Published

- 01:00 am

Bitcoin Latinum (LTNM), the next generation, insured, asset-backed cryptocurrency poised to revolutionize digital transactions is announcing its upcoming plan to launch on ten additional global exchanges in 2022, bringing its total to 20 publicly-traded exchanges.

Bitcoin Latinum currently trades publicly on HitBTC ($6.2 billion in daily volume), FMFW.com ($4.5 billion daily volume), Changelly ($2.71 billion in daily volume), Changelly Pro, LBank ($1.1 billion in daily volume), DigiFinex, Hotbit, AAX, and XT.com exchanges under the ticker LTNM. Monsoon Blockchain, Bitcoin Latinum's lead developer, has announced LTNM will also list on Bitmart ($1.6 billion in daily volume), and can now be researched on CoinBase, Coin Market Cap, and Coin Gecko.

As a cornerstone of Monsoon Blockchain’s strategic plans to further the mass adoption of Bitcoin Latinum, the company has been forging global partnerships with corporations that will integrate the token for their retail transactions. Significant adoption of Bitcoin Latinum and Monsoon’s blockchain ecosystem has been taking place, with a focus on insurance, entertainment, gaming, and data storage entities. Partnerships include OSO ATM for launching 100,000 Bitcoin Latinum ATM’s across the United States, and The h.wood Group for acceptance of LTNM across the company’s diversified portfolio of upscale nightlife and restaurant venues.

Unico, in partnership with Bitcoin Latinum, is launching an NFT marketplace called UnicoNFT, that features thousands of digital artworks that can be bought and sold exclusively with Bitcoin (BTC) and Bitcoin Latinum (LTNM). This is the world's first platform that enables the option of buying, selling and trading NFTs using cryptocurrencies other than Ethereum type currencies. The total market for NFT’s reached $22 billion in 2021, up from $100 million in 2020.

Global adoption of cryptocurrencies for use in retail transactions has been steadily increasing. Within a span of four months in 2021, the global crypto user base doubled from 100 million to 200 million. The ease of purchasing cryptocurrencies has increased significantly over the past two years. As of January 2022, the total market cap for all cryptocurrencies crossed two trillion dollars, with over $116 billion in daily trading volume. Matt Hougan, the chief investment officer of Bitwise Asset Management, told Bloomberg TV in December that Bitcoin could hit $100,000 in 2022.

Bitcoin Latinum was built as an open-architecture cryptocurrency technology, capable of handling large transaction volume, cybersecurity, and digital asset management. Based on the Bitcoin ecosystem, Bitcoin Latinum was developed by Monsoon Blockchain Corporation on behalf of the Bitcoin Latinum Foundation. LTNM is a greener, faster, and more secure version of Bitcoin, and is poised to revolutionize digital transactions.

Unlike other crypto assets, LTNM is insured, and backed by real-world and digital assets. Its asset backing is held in a fund model, so that base asset value increases over time. It accelerates this asset-backed funds growth by depositing 80% of the transaction fee back into the asset fund that backs the currency. Thus, the more Bitcoin Latinum is adopted, the faster its asset funds grow, creating a self-inflating currency. This highlights Bitcoin Latinum Foundation's commitment to supporting the growth of a sustainable crypto ecosystem.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any Bitcoin Latinum offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized investment advice. Bitcoin Latinum strongly recommends you consult a licensed or registered professional before making any investment decision.

For more information about Bitcoin Latinum, please visit https://bitcoinlatinum.com/

