beverages’ treasury team tapped GTreasury to modernize its treasury and risk management system (TRMS) by introducing cloud functionality, automation, and API-based bank connectivity. The initial phase of this project focused on enhancing Asahi Beverages’ existing treasury system implementation with new modules, expanding risk management capabilities and vastly reducing day-to-day manual work by automating monthly treasury journal preparation, reporting, hedge accounting, and more.

A second phase then expanded the deployment of GTreasury’s cloud-based platform to improve Asahi Beverages’ treasury functionality. This included further workflow and treasury tasks automation – including treasury payments and cash forecasting. With GTreasury’s support, Asahi Beverages eliminated manual efforts around EFT requests, deal tickets, and third-party settlement instructions, and enabled the company’s treasury team to strengthen its crucial control environment by enforcing robust system controls. Asahi Beverages’ treasury ecosystem now links the company directly to banking portals and payment APIs, allowing instant access and functionality. The shift to a cloud-based treasury technology strategy has also eliminated Asahi Beverages’ internal IT team from treasury system support duties, while improving system reliability.

Asahi Beverages’ modernized digital treasury strategy has freed up an estimated 30% of its treasury team’s daily capacity, enabling the company’s crucial shift from a reactive and transactional treasury posture to one that can operate more proactively and strategically. With daily cashflow automatically calculated and available, and cash FX deal settlements completed with a single click, the team now focuses instead on projects that reduce risk (such as scenario analysis). Asahi Beverages’ cloud transformation has similarly future-proofed its treasury tooling, enabling the company to easily utilize new TRMS modules as its needs evolve.

“Our relationship with GTreasury has been tremendously beneficial, transforming our treasury from one focused on daily transactional duties to one that actively pursues strategic value-add initiatives for our business,” said Michael Ewison, Group Treasurer at Asahi Beverages. “GTreasury’s streamlined cloud-based workflows empower us with massive efficiencies and the full advantages of a strategic treasury. We couldn’t be prouder to have these capabilities recognized with the 2021 Adam Smith Awards.”

“Asahi Beverages’ cloud transformation demonstrates the profound potential of treasury technology and automation to drive entirely new strategies and markedly improve day-to-day practices,” said Robert McGuinness, Regional Director, APAC, at GTreasury. “We congratulate Asahi Beverages on its well-deserved accolades from Treasury Today.”

Related News

- 03:00 am

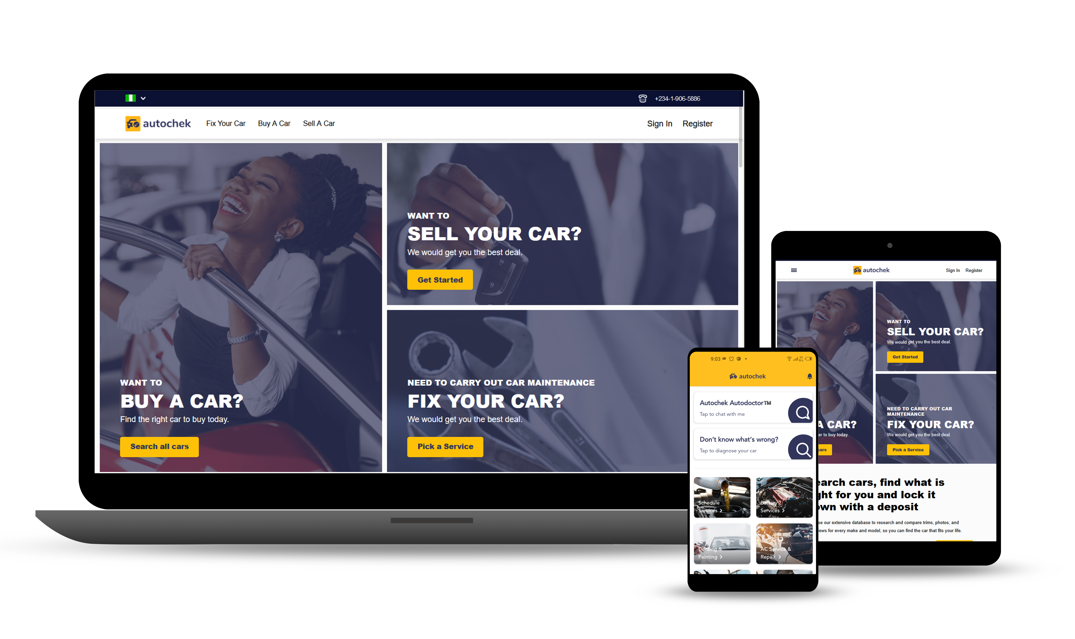

TLcom Capital and 4DX Ventures co-lead round of Africa’s leading Autotech company

