Published

- 08:00 am

Strong demand from investors to capture yield from a diversified pool of institutional loans

The Lending Pool managed by Maven 11 on the capital marketplace Maple Finance has reached a volume of $ 175 million. Launched in July 2021, the Lending Pool has issued 35 loans to premier institutional borrowers in the crypto industry, such as Alameda Research, a quantitative trading firm, GSR, a crypto market maker, and digital asset platform Amber Group.

Maple Finance is a decentralized corporate debt marketplace built to create a sustainable yield source for long-term focused lenders to earn a competitive return on their assets. The capital on Maple Finance’s platform sits in Lending Pools, each managed by a Pool Delegate. As a Pool Delegate, Maven 11 forms the link between investors and companies, tasked with assessing the creditworthiness of borrowers and determining the terms of the investment, such as collateralization ratio and interest rates.

The rapid growth of the Lending Pool managed by Maven 11 demonstrates the increased adoption of decentralized finance (DeFi) as a promising and realistic alternative to traditional financing. Total liquidity on the Maple protocol has surpassed $ 500 million mark with room to grow. The total DeFi market is currently estimated at well over $250 billion, up from $ 20 billion at the beginning of 2021.

Maven 11 Blockchain Venture Fund II

Maple Finance is also one on the participations of Maven 11 Blockchain Venture Fund II, which closed at $ 120 million on 30 November. Maven 11’s involvement in Maple Finance, both as an investor through Venture Fund II and as a Pool Delegate, showcases its ability to offer founders more than just funding, thereby actively adding value to its participations.

“There is major room for improvement in terms of capital efficiency in the lending space for institutional capital. We firmly believe in working alongside founders, borrowers and lenders. It is about more than facilitating capital: it means venturing into new ways of improving capital markets,” says Balder Bomans, Managing Partner Maven 11 Capital.

“As a Maple Lending Pool Delegate, we are opening up our pool to the wider decentralized finance community to encourage a much wider set of users to join the Maple ecosystem.”

Related News

- 09:00 am

Half (50%) don’t know what levelling up the country means for their business

Just three in 10 (30%) business leaders believe that the government will deliver on its levelling up agenda

As the government prepares to release its levelling up white paper later this month, new research1 from Nucleus Commercial Finance finds that more than half (52%) of SMEs are confused about the government’s plans.

This is felt most strongly among medium sized businesses (65%), followed by small (50%) and micro (49%) business leaders. Younger (18-34) business owners are the most confused (68%) about the levelling up agenda, compared to 40% of those aged over 55.

In addition to this, half (50%) of SMEs don’t know what levelling up the country means for their business. This comes at a time when business leaders are feeling the negative impact of regional inequalities.

Nearly six in 10 (56%) of SMEs believe regional inequalities are impacting their ability to attract investment, while a similar amount (55%) believe they are affecting their ability to hire highly skilled workers. Regional inequalities are also having a profound effect on SME finances, with 47% saying they are impacting the financial health of their business, and four in 10 (42%) saying regional differences are affecting their ability to get a loan from a bank.

Despite efforts from the government to address regional inequalities, the research found that SME leaders are largely pessimistic about the government putting its plans into action. Just three in 10 (30%) business leaders believe that the government will deliver on its levelling up agenda.

Chirag Shah, CEO, Nucleus Commercial Finance, said: “Despite the levelling up agenda being a central idea of Boris Johnson's government, SME leaders remain confused about what this is and how it will impact their business. In addition, it's particularly concerning that they feel regional inequalities are putting financial pressures on their business and are severely impacting their opportunities to succeed. “As SMEs are the backbone of the economy and will play a crucial role in helping the UK recover from the impact of the pandemic, it is vital that the levelling up whitepaperprovides clarity for SMEs. This is an opportunity for the government to reinforce its commitment to level the playing field and put its promises into action.”

Related News

- 07:00 am

Blank Rome LLP is pleased to announce that R. Andrew “Andy” Arculin has joined the firm’s Washington, D.C., office as a partner in the Financial Institutions Litigation and Regulatory Compliance (“FILARC”) practice group. At Blank Rome, Andy will advise clients on a wide range of state and federal consumer protection laws relating to mortgages and consumer credit. Andy joins Blank Rome from Venable LLP where he was chair of the firm’s financial services practice.