Related News

- 06:00 am

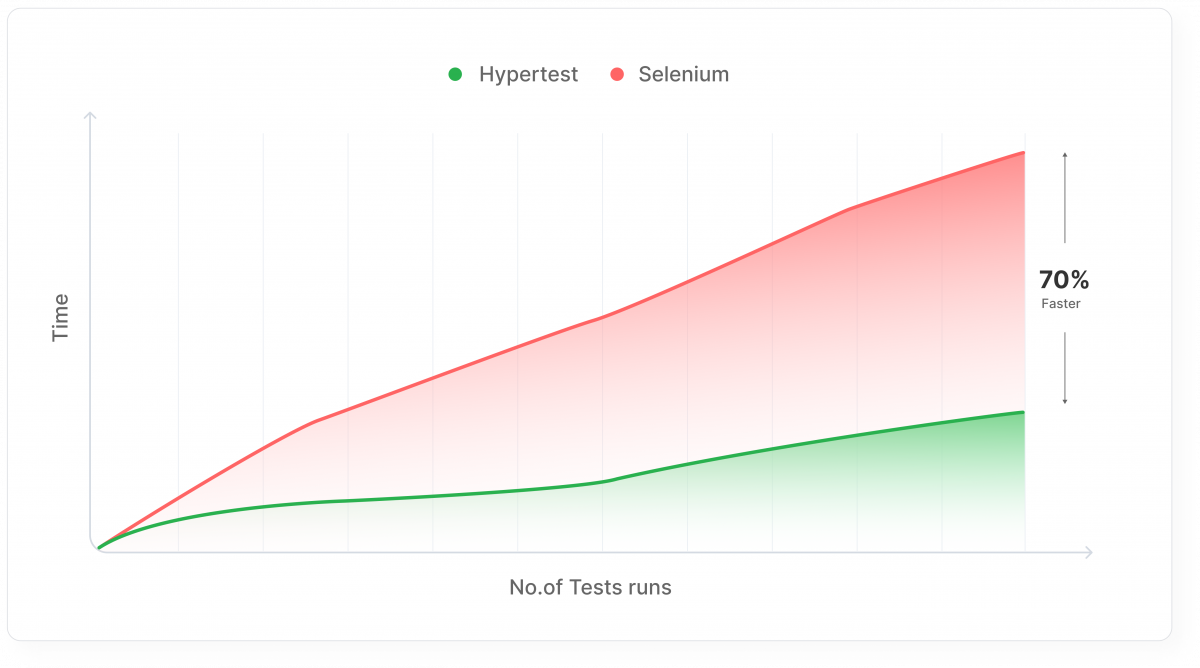

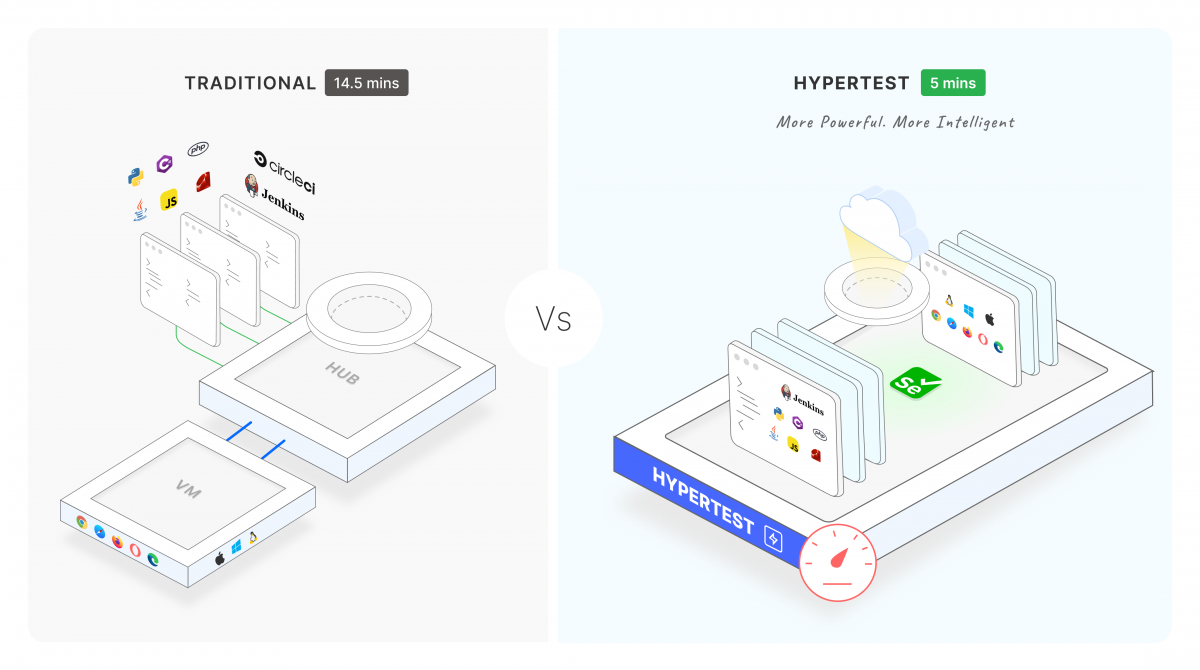

HyperTest, the world’s fastest cloud grid, is up to 70% faster than any other traditional test execution platform

LambdaTest, a leading test execution platform, has launched HyperTest, a next-gen smart testing platform to help businesses run end-to-end Selenium tests at the fastest speed possible.