Autochek, the automotive technology company facilitating auto financing across Africa, has today secured $13.1mn in seed funding. Co-led by follow-on investors, TLcom Capital and 4DX Ventures, the round also included participation from existing investors, Golden Palm Investments, Enza Capital, Lateral Capital as well as new participants, ASK Capital and Mobility 54 Investment SAS (the venture capital arm of Toyota Tsusho Corporation / CFAO Group).

With the new funding secured just under a year after Autochek's $3.4mn pre-seed raise, the round was preempted by Autochek's lead investors - TLcom Capital and 4DX Ventures. As part of Autochek’s growth strategy, the capital will be deployed to bolster its core auto loan processing platform and deepen its footprint in West Africa, starting with its recent entry into Cote d’Ivoire. Additionally, the company is rapidly expanding its footprint across East Africa, following its recent acquisition of Cheki Kenya and Cheki Uganda, East Africa’s leading online auto marketplace. As part of the investment by Mobility54, Autochek will be leveraging Toyota Tsusho’s vast retail network across 54 African countries to further deepen its expansion.

Launched in October 2020 and operational across East and West Africa in 5 countries - Nigeria, Kenya, Ghana, Uganda and Cote d’Ivoire; Autochek combines technology, underpinned by data analytics to deepen auto finance penetration across the continent. Powered by its residual value algorithm, Autochek has built in-house digital solutions such as Collateral Management, Dealer Management Systems and a proprietary CRM system for managing stakeholder operations within the ecosystem such as vehicle financing, inspection, valuation, and inventory management. Since its pre-seed raise in November 2020, the platform has achieved rapid traction across its business, most notably in the area of auto-financing where the number of processed loan applications rose from just 10 in November to over 46,000 to date.

Autochek has now partnered with 70 banks across the continent including leading regional players such as Access Bank, Ecobank, UBA, Bank of Africa and NCBA Bank. The startup has also achieved several key milestones since the start of the year including over 1,000 dealers on the Autochek network actively using the loan processing solution, and over 15,000 certified and financeable vehicles on the Autochek marketplace across its markets. Over the course of the year, Autochek also launched its truck financing platform and more recently financing of brand-new vehicles.

Speaking on the next phase of Autochek’s rapid growth following its fundraise, Etop Ikpe, Founder and CEO of Autochek, said, “At Autochek, our driving force is to increase financing penetration on the continent; we have been amazed by the market adoption rate and the support from our banking partners in the countries we operate in. We stepped into this space knowing we were tackling one of the most significant challenges for Africa’s automotive sector - the lack of a simplified, digital-first financing process. By combining our expertise and networks, we have been able to make an impact in the automotive sector.

“We are extremely delighted with the progress we’ve made in a short amount of time. With this funding and the support of our strategic investors, the entire team at Autochek are dedicated to delivering exceptional service for customers and partners, as well as deploying our technology across Africa.”

Andreata Muforo, Partner at TLcom, says “Autochek has achieved significant traction in one of Africa’s key verticals and is making impressive progress in bringing transparency and efficiency in this complex and fragmented industry. The foundation of its growth has been the strong leadership of its CEO, Etop Ikpe, a repeat founder in the automotive market whose world-class experience gave us the confidence to initially invest in Autochek in 2020. We look forward to the next chapter of Autochek’s growth as it continues to unlock the major upside which has remained dormant in Africa’s automotive sector for decades.”

Walter Baddoo, Managing Partner at 4DX Ventures, says, “Autochek is revolutionising the auto industry in Africa by offering the convenience and selection advantage of an auto e-commerce platform together with the added flexibility of financing. We have enjoyed working with the team so far, and they have demonstrated the talent, ambition, and domain expertise needed to build a complete end-to-end car ownership experience for customers. We are excited to partner with the team as they pursue the next phase of their growth.”