Prior to private practice, Andy served as senior counsel in the Consumer Financial Protection Bureau’s (“CFPB”) Office of Regulations where he helped establish and enforce a multitude of CFPB rules and regulations under the Real Estate Settlement Procedures Act (“RESPA”), Equal Credit Opportunity Act (“ECOA”), Truth in Lending Act (“TILA”), and other federal statutes. He served as lead attorney for various CFPB rulemakings and played a key role at CFPB in educating both the public and industry leaders about CFPB rulemakings.

“Andy’s past experience at the CFPB, paired with his experience in private practice, positions him well to represent our clients on the many aspects of consumer finance law,” said Grant S. Palmer, Blank Rome’s Managing Partner and CEO. “Andy is yet another remarkable attorney we have added to our firm over the past year, and he will be an invaluable resource to our clients, an excellent addition to our D.C. team, and strongly enhance our FILARC practice.”

Andy regularly advises financial institutions, non-bank lenders, consumer reporting agencies, and technology companies (and their vendors) on a range of matters spanning regulatory compliance, civil enforcement, and transactions. He often provides counsel as it relates to consumer credit statutes and regulations, including TILA, ECOA, RESPA, the Fair Credit Reporting Act (“FCRA”), the Home Mortgage Disclosure Act (“HMDA”), Unfair, Deceptive and Abusive Acts and Practices (“UDAAP”), and other federal and state statutes and regulations.

“Andy was one of the early members of the CFPB and we are thrilled to add a bureau alumnus to the team,” stated Wayne Streibich, Chair of Blank Rome’s FILARC practice. “With a focus on consumer lending, Andy’s work ranges from early stage company development to specific product counsel, M&A due diligence, and everything in between. His tenure at the CFPB and his experience working with innovative business loan platforms in the evolving FinTech market provides a unique asset to our practice and clients as we kick off the new year.”

“Blank Rome is a phenomenal fit for my practice, both in terms of culture and business opportunities. I am excited by the firm’s multiservice platform and look forward to working alongside others in the FILARC practice, as well as the firm’s talented litigators. Furthermore, the firm is growing strategically, and I cannot wait to assist in expanding the regulatory practice in D.C.,” Arculin said.

Andy often serves as a thought leader on topics such as consumer lending, FinTech, and mortgage banking. He is also an active member of the Mortgage Bankers Association.

Andy received his J.D., cum laude, from the Columbus School of Law, Catholic University of America, and his B.A. from the University of Virginia.

Related News

- 03:00 am

Round led by Advance Venture Partners includes continued support from core investors including Coinbase Ventures and Unusual Ventures

Alto Solutions, Inc. (Alto),the self-directed IRA platform making it easy and affordable for individuals to invest in alternative assets using tax-advantaged retirement funds, today announced the successful close of a $40 million Series B funding round. Advance Venture Partners was the lead on this round of funding, with additional participation from existing investors including Unusual Ventures, Acrew Capital, Alpha Edison, Foundation Capital, Gaingels, and Coinbase Ventures. Alto will use this round of funding to broaden access and enhance capabilities of its Alto IRA and Alto CryptoIRA® platforms, accelerate hiring across all in-house teams, and continue development of new products.

"I am proud of the success of the Alto team to date and grateful for the continued confidence of many of our core investors in this latest funding round," said Eric Satz, founder and CEO of Alto. "We believe this funding will provide more individuals looking to control their financial future with easy and affordable access to high-growth, diversified, non-traditional asset classes typically reserved for the wealthiest investors, including private equity, venture capital, real estate, securitized artwork, and crypto."

This latest round of funding caps off a record 2021 for Alto, including a successful Series A fundraise of $17 million which closed in April. The firm currently serves more than 15,000 IRA investors with a billion dollars of assets under custody.

"Advance Venture Partners ("AVP") is thrilled to have led Alto's Series B financing. We have followed Alto's progress and believe that the company is well positioned to transform how millions of everyday investors manage and invest their retirement savings," said David T. ibnAle, founder and Managing Partner of AVP. "Alto is attacking an IRA market that, despite representing trillions of dollars in assets, still struggles with antiquated processes and legacy service providers. We're excited to back Eric Satz and a top-flight team that is removing friction from this market and enabling investors to seek both better returns and better diversification of their retirement portfolios." Mr. ibnAle will join Alto's Board of Directors.