At a time when digital businesses are launching products and features at breakneck speeds, and looking to outsmart competitors, testing the code before releasing it to the audience is of utmost importance. HyperTest, which supports Selenium tests, enables businesses to achieve quickest time-to-market by intelligently reducing the test execution time drastically. Selenium is an open-source project that supports web browser automation, using which developers and QA analysts in organizations can automate their testing to save time instead of manually testing each functionality.

Existing automation testing platforms are inherently slow because of lots of network hops that happen during each test. In the traditional approach, triggered test scenarios are first sent to the Selenium hub, which in turn are scheduled to run on the best-suited Selenium node. This results in unnecessary latency as many network components are involved in the entire process. Also, multiple network hops with separated components result in increased test flakiness, a factor that is the biggest hindrance to time to market.

HyperTest unifies all the components into a single execution environment that eliminates these network hops and cuts down on test execution times. This enables businesses to test code and fix issues at a much faster pace and hence achieve an accelerated time to market.

“Traditional solutions barely scratch the surface when it comes to speed of test execution. We wanted to build the fastest test execution platform because businesses are tired of slow test execution speeds. When modern digital businesses are building best-in-class features and products, they also need a best-in-class test execution platform,” said Asad Khan, CEO, LambdaTest. “HyperTest runs as fast as an in-house Selenium installation and is up to 70% faster than other traditional cloud test execution platforms. We are excited for the world to try out HyperTest and experience test execution at never-before-seen speed. It also comes with a lot of smart features that ensures ease of test execution.”

HyperTest comes with real-time console logs for test execution, intelligent grouping of tests to reduce total build time, artifacts management, automatic reporting, and automatic retries on failures. It is also available across Windows, Mac, and Linux.

Founded in 2017, LambdaTest has raised close to $25 million in funding from investment firms such as Sequoia Capital, Telstra Ventures, Entree Capital, Leo Capital Holdings, Blume Ventures, and others.

Related News

- 02:00 am

- Ian Rand, former CEO of Barclays Business Banking, has been appointed Chief Executive Officer of Monument, subject to regulatory approval, and will assume the executive leadership of the bank

- Mintoo Bhandari, Co-founder and current CEO of Monument will transition to the strategic role as Global Head of Corporate Development, leading new opportunity identification, and institutional capital relationship management for Monument

- Monument, the first UK neo bank focused on the needs of ~4.8 million “mass affluent” clients – professionals, entrepreneurs, property investors, and others – had all restrictions on its banking licence lifted in November 2021 and has now launched its initial property investment lending offerings as well as its first suite of saving products to the market

Monument (or the “Bank”) today announces the appointment of Ian Rand as Chief Executive Officer, subject to regulatory approval, taking the reins from Mintoo Bhandari, current CEO and Co-founder, who has led Monument from its inception to the achievement of full banking licence and commercial launch. Bhandari will transition to the strategic role as Global Head of Corporate Development at Monument, which will focus on identifying opportunities to expand Monument’s offerings and continue to cultivate and establish institutional capital relationships to support Monument’s future growth.

Rand will lead the scaling up of Monument as the CEO of Monument Bank Limited. Rand has over 20 years’ experience in banking and most recently was CEO of the Business Banking division of Barclays Bank (and previous COO running day to day operations) with more than £40 billion in assets, serving in excess of 1 million customers representing a large and diverse client base, including high-growth and entrepreneurial businesses. Prior to his 12 years at Barclays, Rand was with JP Morgan, which he joined in 2000, holding MD & COO roles across the Markets business globally. During his tenure at Barclays, he was also Chair of their UK Diversity Council. Ian has joined Monument as CEO designate from 1st January 2022 and will formally assume the CEO role upon receipt of regulatory approval.

