Swiss FinTech vestr Closes Oversubscribed Series A Led by Elevator Ventures

- 3 years 3 months ago

- Fundraising News

Swiss FinTech vestr provides issuers of Actively Managed Certificates (AMCs) with the first independent software engine to digitize the value chain of active investment products. The platform empowers issuers to scale their AMC business, allowing them to focus on their core competencies. Discretionary investment managers use AMCs as a fast, flexible, and cost-efficient alternative to investment funds.

GBG Launches GO-no-code Onboarding for Optimised Customer Experience

- 3 years 3 months ago

- Digital Identity

GBG, the global expert in digital identity, has today launched GBG GO, its third-generation simple, cloud-hosted solution that enables businesses of all sizes to verify the identity of new customers.

Cion Digital Launches Wealth Advisor Lending Platform

- 3 years 3 months ago

- Lending

Cion Digital, developers of the first enterprise SaaS blockchain orchestration and payments platform, today announced the company is expanding their operations to offer its suite of services to a broader portion of the financial services and retail sectors.

Currencycloud Becomes Preferred FX Provider for Integrated Finance

- 3 years 3 months ago

- Infrastructure

Currencycloud, the experts in simplifying business in a multi-currency world, has become a preferred FX partner for Integrated Finance, the London-based Fintech infrastructure platform that helps businesses build, expand and manage the financial infrastructure, delivering easily integrate FX products for existing payment platforms.

B2B Marketplace Solv Launches in Kenya to Unlock MSMEs’ Growth Potential

- 3 years 3 months ago

- Trade Finance

Micro, Small and Medium Enterprises (MSMEs) in Kenya will now be able to access working capital financing and a wide range of other business solutions following today's launch of Solv in Kenya.

Revolut Challenger Atlantic Money Launches in Ireland

- 3 years 3 months ago

- Money Transfers

New international money transfer provider, Atlantic Money, today announces its official launch in Ireland, continuing its expansion in Europe after Belgium and Germany. For the first time, consumers in Ireland can make international money transfers for a fixed fee of €3 at the current exchange rate for transfers up to €100,000.

Ebury Establishes Luxembourg Branch to Bolster Proposition for Alternative Investment Funds

- 3 years 3 months ago

- Investment

Ebury, one of Europe’s largest fintechs and a global provider of transaction payment solutions, has established a branch in Luxembourg, registered under CSSF regulations to support managers in the alternative investments sector. For entities being set up in Luxembourg, Ebury provides a variety of services such as issuing certificates which are required by local regulations to prove that funds have been blocked until company formation is...

Nexi and Illimity: A New Partnership to Support Italian SMEs

- 3 years 3 months ago

- Payments

Nexi, the European PayTech, and Illimity Bank S.p.A.

Glyd Partners with Mastercard to Launch Malaysia’s FIRST Prepaid Corporate Card for Managing Business Expenses

- 3 years 3 months ago

- Credit Cards

Glyd announced today the launch of the Glyd Prepaid Corporate Card for SMEs in partnership with Mastercard which will help small businesses manage their expenses better, enabling them to save time and money.

UBCI BANK-Union Bancaire pour le Commerce et l’Industrie Selects Finastra to Provide Next-generation Digital Customer Experience

- 3 years 3 months ago

- Banking

Finastra today announced that Union Bancaire pour le Commerce et l’Industrie (UBCI), a large Tunisia-based corporate bank, has selected Finastra’s Fusion Corporate Channels to support trade and cash management. The best-in-class digital banking offering will enhance the customer experience for the bank’s corporate clients, while reinforcing its position as a leader in the market for transaction banking.

Stubben Edge and Helodrium Join Forces to Expand Capabilities

- 3 years 3 months ago

- Insurtech

Helodrium has a proven track record of bespoke compliance and regulatory support, helping businesses begin trading in the London & International Insurance Market. With 50 years of experience in this area, they identify their clients’ requirements and potential risks and create tailored strategies to ensure success. The Helodrium team has a detailed understanding of insurance and reinsurance across industries and classes, bringing a...

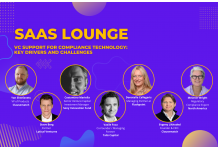

US and Europe's Leading Tech VCs to Discuss RegTech Investment at the SaaS Lounge Webinar

- 3 years 3 months ago

- RegTech

Representatives from Flashpoint VC, Lytical Ventures, the Sony Innovation Fund, and Talis Capital will gather online on November 3, 2022, to discuss the investment in regulatory technology and what it means for tech companies, consumers, and investors everywhere.

Exactpro and BNY Mellon Win Swift Hackathon 2022 in Digital Assets Ownership and Interoperability Challenges

- 3 years 3 months ago

- Asset Management

Exactpro, an independent software testing services provider for financial market infrastructures, is honoured to be recognised winner of the Digital Assets Ownership challenge of the Swift Hackathon 2022 alongside BNY Mellon prevailing in the Interoperability challenge.

Dubai Financial Services Authority and The Securities and Exchange Commission of Thailand Fortify Fintech and Innovation Cooperation

- 3 years 3 months ago

- Infrastructure

The Dubai Financial Services Authority (DFSA) has signed a Memorandum of Understanding (MoU) with The Securities and Exchange Commission of Thailand (SEC), to enable open dialogue about technology-enabled financial innovation in financial services, including FinTech and Regulatory Technology (RegTech). The MoU was by Ian Johnston, Chief Executive of the DFSA, and Ruevadee Suwanmonkol, Secretary-General of the SEC on 18 October 2022.

ChainSafe Raises US$18.75 Million in Series A Funding

- 3 years 3 months ago

- Fundraising News

ChainSafe Systems, one of the world's top blockchain infrastructure firms, announced today that it has secured US$18.75 million in an oversubscribed Series A funding round.