Sarah Leary, venture partner at Unusual Ventures and a director of Alto, added "Alto has a clear vision to give everyday investors a seat at the table for investment opportunities that reflect the future. Alto has shown incredible momentum, especially over the last 18 months, connecting alternative opportunities in crypto, private equity, and other asset classes, with the often overlooked $37 trillion retirement account market. We are thrilled to continue to invest in Alto's mission to make alternative investing accessible to everyone."

Alto's rapidly growing user base is following the mega trend led by institutions, including endowments and family offices, which now hold anywhere from 25-50 percent of their assets in alternatives. Alto is committed to making it easier for individuals to invest their IRA funds, defer taxes, and explore more options for growth. With greater access to alternative assets, individual investors can achieve true portfolio diversification they simply cannot get from investing exclusively in today's shrinking public markets.

Related News

- 03:00 am

Brankas, Southeast Asia's leading Open Finance technology company, announced the close of its US$20m Series B investment round led by Insignia Ventures Partners with participation from existing investors Beenext and Integra Partners. With this round, Brankas aims to scale its network of more than 40 financial institutions and 100+ technology companies, expand its product menu of banking-as-a-service APIs serving customers across 6 markets in Asia, and look to double the 100-person strong team.

This latest round accelerates Brankas' journey to provide the most reliable and comprehensive finance API platform in Asia. Since 2016, the company has been democratizing access to financial and identity data, payments initiation and other developer tools to power the next generation of fintech solutions. With a large unbanked population, Brankas has worked with non-bank providers like remittance companies and e-wallets to offer Open Finance solutions that reach previously untapped customer segments. Brankas aims to serve any company that needs financial data and embedded fintech services to empower their end users in Southeast Asia: technology companies, traditional brick-and-mortar leaders with online channels, and even financial institutions looking to provide a financial marketplace or embedded finance experience to their customers

According to Samir Chaibi, Principal at Insignia Ventures Partners, Brankas is well-equipped and well-positioned to achieve this as the open finance movement accelerates in Southeast Asia. "The Open Finance industry is powering the next generation of fintech services and Brankas is at the forefront of this movement in Southeast Asia. We are thrilled to partner with a team with a world-class API-driven infrastructure built across key Southeast Asian markets to serve the largest fintech players as they scale. We have also been impressed by Brankas's approach to market development and their ability to launch and scale their products in a regulatory compliant manner while ensuring that developers benefit from a reliable and stable source of banking and financial data and beyond."

Visa also participated in the round, marking the global payments network's commitment to the fast developing Open Finance ecosystem in Southeast Asia. AFG Partners and Treasury International (backed by veteran fintech founders Jeff Cruttenden of Acorns and Eli Broverman of Betterment) have also joined the round along with existing Brankas investors Beenext and Integra Partners. Brankas was selected as one of the 5 participants in Visa's 2021 Accelerator Program and jointly developed with Visa, a digital credit card issuance proposition using Visa's data capabilities. The solution was showcased at the Visa Accelerator Demo Day in September 2021.

Leading the way for Southeast Asia's Open Finance Development

Brankas's network of financial institutions and tech companies rely on its menu of embedded finance APIs to develop, rollout, and manage digital experiences across various use cases for Southeast Asia, from digital banking, online credit scoring to e-commerce and gig economy payments.

For financial institutions, Brankas's API platform unlocks digital capabilities and new revenue streams such as online payments, identity verification and account opening, and by extension scales their reach, especially to users who have historically been difficult to serve with traditional financial services. For fintech companies, Brankas is a bridge to critical data needs for verification or scoring processes that would have otherwise taken much longer to develop and optimize for users. These use cases also extend beyond financial services, with companies in sectors like e-commerce also using their APIs to verify and secure payments on their platforms. Across industries and use cases, Brankas offers a compliant, reliable and secure system at scale to simplify the local complexities of building and operating fintech products and services.