Ian joins an experienced team, whose executives and board have held senior roles in HSBC, Barclays, McKinsey & Co, UBS, Goldman Sachs, Apollo Global Management, PWC, Coutts and the UK regulators, amongst others

Ian Rand, incoming Chief Executive Officer of Monument said: “Monument with its unique proposition is an enticing opportunity to take the next step in my career. The Bank aims to fill a much-needed gap in the market – with its deep understanding of the mass affluent community and ability to serve a group who for too long have been left under-served by the market. I am delighted to be leading an incredible team, which has the potential to reimagine the market as it currently stands and fulfil the ultimate goal of helping people save and grow their wealth.

“To date, Monument has had an amazing journey, achieving a number of milestones, more recently receiving its full banking licence and launching property investment lending and savings propositions. Now is an exciting time to help Monument reach new heights as we firmly establish our position in the market.”

Mintoo Bhandari, Co-founder and Chief Executive Officer of Monument said: “It has been a pleasure to have led Monument from its inception, through the pandemic and to the point of commercial launch. I have long held the belief that there would come a point in which a highly experienced, career banking executive, would be most appropriate to take the reins from me to scale the bank. I had formally raised the point of my succession to the Board some months ago and I am very happy that, with the beginning of the New Year, the day has arrived for me to confidently hand over the reins to Ian Rand, who I am certain has the experience and skills to scale Monument Bank from the solid foundation we have in place to take it to new heights. Ian has a wealth of technical and organisational experience as a banking leader; but, most importantly he shares our vision and enthusiasm to make Monument a valuable, impactful, and durable institution in the rapidly evolving financial services marketplace.”

Related News

- 09:00 am

Equifax, Experian, and TransUnion Routinely Failed To Fully Respond To Consumers With Errors

A new analysis by the Consumer Financial Protection Bureau (CFPB) reveals how changes in complaint responses provided by nationwide consumer reporting companies resulted in fewer meaningful responses and less consumer relief. In 2021, Equifax, Experian, and TransUnion together reported relief in response to less than 2% of covered complaints, down from nearly 25% of covered complaints in 2019.

“America’s credit reporting oligopoly has little incentive to treat consumers fairly when their credit reports have errors,” said CFPB Director Rohit Chopra. “Today’s report is further evidence of the serious harms stemming from their faulty financial surveillance business model.”

Credit reporting plays a critical role in consumers’ lives and has an enormous reach beyond consumer financial services. More than 200 million Americans have credit files, and lenders rely on this information to decide whether to approve loans and on what terms. Consumer reporting also informs decisions about employment, insurance, housing, and even essential utilities. For consumers, inaccuracies on credit reports drive up the cost of credit and severely limit opportunities, such as starting a small business or buying a new home.

Consumers submitted more than 700,000 complaints to the CFPB regarding Equifax, Experian and TransUnion from January 2020 through September 2021, which represented more than 50% of all complaints received by the agency for that period. Consumers submit more complaints about inaccurate information on their credit and consumer reports than about any other problem. Consumers most frequently assert that the inaccurate information belongs to someone else, and consumers often describe being victims of identity theft.

The CFPB found the three companies often failed to provide substantive responses, especially when they alleged the complaints were sent in by third parties. However, consumers can authorize third-party representatives to submit complaints on their behalf.

Equifax, Experian, and TransUnion Fail to Meet Statutory Obligations

The Fair Credit Reporting Act (FCRA) requires Equifax, Experian, and TransUnion to conduct a review of complaints sent to them through the CFPB where consumers allege there is incomplete or inaccurate information in their consumer reports and the consumer appears to have previously attempted to fix the problem with the company. The companies must then report their determinations and actions for these covered complaints to the CFPB. Today’s report shows:

- Equifax most often promised to open investigations and send the results to the consumers at later dates, but it would fail to provide the CFPB with the outcomes of the investigations.

- TransUnion made similar promises and frequently failed to provide the outcomes of investigations to the CFPB. It often stated it would take no action on complaints because it believed the complaints were submitted by third parties.

- For many complaints, Experian frequently stated it would take no action because it believed the complaints were submitted by third parties, however, it did respond to the remaining complaints with substantive responses.

Medical Debt Mistakes

One of the main sources of consumer debt that can lead to consumer reporting inaccuracies and mistakes is medical bills. Consumers find that opaque pricing, the complex system of insurance coverage, and frequent delays in consumers finally receiving bills create an unnavigable quagmire and can make it harder to resolve billing errors. Accordingly, the CFPB’s previous research shows consumers often struggle to even determine whether the debt belongs to them, and, if it does, whether the amount is accurate.

