Published

- 08:00 am

AppGallery users in the UK can now access and manage their personal finances across different banks, using the power of Open Banking and Huawei’s HMS Core technology

Snoop recently won the ‘Innovation of the Year’ category at the 2021 British Bank Awards

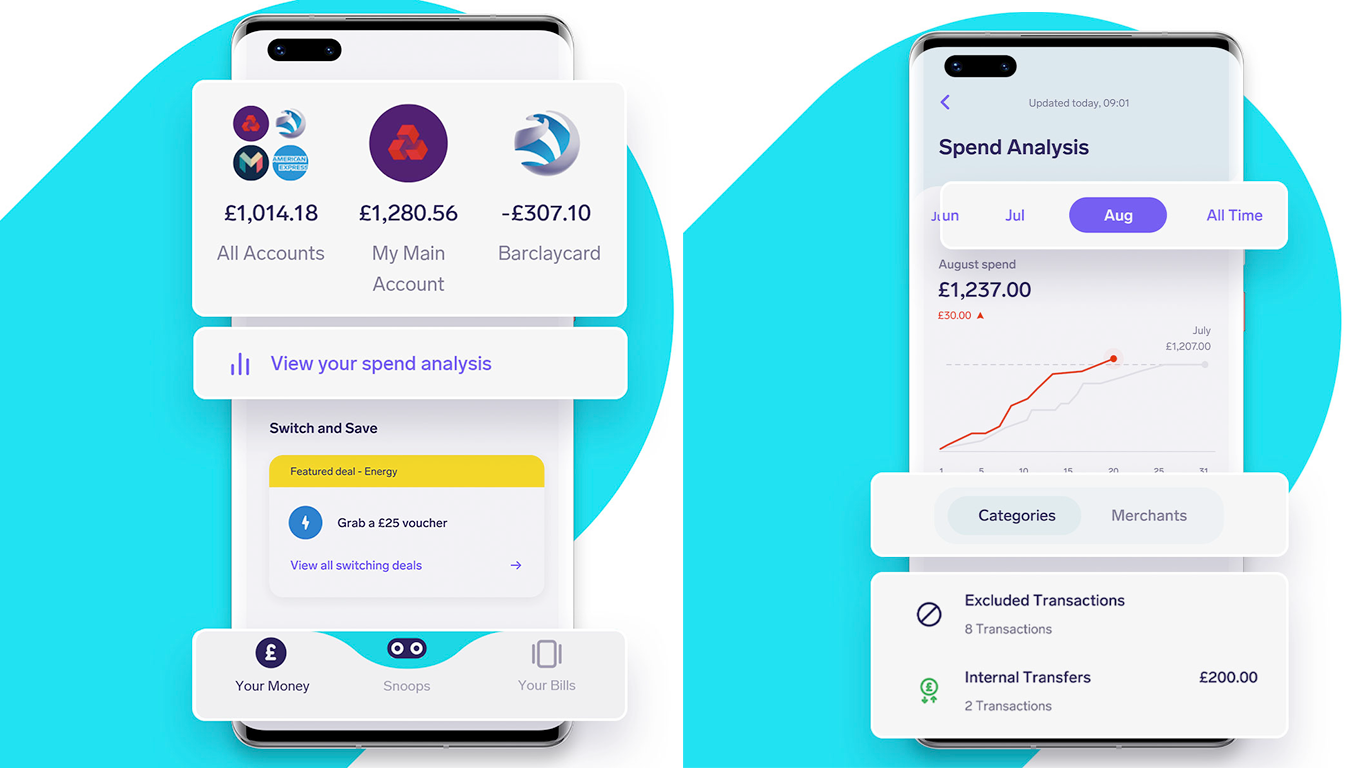

AppGallery, one of the top three app marketplaces globally, has announced the launch of Snoop in the UK, providing users with access to money management tools across different banks.

Using open banking technology, Snoop offers its users’ increased visibility over their personal finances through a one-stop platform that collates bank accounts, credit cards and transaction data in one place. With over 50 UK financial companies working in collaboration with Snoop − including top high street banks and credit card providers such as Lloyds, Halifax, Barclays, HSBC, NatWest and Santander − AppGallery users in the UK can now access their favourite financial services in a seamless and organised manner.

“Our award-winning app uses Open Banking and advanced analytics to help people spend, save and live smarter,” said Antony Simm, Cofounder at Snoop. “The app’s personalised money-saving insights can save the average household £1,500 per year and we’re thrilled to be partnering with Huawei to help make everyone better off.”