Todd Schweitzer, CEO of Brankas, emphasizes the immense possibilities of Open Finance especially in Southeast Asia, "Open Finance is about more than just payments or banking. Our work at Brankas building Southeast Asia's next-generation financial services infrastructure has unlocked opportunities for new financial product development, in a region that has historically been dominated by large brick-and-mortar incumbents. Thanks to our growing network of partners and customers we are continuously deepening our understanding of these opportunities and leading the development of solutions to open these doors for them here in Southeast Asia."

As Brankas has grown to cater to more use cases and include more partners and customers in their network, the company has consistently led the way in developing Southeast Asia's open finance ecosystem. For example, Brankas is the first in the region to launch banking-as-a-service APIs for account opening and credit card issuance.

Brankas has also gained the trust of regulators as an open finance pioneer and leader. In October 2021, Brankas was awarded a prestigious grant from Singapore's Central Bank to develop an open-source core banking system. The company also participated as the first approved financial API service provider in the Philippines' Open Finance pilot.

Bringing Unprecedented Choice and Access to Southeast Asia

Following this Series B round, Brankas is deepening the capabilities of its payments, data, and banking-as-a-service API product menu in Indonesia, the Philippines, and Thailand. The company is soon to announce partnerships with top digital banks and fintech leaders in Vietnam and Bangladesh, going live in early 2022.

Operating as a distributed, remote-first organization since its founding, Brankas now has more than 100 staff in 17 countries. Recent senior hires include Simo Figuigui as Head of Business Development and Growth, and Arvin Razon as Head of Regulatory, Legal and Compliance Affairs.

In order to further develop their menu of products for open finance, Brankas looks to ramp up its hiring across multiple roles in product, sales, and engineering. More details on the roles can be viewed on the company's career page and LinkedIn.

With new investors, partnerships, and hires, Todd shares his outlook for Brankas: "At Brankas, our vision is to make modern financial services available to everyone. 2021 has been a breakout year for Brankas, enabling financial institutions and companies to partner in new ways and offering unprecedented choice and access for Southeast Asia consumers. All this has happened as we see open finance adoption gaining traction greater than ever before in the region. As a leader in this movement, we are primed to pioneer new products and use cases for Southeast Asia's next generation of financial services, and we'll need as many hands on deck to follow through on this. This means continuously growing our network, building out our team's capabilities, and working closely with our new investors. We are proud to join the Insignia portfolio, and we welcome Visa as a new investor and strategic commercial partner. Thanks also to Treasury International, AFG, and our existing investors Beenext, Integra, and Plug and Play for their continued support and mentorship.

Related News

- 01:00 am

Insider Intelligence’s Banking Trends to Watch in 2022 report identifies three key areas of digital transformation that will further upend the banking industry in the new year.

Which 2021 developments portend 2022 changes? Incumbents and digital challengers alike have prioritized enhancing personalized offerings for their customers.

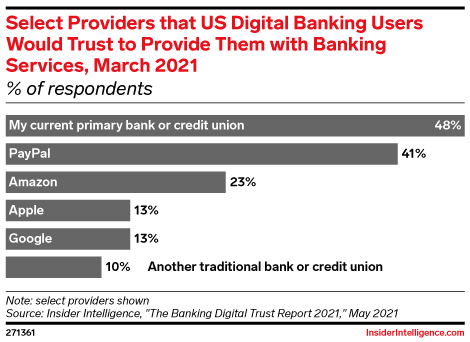

Meanwhile, big tech companies have grabbed a foothold in embedded finance through payments, and could potentially venture into banking.

Finally, Western financial institutions are poised to offer consumers super apps like those popularized in the Asia-Pacific region, which will provide wider product breadth than has been available previously.

What does this mean for 2022? Here’s a look at three big trends that will shake up banking in the new year:

Big tech companies have used embedded finance, via payments, as an “on-ramp” to financial services. This entryway lets non-financial companies roll out financial products and services to their own customers.

- Tech companies are well-established now in payments: Apple Pay and Google Pay have respective market shares of 43.4% and 25.0% in proximity mobile payments, a nearly $247 billion market.

- Venture capital firms invested nearly three times more money in embedded-finance companies in 2021 versus 2020, per PitchBook.