Despite being a $45bn industry, Africa’s used car market only has a 5% financing penetration rate, marking a major contrast to the rates of 98% and 99% in Europe and the USA respectively. Due to a lack of transparency from the automotive sector, there is no way for lenders to understand the present and residual value of vehicles, creating a significant reluctance to issue loans. However, with Autochek’s established links with car dealerships and 150-point inspection and valuation reports, the company can access vital information on the quality and condition of a range of vehicles, providing lenders with the much-needed trust and transparency to make informed decisions. Based on its algorithms, Autochek is also able to develop a credit profile on behalf of customers and effectively reduce a loan application process from 40-45 days to 48 hours.

The Autochek mobile app is currently available on Android and is due to be launched soon on iOS.

Related News

- 09:00 am

VALTATECH TO IMPLEMENT COUPA PROCURE TO PAY, SUPPLIER INFORMATION MANAGEMENT AND VALTATECH E-INVOICING SOLUTIONS FOR GREENSTONE; INSURANCE DISTRIBUTORS OF BRANDS INCLUDING REAL INSURANCE, AUSTRALIAN SENIORS, RSPCA PET INSURANCE, MEDIBANK LIFE INSURANCE AND GUARDIAN INSURANCE

Greenstone Financial Services (Greenstone), a leading Australian insurance distributor of several well-known insurance brands, has chosen financial process automation experts, Valta Technology Group (Valtatech), to implement, integrate and manage its new Procure to Pay (P2P), supplier information management (SIM) and Peppol e-invoicing solutions.

The insurance distributer has selected Valtatech to both manage its companywide Coupa P2P and SIM module roll-out and implement its own Peppol e-invoicing solution. Implementation of all three solutions will enable Greenstone’s procurement, accounting, finance, and legal teams to drive efficiencies and gain control over the wider business’s previously paper-based procurement, supplier management and invoicing systems thereby improving the Greenstone’s visibility and control over spend; while boosting its ability to satisfy audit demands and reduce costs.

Valtatech’s proprietary e-invoicing solution is a certified Peppol Access Point, which will enable more of Greenstone’s customers and partners to adopt paperless e-invoicing thereby replacing handwritten or scanned PDF invoices and enabling more of the distributor’s procurement spend to be conducted digitally via purchase orders.

Graeme Booth, CFO from Greenstone, says: “Our ongoing partnership with Valtatech will improve our ability to manage our procurement activity and pipeline, giving our teams the visibility and insights they require to improve risk mitigation, due diligence processes and governance; while providing cost savings opportunities and contributing to our CSR environmental goal in moving to largely eliminating paper waste in our day to day operations. Alongside driving improved efficiency in our purchase to pay transactions, invoicing and supplier management processes; our chosen blend of technology, coupled with Valtatech’s extensive cloud and digital transformation experience, mean we can set up the new system with very little disruption to the business or our partners.”

Jussi Karjalainen, Founder and Managing Partner of Valtatech, says: “There has never been a more critical time for finance and procurement leaders to regain control of their procurement and invoicing functions. Now more than ever, back-office and procurement teams are tasked with demonstrating measurable business value and driving real efficiencies, without disrupting their business operations. As procure to pay and source to pay automation experts, we can help organisations, like Greenstone, to adopt best practice and select the right solutions for their needs.”

Related News

- 06:00 am

Four internships working on Experian’s United for Financial Health programme to help communities recover financially from Covid-19

Four Code First Girls graduates have joined Experian to play an important role in developing its United for Financial Health projects in Italy and South Africa.

The graduates will provide Experian with their coding skills and a new perspective on how best to tackle financial exclusion and help communities recover from Covid-19.

Experian is sponsoring the four Code First Girls graduates to complete their Nanodegrees between now and January 2022.

Two of the coders are in the UK, one is in Kenya and one in South Africa. They join Experian as paid graduate interns in EMEA, where they will work on United for Financial Health projects in Italy and South Africa.

Experian will also partner with Code First Girls to host a MOOC (Massive Open Online Course) on October 28. The free one-off taster session is designed for complete beginners and will provide them with examples of leveraging data for good.