Medical billing is just one example, but it highlights the ease with which errors, mistakes, and inaccuracies can occur, along with the financial consequences that follow.

Related News

- 03:00 am

The collaboration gives regulated firms choice and flexibility to automate global KYC

PassFort, a Moody’s Analytics company, announced today a new partnership with Trulioo, a leading global identity verification company. Through this partnership, PassFort, a global provider of software-as-a-service regulatory technology solutions, and Trulioo will offer regulated businesses a way to digitally transform Know Your Customer (KYC) and Know Your Business (KYB) processes, no matter where in the world the business or their customers are based.

With the increased introduction and uptake of digital financial services around the world, borders are becoming less relevant to financial technology firms and their customers. Organisations want to acquire and onboard customers from different regions and consumers do not want to be bound by their country of origin when accessing financial products.

Research from PassFort shows that customers who received a better than expected experience of compliance onboarding, described themselves as more likely to recommend their provider (77 percent). Meanwhile, only 32 per cent of customers whose experience was worse than expected said they would recommend their provider.

The partnership brings flexibility and worldwide coverage, so onboarding and risk monitoring can be tailored and performed digitally for any type of customer and any product anywhere in the world. PassFort provides the orchestration layer that can be used to map and manage any type of risk and compliance workflow, while integrating Trulioo’s identity verification checks to bring the robust and accurate data needed to satisfy KYC and KYB processes.

“Over the last 12 months, more than 4.3 million compliance journeys were started in the PassFort platform in 197 countries, covering 211 jurisdictions,” said Donald Gillies, Head of PassFort, a Moody’s Analytics company. “It is really important to us and our customers that their compliance processes are efficient and scalable – growing into new regions as our customers grow and supporting their new products as they are launched. Our partnership with Trulioo creates the best possible experience for global financial services customers who can expect a smooth digital compliance journey.”

"Upholding trust and safety online is critical, especially in an increasingly borderless world," said Garient Evans, SVP, Identity Solutions at Trulioo. "We're pleased to support a global-first approach and partner with PassFort to offer the world's largest network of identity data and services through Trulioo GlobalGateway."

Related News

- 09:00 am

Litigation funding specialists Apex Litigation Finance have announced the appointment of Mark Sands as Head of Insolvency, where he will be taking overall responsibility for the company’s presence in the insolvency sector.

Mark has more than 35 years of experience in the insolvency profession, most recently in a senior role at Quantuma. A former President of the Insolvency Practitioners Association, Mark’s career previously included roles at KPMG and Tenon.

His career as a licensed insolvency practitioner has focused on working on the insolvencies of individuals and SMEs. Apex say that this focus makes him a strong fit for their business, as the firm specialises in supporting small/mid-sized claims rather than the multi-million-pound claim focus of other litigation funders.

Mark also brings a history of success with contentious insolvency. He believes that his ability to delve deep into cases will be an asset for Apex and its clients:

“It’s an exciting time for the company, which has established itself as a force in the litigation funding market in a relatively short period. I am also thrilled to be joining a company breaking new ground with its use of innovative technology. “Once cases are taken on, a thorough investigation can be the key to winning settlements. I am confident that my experience in investigation services will prove to be a great benefit. I will also be able to draw on my wide network of IPs, litigators and other professionals to grow Apex’s position in the insolvency sector.”

Apex CEO Maurice Power says:

“It’s a pleasure to have Mark joining our team. His experience and expertise are perfect for the role, and we know that he will add huge value to our business and our clients. Testament to Mark’s abilities is his excellent track record in winning cases that have gone to court. Although we always prefer cases to settle without the need for a court hearing, Mark’s proven investigative ability and diligence can only strengthen our capability in ensuring positive outcomes for our clients and supporting access to justice.”

As Apex continues to grow the team, they are keen to hear from interested individuals from various disciplines, including legal, insolvency, litigation funding, AI development and business development. However, specific litigation funding experience is not essential. Instead, Apex will look at an individual’s skill set and identify those who can contribute to their success.

Interested applicants are asked to contact Apex via enquiries@apexlitigationfinance.com by sending a current cv and details of why they would be ideal for Apex.