- Big tech companies are also expected to show continued interest in banking—despite Google’s decision to pull the plug on Plex. However, they will likely attempt to do so by partnering with established financial institutions (FIs).

Meanwhile, hyper-personalization is gaining traction in banking and wealth management. This includes:

- The emergence of niche FIs like Daylight, which caters to LGBT customers.

- Incumbents operating AI-powered services to give bespoke experiences to their customers. Examples include Bank of America’s Erica and Chase’s Digital Assistant.

- Unmet demand among the aspiring affluent consumer demographic. They’re in a bind: Their financial needs must be addressed, but they haven’t accumulated enough funds to work with advisors.

Finally, Western consumers are getting closer to amassing super apps, which are digital platforms that conveniently bundle a wide range of services.

- This operating model is already available in the Asia-Pacific region via companies Ant Group and Tencent.

- Super apps allow people to avoid decision-making overload from separately available services. A Deloitte study for the US found that approximately one-third of consumers feel overwhelmed by the quantity of options available to them.

- PayPal and Revolut are among the most likely to deploy super-apps in 2022 that break through with consumers, but they will need to add even more features if they want their products to attain breadth as significant as their Asian counterparts’. Block's Cash App Pay is another potential super app to watch out for.

Related News

Product Profile

Screenshots & Video

Product/Service Description

Tranzbase is a convenient system of internal and external services combined on a single platform.

Tranzbase allows to:

- Effectively and simply manage personal and corporate investments

- Automate mass payments and regular online transfers

- Interact with bank cards of company employees

- Remotely open accounts, service internal and cross-border transfers

International payments are made via SWIFT, users have access to the British FPS and CHAPS services, the European SEPA network and interbank Forex for currency conversion at a favorable rate. Clients can work with these systems from IBAN accounts.

Customer Overview

Features

Tranzbase is a modern and dynamic payment institution providing a full range of e-commerce and digital banking services. Customer’s comfort is the main concept of the company. The company believes that long term compliance and manager cooperation should stay in the past. Any Tranzbase solution is easy and rapid for implementation as remote business account, IBAN assignment, and wire transaction. 20 years of experience providing high quality customer support 24 hours per day. Responsibility, safety and confidence are a relevant client approach.

Besides the platform is offering one of the fastest corporate services on the FinTech market – 24hours business accounts ready for money transfers over then 150 countries. And many other powerful features for corporate tasks.

Benefits

The company provides a remote account opening in 24 hours. A personal manager helps the customers with openings an account and other Tranzbase’s services. Tranzbase offers 24/7 user support. SWIFT and SEPA standards , IBAN account, FPS and CHAPS services are supported.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

- 08:00 am

Funding to support fast-growing software provider’s growth into new markets and create 60 new roles

AppLearn, a Manchester-headquartered global Digital Adoption platform (DAP) provider, has secured significant financing from Silicon Valley Bank (SVB), the bank of the world’s most innovative companies and investors, and NPIF – Maven Equity Finance, managed by Maven Capital Partners (Maven) and part of the Northern Powerhouse Investment Fund (NPIF).

Funding from SVB and NPIF - Maven Equity Finance equates to an 8-digit figure investment. The revolving lending facility will enable AppLearn, which also has offices in Boston and San Francisco, to scale its international reach as it makes considerable in-roads in the multi-billion-dollar global DAP market.

Funding will also support the creation of up to 60 new roles within the organization’s North West-based team, as it embarks on an ambitious programme of international growth. With customers in c.100 countries currently, the funding will see AppLearn’s flagship DAP product, Adopt, launched into new territories such as South Africa. It will also accelerate the company’s presence in the lucrative North American market.

A DAP is a layer of software that seamlessly integrates with other applications, intuitively learning how users interact with it. It gathers information to provide support in the flow of work (in-app), user analytics, which guides people through tasks and functions. This enhances productivity, improves user onboarding, and helps organizations to better optimize critical technology investments to drive business objectives.

The financing from SVB and NPIF- Maven Equity Finance follows an investment into AppLearn from California-based K1 Investment Management secured in September 2019. As a result of this investment, the company has gone on to substantial growth.