Rhona Moodly, HR Director for EMEA at Experian, said: “The United for Financial Health programme is designed to level the playing field for people who are financially excluded, especially as economies recover from the pandemic. We recognise the scale of the challenge means we need to find the best in young tech talent. The Code First Girls graduates will give us a new outlook on the problems we need to solve together, and we know they will achieve so much in their time with us.”

Anna Brailsford, CEO at Code First Girls, said: “We are delighted to see the impact that our partnership with Experian is already having on women around the globe. Opportunities like these internships give Code First Girls graduates the chance to continue improving their skills and get real-world experience of what its like to work in an international business environment. These transformational stories are vital to give women the fair advantage, and their work will have life-changing impact for the individuals involved, their families, and their communities.”

As part of the United for Financial Health programme in Italy, Experian works with two non-profit organisations to create a new credit assessment. It will help people, including the unbanked, who have little or no financial track record and find it difficult to access mainstream financial services.

The coders will help develop the IncludiMi app, which will enable credit ‘invisibles’, including the unbanked, to calculate their financial health using non-traditional data.

While in South Africa, they will be working on a project in partnership with the National Small Business Chamber to educate business owners on their financial and credit health. It will empower them to improve their personal and business credit profiles and improve their chances of accessing funding to run or grow their companies.

Related News

- 07:00 am

-Banorte builds a completely new XVA desk and revamps its PFE limits management-

Murex, the global leader in trading, risk, and processing solutions for capital markets, is pleased to announce that Banorte has successfully implemented Murex’s flagship MX.3 platform for its credit risk management and XVA desk deployment.

Sales, trading and operations teams have relied on the Murex platform for more than a decade. Following an extensive selection process, Murex’s platform was chosen by Banorte to adopt advanced credit risk mitigation technics and enable the organization to deploy a new XVA desk.

Discover more about the benefits brought to Banorte in a case study outlining project specifics.

“We are delighted to see the MX.3 platform is being used by Banorte for its XVA desk,” said Jean Carrer, head of business development in Murex’s Mexico offices. “It strengthens our partnership, paves the way to additional systems replacement and highlights Murex’s position as the leading technology vendor in the credit risk and XVA space in Latin America.”

“At Banorte, we successfully implemented the Murex PFE solution to enhance the analytical credit risk solution we had been using for many years with Murex and deploy more modern credit limit management metrics,” said Abraham M. Izquierdo, FRM: Executive Director, Risk, at Grupo Financiero Banorte. “This rollout of PFE was made possible thanks to our partnership with Murex and its Upgrade as a Service. Within 24 months, we upgraded twice and brought many new functions to our business: collateral, equity desk opening, LIBOR reform, and, of course, PFE and XVA. Murex’s ownership of this process allowed Banorte to focus on our own complete internal operating overhaul for setting up a dedicated XVA desk.”

Related News

- 01:00 am

ION’s WAM solution has been successfully deployed across three regions to optimize EMS’s manganese material flows to its global customers

ION Commodities, a global provider of commodities trading and risk management solutions, announces the successful implementation of ION Commodities WAM Demand Planning and WAM Enterprise Planning solutions at Eramet Marketing Services (EMS).

EMS, a global mining and metallurgy group headquartered in Paris, required an enterprise solution to optimize demand and supply plans and synchronize purchasing, distribution, manufacturing, and delivery to customers. ION’s WAM solution now enables EMS to forecast sales more accurately and minimize delivery costs across its global manganese supply network, while maintaining optimal finished, intermediate, and raw material inventory positions despite market volatility.

ION’s WAM supply chain optimization solution provides a centralized planning system of record. It enables the creation of optimized plans and schedules, provides visibility into global inventories and trades, and generates predictive analytics to guide operations and maximize profitability.

“ION’s WAM solution will improve coordination of our global manganese operations related to ore extraction, transportation, and refining, along with alloy manufacturing and the distribution of finished products to our 1,500 customers worldwide,” said Grégoire Castagna, Value Chain Manager, Eramet.

“We are delighted with the successful implementation of WAM for EMS. This is the latest expansion of ION’s presence in the metals and mining sector globally, providing supply chain management solutions and helping businesses take advantage of new opportunities in changing markets,” said ION Corporates CEO Richard Grossi. “WAM will provide EMS with better visibility of its global manganese operations and performance of its supply chain, enabling it to seamlessly execute its role within Eramet as the vital link between the mining teams, the processing plants, and the customers.”