Improving user control through financial transparency

Snoop is committed to improving the overall digital finance experience. The app uses AI technology to scan transaction data and find smarter ways for users to save their money, providing tailor-made and relevant insights based on individual spending habits. UK-based users can now realise their saving capabilities through Snoop’s bespoke money switch recommendations, helping them to maintain a healthy financial life.

Huawei empowers its partners through its HMS Core capabilities

Through AppGallery and its innovative HMS Core capabilities, Huawei is committed to offering its partners the technology and support they need to expand both their app offering and userbase.

Integrating with Huawei’s Core, Push, Analytics and Ads Kit, Snoop demonstrates how developers in the financial services sector can be amongst those leveraging Huawei’s innovative HMS Core to bring enhanced app experience to all AppGallery users.

Huawei – driving financial health through AppGallery

Through its partnership with Snoop, Huawei continues to demonstrate its commitment to AppGallery users in the UK, leveraging open banking capabilities to provide access to over 50 UK financial services companies.

“At Huawei, we’re passionate about providing our users with access to a choice of financial services and apps” said Siri G. Børsum, Global VP Finance Vertical Eco-development & Partnerships at Huawei Consumer Business Group. “By driving competition in the digital financial services space, we’re encouraging this access to choice, by which we hope to increase global financial health overall.”

Those using Huawei devices can now install the app from AppGallery, securely authenticating their ‘online banking’ sign in for 90 days before requiring re-authentication. In doing so, Huawei encourages a more secure and reliable experience and remains committed to protecting its users' data.

Related News

- 02:00 am

Bitcoin Latinum (LTNM), the next generation, insured, asset-backed cryptocurrency, has officially listed on the DigiFinex exchange, opening over 200% in its first hour of trading. Bitcoin Latinum congratulates DigiFinex on a successful launch, and everyone who has supported the project.

Monsoon Blockchain, Bitcoin Latinum’s lead developer, has announced plans for Bitcoin Latinum to officially list on seven top-tier public exchanges, under the ticker LTNM. In addition to DigiFinex, the exchanges are: HitBTC (the fifth largest exchange by volume at $4 billion), FMFW (formerly Bitcoin.com and operating with $3.3 billion in daily trading volume), Changelly ($2.71 billion in daily volume), Changelly Pro, Bitmart ($1.6 billion in daily volume), and XT.com by the end of 2021.

Headquartered in Singapore, DigiFinex boasts over 4 million users across the globe, and can be accessed by users in 150 countries. With daily trading volume around $1 billion, DigiFinex is one of the top rated global cryptocurrency exchanges that offers spot, leverage, perpetual trading, and fiat to crypto trading. In addition, DigiFinex offers unparalleled 24/7 customer service for its user base. For more information about DigiFinex, please visit https://www.digifinex.com/

Bitcoin Latinum was built as an open-architecture cryptocurrency technology, capable of handling large transaction volume, cybersecurity, and digital asset management. Based on the Bitcoin ecosystem, Bitcoin Latinum was developed by Monsoon Blockchain Corporation on behalf of the Bitcoin Latinum Foundation. LTNM is a greener, faster, and more secure version of Bitcoin, and is poised to revolutionize digital transactions.

Unlike other crypto assets, LTNM is insured, and backed by real-world and digital assets. Its asset backing is held in a fund model, so that base asset value increases over time. It accelerates this asset-backed funds growth by depositing 80% of the transaction fee back into the asset fund that backs the currency. Thus, the more Bitcoin Latinum is adopted, the faster its asset funds grow, creating a self-inflating currency. The listing on DigiFinex highlights Bitcoin Latinum Foundation’s commitment to supporting the growth of a sustainable crypto ecosystem.

Bitcoin Latinum was developed with a highly scalable network that will initially support up to 10,000 transactions per second and millions of transactions per day to facilitate retail transactions. With its Proof of Stake (PoS) consensus method, Bitcoin Latinum ensures the network facilitates more transactions per minute at lower transaction fees. Utilizing an efficient consensus mechanism, Bitcoin Latinum provides a much better on-chain payment network compared to Bitcoin, with an average transaction confirmation in 3-5 seconds.

LTNM is one of the greenest cryptocurrencies in existence, and recently joined the Crypto Climate Accord. Utilizing its advanced Proof of Stake (PoS) mechanism, LTNM holders will earn rewards for holding their coins as collateral to stake on the Bitcoin Latinum network. This leads to less electricity consumption. LTNM reduces the energy consumption to only 0.00015 kWh per transaction.

For more information about Bitcoin Latinum, please visit https://bitcoinlatinum.com

Related News

- 03:00 am

A new partnership is riding to the rescue of would-be motorbike owners who have been unable to purchase a bike in the past due to poor credit ratings.