Related News

- 06:00 am

Up to double bonus Avios available on the British Airways American Express® Cards

From today, American Express is launching a series of limited time offers that will award generous Welcome Bonuses on its British Airways American Express Cards. Running until 28 February, 2022, these promotions include new Cardmembers* receiving a Welcome Bonus of up to double the usual amount, and existing Cardmembers receiving up to 12,000 Avios when they invite a friend.

These are among the most generous Welcome Bonuses ever offered on the Cards.

British Airways American Express® Credit Card

New Cardmembers who sign up for the British Airways American Express Credit Card before 28 February, 2022, will receive a Welcome Bonus of 10,000 Avios, double the usual sign up reward of 5,000 Avios.

If a new Cardmember is invited by an existing Cardmember they get 12,000 bonus Avios as part of the offer, double the normal 6,000 Avios. While the Cardmember inviting them receives 6,000 bonus Avios, up from 4,000 Avios.

There is also an exclusive offer for British Airways Executive Club members, who will receive 20,000 Avios when they take out the Card, up from the usual 10,000 Avios. This exclusive offer is available until 22 February, 2022.

To qualify for these bonuses, new Cardmember must spend £1,000 in their first three months. Spend on the Card also offers 1 Avios for every £1 spent on top of the Welcome Bonuses.

British Airways American Express® Premium Plus Card

New and existing British Airways American Express Premium Plus Cardmembers will also see even greater rewards during this offer.

Signing up for a British Airways American Express Premium Plus Card before 28 February, 2022, will see new Cardmembers receive 40,000 bonus Avios, a 60% increase on the usual 25,000 Avios Welcome Bonus. Meanwhile, new Cardmembers invited by an existing Cardmember will get 42,000 bonus Avios, up from 26,000 Avios outside of the offer period, with the existing Cardmember receiving 12,000 bonus Avios, up from 9,000 Avios.

Again, there is an exclusive offer for British Airways Executive Club members, who will earn 45,000 bonus Avios, an extra 15,000 bonus Avios than they would normally receive. This offer is available until 22, February 2022.

All bonuses on the British Airways American Express Premium Plus Card are dependent on the new Cardmember spending £3,000 in their first three months. Spend on the Card also offers 1.5 Avios for every £1 spent on top of the Welcome Bonuses.

Maggie Boyle, Vice President, American Express, said:

“As we look to the year ahead, people remain hopeful about the prospect of travelling abroad with friends and family. This is why we have started the year by launching some exciting offers for new and existing British Airways American Express Cardmembers. By offering substantial increases in Avios with these limited time offers, we’re helping them get away and offering our support for their travel aspirations in 2022.”

Beyond the Welcome Bonuses

These offers follow the launch of the improved British Airways American Express Cards in September 2021, which saw American Express make it quicker to earn Companion Vouchers and easier to redeem them, alongside introducing a new look for the Cards. More information is here.

The British Airways American Express Credit Card representative APR is 24.5% variable, and for existing British Airways American Express Premium Plus Cardmembers it is 101.1% variable. The British Airways American Express Premium Plus Card has an annual fee of £250.

Related News

- 03:00 am

Next generation payment processing company, Radar Payments by BPC, has been selected to tackle eCommerce fraud prevention by Singapore's largest home-grown online payment solutions fintech Red Dot Payment (RDP), an e-commerce enabler focused primarily on serving the e-commerce and hospitality verticals.

RDP has selected the Fraud Risk Management and Prevention solutions delivered as a SaaS model from Radar Payments after reviewing other fraud detection systems. Their choice was influenced by its peerless technological capabilities and ease of integration, as well as its affordability and excellence in account management.

Established in 2011, RDP was founded by Randy Tan, who is still leading the company as its CEO. Initially starting in Singapore, RDP has expanded to other regions, with local offices in Australia, Indonesia, Taiwan and Thailand, and further expansion provisionally planned in Japan, Hong Kong and Malaysia. In July 2019, the fintech and e-payment business PayU took a majority stake.

RDP was ranked #35 out of 500 companies in the Financial Times’ special report on high-growth companies in the Asia Pacific after demonstrating phenomenal revenue growth of 171% CAGR. They were also ranked Top 10 Fastest-growing firms in Singapore by the Strait Times in 2020.

Earlier this year, RDP became a principal member with both Visa and MasterCard. They are already an acquirer for AliPay, Diners Club International, WeChat Pay, and Union Pay, with a payment suite that includes AMEX, PayPal, PayLah and PayNow (SGQR) and many other alternative local payment methods in the respective countries they operate in.