AppLearn is led by CEO Andrew Avanessian, who joined the business in 2019 and was formerly COO at cyber security company Avecto. Together with an experienced C-Suite, Avanessian has overseen growth of 108%.

Andrew Avanessian, CEO of AppLearn, commented: “Silicon Valley Bank and NPIF -Maven’s support comes at a pivotal time for our business. The strides we have made in the digital adoption market over the last three years has placed AppLearn on the cusp of transformative growth. This funding now enables us to put in place the foundations to fuel our ambitious international strategy and growth plans.

“The global appetite for digital adoption is rapidly advancing, in no small part due to the events of last year. With an increasing number of businesses accelerating their digital transformation journeys, global IT spending is expected to reach $4 trillion this year. AppLearn is in a prime position to bring our technology to this ever-expanding market, and we’re excited to be doing this with NPIF - Maven and Silicon Valley Bank’s backing.”

Dean Cox, Senior Investment Manager at Maven, said, “AppLearn is addressing a genuine need in in the industry for digital transformation services. The business is well placed to take advantage of the current migration to a digital economy and leverage off the new challenges facing enterprises today. We’re delighted to back Andrew, Adam and the team who are experienced and technology focussed with an excellent reputation in the market.”

Ben Tickler, Director of Venture and Growth at Silicon Valley Bank UK Branch, said,

“Silicon Valley Bank is delighted to extend its partnership with the outstanding team at AppLearn and their trusted investors. It is great to see further funding in Manchester's innovation ecosystem and we look forward to watching the team continue to grow, build, and scale.”

Grant Peggie at British Business Bank, said: “The Northern Powerhouse Investment Fund is committed to backing innovative growing businesses across the North to achieve their objectives. AppLearn’s story demonstrates the impact that investment can have on an organisation’s growth and we look forward to seeing the success that AppLearn achieves in Manchester, across the UK and globally.”

The Northern Powerhouse Investment Fund project is supported financially by the European Union using funding from the European Regional Development Fund (ERDF) as part of the European Structural and Investment Funds Growth Programme 2014-2020 and the European Investment Bank.

Maven Capital Partners UK LLP is authorised and regulated by the Financial Conduct Authority, Firm Reference Number 495929.

Related News

- 04:00 am

- New partnership will allow both Contis and Ecospend to enhance their product offerings

Ecospend, the leading UK provider of Open Banking technology, has today announced that it is partnering with Contis, the leading pan European Banking-as-a-Service (BaaS) provider.

Contis offers a range of BaaS products to its customers across a variety of sectors, including cloud-based, real-time accounts and payments solutions.

By integrating Ecospend’s ‘pay-by-bank’ technology, Contis’ customers will have the option to make account-to-account payments, as well as utilise account information services (AIS) for financial insights.

As a result, Contis customers will be able to make instant payments between accounts, including holding accounts, allowing them to perform immediate withdrawals, refunds and ensure guaranteed deposits. Additionally, through Ecospend’s technology, and to help clients manage their finances, an authorisation code will be shared to confirm when funds have settled. This guarantees no refund or withdrawal is paid out before the initial payment is processed.

In addition, Ecospend’s clients will gain access to Contis’ holding accounts which will allow for instant and guaranteed deposits, withdrawals and refunds through Open Banking technology. Ecospend’s customers will also be offered access to Contis’ accounts and can pay out of their accounts via Faster Payment, Sepa Credit Transfer, Sepa Instant and International Payment rails.

James Hickman, COO, at Ecospend, comments:

“We are pleased to be partnering with Contis to help enhance their BaaS products with our Open Banking technology. By using our pay-by-bank tech, Contis will be able to offer its customers the ability to make instant payments, across its suite of services, whilst helping them gain better financial insight through our AIS enabled solutions. By working together with Contis, we can ensure that we both benefit from each other’s experience and expertise and continue to offer our customers the best experience possible.”

Andy Lyons, MD Head of banking solutions, comments:

“Working with Ecospend will allow us to fast-track payments across a range of our account services and ensure that customers no longer have to wait for payments to process. Additionally, by adding the authorisation code functionality to our holding accounts, customers can be more confident in the payment process and manage their finances more accurately. We hope that this will be the beginning of a long, and prosperous partnership with Ecospend.”