Micro Insurance Company (MIC), which specializes in offering custom insurance solutions, has teamed up with CrediOrbe to create an innovative insurance alternative for people seeking a loan to buy a motorbike.

Colombian motorcycle credit business, CrediOrbe, was receiving tens of thousands of calls a month from individuals looking for a loan, but was only able to offer financing to less than 4% of these customers. The reason is because the remaining callers failed credit checks, as many of these people work in the informal sector, without a regular paycheck.

As a result, MIC partnered with CrediOrbe to create an insurance product that would also provide a solution to those who were walking away empty handed. CrediOrbe's investors launched Foriu – a new business that offers an insurance alternative for people who want to buy a motorbike but are refused a loan by CrediOrbe. These affordable policies not only provide customers with a great insurance product, but also help individuals to build a credit history. Thus, if in a few months' time they still want a loan to purchase a motorbike, they can go back to CrediOrbe and show a positive track record of making payments on time, and get approved.

Foriu is the partner of CrediOrbe offering these affordable insurance policies that are designed and created by MIC. With premiums starting from as little as $2 a month, the policy is within reach of most CrediOrbe customers in Colombia.

Richard Leftley, EVP of Micro Insurance Company, says:

| “With CrediOrbe unable to offer motorcycle loans to many thousands of people every month, we looked at creating a solution. We explored what other insurance products could be sold to people who didn’t secure motorbike financing. The result is Foriu. Now, instead of being offered nothing, callers to CrediOrbe are instead guided in the right direction. As an alternative to a motorbike loan, they can sign up for a really great insurance policy which, in time, will lead them to eventually securing the loan they were initially after.” |

Mariana Gallego, Commercial Manager and Digital Transformation of Foriu, adds:

| “We see this as a win, win, win! The company gets to provide additional financial products to our clients, grow our insurance distribution arm, and clients get a great insurance product that was not previously available in Colombia. They also start to build credit which they can use in the future to purchase a motorbike and fulfill their dreams.” |

Related News

Galit Michel

VP of Payments at Forter

For the past ten years, globalisation and digitalisation have changed the way companies connect with consumers around the world, enabling consumers to shop across borders seamles see more

- 05:00 am

bunq, the Amsterdam-based digital challenger bank, has partnered with Currencycloud, the experts in simplifying business in a multi-currency world, to deliver a truly international bank account for the post-pandemic era.

Whether getting paid or making a payment, bunq's multi-currency accounts with enhanced local capabilities will give users the freedom and control to manage, receive and pay funds in different currencies.

Initially bunq customers will benefit from five new currencies, including USD and GBP accounts. These are in addition to the existing Euros accounts that can accept funds via SWIFT and local payment schemes, delivered using the Currencycloud Spark multi-currency e-wallet solution.

Ali Niknam, Founder and CEO of bunq, commented: “We are truly excited to launch our ‘Local Currency’ account today. This will bring huge benefits to all bunq personal and business users, giving them the freedom to easily use multiple currencies without ever have to leave the bunq app.”

Nick Cheetham, Chief Revenue Officer at Currencycloud, said: “We have watched bunq go from strength to strength across Europe and we are thrilled to be working with them to expand their offering and reach new markets through the benefits offered by Currencycloud Spark.”

With the ability to hold USD and GBP already integrated, accounts in further currencies will be added in the coming months.

Related News

Galit Michel

VP of Payments at Forter

The UK Financial Conduct Authority ( see more

- 01:00 am

New storage server makes archive data actively available, providing greater flexibility to customers

Qumulo, the breakthrough leader in radically simplifying enterprise file data management across hybrid cloud environments, today unveiled the Qumulo Certified K-432T appliance, a new active archive platform for Qumulo® Server Q. The cutting-edge K-432T system provides Qumulo customers with high-density archives that deliver consistent active archive performance at massive scale. The K-432T is immediately available from Arrow Electronics, Inc.

As file data continues to grow exponentially, it is a challenge for organizations to manage this valuable asset with the resources they have. Meanwhile, long-term data retention requirements in industries from financial services to healthcare and beyond make this challenge even greater as data footprints grow year after year with content retained to meet compliance requirements. With the K-432T, customers can manage massive amounts of long-term archive data with consistent performance for regular use, eliminating the need for off-line cold storage such as tape, cloud archive and lower performance legacy storage systems. Built with 24 18TB hard drives per node, the largest available on the market, the K-432T is the highest density and highest capacity archive platform that Qumulo has certified to date, capable of clusters of over 34PB.