RDP selection of Radar’s Payments Fraud Risk Management and Prevention service comes at a time when the number of online cybercrime rises due to digitisation around the world. The technology developed by Radar Payments was not only singled out for its best in class performance but also its proven track record in helping financial institutions and businesses of all sizes to tackle vulnerabilities within the digital ecosystem for consumers across regions.

David Owyong, COO, Red Dot Payment, commented:

“We believe that conquering eCommerce fraud requires a global perspective, and we pride ourselves on working closely with our merchants to help them harness the power of payments. As we overcome the turbulence of the past 24 months, we believe that the hospitality sector is the next industry where we’ll witness huge advances in eCommerce. With the help of Radar Payments, we’ll continue to support local merchants in this field as well as create a secure environment for international companies with ambitions to serve consumers in Southeast Asia.”

Terry Paleologos, COO at BPC said:

“We are thrilled to be helping one of Singapore’s fastest-growing companies to grow even faster, through ensuring that they have best-in-class fraud prevention service which comes with unparalleled expertise and local insights that do help remove any friction to the customer payment experience.”

Related News

- 08:00 am

Cyprus based broker, Sheer Markets has selected Muinmos as its RegTech partner for fast onboarding and regulatory compliance.

Sheer Markets, which was founded in 2019, is regulated by CySEC and the LFSA (Labuan Financial Services Authority). The firm selected Muinmos’ complete and fully automated AI-based onboarding solution. This comprises of three modules: mPASS™ for full financial product, services and cross-border clearances including automated categorisation, suitability and appropriateness checks; mCHECK™ for all relevant AML/KYC/KYB requirements; and mRX™, a risk management module enabling Sheer Markets to risk profile their clients based on their pre-configured risk parameters.

Elif Kundakci, Executive Director and Head of Dealing, Sheer Markets comments,

“We started out by doing extensive research to find the best client onboarding provider - a company with a deep understanding of regulations in Europe and the rest of the world. We wanted them to cover cross border regulations in real-time as well as screen applicants instantly for KYC/AML, PEPs & Sanctions and also instantly perform the eIDv (electronic Identity Verification) and address checks. Muinmos topped the list with their mCHECK™ module and provided so much more with the additional modules of mPASS™ and mRX™. They ticked all the boxes in terms of technology, accuracy and compliance and also provided ongoing monitoring and regulatory reporting.

“Integrating with the Muinmos API was quick and easy and we are already reaping the benefits of partnering with Muinmos – we can onboard clients in less than three minutes and have received excellent support. In addition to its technologists, the Muinmos team consists of a number of Legal and Compliance experts and we have really benefited from their insight and knowledge.”

Remonda Kirketerp-Moller, Founder and CEO, Muinmos said,

“We are thrilled to have been selected by Sheer Markets. With their CySEC (CIF) licence to service clients in the EU and an offshore licence from the LFSA to service clients in the rest of the world, they have a truly global client base. Acting with integrity and remaining compliant at all times is a key priority for the brokerage and Muinmos is ideally placed to help them to effectively navigate the complexities of onboarding clients across multiple jurisdictions, ensuring ongoing compliance and provide an enhanced customer onboarding experience regardless of where their clients are based.”

Sheer Markets provides clients with competitive, streaming access to a comprehensive instrument range, including non-deliverable forwards (NDFs), emerging markets currencies (EMFX), and Cryptocurrencies. For more information, visit www.sheermarkets.com and www.sheermarkets.io.

Muinmos is an award-winning RegTech firm. With its unique product set which includes a Regulatory Onboarding Engine, KYC/AML and risk management modules, Muinmos uses algorithmic rule-based AI and machine learning to help financial institutions onboard any client type in under three minutes and remain fully compliant as regulatory parameters change. For further information, visit www.muinmos.com