Related News

- 02:00 am

Open Banking Expo, the leading global community of Open Banking and open finance executives responsible for digital transformation across financial services, will bring the Open Banking and open finance industry in Europe and the UK face to face next Thursday, 4 November.

This year’s event has drawn some of the biggest names from across the breadth of financial services, with the speaker line-up including over 80 leaders in banking and fintech.

The day will kick off on the main stage with a forward-looking panel discussion exploring what is required to build a thriving open finance ecosystem, followed by Marion King, Director of Payments, NatWest Group, who will share her vision for what a payments strategy should look like by 2030.

Other highlights include Dr Ruth Wandhöfer on Stage 2 who will explore the future digital ecosystem and dive into topics like blockchain, distributed ledger technology (DLT) and central bank digital currencies (CBDCs) as potential building blocks of the future economy.

Also on Stage 2, sponsored by European fintech Tink, James Shafe, Head of Consumer and Retail Policy Department, the Financial Conduct Authority, will share the learnings from the Call for Input on Open Finance, which was published earlier this year.

On Stage 3, sponsored by London-based fintech Volt, UK Open Banking Lead at Goldman Sachs Winston Pearson will look into the potential of Open Banking to transform corporate treasury.

And on the fourth, which will be the Payments Stage sponsored by Bottomline Technologies, Chris Hemsley, Managing Director, Payment Systems Regulator, will share about the importance of developing digital payments with people and businesses in mind.

The guests will also hear from the newly appointed Open Banking Implementation Entity (OBIE) Chair, Charlotte Crosswell. As part of the closing keynote on the main stage, she will share her vision for OBIE and the future of open banking in the UK and beyond.

In addition to the rich content, Expo attendees will have plenty of opportunities for networking across a number of spaces, including the Networking Lounge hosted by Klarna, a café hosted by Yapily and barista coffee from Oolys. The event will culminate in the After Party hosted by Equifax.

With Token as its headline sponsor, the event promises to be the biggest industry reunion in over 18 months.

Adam Cox, co-founder of Open Banking Expo, said: “We can’t wait to welcome everyone at the Business Design Centre in London next week. We really worked hard to bring the best speakers and content across four event stages as part of this year’s event. The tickets have been selling fast which only shows how much the industry is looking forward to a face-to-face conversation.”

The latest programme is available on the event’s website.

Hundreds of C-level and senior-level delegates from across the financial services sector are expected to attend and exchange ideas and insights on the future of Open Banking, its governance and roadmap in Europe and the UK.

Related News

- 05:00 am

The additional funds extend Ondato’s seed round to a total of €5.6M, spurred by 4x growth since January

Compliance-as-a-Service startup Ondato has closed a €3.6M seed extension round led by OTB Ventures, LitCapital and Startup Wise Guys, bringing the total amount raised by Ondato so far to €5.6M. The seed extension sees the addition of experienced institutional investors LitCapital, who will provide strategic support as the startup continues to scale rapidly. The funds will be used to expand the team with a focus on high-calibre hires to support new market expansion, product development and operations.

With the explosion of digital banking and the digitisation of other financial services, customer identification and other aspects of KYC compliance have become unavoidable. However, most financial services companies see customer identification as a burden to overcome and quickly tick off a checklist. On the other hand, a smooth onboarding experience can make all the difference to new and existing customers.

This is where Ondato comes in. The company aims to not only provide the highest standard compliance tools, but help turn compliance into a competitive advantage for its clients. To do so, it offers a multi-functional compliance management suite designed specifically for financial institutions, offering integrated solutions for identity verification, data monitoring, screening, due diligence, risk scoring, and case management, all under a single software as a service (SaaS) model.

“We have grown 4X in the last 10 months and substantially expanded our team size and range of services. The data shows us that there is a need to both deepen and widen the use of KYC services. The additional funds will help us sustain a pace of growth that has beaten our expectations. We are also excited to welcome LitCapital on board to enter our next expansion stage. With their backing as experienced institutional investors, we are well positioned for continued growth and a strong Series A in 2022,” said Liudas Kanapienis, co-founder and CEO of Ondato.