“At Qumulo, we continue to expand our platform portfolio to offer customers greater flexibility and freedom to build their unstructured data lakes with the capabilities they need from the best-of-breed technology options,” said Jason Sturgeon, Server Q Product Leader at Qumulo. “We’re excited to offer customers the Qumulo Certified K-432T. Not only will it allow administrators to manage more data within a single cluster, it will also help reduce operational overhead and improve data user access experiences.”

According to the Active Archive Alliance’s 2021 Report, organizations today are working to capitalize on active archiving’s lower cost, AI-driven analytics and cybersecurity to regain lost revenue and improve competitive advantage (1). The K-432T solution addresses these concerns and more. Its ability to scale to over 34 PB yields lower upfront costs as well as power, networking, and data center space, providing even better TCO for customers.

“Managing data with Qumulo is so simple it’s hard to describe the impact. It has given us tremendous ROI in terms of time saved and problems eliminated, and having that reliable storage we can finally trust makes us eager to use it more broadly throughout the company,” said John Beck, IT manager at Hyundai MOBIS.

To learn more about how the Qumulo Certified K-432T can simplify your largest unstructured data storage use cases, contact us today.

Related News

- 08:00 am

Planixs, the leading provider of real-time, intraday cash, collateral and liquidity management solutions, is thrilled to announce that it has made Business Cloud’s FinTech 50 ranking for 2021 and has been named the leader in its category.

The ranking celebrates the UK’s most innovative start-ups, scale-ups and established firms creating original technology for finance and payments. Overall, 176 UK FinTech firms were shortlisted for potential inclusion, with the top 50 determined by a combination of reader votes and from an independent judging panel.

Following a 2,300-strong reader vote, an independent judging panel made their choices from the shortlist, placing Planixs in the final 50 ranking.

Business Cloud is a media firm that runs a monthly technology publication and hosts events that cover everything from the Internet of Things and Big Data to AI and Digital Transformation. Each year the publication ranks the most pioneering and forward-thinking FinTech firms across the UK.

The accolade follows a successful period for the real-time software provider – from launching its Strategic Reporting Module that provides advanced reporting capabilities to being awarded FinTech of the Year (in the RegTech category) in this year’s US FinTech Awards. The firm has also added to its customer portfolio with new business wins including NORD/LB Norddeutsche Landesbank, Santander, Allied Irish Bank, Landesbank Baden-Württemberg (LBBW), SIX and Banque Internationale à Luxembourg (BIL) and has expanded its operations into Europe with a senior sales hire and new business premises in Frankfurt, Germany.

Founded in 2011, Manchester-based Planixs works with some of the world’s most prominent global financial institutions, providing its market-leading product suite Realiti® - a cloud-based and on premise technology solution suite that delivers real-time intraday cash, collateral and liquidity management capabilities to the financial services industry.

Neville Roberts, founder and CEO at Planixs said, “It is an honour to be recognised as one of the leading FinTech’s in the UK and as the leader in our technology category. At Planixs we are dedicated in leading the way in real-time technology, helping financial services firms transform their operations through increased visibility and insight, resulting in improved liquidity management, regulatory compliance and cost reductions.”

Related News

- 04:00 am

Merchants can enable more than 50 cryptocurrencies, including Bitcoin, as alternative payment methods grow in demand

ACI Worldwide, a leading global provider of real-time digital payment software and solutions, today announced a strategic partnership with RocketFuel Blockchain, Inc. (OTC QB: RKFL), a global provider of payment solutions via Bitcoin and other cryptocurrencies. ACI Secure eCommerce will offer RocketFuel's solution via a single integration, enabling merchants worldwide to accept cryptocurrency payments—with no processing fees—an industry first.

RocketFuel's highly efficient and easy one-click payment solution offers Bitcoin and more than 50 other cryptocurrencies. In addition, the solution provides bank transfers to merchants and their customers online and in-store using smart devices—both Android and IOS—with QR codes or NFC capabilities.

ACI's Secure eCommerce solution with RocketFuel integration allows merchants to easily incorporate new payment methods into the mobile checkout, offering smarter payment choices for their customers, who are increasingly making purchases using cryptocurrencies. The single integration will quickly and efficiently update new cryptocurrencies as RocketFuel adopts them.

RocketFuel's recently launched "Zero Fees for Life" offer enables merchants to accept dozens of cryptocurrency payment types from customers without paying any processing fees for life. Supported by ACI Secure eCommerce, this initiative provides merchants with a fast and secure payment gateway with zero crypto volatility.