Related News

- 08:00 am

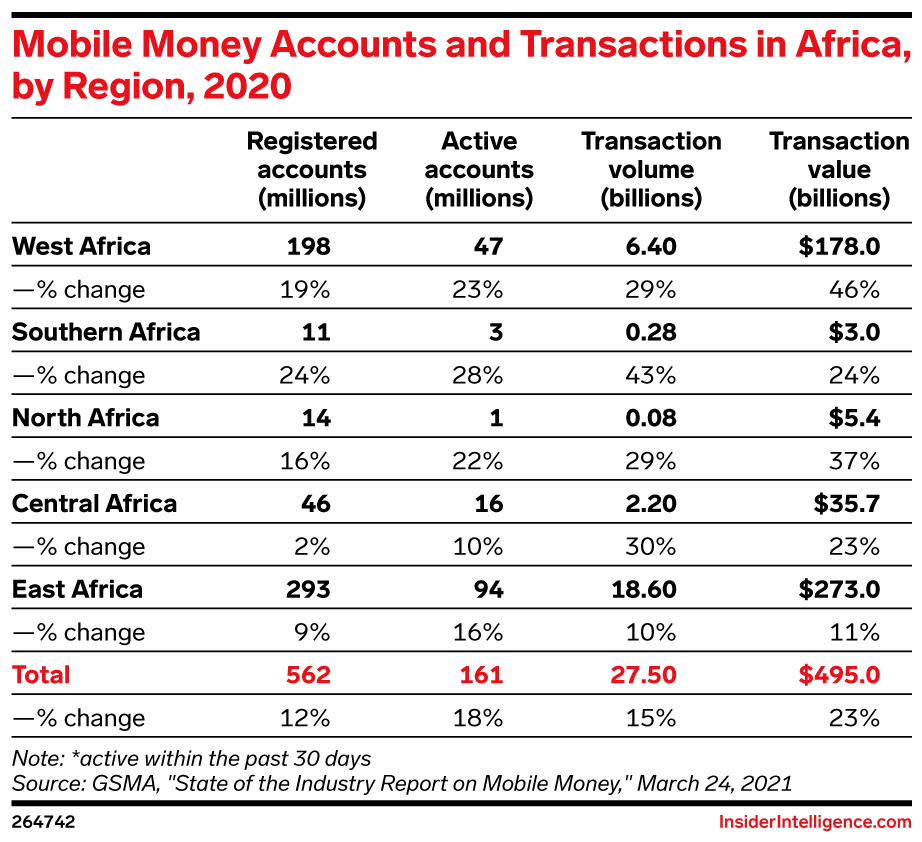

The funding spotlight turned toward Africa in 2021 as tech startups broke funding records, raising $5 billion across the continent, per TechCrunch.

- Fintechs dominated this funding, accounting for nearly $3 billion of the continent’s investments, per Briter Bridges—double the amount raised by fintechs in 2020 and triple the total in 2019.

- Payment startups globally also raised record funding in 2021, totaling $31.9 billion as of December 14, according to CB Insights.

The beneficiaries: Here are some of the companies that benefited from the increased attention paid to Africa.

- Mobile payments platform Opay raised one of the biggest sums, closing a $400 million Series C round in August that valued the company at $2 billion. SoftBank Vision Fund—the world’s largest technology-focused investment fund—made its first African investment with this funding round. Opay has seen huge growth: Monthly transactions exceeded $3 billion as of August, up from $2 billion in December 2020, per Bloomberg.

- Digital payment provider Flutterwave raised $170 million in a March Series C round. The company expanded globally in 2021, making partnerships beyond local tie-ups with payment giants like Discover and PayPal.

- Digital payments network MFS Africa raised $100 million. The company powers more than 320 million mobile money wallets through a network of roughly 180 banks and mobile money schemes and 250 global institutions.

- Cross-border payments company Chipper Cash raised $250 billion between May and November 2021, bringing its valuation to $2 billion. Chipper Cash offers a peer-to-peer cross-border payment service via its app, which is used across seven African countries.

The bigger picture: The recent cash influx reflects growing deal volume in Africa as more firms acknowledge its growth potential.

We believe Africa is poised to experience the next great wave of innovation, with a “who’s who” of multinational payments giants piling in to make it happen. We’ve already seen powerhouses like Stripe, Zip, and Mastercard get involved in the region, and we predict that in 2022, multinational financial services companies will shift their focus from partnerships to acquisitions across the continent.

With 1.4 billion inhabitants and a collective GDP of $2.7 trillion, Africa is a vast market ripe for payments digitization. Regional giants M-Pesa and MTN MoMo have already built a nearly $500 billion market for mobile money, showing that breakthroughs in the region are possible and giving payment providers an opening to digitize.