“Ondato has identified a unique opportunity in a booming market and successfully built and marketed a product that goes beyond what any other KYC provider has – a truly comprehensive compliance management software making use of the latest technology. We are impressed with what Liudas and his team achieved during such a short period of time, and we are extremely happy to be able to work alongside them,” commented Šarūnas Šiugžda, Founder and Managing Partner at LitCapital, who is also joining Ondato as a Board Member.

Founded in 2016, Ondato has developed software enabling banking institutions to onboard new clients and manage other compliance functions. The company serves over 200 clients in more than 30 countries operating in fintech, banking, insurance, telecommunications, and other related sectors.

Ondato aims to use the additional backing to further focus on product development and customer acquisition in Europe and the US ahead of a planned Series A in early 2022.

Related News

- 03:00 am

Renaissance Insurance handles hundreds of insured events every day, and one of the essential elements of this process is calculating damages to vehicles. Up until now, only experts – Company employees or contractors making independent assessments – were involved in calculating damages. This ensured that the calculations were of high quality, but there were always certain limitations when it came to the speed and cost of making these calculations.

After conducting large-scale and detailed testing, carried out on hundreds cases, the Company decided to begin using an AI service provided by Mains Lab to calculate damages in its commercial operations. The technology is based on computer vision: which parts of the vehicle have suffered damage and the degree of damage are determined; hidden damages and the need to remove or install additional parts for repairs are predicted; catalogue numbers are updated; the vehicle identification number (VIN) is identified; odometer readings and information from registration documents are discerned; the amount of necessary repairs is determined; and a calculation is prepared. The incorporation of this technology will further improve the level of customer service by speeding up the claims process and improving operating efficiency.

“Innovative solutions will have a significant impact on business in the current climate. At the same time, we are changing the essence of the customer experience, as we are reducing the amount time customers have to wait for payment or for their car to be repaired”, says Vladimir Tarasov, Vice President of Renaissance Insurance.

Sergey Khudyakov, one of the co-founders of Mains Lab, said: “Our colleagues from Renaissance Insurance have very stringent requirements when it comes to the quality of the claims process. As our solution was being tested over several months, we got constant feedback from our colleagues, which enabled us to quickly refine the technology for use by the insurance company. I am confident that, if a car owner has an accident, our joint product will make their life a little bit easier.”

Related News

- 01:00 am

- UK Finance departments slow to adopt digital transformation despite acknowledging that manual processes lead to critical errors -

Research into UK SME finance and accounting departments has exposed the sheer lack of digital tools currently used, with just one in five (20%) having adopted the use of automated invoice processing and 39% are still using Excel spreadsheets and manual processes.

The research of over 200 UK finance and accounts payable professionals also revealed that over a third (35%) haven’t automated their accounting processes because they use multiple formats for invoices and don’t want multiple software systems.

This reluctance to adopt automation is, despite acknowledging the faults of manual accounting processes, such as being too time consuming (43%), can result in late payments (29%) and even the loss of financial documents in the past (27%). Others recognised the drawbacks of manual processing as an inability to operate efficiently with the shift to remote working (27%) and the reason for making critical human and admin errors (26%).

Francois Lacas, Deputy Chief of Operations at Purchase to Pay software provider, Yooz, says, “UK businesses are facing many tough challenges at the moment as they, like many businesses across the world, begin their recovery from the pandemic. Add in the challenges brought about by Brexit and it becomes clear that they need to get smart when it comes to business and finance operations. You could make a strong argument that the need for streamlined processes and financial automation has never been more critical for business prosperity as it is now.”

The independent research, commissioned by Yooz, also found that a quarter (25%) of UK finance leaders say it takes their business anywhere between one and seven days to process a supplier invoice. According to Government figures there are six million SMEs in the UK, meaning that 1.5 million UK businesses are taking longer than necessary to process supplier invoices.

Lacas continues, “By automating financial processing, not only are you saving financial resources, but your employee resources, too. Your finance team is critical to your business's success. When automating these processes, all of the work is done automatically for your team.”

A further 6% of companies, which equates to 360,000, admitted to taking more than seven days to process supplier invoices. When you consider that SMEs account for three fifths of the UK employment and around half of the UKs annual turnover, can they afford to be reliant on slow invoice processing.

Lacas concludes, “Now is the time for businesses to seize the opportunity to embrace new technology and a better way of working.”