"Cryptocurrency will revolutionize eCommerce and in-store shopping as consumer adoption continues its ascent, and more merchants worldwide recognize the significant benefits of this payment type," said Peter Jensen, CEO, RocketFuel. "We are excited to partner with payments leader ACI Worldwide to spur more choice for merchants and their customers. RocketFuel's 'Zero Fees for Life' pricing model makes this an attractive alternative to other traditional methods of payments that include a fee for merchants."

"ACI Worldwide continues to innovate to stay ahead of the curve on behalf of our merchants and their customers," said Debbie Guerra, head of the merchant segment, ACI Worldwide. "ACI's Secure eCommerce solution, now with RocketFuel's cryptocurrency payment platform, will enable merchants to attract new customers, drive conversion, increase retention, reduce costs, and further alleviate fraud. It is a win-win all around."

ACI Secure eCommerce is a holistic platform that combines a powerful payments gateway, sophisticated real-time fraud prevention capabilities and advanced business intelligence tools. It provides merchants with access to an extensive global payments network and the confidence that their customers and transactions are protected against fraud.

ACI Secure eCommerce was recently recognized by Juniper Research, winning three awards for innovation in payments, including a Platinum Award – the highest accolade in the category of 'Payments Innovation of the Year." In addition, ACI's fraud management solution recently received full approval on the patent for its incremental learning technology.

Both ACI and RocketFuel will attend Money20/20, October 24-27 in Las Vegas. NV; attend ACI's session "Protecting Payments with the Dynamic Duo: P2PE and Tokenization" with Debbie Guerra on Mon. Oct. 25 at 1:25pm

Related News

- 06:00 am

Next-generation platform combines digital identity proofing, compliance verification and anti-money laundering checks at scale to ensure smooth business operations and unmatched user experience

Jumio, the leading provider of AI-powered end-to-end identity verification, eKYC and AML solutions, today announced the launch of an intuitive no-code orchestration layer for its KYX Platform that unifies an entire set of risk and fraud detection capabilities to address identity proofing, compliance verifications and AML use cases. Jumio pioneered the ID + selfie approach to identity verification and is now significantly expanding its platform capabilities for business customers. The KYX Platform will now provide multi-layered, end-to-end risk detection with flexible workflows, increasing visibility by showing a holistic view of the consumer identity and any underlying risk.

As fraudsters become increasingly sophisticated, businesses are having to layer in countless risk signals from multiple vendors in an attempt to protect their ecosystems. The Jumio KYX Platform addresses these pain points by enabling its customers to orchestrate the controls and assurances needed to know and trust their end users — all through a single API layer powered by AI and automation, achieving record high catch rates and low false positives.

“Jumio’s next-generation KYX orchestration platform reimagines the process from one-off authentication to holistic user recognition and verification,” said Jumio CEO Robert Prigge. “Rather than treating all users as potential threats, the platform puts the business customer at the center of the verification process. This delivers a more seamless user experience that verifies consumer or employee data coupled with enhanced authentication using a document such as a government-issued ID.”

With the addition of an orchestration layer, Jumio’s platform leverages its best-in-class identity verification technology to address today’s market challenges caused by the rampant theft of personally identifiable information (PII) via large-scale data breaches. Jumio’s ability to quickly verify and validate consumers, via government-issued IDs and other data sources and risk signals, completely differentiates the next-generation KYX Platform from other providers who rely on data that have been compromised in breaches. The engine behind the platform allows enterprises to create custom risk and fraud workflows using a no-code interface and presents a unified risk score to provide a single outcome across multiple risk checks.

“Our intent is to take the heavy lifting of fraud prevention out of the hands of our customers. By leveraging our KYX Platform, complete with flexible workflows, no-code orchestration and multi-layered risk signals, organizations can assess not only the risk of the individual, but also the devices associated with them, the IDs they furnish and their facial biometrics — all in one platform through a single API layer,” said Bala Kumar, chief product officer of Jumio. “We want to enable our customers to focus on their primary business and leave the fraud prevention to us. We are their first and strongest defense for bringing in valuable customers while keeping the bad actors out. Suspicious transactions will get pushed to our integrated case management solution so fraud and compliance analysts can quickly triage and resolve any issues.”

Latam fintech pioneer, Rappi, is one of the first Jumio customers to sign up for early access to the next-generation Jumio KYX Platform.

“We’re excited to work with a platform that gives us the flexibility to add data sources, maximize conversions and optimize the user workflow and overall customer experience,” said Juan Pablo Ortega, Rappi co-founder. “This vision aligns and supports our expansion ambitions and goals for the future.”

Visit jumio.com/KYX to learn more.